Page added on January 26, 2011

Chinese Oil Consumption Growth

Time for an update on Chinese oil consumption growth. I took the annual data from the BP spreadsheet, and extended it to 2010 based on the data in the first three quarters vs the same quarters of 2009 (from the EIA Table 2.4). This next graph plots both consumption (blue, left scale in millions of barrels/day) and the annual percentage growth (red, right scale):

You can see that consumption in 2010 looks well over 9mbd, and will likely exceed 10mbd in 2011. The growth rate was somewhat suppressed during the 1998 Asian flu event and the 2000-2001 tech crash, then grew rapidly in the early 2000s, fell in the 2005-2008 oil shock, but then recovered to almost 10% – above trend – by 2010 with the moderation of prices. Chinese consumption hasn’t fallen year-on-year since 1990.

What is trend growth exactly? Well, if we take the prior decade compound annual growth rate (CAGR), that looks as follow:

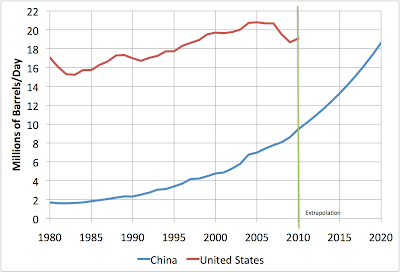

You can see that since the reforms of Deng Xiaoping really took hold, growth has tended to average about 7%/year on the decadal time scale. If you assume they can maintain that 7% average pace for one more decade, this is how Chinese consumption will stack up next to the United States:

I would take it as rather likely that US consumption will have to shrink further from the 2005 peak in the face of this kind of growth in China (not to mention the Middle East and other emerging markets) and given the difficulties in increasing supply much further. If so, China will exceed the US as an oil consumer sometime late in the current decade.

Finally, here’s the recent history of the oil future price for December 2015:

4 Comments on "Chinese Oil Consumption Growth"

Kenz300 on Thu, 27th Jan 2011 12:30 am

China has made a commitment to wind and solar power making huge investments and becoming a market leader in a few short years.

They are also supporting the future of electric vehicles with big investments and subsidies for electric vehicles.

Will they support the biofuels market with similar large investments in research and development in second generation ethanol and biodiesel?

Frank on Fri, 28th Jan 2011 1:40 am

I applaud this article but am perplexed about something…

You stated (Caps added to help make my point): “I would take it as rather likely that US consumption WILL HAVE TO SHRINK further from the 2005 peak in the face of this kind of growth in China (not to mention the Middle East and other emerging markets) and given the difficulties in increasing supply much further.”

My question is: Why do we have to “shrink” our oil consumption? Is it for the same reason we send them all our best manufacturing jobs? Is it for the same reason we send them all our money (China has a trillion dollar fund of hard cash)? Or is it bedause we are just a bunch of wimps too weak to get in the way of our superiors?

At first glance, it would seem to me that rapidly increasing Chinese oil consumpltion only exacerbates the peak oil conundrum for us and them. But, it seems like they are to sail ahead while we sink into depression. If there is not some more sinister conspiracy afoot, it seems logical that China too must suffer from the emerging peak oil scenario.

Kenz300 on Sat, 29th Jan 2011 2:44 am

The last time oil prices went to $147/barrel people in the US were parking their pickup trucks and SUV’s and were tripping over themselves at the foreign car dealers looking for high mileage vehicles.

Fuel efficiency standards are being raised in the US and autos will become more fuel efficient. When more of an average family’s monthly budget is going for higher transportation costs something else in the budget has to give. Food, clothing and mortgage payments may suffer from higher energy prices.

Bring on the electric, hybrid, and flex-fuel vehicles. With higher oil prices we will all begin to think about how much energy we use and make decisions to reduce our energy use. We need to transition to alternative energy. The real question is how fast will we be required to change.

Ankur on Fri, 15th Sep 2023 10:15 am

Such a wonderful amazing game euchre online now you here the a right website.