Page added on October 8, 2019

Peak oil demand is now

The theory of “peak oil demand” was a techno-utopian response to the supposed debunking of the peak oil theory first set out by M. King Hubbert in the 1950s. Hubbert’s simple observation was that oil fields tend to reach peak production roughly 40 years after they are discovered. Since most of the oil in the USA had been discovered in the 1930s, this suggested that US oil production would peak around 1970. When 1970 came and went without a production peak, the few journalists who remembered Hubbert took the opportunity to ridicule him. Then, in 1971, US oil production peaked and fell into decline. What followed was a massive panic about oil shortages after the OPEC states cut the supply of oil to the USA and its allies in 1973.

Peak oil in the USA was, however, more an economic than a geological issue. The 1974 deal between the USA and Saudi Arabia to make the US dollar the sole currency for trading oil, allowed the US state to maintain its privileged market position. Moreover, cheaper oil deposits could be exploited overseas far more profitably than attempting to boost domestic extraction. And so, US oil fields were left to gradually decline.

Unfortunately, the other part of Hubbert’s forecast was based on the fact that the peak of global oil discoveries came in the mid-1960s. As a result, global oil production could be expected to peak sometime in the first decade of the twenty-first century. This prompted renewed interest in peak oil in 2005, when several retired oil industry insiders such as Matthew Simmons, Colin Campbell and Jean Laherrère published books and papers warning of a coming age of oil shortages. By this time, of course, anyone who was paying attention understood that the American invasion of Iraq had very little to do with bringing freedom and democracy, but everything to do with controlling the USA’s last accessible reserves (Russian and Iranian reserves requiring all-out war to liberate) of conventional oil.

Conventional global crude oil extraction did, indeed, peak in 2005 as predicted. Rising oil prices raised the spectre of generalised price increases; prompting central banks to jack up interest rates which, in turn, triggered a round of debt defaults that exploded the banking crisis of 2008.

The economics text books on which the central bankers based their action were wrong. Rising oil prices do not cause generalised price increases in the long-term. Firstly, market competition tends to cause businesses to absorb the additional cost rather than pass it on to consumers. In a similar way, the largely deregulated (compared to the 1970s) labour market prevents workers from increasing their wages to offset the additional cost. Oil – or at least the fuels refined from oil – is non-discretionary for most users. So, as Frank Shostak at the Mises Institute explains:

“If the price of oil goes up and if people continue to use the same amount of oil as before then this means that people are now forced to allocate more money for oil. If people’s money stock remains unchanged then this means that less money is available for other goods and services, all other things being equal. This of course implies that the average price of other goods and services must come off.

“Note that the overall money spent on goods does not change. Only the composition of spending has altered here, with more on oil and less on other goods. Hence, the average price of goods or money per unit of good remains unchanged.

“From this we can infer that the rate of increase in the prices of goods and services in general is going to be constrained by the rate of growth of the money supply, all other things being equal, and not by the rate of growth of the price of oil. It is not possible for rises in the price of oil to set in motion a general increase in the prices of goods and services without corresponding support from the money supply.”

This is what happened in the aftermath of the 2008 crash, when oil prices briefly shot up to $140 per barrel. While the stratospheric price caused maverick investors to open up reserves of unconventional oil that had previously been deemed unprofitable; the rest of us began to cut back on our discretionary spending. The retail apocalypse that has seen US shopping malls and UK retail chains collapse in their thousands was the direct consequence of high oil prices. But here’s the thing; empty shops have no need of heating, lighting or stock deliveries. And so the companies that used to supply these things also had to cut back; as did the factories that made the goods that those shops used to sell. What it added up to was a slump in global demand for oil just at the point when the unconventional oil began to pour onto the market. By 2014 – after a period of see-sawing prices – oil dropped into a $40-$60 per barrel band that it has struggled to escape from… a price that is still too high for consumers; but too low for producers.

The fall in oil prices from 2014 did, however, put an end to mainstream concerns about peak oil. The economists, it seemed, were correct in assuming that higher prices would merely result in additional reserves of oil being extracted; as was evident in the US “fracking miracle.” Moreover, as the price of petroleum increased, that other canard of economics – “substitutability” – would kick in; in the shape of a new generation of electric vehicles.

This gave rise to the theory of “peak oil demand,” which held that the electrification of the economy and the decoupling of GDP growth from energy and resource consumption was ushering in a new “fourth industrial revolution” that would eventually replace the Oil Age entirely. In the not too distant future, a new communications infrastructure built around renewable energy technologies would simultaneously save us from climate change and wean us off our addiction to fossil fuels.

It was a myth, of course. The success of the “tech” sector of the economy has not been based on the widespread deployment of new technologies; but rather on the leveraging of the labour of an increasingly desperate precariat class at the base of western economies. The success stories are companies like Deliveroo, Uber and Amazon which use sub-contract labour to get around minimum wage legislation in order to out-compete traditional rivals. Meanwhile, a growing army of impoverished and under-employed workers turn to platforms like Task Rabbit and Fiverr in the hope of obtaining enough piecework to put food on the table.

The two big industrial revolutions – the British coal-based one in the late eighteenth century and the American oil-based one after World War Two – have one key factor in common; they both resulted from labour shortages and (relatively) high wages. In these circumstances, widespread investment in expensive new technologies makes economic sense. But the opposite situation prevails today. Despite the largely discredited official employment figures, there is no shortage of labour in western economies. And as a result, real wages are still lower than they were before the 2008 crash. Far from rushing to deploy new technologies that will never turn a profit, capital has been diverted into rent seeking and asset speculation. Meanwhile, in the real economy automation is giving way to manual labour as the best way of remaining profitable.

What growth there has been in the global economy in the last decade is the result of cheap labour and an absence of environmental regulation in developing economies in Asia. So long as enough western consumers could continue to take on debt to purchase cheap consumer goods, states like China could continue to inflate their GDP figures to give the impression that all was well. And so long as everything appeared fine, western asset speculation could continue to suck the life out of the economy.

On a global scale, however, the economy is increasingly subject to two phenomena first outlined by Karl Marx in nineteenth century England:

- The tendency for the rate of profit to fall, and

- The crisis of over-production.

Marx, writing at a time when most work was still manual, wrongly attributed the decline in profitability solely to rising labour costs. In reality, labour is just a sub-set of the rise in energy costs that is inevitable as complexity increases. Nevertheless, what Marx observed in individual English factories is the same process that now afflicts entire states. As countries like China have industrialised, so they have needed an increasingly skilled (and therefore expensive) workforce. In addition, they have become increasingly dependent on imported fuels (China is now the biggest importer of oil from the Middle East) as their industrial base has outgrown their domestic energy resources. Finally, all of this requires a public infrastructure that must ultimately be paid for out of the profits of industry (albeit manipulated through the chicanery of the financial sector). The result is that the developing states are less profitable than they used to be; making the steady flow of cheap goods to the west unsustainable.

If this was not bad enough, Marx’s single most important observation is undermining the global economy from the other end. Although Marx referred to the in-built cyclical crisis of capitalism as being about over-production; in the modern global economy, it is better understood as a crisis of under-consumption. This was how Amazon co-founder Nick Hanauer explained it in his infamous banned TED Talk in 2012. As more and more wealth is hoovered up by a handful of billionaire plutocrats at the top, so spending power across the economy collapses. On the one hand, this is because plutocrats hoard currency in unproductive assets. On the other hand it is because the majority of ordinary working people no longer have the spending power to buy all of the goods and services that are being produced.

Things have gone from bad to worse in the years since Hanauer’s TED Talk. As Jake Johnson at Common Dreams recently reported:

“Adding to the mountain of statistical evidence showing the severity of U.S. inequality, an analysis published Friday found that the top one percent of Americans gained $21 trillion in wealth since 1989 while the bottom 50 percent lost $900 billion.”

As this graph from How Much demonstrates, the items that have declined in price in the last two decades are those like cars, smartphones and TVs that largely benefit high earners, while the things that have increased tend to be non-discretionary items like student debt repayments, medical costs, housing costs and food that hit the poor hardest:

A similar pattern has beset ordinary people in Britain, where utility costs – particularly energy prices – have accounted for the majority of the inflation since 2008. Meanwhile, in France a relatively small tax increase on fuel was sufficient to spark a “yellow vest” protest that continues to this day.

This is the real peak oil demand in action. Not the techno-utopian fantasy of a world that no longer needs oil; but the stark reality of a world that can no longer afford it. The complicating factor, though, is that in a world that cannot afford oil, it is not oil demand that declines (at least not to begin with). Oil is ubiquitous. Western civilisation cannot exist without it. Even the majority of ordinary people continue to rely upon it to run the public transport or to fuel the private cars that they depend upon to keep their jobs. And so households and businesses look to cut their discretionary spending instead. This is why it is wrong to regard the growing retail apocalypse as a discrete crisis. In practice, it was the product of millions of consumers switching their spending from discretionary items like meals out, holidays, electronic gadgets, fashion accessories and toys to essential items like energy, food and housing… and as the pace of decline grows, even these non-discretionary spends are being threatened.

For what it is worth – although the mainstream media was noticeably reticent about it – the UK is probably in a technical recession following the release of the spring quarter growth figures (negative 0.2 percent). And while some of this can be explained by the growing prospect of Britain crashing out of the EU without a deal, we shouldn’t over-play this. After all, the entire global economy has slowed dramatically in the past year. One indicator of the slowdown is the decline in both production and price of copper. “Dr Copper” has traditionally been seen as a measure of the health of the modern economy because copper is essential to the overwhelming majority of goods and services. If demand for copper is high, it is a sure sign that the real economy is growing. If, like today, production and price have slumped, it is a sure sign of an economic contraction. As Tim Treadgold at Forbes explains:

“A modest fall in global production of copper ought to be matched by a rising price but that’s not the case as a metal widely seen as a bellwether for the broader economy because of its multiple industrial uses sits close to a two year low.

“The problem is that a 1.4% decline in output from the world’s copper mines in the first half of the year was offset by a 1% fall in the use of copper…

“The fact that copper use is declining rather than rising is a pointer to a slowdown in global industrial production which could precede deeper economic problems with copper acting as an early-warning indicator, hence its nickname of Dr Copper.”

What may yet turn out to be “peak copper demand” – something that was not supposed to happen according to the fourth industrial revolution enthusiasts and their green new deal siblings – is actually a manifestation of peak oil demand in practice. That is, as the cost of energy in general and oil in particular increases, so “demand” (in the economic sense of desiring something and having enough money to pay for it) falls across the economy. Ironically, though, the slump in general demand eventually feeds back to oil itself. Closed shops and idle factories have considerably less need for energy. As August Graham at City AM reported last week:

“The International Energy Agency could cut its forecasts for global oil demand again if economies around the world fail to pick up speed…

“Further cuts ‘will depend on the global economy. If the global economy weakens, for which there are already some signs, we may lower oil demand expectations,’ Fatih Birol told Reuters on the sidelines of the World Knowledge Forum in Seoul.”

Nor is the IEA alone in reporting a slump in demand for oil. As Nick Cunningham at Oil Price reports:

“Global oil demand continues to see downgrades from major energy forecasters, with several downward revisions in just the past week.

“The U.S. EIA said in its Short-Term Energy Outlook that it expects oil demand to grow by only 0.9 million barrels per day (mb/d) this year, the latest in a series of downgrades from the agency… just about every major forecaster has been forced to dramatically slash their numbers [because] the global economy has slowed down by much more than expected. If the roughly 890,000-bpd demand growth figure comes to pass as the EIA now predicts, it would be the first time since 2011 that oil demand grew by less than 1 mb/d.

“OPEC also cut its forecast to about 1 mb/d in its latest report, down 80,000 bpd from last month, citing a slowing global economy. ‘This highlights the shared responsibility of all producing countries to support oil market stability to avoid unwanted volatility and a potential relapse into market imbalance,’ OPEC said in its report.”

Just as the UK media tends to blame Brexit for the UK slowdown, so US journalists like Cunningham tend to blame Trump’s trade war with China. In reality, though, these political phenomena are themselves symptoms of the growing unaffordability of energy; as electorates turn to nationalism as a potential solution (it isn’t) to problems (attempting to have infinite growth on a finite planet) that globalism has failed to resolve.

This is not, of course, an economic environment in which investors will be jumping over each other to throw money at the next (usually smaller and more expensive) undeveloped oil deposit. Nor are they going to be in a hurry to lose their shirts on a green new deal that will make energy even more unaffordable than it is today; which is why both fossil fuels and non-renewable renewable energy-harvesting technologies are increasingly dependent upon government subsidies (which require higher taxes and which thus further lower spending power) to continue operating.

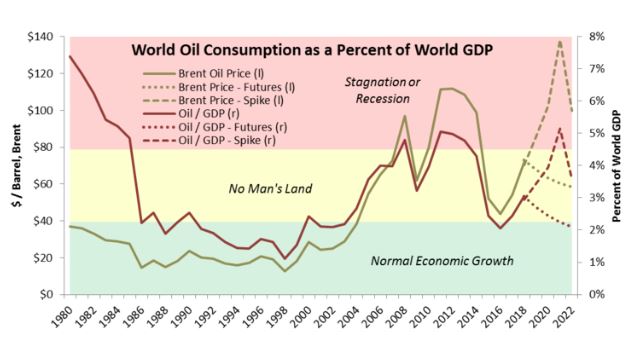

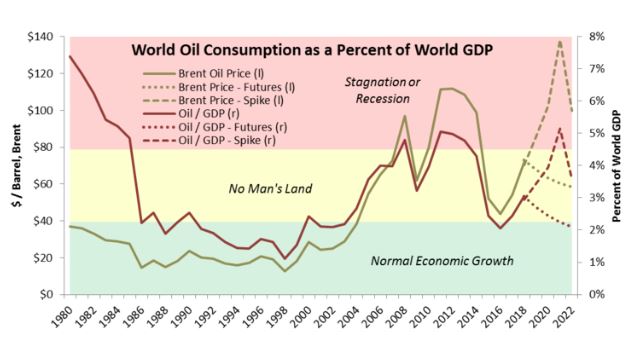

For the past decade, the global economy has been zig-zagging in response to the price of oil. Whereas in the years prior to 2005 it had been possible to find an oil price that both consumers and producers could afford – the so-called “goldilocks zone” – only once in the last 15 years (2015-16) has the price of oil fallen to a level where “normal” economic growth could occur. The result of this unexpected increase in growth, however, was too high a demand for oil which translated into rapidly rising oil prices once more. And, of course, the result of those higher oil prices – which approached $80 per barrel last year – is the current slowdown in the global economy. As the Princeton Energy Advisors explain:

“When oil is cheap and oil spend is less than 2.5% of world GDP, the global economy tends to grow at a solid pace.

“When oil consumption exceeds 4.5% of global GDP, the world economy typically faces either recession or stagnation (in the 1970s, ‘stagflation’, after 2011, ‘secular stagnation’).

“In between, when oil consumption exceeds 2.25%, but is less than 4.5%, of GDP, growth can continue, but oil prices begin to weigh on the economy. Interestingly, oil prices are not stable in this ‘no man’s land’. That is, the demand-constrained price of oil is 1.75-2.5% of GDP; the supply-constrained price of oil is above 4.5%. The oil price will either fall to the demand-constrained price or rise to the supply-constrained price. There is no stable landing point in between.

The question, then, is whether we are simply repeating the zig-zag price/demand pattern that has dogged the economy for more than a decade; or whether we are about to enter entirely new and highly dangerous territory. Oil futures traders anticipate another decline in oil prices as supply overtakes the slowdown in demand. The Princeton Energy Advisors, in contrast, anticipate a price spike toward the $140 per barrel level that preceded the 2008 crash:

“The futures curve still believes oil prices will be demand-constrained in the 2020s, but given the extraordinary dependence of global demand growth on an ever-increasing Permian supply, the odds of it ending badly look high.

“Our outlook now anticipates that the current business cycle will end in 2021 with oil spend averaging 5.1% of GDP for the year, representing an average price of $138 / barrel on a Brent basis.”

A price spike of that magnitude will be catastrophic for western states that are in an even worse condition than they had been in 2008; when $140 per barrel oil was also unaffordable. And so the global economy looks set to take another drop down the elevator shaft of decline in the near future. But at no time will the economy experience the kind of oil shortages that the original peak oilers imagined (based on the experience of the artificial shortage in 1973).

What neither the oil geologists nor the techno-utopians foresaw is that both “peak oil” and “peak oil demand” are essentially the same thing. As the cost of extracting oil has increased, so generalised demand has slumped across the economy; ultimately feeding back into a decline in demand for oil. As oil producers implement production quotas in an attempt to shore up prices, demand declines even further; forcing prices down and making potential new production unprofitable. But all of this is occurring within an economy in which people still drive around in petroleum-fuelled cars, and continue to buy products made from and transported with oil. Only at the margins, where millions of former consumers join the ranks of the precariat do we see the decline in demand for oil for what it is. For now, these people are like the canary in the coal mine, warning us of what is coming. But for now at least, the majority can cling to the fragile belief that technology will save the day.

As you made it to the end…

you might consider supporting The Consciousness of Sheep.

28 Comments on "Peak oil demand is now"

Richard Guenette on Tue, 8th Oct 2019 5:21 pm

By 2100, the world’s human population will be: zero. We are living on borrowed time.

JuanP on Tue, 8th Oct 2019 5:29 pm

My wife and I will definitely not be here by then. I am grateful for that.

stupid juanP sock on Tue, 8th Oct 2019 5:31 pm

Richard Guenette on Tue, 8th Oct 2019 5:21 pm

lunatics talk to themselves on Tue, 8th Oct 2019 5:31 pm

My wife and I will definitely not be here by then. I am grateful for that.

peakyeast on Tue, 8th Oct 2019 6:16 pm

The necessities of life are getting more expensive. The unnecessary luxuries of life are getting cheaper.

One doesnt have to extrapolate that for long to see where there the real problem lies.

Dennis Meaney on Tue, 8th Oct 2019 6:33 pm

Mike Ruppert had us all checked out by 2030. I feel terrible for the wild creatures who were just getting on in their balanced ways.

makati1 on Tue, 8th Oct 2019 6:35 pm

peakyeast, your observations are spot on.

Theedrich on Wed, 9th Oct 2019 5:34 am

The “Peak Oil” article is overly complex. Marx’s “tendency for the rate of profit to fall, and The crisis of over-production” are really two aspects of Tainter’s explanation of complexification as the reason for diminishing returns leading to the collapse of complex societies. And the entire article can be summarized as what Gail Tverberg has been saying for eons: the inability of purchasers at the bottom of the economic pyramid to buy the products of producers leads to collapse.

And, once government revenues begin to fail seriously, guess which groups are going to be at the bottom of the purchasing pyramid.

REAL Green on Wed, 9th Oct 2019 6:58 am

“Drought, saltwater intrusion loom in the Mekong Delta”

https://tinyurl.com/y5f6cg5a relief web

“Saltwater could reach 30-35 kilometres from the coast in December and 45-55 kilometres by January and February, it said…It advised rice farmers in higher areas to shift to other drought – resistant crops in winter-spring and rotate between rice and shrimp in low-lying areas…The committee has instructed relevant agencies to inspect irrigation works to repair degraded ones to prevent saltwater intrusion and store freshwater…Sluice gates and irrigation canals will be dredged and temporary dams will be built to keep out saltwater.”

REAL Green on Wed, 9th Oct 2019 6:59 am

“Florida is in for more dead corals, sea rise and floods, says new UN climate report”

https://tinyurl.com/y2gfztj2 phys org

“South Florida expects two feet of sea rise by 2060, according to a 2015 unified sea rise projection by the South Florida Climate Compact, and more than five feet by 2100. This projection includes sea level rise curves created by NOAA and the U.S. Army Corps of Engineers, which predict more dramatic sea rise than the IPCC report. That projection is being updated for 2020. Sea levels don’t rise uniformly around the world, Kirtman said. It depends on geology, geography and ocean currents. Since 1982, Miami has seen about 6 inches of sea level rise, he said. Galveston, Texas, saw closer to 8 inches, while Honolulu saw about an inch and a half. The report also found that places like Miami and Key West could see so-called “hundred-year floods,” which have a 1% chance of happening every year, annually as soon as 2050. According to a Washington Post analysis, more than 1.2 million people in Miami-Dade live in 100-year flood zones. Florida alone has $714 billion of property in the 100-year floodplain. “By 2100, almost everywhere where we have a tide gauge and can measure tide, we’re expecting the historic 100-year tide level will be reached annually,” Oppenheimer said. And more extreme flood events, like the 500-year flood event in Houston after Hurricane Harvey, will happen more often. Something else that could become more common? The relatively new phenomena of marine heatwaves.”

REAL Green on Wed, 9th Oct 2019 7:00 am

“German chemical industry sketches costly carbon-neutral path”

https://tinyurl.com/yxdxkk5b phys org

“The necessary CO2-free processes to produce basic chemicals are known in principle, but have to be developed further for large-scale application,” it added, suggesting many could be ready “in the mid-2030s”. But for the plans to make business sense, low electricity prices and a massive increase in renewable generation would be needed. Switching to the new carbon-neutral processes and technologies would multiply the key industry’s electricity demand elevenfold, to 628 terawatt-hours per year, the VCI estimated—or as much as Germany generates annually today.”

REAL Green on Wed, 9th Oct 2019 7:00 am

“Buildings Account For 11% Of Global Emissions. Here Are Two Ways To Slash That Number”

https://tinyurl.com/y5zm2769 clean technica

“Lowenstein, Donahue, and Foster argue that “expanding wood construction while limiting global harvesting to no more than the annual growth could produce a combination of emissions reduction and carbon sequestration equivalent to eliminating construction emissions altogether. This could take a big bite out of the carbon problem, roughly equivalent to the present contribution from all types of renewable energy…constructing a 5-story office building with wood had less than a third of the global warming impact of a comparable steel and concrete building. The university has an 18-story dormitory made from cross laminated timber — a form of wood construction that is similar to plywood but on a much larger scale. Wooden buildings not only reduce the carbon emissions from construction, they keep atmospheric carbon locked up for the life of the building — or longer if components are reused.”

REAL Green on Wed, 9th Oct 2019 7:25 am

I sure hope y’all enjoyed my spamming the discussion with my usual off topic copied and pasted dumbass bullshit. Cause it sure made me feel REAL important.

Brian on Wed, 9th Oct 2019 10:30 am

Ultimately we have an infinite growth system tied to a finite planet. Unfortunately, our political leadership continues to prevent an economic depression. Economic depression will destroy wealth at the top of the pyramid and lower prices on the big ticket items… Houses & Cars.. Most of western civilization spends its money on those two items above all else. The average American is struggling financially.. They are stressed out and eventually they will be looking for someone to blame for their misery. Our leadership would be wise to take heed… Historically these cycles end violently… Especially with a heavily armed civilian population.

majece majece on Wed, 9th Oct 2019 10:54 am

I advise you to visit https://eduessayhelper.org/blog/career-goals-essay if you want to get career goals essay writing tips. It’s really important to know

Cloggie on Wed, 9th Oct 2019 2:21 pm

#PerfectTiming

https://www.spiegel.de/wissenschaft/technik/chemie-nobelpreis-2019-auf-der-suche-nach-der-perfekten-batterie-a-1290481.html

Nobelprize 2019 Chemistry went to three battery researchers:

John Goodenough (USA)

Stanley Whittingham (UK)

Akira Yoshino (Japan)

Their field: Lithium-Ion technology

Cloggie on Wed, 9th Oct 2019 2:29 pm

A day in the life of the Marxist empire…

https://www.spiegel.de/wissenschaft/mensch/der-nobelpreis-hat-ein-frauenproblem-a-1290715.html

“Der Nobelpreis hat ein Frauenproblem”

(The Nobelprize has a woman problem)

Der Spiegel is complaining about the fact that this year again most Nobel prizes go to WHITE OLD MEN.

Won’t be long until the western political left will attempt to introduce a Nobel prize quotum/affermative action for wimmin, gays, blacks, muslims, 16 year old girls with Asperger’s syndrome, etc., etc.

Cloggie on Wed, 9th Oct 2019 2:51 pm

i support (((supertards))) awarding nobel prizes to (((supertards))) endlessly

Outcast_Searcher on Wed, 9th Oct 2019 3:06 pm

peakyeast, did you read the chart? Food and beverages, housing, cars, and items overall (the CPI) rose in price less than wages.

So for medical care, especially hospitals, yeah, that’s nasty and WAY exceeding inflation.

For the rest, not so much. Can’t afford to have kids (re child care, nursery school)? Then DON’T HAVE THEM — we have a big overpopulation problem anyway.

Darrell Cloud on Wed, 9th Oct 2019 5:31 pm

We are not there yet. When I see more bicycles on the road than cars, I will know we have arrived.

Duncan Idaho on Wed, 9th Oct 2019 6:24 pm

When I see more bicycles on the road than cars

Been to Holland lately?

supremacist muzzies jerk on Wed, 9th Oct 2019 8:38 pm

for some time now i have thought of appointing additional supertard titles and just out of the blue juanP blurted out “supertard mak”. It can’t be a more opportune time to make announcemnt of new supertards. i do this to bribe them so they shut up mostly.

this is a teachable moment – it drives home the point that like all currency – supertard currency is not immune to inflation. if it is immune is isn’t useful.

as a fmr-paultard i was told to hug and make love to gold. the only problem is my shirts disappeared and it’s cold to hug and make love to goal without clothing. in other words, i lost my shirts being a gold bug.

the following are new appointee to supertards:

supertard Cloggie

supertard makato (uneducated makako UM is no more)

supertard JuanP (no longer need to go back to sh*thole sute americano)

congratuations to all supertard. your jizya payments will be forthcoming with multiple auto keltects, learjet, 10,000 acres, goats, and millions of rounds for recreational purposes.

supremacist muzzies jerk on Wed, 9th Oct 2019 9:58 pm

us military have custody of two beetles muzzies and would rather spend a lot of money for their defense and trials. it’s cheaper to sell to me for $1 each because they’re unamputated. i’ll cut off both feet and hands and hold them in supertard’s 10,000 acres without food or water. they have to manage to survive themselves

supremacist muzzies jerk on Wed, 9th Oct 2019 10:20 pm

supertard big muzzie beard said muzzie so dangerous that he was banned initially but now let out to roam free in the uk.

then supertard big muzzie beard listed all dangerous muzzies who said everything from killing kufar and chopping heads.

for the record, i just want to amputated the muzzies. i’m not the bad guy here.

https://www.jihadwatch.org/2019/10/uk-islamic-state-couple-free-to-walk-the-streets-because-they-refuse-to-talk-to-police

Saudi Sheikh Mohammed al-Arefe. Al-Arefe has said: “Devotion to jihad for the sake of Allah, and the desire to shed blood, to smash skulls, and to sever limbs for the sake of Allah and in defense of His religion, is, undoubtedly, an honor for the believer. Allah said that if a man fights the infidels, the infidels will be unable to prepare to fight.”

REAL Green on Thu, 10th Oct 2019 6:17 am

“Cannabis: a remedy for the soil?”

https://tinyurl.com/y66rtlpj the ecologist

“But what is less emphasised in the media today are the may uses of the cannabis plant in addition to its added benefits to the soil. Unlike cotton and many other plants used in textile, hemp needs less water and requires no pesticides, allows for soil remediation (phytoremediation) – whereby hemp can absorb pollutants from the earth – and it returns 60-70 percent of the nutrients it takes from the soil. The cannabis plant has a wide range of uses which makes its cultivation both a boon for the ecology as well as for nutrition among other uses. This plant can provide oil used for cooking, fuel, personal care products, dietary supplements, beverages, baked goods, protein powder, beer, flour and animal feed. Beyond this, hemp is used in building materials (fiberboard, insulation, cement and mortar), paper products and industrial textiles. Additionally, there are myriad agricultural benefits from this plant: it suppresses weeds, its roots provide soil aeration and it allows for pollen isolation. Production benefits What this means for the planet is that hemp offers the most far ranging uses for our sustainability. For instance, hemp requires half the amount of water that cotton needs to produce a 250 percent higher yield than cotton because when processing is figured into the water usage equation, “cotton uses more than four times as much water as hemp”. Cotton production relies on pesticides while hemp does not and hemp is naturally resistant to pests as its dense foliage provides enough shade to prevent or suppress weed growth. From industrial hemp farming which is expected to almost double in growth by 2026 to “pick-your-own” hemp fields, the future of textile is quickly moving towards a hemp-based production in North America.”

supemacist muzzies jerk on Thu, 10th Oct 2019 8:16 am

canabis is just addiction supertard. are you abandoning permacultism? first you said you abandoing america project now this

Prince on Tue, 16th Nov 2021 2:45 am

Thank you for the excellent articles share with us. Please share some other topics with me, I am a really big fan of your writing skills and I agree with this. You might be interested in t.j. maxx payment methods

global green grant fund on Wed, 5th Jan 2022 3:37 am

I read this post your post is so nice and very informative post thanks for sharing this post. Checkout global green grant fund