Page added on December 25, 2019

Why Oil No Longer Rules The Stock Market

Things are looking pretty good for the average American investor at the moment, with the S&P 500 still taking out new highs and a 27.3 percent YTD gain rivalled only by Russia’s RTS Index 39.2 percent return over the timeframe on the global arena.

Rising stock valuations are awesome for investors holding stocks in their portfolios–but not so great for those holding cash waiting for good entry points.

For investors who prefer to go shopping for bargains when there’s blood in the streets, the good news is that in every bull market there’s almost always a bear market tucked away somewhere.

And currently there’s no bigger bear than the energy sector.

While the tech sector continues hogging the limelight (and the dollars), the energy sector has been attracting attention for all the wrong reasons.

The tech sector has continued to shoot the lights out, totally eclipsing the energy sector, which has badly lagged almost every other sector in the US financial markets.

The tech sector’s favorite benchmark, the Technology Select Sector SPDR Fund (XLK), has climbed 45.3 percent YTD and an amazing 305 percent over the past decade.

In sharp contrast, the Energy Select Sector SPDR Fund (XLE), which has energy heavyweights ExxonMobil (NYSE:XOM) and Chevron (NYSE:CVX) as its biggest components (43.51 percent combined weighting), has only managed a mere 7 percent YTD gain and 9.3 percent over the decade.

XLE vs. SPX 5-Year Change

Source: CNN Money

Things look even more dire when you zoom out.

Over longer timeframes, the energy sector has lagged most other sectors, returning -14 percent since June 2008.

Source: Fortune

The biggest players in the stock market now are technology companies, with Microsoft’s (NASDAQ:MSFT) $1.2T valuation bigger than the entire energy sector. Microsoft, Apple, Amazon and Facebook (NASDAQ:FB)–in that order—are the most valuable public companies.

At the same time, the top-rated energy company, ExxonMobil, dropped from the top 10 for the first time ever with its $292.9B market cap only good for 11th position.

The energy sector’s 1.5x Price-to-Book value average ranks way below the tech sector’s 8.7x and even the S&P 500’s 3.5x, meaning many stocks in the space are heavily discounted. The energy sector’s weighting in the S&P 500 has dropped to just 4 percent compared to 13 percent in 2000 while tech now commands 26 percent of the market.

Clearly, investors are not thinking very highly of energy stocks.

However, things were very different two decades ago when tech was much less dominant and diverse sectors were well represented in the top echelons. The top 4 companies in 2000 were General Electric, ExxonMobil, Pfizer and Citigroup, in that order.

Long live oil & gas

With the way things are going, it appears the tech boom is about to send oil and gas stocks into oblivion. Tech is clearly stealing the show, and even older tech companies like Microsoft and Apple have managed to find favor with the investing universe. It’s conceivable that 20 years from now, no single energy stock will even make the Top 20 in the S&P 500 Hall of Fame.

But make no mistake about it: oil and gas stocks are not dead yet, even if they’re not Hall of Famers.

Despite the obvious popularity of tech stocks and the rapid growth of renewable energy, oil and gas still have some solid catalysts behind them that will ensure they continue featuring prominently in our energy economy for decades to come.

First is the robust demand for fossil fuels. Oil and gas markets enjoy the rare luxury of being immune to the price elasticity of demand. As long as the global population continues to grow, demand for oil and gas will keep climbing regardless of prices. The world currently consumes 26 million b/d of gasoline and 30 million b/d of diesel fuel every single day, and those numbers will keep climbing as more and more people purchase cars, especially in the developing world. It’s a numbers game, really.

India has 4 cars to every 100 people while China has 7 for every 100 citizens, both a far cry from the 82-cars-to-100-people ratio in the United States. As more people in developing nations buy cars, the demand for oil is guaranteed to keep rising. There are 1.2 billion passenger cars with more than 98 percent of them relying on oil. This fleet is expected to exceed 3 billion by 2050, the ongoing EV revolution notwithstanding.

Oil demand has been on a constant uptrend over the past two decades save for times of severe recessions.

Source: Statista

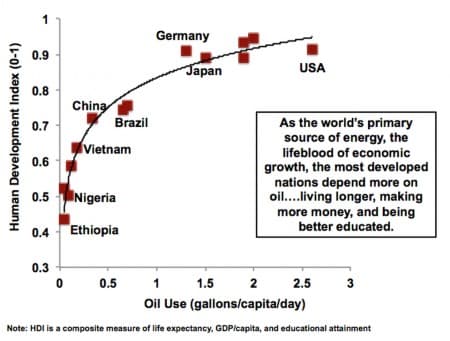

Second, oil consumption has been a key indicator of the quality of life and is likely to remain that way in the foreseeable future. Oil remains the cornerstone of modernity with higher consumption almost synonymous with higher standards of living.

Roughly 83 percent of the world’s population currently lives in underdeveloped countries. The average person in rich countries consumes 1.6 gallons of oil products a day compared to just 0.32 gallons for a person living in a poor country. With the world now experiencing a dramatic reduction in poverty levels, you can expect oil demand to continue enjoying robust growth.

Source: Forbes

And finally, oil and gas will continue being our primary energy sources over the next couple of decades simply because we lack the capacity to ramp up renewable sources at a fast-enough clip to keep up with rapidly growing energy demand. Natural gas demand has been growing especially fast as LNG continues to replace coal as the favored fuel for electricity generation.

Natural gas has the potential to mitigate climate change. When used in power generation, natural gas emits ~50 percent less CO2 than coal and 30 percent less than oil, not to mention that it results in negligible emissions of nitrogen oxides, (NOx), mercury (Hg), sulfur dioxide (SO2), and particulates. The EIA estimates that natural gas will maintain its current 22 percent slice in the global energy market by 2040, whereas the fraction by oil+ coal combined is expected to fall quite dramatically.

Meanwhile, in a worst case scenario, the IPCC (Intergovernmental Panel for Climate Change) has demonstrated a clear and sustained role for natural gas under the ambitious 1.5° Celsius target wherein natural gas would still supply 19 percent of global energy needs by 2040, down from 22 percent currently.

By Alex Kimani for Oilprice.com

13 Comments on "Why Oil No Longer Rules The Stock Market"

Kenz300 on Wed, 25th Dec 2019 12:38 pm

Fossil fuels are a bad investment for people and the planet.

Look how many coal companies have gone bankrupt over the last 3 years with more bankruptcies coming.

Kenz300 on Wed, 25th Dec 2019 12:41 pm

Financial institutions and insurance companies are now starting to factor in the risk of Climate Change from fossil fuels. They do not like what they see.

Duncan Idaho on Wed, 25th Dec 2019 1:25 pm

0 — Symbolic beginning of the destruction of the world in the name of Jesus Christ & Western Civilization. The birthday of the ‘christ-god’ only falls in step with the 25th in 354CE & only becomes important enough to merit the name ‘Christmas’ in 1132CE.

Duncan Idaho on Wed, 25th Dec 2019 1:35 pm

2009 — Ireland: Two more bishops resign due to child sex abuse allegations contained within the Murphy Report. They were Dublin’s only remaining serving auxiliary bishops.

Famlin on Wed, 25th Dec 2019 2:27 pm

Oil companies will go after all sources; offshore, shale, sands …, still oil production will grow much slower than renewable and natgas. Expect oils influence to loosen.

JuanP is stupid on Wed, 25th Dec 2019 2:46 pm

Stupid you have been outed we know kenz is you.

this is from stupid:

Kenz300 said Financial institutions and insurance companies are…

Kenz300 said Fossil fuels are a bad investment for people and t…

Anonymouse on Wed, 25th Dec 2019 3:09 pm

No, delusional davyt-t-t-t-tard. YOU are the ‘stupid’ one here. KenZbot is exactly who and what he has always been, a dumb, low-rent version of kloggjude. A broken record with no life, a limited collection of talking points, who farts and darts and then disappears, thankfully, for long periods of time. Unlike you and the fraudmeister that is.

Recently, he seems to think it is safe to return for….reasons?, and is once again spreading his ‘message’ to like minded simpletons who are capable of processing his canned one-liners and hokey talking points. I guess you and the jude must be his intended target audience, who knows? Its hard to tell, because like you, he never says anything. All you say is ‘JUANPEEEEEEEE’ every waking minute. All kenZtard keeps saying is…..fossil fuels are history and the poor are too dumb to stop having children.

In any event, not ‘juanp’, idiot.

Anonymouse on Wed, 25th Dec 2019 3:31 pm

blowjobs for my friends makati1 and Juan. Merry Christmas loves

JuanP on Wed, 25th Dec 2019 3:31 pm

Thanks Anon, your the cutest and greatest

makati1 on Wed, 25th Dec 2019 5:02 pm

Christmas was moved from its original birth of Christ day to replace the Druid holiday. if they can move birthdays, what other lies have they told in the name of religion? Answer: All are lies, based on “faith” which melts away with a real education and intelligence.

“The date of birth of Jesus is not stated in the gospels or in any historical reference, but most theologians assume a year of birth between 6 BC and 1 BC.[1] The historical evidence is too incomplete to allow a definitive dating,[2] but the year is estimated through two different approaches—one by analyzing references to known historical events mentioned in the nativity accounts in the Gospels of Luke and Matthew, and the second by working backward from the estimation of the start of the ministry of Jesus.[3][4] The day or season has been estimated by various methods, including the description of shepherds watching over their sheep.”

https://en.m.wikipedia.org/wiki/Date_of_birth_of_Jesus

Now it is mostly a commercial holiday when “believers” go to church for the only time in the year.

makati1 on Wed, 25th Dec 2019 5:46 pm

“Although most Christians celebrate December 25 as the birthday of Jesus Christ, few in the first two Christian centuries claimed any knowledge of the exact day or year in which he was born. The oldest existing record of a Christmas celebration is found in a Roman almanac that tells of a Christ’s Nativity festival led by the church of Rome in 336 A.D. The precise reason why Christmas came to be celebrated on December 25 remains obscure, but most researchers believe that Christmas originated as a Christian substitute for pagan celebrations of the winter solstice.”

https://www.theburningplatform.com/2019/12/25/this-day-in-history-christ-is-born-6/#more-209688

A fictitious date for a fictitious person.

Sissyfuss on Thu, 26th Dec 2019 9:38 am

The math inherent in this article screams peak oil. That is,in between our fellow players screaming at each othe.

dissident on Sat, 28th Dec 2019 9:21 am

Reality has stopped being a factor in the stock market. It is a casino built on delusions. Where most “investors” buy high and sell low due to being easily panicked. This herd of idiots is leveraged by the big players to ratchet themselves higher regardless of real world performance of the companies whose stock they are trading.

The stock market also uses the mass media distortion of reality. You will note how over the last 20 years the coverage of the economy has become rosier and rosier. The worst recession in the USA since the 1930s that followed from the 2008 meltdown has been completely ignored. All those millions of jobless forming Obama and Trump -villes are really not there. All that matters is that the top 1% (more like 0.1%) is managing to make explosive gains.