Page added on July 1, 2016

Why Oil Prices are Going Up, and Will Continue to Go Up

Oil prices are going up as oil supply and demand are approaching a more balanced situation, writes geophysicist Jilles van den Beukel. And they will continue to go up as supply is expected to fall below demand in the 2018-2020 period. The key factor in supply reduction is that cost cutting is leading to higher decline rates of mature conventional fields. So far this decline has been compensated by new oil field developments, but the current severe investment cuts will gradually reduce the flow of “new oil” to a mere trickle by the early 2020’s. In the meantime demand is still growing, despite the expansion of renewables and higher efficiencies.

Oil prices have been going up over the last few months, from below $30 per barrel in February to the current levels of around $50. Many short term issues of a different nature play a role here, ranging from market psychology to supply interruptions such as those caused by the Alberta wildfires. But I would argue that in the background there is a persistent upward trend, caused by the simplest of explanations: supply and demand are getting more into balance again.

When predicting future oil supply and demand no individual can produce anything close to the comprehensive analyses of organizations like the IEA or the major consultancy firms. But one can try to highlight processes that give some insight into the way that supply is responding to changes in the oil price.

Increased field decline of conventional oil fields kicking in

Much of the publicity on the way that oil supply is responding to lower prices has focused on unconventional shale oil in the US. And indeed the rapid advance of US shale oil has been a key factor in the creation of ‘oversupply’. But actually the response of the more than 50 million barrels/day (mbpd) production from conventional (non-OPEC) fields plays a much bigger role. Small changes in the average decline rate of these fields result in large changes for oil supply in absolute numbers.

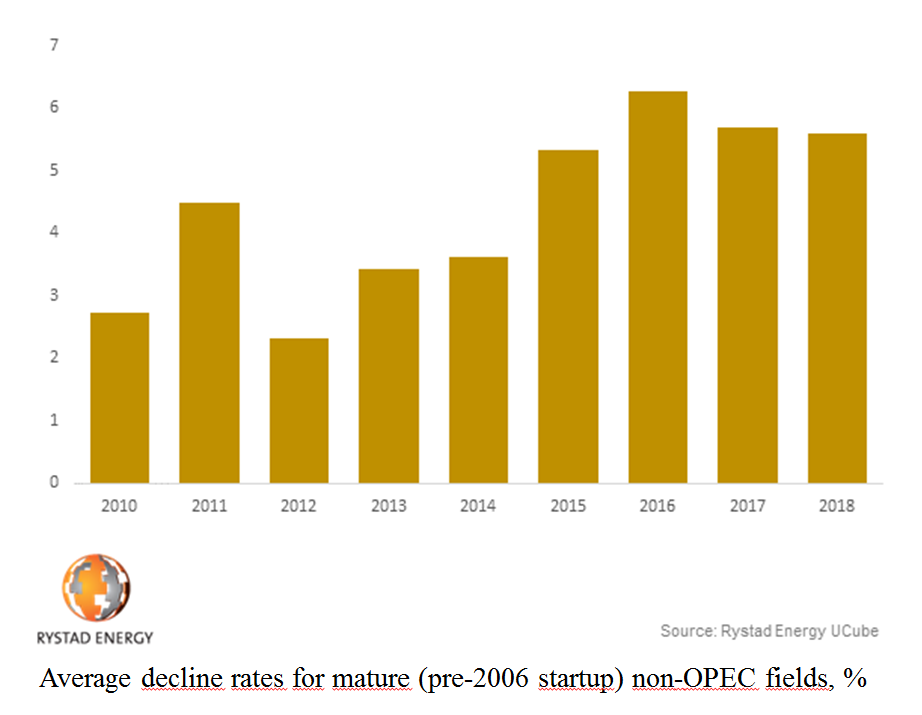

The figure below is taken from a recent study (June 2016) from Rystad Energy. It shows the average decline rate for mature non-OPEC oil fields. Up to 2015 these figures are actuals; for 2016 this is a prediction with limited uncertainty and for later years uncertainty increases.

Due to higher activity, the average decline rate in the 2010-2014 high oil price world was only about 3% (without any activity it would have been about 8-9%). Reduced activity in the subsequent low oil price environment resulted in higher decline rates of about 5-6%. In absolute terms: for 2016 this amounts to a supply decrease of 3.3 mbpd (on total global oil production of some 90 mbpd).

There are several important points to be noted about these decline rates. First of all, the fast response of field decline rates to price levels is due to the nature of the activities involved: workovers and infill drilling can be planned and executed in a relatively short time frame.

Secondly, the effects of this reduced infill drilling in conventional fields will be felt for years to come: a conventional well not drilled in 2015 is still likely to result in lower production in 2020 and beyond.

Thirdly, decline rates are much less of an issue for OPEC fields. Production in a country like Saudi Arabia is capped by political decisions or infrastructure capacity rather than geology (they have much higher reserves-to-production ratios).

So why do decline rates of conventional non-OPEC fields receive so little attention? I think it is because field decline has so far been masked by new fields coming on stream. For 2016, the added production from new fields amounted to about 3.0 mbpd, roughly compensating for the decline of existing fields. Many projects are still coming on line (especially in deepwater) that have been sanctioned in the 2010-2014 high oil price environment.

New oil compensating for field decline is not sustainable, however. Hardly any new major developments have been sanctioned in 2015 and the first half of 2016. Over the coming years new oil from projects currently being developed will gradually decrease from 3.0 mbpd in 2016 to a much lower level in the early 2020’s (exactly how low will depend on when the sanctioning of new developments will resume). For 2017, a similar level of field decline (compared to 2016) is already expected to outstrip new developments by about 1.2 mbpd.

Reduction in US shale oil production is kicking in, finally

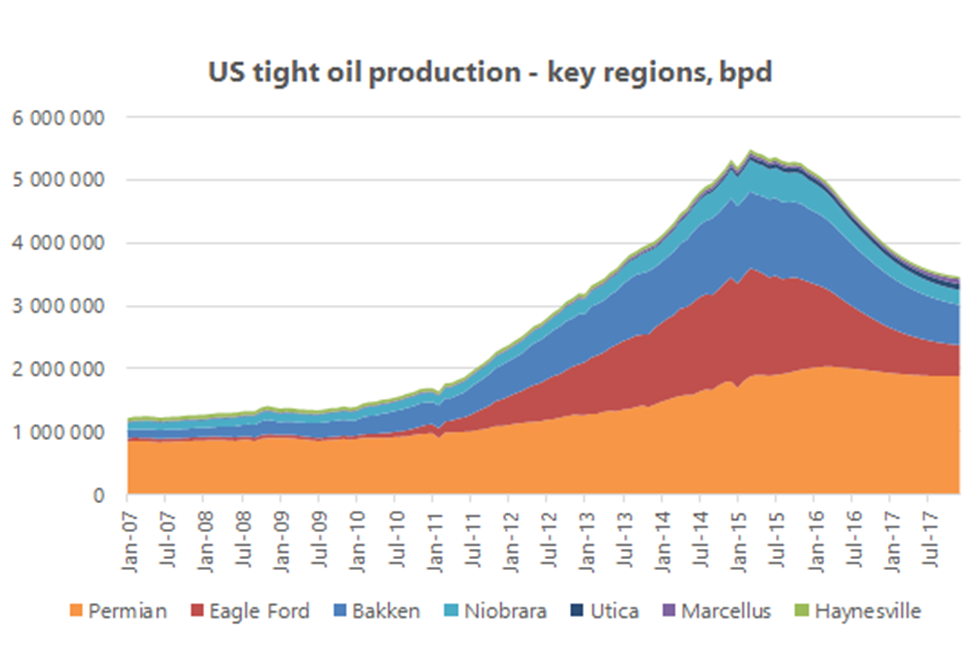

At the same time, we are finally seeing a reduction in US shale oil production in response to the price decline, as can be seen in the figure below.

I have chosen to use data from a Seeking Alpha paper rather than the well known EIA figures that only give production up to the present day. Obviously the prediction beyond mid 2016 depends on future oil prices (the predicted further decline is in the middle of the range for a number of forecasts from different organizations).

The time it takes for US shale oil production to respond to the low oil price oil world is much longer than often assumed. It took close to a year before peak production was reached: it took close to another year before a steady reduction (per month) of up to 100,000 bpd was reached.

This shows that US shale oil cannot take on the role of short term swing producer (as Saudi Arabia used to do). It cannot do so timewise (it takes two years to fully respond) and it cannot do so volume-wise (changes in US shale oil production being too small compared to global supply). It does play an important role, as part of a complex global oil supply system.

A shake-out is taking place in the US shale oil sector with increased focus on the best plays and the best sweet spots within these plays. The Permian is emerging as the dominant play in shale oil, in the same way as the Marcellus has emerged as the dominant play in shale gas.

$50 per barrel is too low to be sustainable

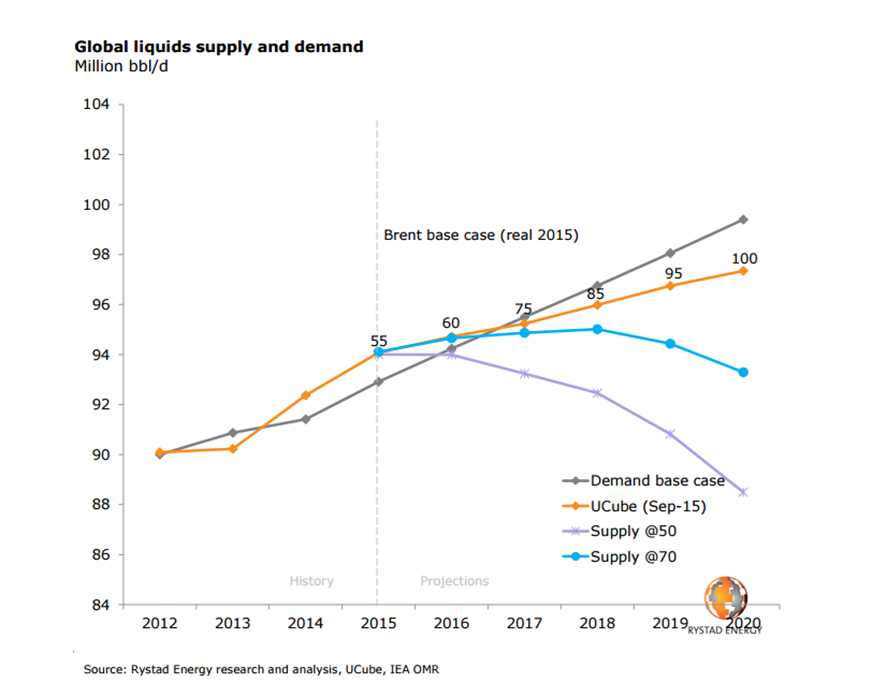

The major international consultancy firms cover all parts of the energy business. Rystad Energy, a small independent Norwegian consultancy firm, primarily focuses on one part of the business only: maintaining a state of the art database of all oil fields (plus potential developments with timelines and oil prices needed for project sanction) on a global basis. This enables them to model future oil supply for different price scenarios. In this important niche they have become a world leader.

The figure below gives some of these scenarios. These integrated models combine shale oil production, conventional field decline and new conventional developments (as well as more secondary processes such as exploration, end of field life and project delays). The gradual decrease of global oil supply in a constant 50 dollar per barrel scenario is primarily due to the combination of the continuation of significant mature field decline and the gradual decrease of oil from new developments over the coming years.

Unless more dramatic cost reductions materialize, these models imply that a long term price of the order of $70-90 per barrel is needed to generate sufficient supply anywhere near expected demand. The reason is simple: it is at this price level that many projects, of a different nature (onshore, shallow offshore, deepwater and shale oil), become sufficiently profitable to go ahead. Lower prices will eventually result in undersupply; higher prices will eventually result in oversupply (regardless of oil demand continuing to increase at its current rate or reaching a plateau).

Oil demand: India taking over from China as a growth engine

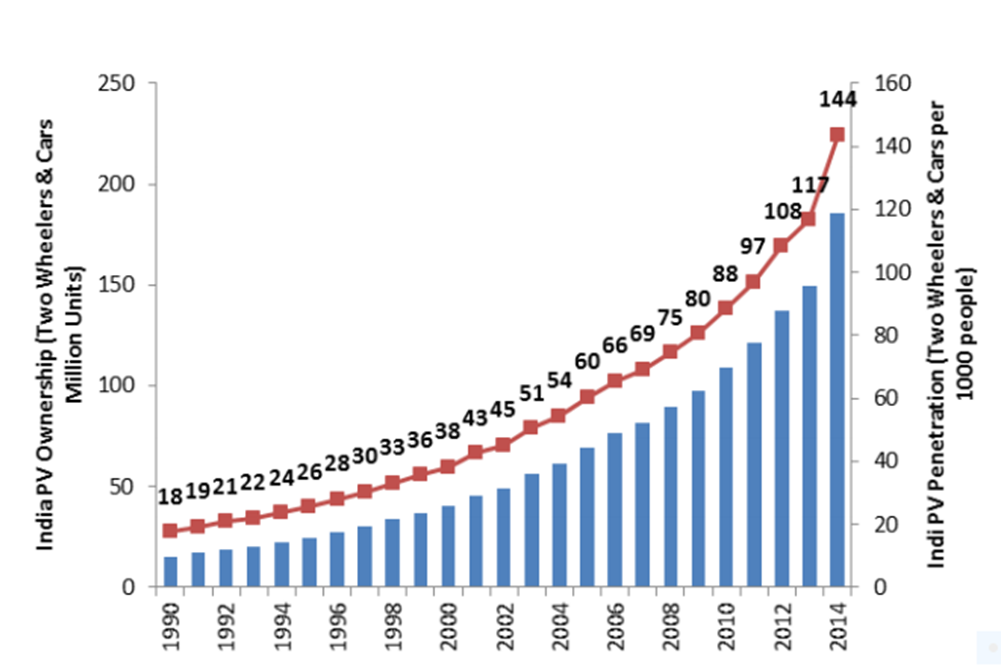

In the meantime oil demand continues to stubbornly grow each year, at a rate of about 1.5 mbpd. So far any increase in efficiencies or renewables is more than offset by increasing demand in non-OECD countries. The populations of China and India (about 1.4 billion and 1.3 billion respectively) are so large that what happens in these countries simply matters most.

As the growth in Chinese oil demand abates it seems that India is taking over China’s role as the key country for oil demand growth in Asia. A recent study of the Oxford Institute for Energy Studies paints a breathtaking picture of a country where manufacturing and car ownership (and hence oil demand) are about to explode. Last year India’s oil demand grew by 0.3 billion barrels/year (compared to an average of about 0.1-0.15 billion barrels/year over the last decade). India is now in the position where China was about 15 years ago.

Even if India’s phase of rapid economic growth would be characterized by a greater focus on renewables this would be more of an issue for coal and gas than for oil.

One day the energy transition will take off in earnest and peak oil demand will be reached. But it will come at a slower rate than the response of oil supply to changes in oil price or changes in oil demand. The energy transition will lead to a reduction in volumes but not (necessarily) to a reduction in price. For an oil company volumes matter. But price matters much, much more.

61 Comments on "Why Oil Prices are Going Up, and Will Continue to Go Up"

Plantagenet on Fri, 1st Jul 2016 10:51 am

Yup.

India is the most populous country in the world. As they modernize and more and more Indians also want the American lifestyle complete with car, there will be more demand for oil, leading to higher prices for oil

Nice to see that some people understand that supply and demand is still relevant and key to oil prices.

Cheers!

PracticalMaina on Fri, 1st Jul 2016 11:05 am

Exxon has to pay extra bribes to continue to lie like a dog, and we get to fund the destruction of our own environment.

HARM on Fri, 1st Jul 2016 12:10 pm

I would say the lack of water is a bigger problem for the 1.3 billion (mostly impoverished) inhabitants of India. Plus the fact that relatively few Indians can afford a car.

adonis on Fri, 1st Jul 2016 12:23 pm

we have reached peak demand therefore with less demand oil prices can only go down causing a drop off in production once prices drop low enough for a slight increase in demand prices of oil will slightly go up.according to central banks governments must do the heavy lifting to spur growth we shall see very little from them as they are not as rich as they used to be

JuanP on Fri, 1st Jul 2016 12:50 pm

Adonis “We have reached peak demand”

Please provide a link backing up your ridiculous claim.

rockman on Fri, 1st Jul 2016 1:39 pm

Juan – Back to the same problem with folks not understanding the supply/demand dynamic, eh? They just don’t it that demand isn’t what folks can AFFORD to buy…not what they WANT to buy. And no producer can SUPPLY oil to someone who can’t afford to buy their oil. Such a simple concept to understand. Granted there are short periods for the feedback loops to allow the balance to be restored. Which means there is no oversupply: exporters are selling ever bbl they are producing to all the buyers that can afford the price. Just as there was no shorter of oil when it was $100/bbl: same status: ever buyer that could afford the price they had all the oil they wanted.

IOW therer has not a single significant period of time when every CAPABLE oil buyer could acquired the oil they wante.

Except used wartime conditions, of course.

Kenz300 on Fri, 1st Jul 2016 3:02 pm

The transformation of our vehicle fleet to electric will happen sooner than many people think…. battery costs continue to fall making electric vehicles cheaper every year………

Electric cars, trucks, bicycles and mass transit are the future…..fossil fuel ICE cars are the past…………..

Think teen agers vs your grand father…………………. cell phones vs land lines…….

NO EMISSIONS……..climate change is real………

Save money……no stopping at gas stations…..no oil changes……..less overall maintenance……

Electric bus maker Proterra follows Tesla’s lead and open-sources its Fast-Charging patents | Electrek

http://electrek.co/2016/06/28/electric-bus-maker-proterra-tesla-lead-open-sources-fast-charging-patents/

Bob Owens on Fri, 1st Jul 2016 3:16 pm

The same thinking as this article states was in vogue when oil was over $100. The price could never come down because… Well, here we are now with low prices that nobody predicted. What will the future hold? Guess what: Nobody really knows.

penury on Fri, 1st Jul 2016 3:25 pm

I hate constantly repeating comments, but one more time. The majority of fossil fuels are not used for personal transportation but for manufacture of goods, transportation by ocean,. rail, or truck or air. When the economies fall and people cannot buy guess what happens? All of the foregoing stops and we then have a lot of fossil fuels which are not being used. If no one can afford the price,it does not matter what the price is. Also if the demand is there, it also does not matter what the price is. Bill Gates will still be driving and flying long after you are walking.

Dustin Hoffman on Fri, 1st Jul 2016 4:16 pm

Venezuela’s Oil Reserves Are Probably Vastly Overstated

A simple way to think of this is to imagine the amount of dissolved gold in the oceans. There is an estimated 20 million tons of gold in the oceans, which is far greater than all of the world’s gold reserves. But it exists at such a dilute concentration that it isn’t economical to produce with existing technology. While an ounce of gold currently sells for around $1,300, it could take ten or even a hundred times that amount to extract and purify an ounce from the ocean. So the gold resource of the ocean is huge, but the proved reserve is zero.

The proved reserve is always a subset of the resource, and it is quite possible for a resource of billions of barrels to result in few or even zero proved reserves. This was the case for many years with Venezuela’s heavy oil. It has been known for decades that the Orinoco Belt likely contains over a trillion barrels of oil. But this oil is very heavy, and as a result it is expensive to extract and upgrade. Thus, a very small fraction was historically classified as proved reserves

http://www.forbes.com/sites/rrapier/2016/07/01/venezuelas-oil-reserves-are-probably-vastly-overstated/#4d8c1c1e612c

Well now, some hard truth comes out of the mouth of the Beast

Anonymous on Fri, 1st Jul 2016 4:17 pm

Ken, for about the…nth time. There is no ‘transformation’ to the mystical all-private 2 ton EV world you keep blammering on about. I live in an ‘advanced’, ‘wealthy’, ‘hi-tech’ nation, or at least one that considers itself all these things, and there are literally NO EV’s where I live, and few in common use in the rest of country either. Not for commercial use, not for private use. The tiny handful that do exist, are regarded as oddities or toys. Few, are being used in practical everyday, civilization sustaining activities.

You keep parroting the same old shit over and over. Yes, EV’s do exist, and are being sold. What they are not doing, is leading some fantasy ‘transformation’ to the all-EV future. Which btw, if you listen to its current proponents would create a ‘future’ that looks exactly like the present.

Roger on Fri, 1st Jul 2016 6:12 pm

Judging by the Rystad chart — and factoring in the ongoing “unplanned interruptions” and sub-$50 oil price year to date — I’d say the Raymond James forecast of $80/bbl by YE17 is way low. That is, if we’re to avoid demand curtailment via a price spike…which could approach $200/bbl.

Boat on Fri, 1st Jul 2016 6:19 pm

Dustin Hoffman on Fri, 1st Jul 2016 4:16 pm

“Venezuela’s Oil Reserves Are Probably Vastly Overstated”

Reserves swing with price. Low price, low reserves. High price, big reserves.

Roger on Fri, 1st Jul 2016 6:59 pm

I have no doubt Venezuela, at $100/bbl, has the reserves to turn on 2 MM bbl/d, and likely even more. The problem isn’t the oil, it’s the people/government. All the major’s were burned by “nationalization” long ago…and the small E&P’s about 30 years ago. Now, the service companies are fixing to get a taste … then the Chinese (likely their last significant investor). It’s a real shame, especially for the people of Venezuela, who should be quite prosperous given the abundant natural resources they’re blessed with.

JuanP on Fri, 1st Jul 2016 8:02 pm

Dustin, Listen to Boat. He is right on this “Reserves swing with price. Low price, low reserves. High price, big reserves.”

shortonoil on Fri, 1st Jul 2016 8:05 pm

” Reserves swing with price. Low price, low reserves. High price, big reserves. “

Reserves are a function (among others) of price and production costs. The real question is; can price increase faster than production costs:

The answer is no, not from 2012 onward.

http://www.thehillsgroup.org/

JuanP on Fri, 1st Jul 2016 8:07 pm

Roger, Venezuela was a capitalist country for decades, but the people never prospered, only the oligarchs did. The majority of Venezuelans had a better quality of life under Chavez than they ever did before, do now, or will in the future. Just like the majority of Cubans have been better off under the Castro brothers inspite of the American embargo and the Special Period. Before Castro Cuba was an oligarchy and the majority of the population suffered from malnutrition and had no access to higher education or healthcare services.

shortonoil on Fri, 1st Jul 2016 8:14 pm

Reserves can also be described for petroleum, as a deposit of hydrocarbons from which an amount of energy equal to what would be required to extract it, can be acquired from it. In, other words, when petroleum can no longer power its own extraction the process will cease.

joe on Fri, 1st Jul 2016 8:34 pm

Sadly decline rates in conventional feilds will not solve conventional peak oil. Fracking and tight oil will replace investments in old conventional wells. Mainly because of speed of turn around. Easy oil will flatline and high prices will spur tight oil booms. Old easy oil feilds will be left to fall into disrepair. This process will take about 10 to 20 years. This matches exactly plans to switch to a mix of gas and renewable for energy and electricity for transport, as well as preparing for an automated future services sector with a limited manufacturing economy. The only real issue now is that there is too many people. But lower future investments in human capital including healthcare will likley take care of that. Oil will become too costly to use as transport fuel, electricity will be too controlable and mass migration will become very hard as air travel and ship designs simply will not accomodate humans. The future will look briefly like a terminator future, then further decline will eliminate even that. Horses and swords may one day dominate future tech.

Boat on Fri, 1st Jul 2016 8:47 pm

short,

I have read tar sands have cut costs and can operate at $50. Tight oil has cut costs up to 30 percent.

dissident on Fri, 1st Jul 2016 9:23 pm

US tight oil is already in decline. Anyone thinking that there will be tight oil booms to offset mature conventional field declines and lack of new conventional discoveries is living in a technicolor delusion.

Truth Has A Liberal Bias on Fri, 1st Jul 2016 10:49 pm

boat, If tight oil was profitable then it’s production would be increasing but it isn’t and that’s why it’s decreasing. Duh! Fucking retard.

Roger on Fri, 1st Jul 2016 10:55 pm

JuanP,

Thanks for the correction. I agree with you to a point.

That is, I believe the fundamental problem isn’t in the ogligarchs or the “capitalist” system (I don’t equate ogligarchs with capitalism…my view of capitalism is perhaps outdated…based on Christianity, as in “We hold these truths to be self evident, all men are created equal and endowed by their Creator with…”; likely a mix of American history and economics rather than a text book definition of capitalism). However, your point is understood and agreed with — i.e., if “capitalism” we’re the solution, why isn’t oil bringing prosperity to Africa (e.g., Nigeria, or Sudan).

I’m left with the obvious–the problem isn’t the system (“ogligarchs” vs. “capitalism”), it’s us. Given the opportunity, we’ll exploit one another to the bitter end. The only solution I know is through a change of heart — only possible by God’s grace through Jesus Christ.

shortonoil on Sat, 2nd Jul 2016 6:00 am

” short,

I have read tar sands have cut costs and can operate at $50. Tight oil has cut costs up to 30 percent.”

Oh sure,,,,, these outfits let $100s of billions in profit slip their fingers for YEARS because they were too stupid to cut costs.

Keep buying into that Large Talking Pink Rabbit story. You’ll get rich at it????

What is about obvious contradictions that seems to bother you?

shortonoil on Sat, 2nd Jul 2016 6:13 am

With an ERoEI of about 5.5:1 the bitumen operators are now losing on their full life cycle production cost about $75/ barrel. Shale isn’t doing any better, and they keep on operating by stacking up their $1 trillion in debt. When the Chinese debt pyramid collapses, and the FED has to pull in its horns, or go broke, that will all come to a screeching halt.

Davy on Sat, 2nd Jul 2016 6:38 am

Roger, you are doing your beliefs a disservice bringing up religion here. This is not the place for it. Board members find it distasteful. It takes away from the discussion by creating distractions from the main point. Your comments otherwise are fine.

I am not anti or pro religion. I do feel what we are talking about here is vital and critical for quality of life for many of us going forward. Something is coming that is going to disrupt everything about our lives. It is going to hit hard and leave us stunned.

I have been prepping for years mentally and physically and I know it will not protect me from the disruptions ahead. It is mainly going to give me some meaning to this disruption. That is what many of us are after here and that is meaning in the face of chaos.

JuanP on Sat, 2nd Jul 2016 7:01 am

Davy, I was going to give Roger a pass. I have been trying to ignore political and religious comments unless they are obnoxious. I may not be a Catholic anymore, but I try to live by the motto attributed to Jesus nonetheless. Do unto others as you wish others did unto you is the best advice I have ever heard. I wish Christians focused on that teaching and forgot the rest of it.

I don’t believe in any political or economic systems other than basic hunter gatherer tribal arrangements. I agree with Roger that we are the problems. I do not believe that all men are created equal, though. We are all different. I also like the saying “To each according to his needs and from each according to his capacities”. I have always tried to take less and give more than others because I have been blessed in many ways and feel that it is only fair to do so. Itry to be fair, honest, and just as much as my flaws allow.

Kenz300 on Sat, 2nd Jul 2016 7:09 am

And Iran will increase production ……………….

causing oil prices to fall……………….

JuanP on Sat, 2nd Jul 2016 7:12 am

Joe “The only real issue now is that there is too many people.”

While the rest of your comment doesn’t make sense to me, I can somewhat agree with your statement above. I believe that the real issue is our human nature which is the cause of our main predicament which is too many people.

JuanP on Sat, 2nd Jul 2016 7:19 am

Short “Reserves can also be described for petroleum, as a deposit of hydrocarbons from which an amount of energy equal to what would be required to extract it, can be acquired from it. In, other words, when petroleum can no longer power its own extraction the process will cease.”

I like your definition better, short. It better suits my scientific nature, but the other one is the most commonly used one, I believe.

Don Stewart on Sat, 2nd Jul 2016 10:04 am

JuanP and short

Reserves always have to be defined relative to two conditions:

*the technology used to produce the reserves

*the characteristics of the economy which uses the products.

Few people look at the total picture (I believe the Etp model does look at the total picture). At the present time, I believe these two statements are more or less accurate:

*The technology used to produce oil is mature and we can expect only incremental improvements

*The economy which uses the oil products uses them grossly inefficiently. For example, perhaps 1 or 2 percent efficiency….and maybe less than that.

The ‘efficiency’ in the second point is related to moving payload mass over distance…not the total weight over distance. So, for example, we measure how much energy was spent moving a 150 pound human 10 miles to go to work.

Those like the physicist Robert Ayres and the Ellen Macarthur Foundation who have looked at efficiency in that way have concluded that our practices are quite inefficient.

If you accept what I have said thus far, a couple of conclusion follow:

*The Etp model’s predictions of the end of the oil age due to depletion and the increased amount of the energy in the oil which was required to produce the oil are real limitations. One can derive similar conclusions from EROEI studies.

*Printing money to try to solve a societal inefficiency problem is most likely not going to work because printing money is designed to protect business as usual, not radically reform it.

Therefore, we have a very large problem because two very large systems are now dysfunctional. Nothing we can do with the financial system is likely to solve them. Therefore, thinking that high prices are the solution to the reserves problem is not a good way to think about it.

Don Stewart

yoshua on Sat, 2nd Jul 2016 10:07 am

“All companies in the world, including state oil companies like Saudi Aramco and National Iranian Oil Company (NIOC), will have to resort to Enhanced Oil Recovery (EOR), it is just a matter of time. Saudi Arabia has a wealth of fields, so they may not have to resort to it for the next five or ten years. Oman has to do it now, but in twenty years from now, all countries will have to resort to EOR if they want to recover oil.” (2005)

Saudi Arabia started officially its EOR program at the giant Ghawar field in 2015.

JuanP on Sat, 2nd Jul 2016 10:17 am

Don, Thanks for your contribution!

rockman on Sat, 2nd Jul 2016 10:52 am

P – “If no one can afford the price,it does not matter what the price is.” Never has been true and never will. The problem with your statement is the “no one” portion. Perhaps a better way to make the point is that “not everyone” can afford oil no matter what the price is. Many BILLIONS of bbls were bought when prices were $130+/bbl. And even though many BILLIONS of bbls have been bought the last couple of years there were still hundreds of millions who could afford even $28/bbl oil.

Oil was still sold when the price peaked to record levels in the later 70’s and again around 2008. Of course the peaks will be short lived: the sellers will always adjust prices downward in order to max their cash flow and not their profit margin. Just as we’ve seen the KSA et do the last two years.

There will never be a moment in the future when “no one” can afford to buy oil: the producers will lower prices to $1/bbl net if that’s what it takes: oil sitting in the ground not being produced is completely worthless.

rockman on Sat, 2nd Jul 2016 11:08 am

Juan – I’ll have to challenge your statement: so you use 1 Btu of energy to produce 1 Btu of energy: would you count those bbls in the ground as reserves if it cost you $1.00 to produce that Btu and sold it for 20¢?

I doubt it. This is just a very rough generalization but when oil was $90+/bbl most projects became uneconomical to pursue at at EROEI of less than 5 or 6. And now try to wrap you head around this: costs have fallen some what but not as much as the price of oil. As result the EROEI of current ECONOMICAL projects will be even higher then the 5-6 range.

IOW the EROEI of projects actually drilled doesn’t necessarily decrease over time since economics will make that call…as well as what are “reserves” and what aren’t.

rockman on Sat, 2nd Jul 2016 11:31 am

yoshua – “Saudi Arabia started officially its EOR program at the giant Ghawar field in 2015.” Actually rather old news – from March 2011:

“Saudi Aramco plans to start by 2013 injecting carbon dioxide to boost production at its Ghawar oil field, the world’s largest, the company said.

Aramco will pump 40 million cubic feet a day from two gas- processing plants into a section of the field, Samer al Ashgar, manager of the company’s EXPEC Advanced Research Center, said today at a carbon-capture conference in Khobar, Saudi Arabia.

Saudi Arabia, holder of the world’s largest crude reserves, aims to boost the amount of oil it gets from its fields to help meet rising demand at home and abroad. Ghawar produces about 5 million barrels of crude a day on average, Aramco data show. The deposit has reserves of 88 billion barrels, Saudi Oil Minister Ali al Naimi said in October.

Saudi Aramco has planned and designed the carbon-dioxide capture facility and transport system and has starting building it, al Ashgar said today. The carbon will come from the Hawiyah and Uthmaniyah gas-processing plants, he said.

Saudi Arabia also has a so-called enhanced oil recovery project in part of the al Wafra field that aims to pump more crude by heating it underground using steam injection. That field has rerserves of about 23 billion barrels, a company official said in October.

The steam injection is expected to cost about $340m and is run by Chevron Corp. The project is showing great potential and the recovery technique may be applied to the entire field once it’s completed, al Naimi said in December.”

Which is good news but not necessarily huge game changer. For decades the KSA has had some of the best reservoir management engineers (a lot are Swiss) on the job. Between water/chemical injection, pressure maintenance and horizontal wells (technically not “EOR” but serve the same function) the KSA has already recovered more oil then is typical. Also understand that most EOR efforts don’t tend to produce a surge in production but usually a decrease in decline rate. Actually the steam flood could result in a dramatic increase but don’t have enough details to guess.

rockman on Sat, 2nd Jul 2016 11:52 am

Davy – OK, for Roger’s benefit, let’s replace “religion” with morality. That should be a problem here since we commonly bombarded with opinions about what are the “right” and “wrong” moral choices. Pick Corporation A: is it a good corporation or en evil one? But even that doesn’t answer the question of the value of the corporate system since it’s only one company. So let’s try an entire country: how would you rate Country A? I know I’m asking for a generalization but has that been the nature of most of the comments here, right?

So what’s you answer: is the corporate system in Country A good or evil? And everyone else: feel free to express your opinion also.

Boat on Sat, 2nd Jul 2016 1:03 pm

Truth Has A Liberal Bias on Fri, 1st Jul 2016 10:49 pm

boat, If tight oil was profitable then it’s production would be increasing but it isn’t and that’s why it’s decreasing. Duh! Fucking retard.

No company drills dry wells just to lose millions. There are still hundreds of drilling rigs that have not shut down. You seem to have trouble with simple concepts that a retard

Boat on Sat, 2nd Jul 2016 1:05 pm

has to explain.

ghung on Sat, 2nd Jul 2016 1:43 pm

penury said; “The majority of fossil fuels are not used for personal transportation but for manufacture of goods, transportation by ocean,. rail, or truck or air.”

In the US, light trucks and cars use more fuel than the rest of the transportation sector. The electricity production sector is the #1 user of fossil fuels; about 30%.

Globally, in terms of CO2 production, electricity/heat production has a slight edge over agriculture/land use (25% vs 24%), industry (21%), transportation (14%)..

https://www3.epa.gov/climatechange/ghgemissions/global.html

Don Stewart on Sat, 2nd Jul 2016 2:21 pm

rockman

relative to the increase in EROEI of drilling prospects which make the cut and actually get drilled when prices are low.

Every set of prospects is actually a distribution. Probably a normal distribution, but perhaps some other function is a better description. If the price falls, then poorer part of the distribution will tend not to get drilled. So, yes the EROEI of those wells that actually get drilled can increase. But that tells us nothing about the EROEI of all the prospects…it hasn’t changed at all.

Now, if one is trying to make a buck, what counts is the profitability of the prospect one is actually looking at. But if one has a different objective (advising one’s children whether to go into the oil business), then the question changes to ‘how many prospects will actually be drilled and provide an opportunity for someone to make a living off them?’ If one is trying to read the tea leaves in terms of global economies, the same sort of question is relevant.

So, No, EROEI is seldom or never the decisive factor in terms of spending money. But that doesn’t make it irrelevant for broader purposes. One COULD deal with distributions rather than averages in models, but the complexity would increase. Increased complexity may not be worth the effort.

I hope I understand your point, and have responded appropriately….Don Stewart

shortonoil on Sat, 2nd Jul 2016 3:38 pm

Hi Don,

Maybe this will help get the point across. Producers for the last 100+ years have pursued the best sources available to them. That has been accomplished with aid of a battery of specialists. They searched for deposits that generated the highest profits, and that turned out to be the ones that provided the highest ERoEI. They looked at many factors, but the predominate one was flow rate. Flow rate is directly proportional to ERoEI. Each barrel of oil carries 5.88 million BTU, and the greater the flow rate the more BTU one gets for their effort.

Energy Returned over Energy Invested.

http://www.thehillsgroup.org/depletion2_009.htm

denial on Sat, 2nd Jul 2016 3:53 pm

If nuclear fusion does not work soon and I mean within five years….then we are all toast and society does not move on to the next level they fall to caveman or disappear. You can’t work backwards towards a collapse…in fact we have been collapsing for some time but the PTB have been able to manipulate everything to keep things going.

Anonymous on Sat, 2nd Jul 2016 5:11 pm

Lol denial, if nuclear fusion could be made to work, here is small laundry list of problems that would need to be addressed right from the get-go.

1) It would be the most expensive electricity ever produced-really

2) They would still produce deadly radioactive wastes-really

3) To build even one commercial fusion reactor would likely take 1-2 decades to get online and hooked up to the grid at a minimum.

4) Fusion reactors run hot, very hot, like greater than sun hot. So much for ‘reversing’ global warming trends using fusion reactors.

5) Not likely anyone could afford to actually build one. See point 1

6) Unlikely a work force skilled enough to actually staff more than one, if that. Certainly wont train one in 5 years lol.

7) Fusion reactors would be built the same way fission reactors are, with fossil fuels. Cement, exotic metals, all produced by FF, not electricity.

8) Fusion reactors produce, you know, electricity, not diesel, jet, or any kind of liquid fuel.

Not quite sure what ‘problem’ it is you are expecting fusion to solve. If anything, fusion stations would create MORE problems than they would solve haha. In that regard, they are kind of like….oil aren’t they? Using oil at the level we do is creating just as many problems as benefits, right? So lets give fusion a try @ 100s or thousands of times the cost and difficulty, see how that works out….

JuanP on Sat, 2nd Jul 2016 5:36 pm

Rock “… would you count those bbls in the ground as reserves if it cost you $1.00 to produce that Btu and sold it for 20¢? I doubt it”

No, you are right; I wouldn’t. I get your point.

JuanP on Sat, 2nd Jul 2016 5:46 pm

Rock “Between water/chemical injection, pressure maintenance and horizontal wells (technically not “EOR” but serve the same function)…”

I wondered when I read the comment that you are replying to about how inaccurate it was. I knew that KSA had started using EOR earlier than 2015, and It seems I was right about that. But, I also thought that injection was EOR, but you say it “technically” is not. Intuitively it would seem to be to me, but I know that many of these things are not what my intuition tells me they are. Thanks for sharing!

JuanP on Sat, 2nd Jul 2016 5:59 pm

Rock “how would you rate Country A?”

You know I sometimes beat up the USA for some of the things it does to other countries, but I have also said many times that I don’t think any other country in the same position would have done any better. The USA is a victim of its power because power corrupts. Should we not expect the most powerful country in the world to be the most corrupt, too? I think it would be unreasonable to expect otherwise.

I have often stated that even my own, tiny, insignificant country, Uruguay, has committed atrocities like the complete extermination of its native population in a genocidal campaign that was incredibly brutal and thorough. Uruguayans were more brutal and genocidal than Americans in their treatment of natives. Would we have been any better than the USA is if we had been the most powerful country on Earth? I am quite certain we would have been at least as bad, if not worse.

rockman on Sat, 2nd Jul 2016 7:21 pm

Don – “But that tells us nothing about the EROEI of all the prospects…it hasn’t changed at all.” You got it, bud. That’s exactly the point I’ve been flogging to death. There are still some Eagle Ford SG

Shale being drilled today. And yes: they have the exact same EROEI they would have had they been drilled when oil was $120/bbl. Just as their are EFS wells not being drilled today even though they have the exact same EROEI as wells that were drilled 4 years ago. And you understand why: they don’t reach the economic threshold at the current. You might want to feel philosophically that EROEI is a vital facter but the folkjs that make drilling decisions don’t.

Consider the Canadian oil sands. I’m no expert but in theory in some cases they may have been using more Btu’s to produce a bbl then that was contained in that bbl but still made a profit when oil was $90/bbl. How? If they were using a lot of NG Btu’s (much cheaper by the Btu then oil Btu’s were were selling for).

Also consider the refining process. If you weren’t aware a fair bit of energy besides what’s contained in a bbl of oil is used to make the mix of products. Not that the yield is 100% gasoline but oil is current selling for around $1.18/gallon. Gasoline is selling for about twice that. They aren’t making the difference as profit: part of it is paying for NG and electricity.

And take it one more step…a personal one. Most here (maybe you two) burn gasoline to get to work. So let’s hear from everyone: how many here create more Btu’s at work then they burn getting to the job. But let’s think bigger: how many here create more Btu’s on the job then they consume? Anyone feeling a tad uncomfortable? LOL. Well the Rockman certainly has…by a wide margin even when just getting his share as a team member. Can anyone here make the same claim? LOL.

rockman on Sat, 2nd Jul 2016 7:47 pm

Juan – “Should we not expect the most powerful country in the world to be the most corrupt, too? I think it would be unreasonable to expect otherwise.” Unfortunately we have to move into the world of “relative morality”. LOL. So you consider the US to be more corrupt the Nigeria, Russia and Mexico? I could add numerous other countries to the list but let’s start there.

You might as well toss out the 3 countries you consider the least corrupt.

shortonoil on Sat, 2nd Jul 2016 8:04 pm

“Consider the Canadian oil sands. I’m no expert but in theory in some cases they may have been using more Btu’s to produce a bbl then that was contained in that bbl but still made a profit when oil was $90/bbl. How?”

The US produces (probably) 3 mb/d that takes more BTU to produce than it contributes. Its called Shale Oil, LTO, camel peas….???

How was it done? Over $1 trillion in investment to create an industry with annual gross sales of $362 billion. If the industry returned a 10% profit margin on its gross sales (which it doesn’t) ignoring interest rate, it would take 27 years to recover the initial investment.

Not exactly the Midas touch!!

The world now has $2.3 trillion per year in such losers, and its not going to get any better.