Page added on June 18, 2019

Well, It’s Growing: The Shale Revolution

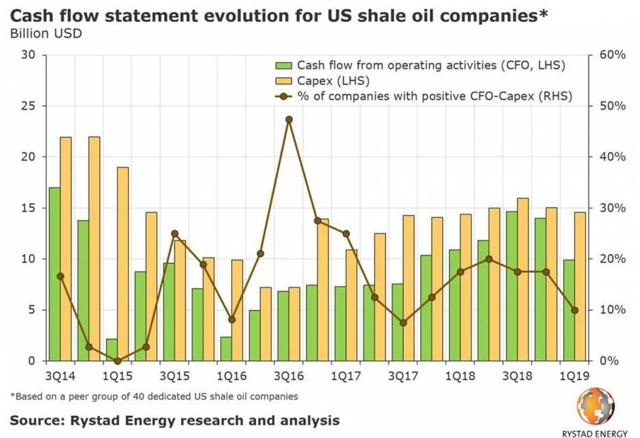

Only 10% of shale companies had a positive cash balance for Q1’19.

Mother Nature has production limits, and there is speculation that the shale industry has reached them.

Having exposure to different phases of exploration helps oil companies diversify their revenue base.

The U.S. is a leader in the shale revolution.

EOG Resources has great exposure to shale opportunities and is growing quickly.

Shale Oil: Will It Burn Out?

Shale oil appears to be the place where cash goes to burn. For Q1’19, only 10% of shale companies have a positive balance from cash flow from operating activities. The current gap between capital expenditures and cash flows from operating activities is $4.7 billion, meaning that shale companies are spending a lot more than they are making.

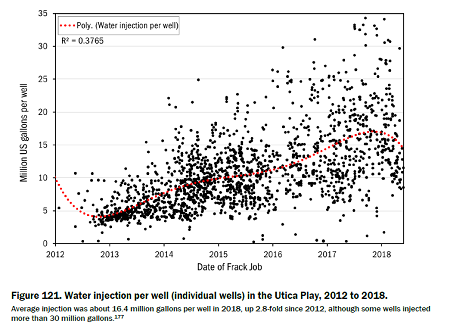

There is speculation that the industry is frontloading production as they use more and more extravagant drilling techniques. Lateral lengths have increased 44% since 2012, and water used in the drilling process has increased 250% over the same time frame, as the below graph depicts. Tech is being stretched to its utmost limits.

(Source: Post Carbon)

As J. David Hughes, an earth scientist, stated:

Assuming shale production can grow forever based on ever-improving technology is a mistake – geology will ultimately dictate the costs and quantity of resources that can be recovered.

At some point, Mother Earth will be exhausted. Oil is not a renewable resource. Hughes made another excellent point in the “Lifecycle of Shale Plays” about the law of diminishing returns with regards to drilling technology. If there is no oil to drill for, it doesn’t matter how fancy the technology gets – there won’t be anything there.

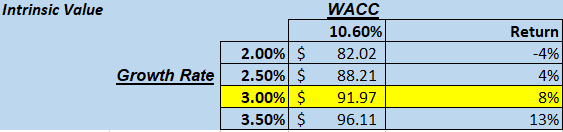

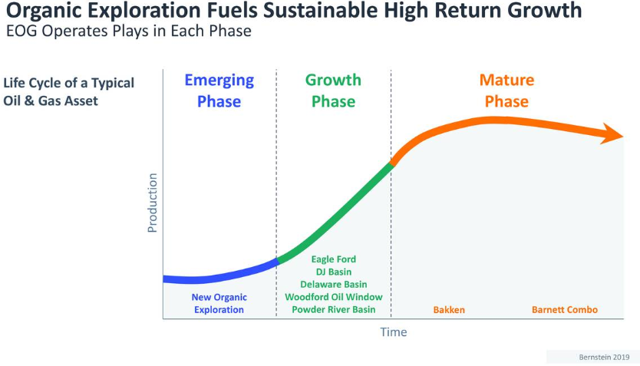

However, companies are managing the limits of nature well. There is a life cycle of oil and gas assets, and companies that have exposure to all three phases are poised well for growth over the next few years. EOG Resources (EOG) has several wells in each of the phases, and is currently undervalued according to my discounted cash flow calculation.

(Source: Company Presentation)

The Shale Revolution: Led by the U.S.

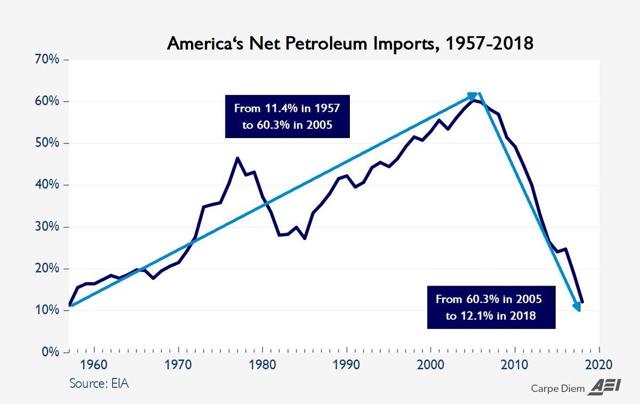

By 2025, the U.S. is expected to supply one in five of all barrels of oil produced. The Shale Revolution has tremendously supported the economic growth of the U.S., reducing the number of net petroleum imports by 48.2% since 2005.

(Source: Mark J. Perry)

The U.S. is currently the world leader in natural gas and oil production, producing more than both Saudi Arabia and Russia. According to the Energy Information Association, the United States is expected to become a net energy exporter by 2020, benefiting from estimated declines in domestic energy consumption coupled with an increase in crude oil and natural gas production.

(Source: Oil Price)

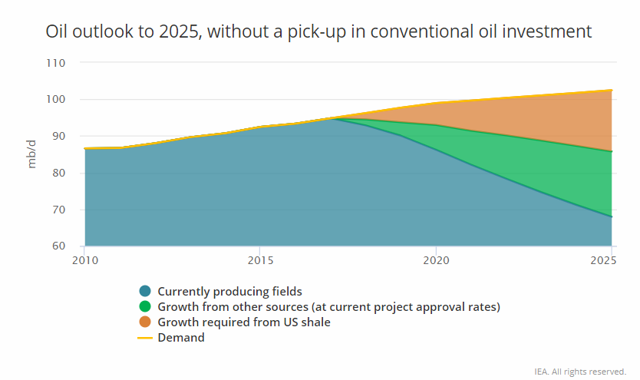

Since 2008, U.S. shale production has increased by 6 million barrels a day. But the issue is, in order to meet demand in the future, U.S. shale production would have to increase by an additional 4 million barrels a day into 2025, totaling 10 millon barrels a day. That is a tough ask, even disregarding the increasing uncertainty and volatility in the markets today. However, the constraint on supply could drive oil prices higher down the road, which would be a net positive for the oil companies.

(Source: IEA)

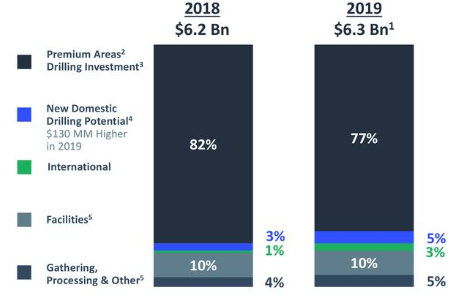

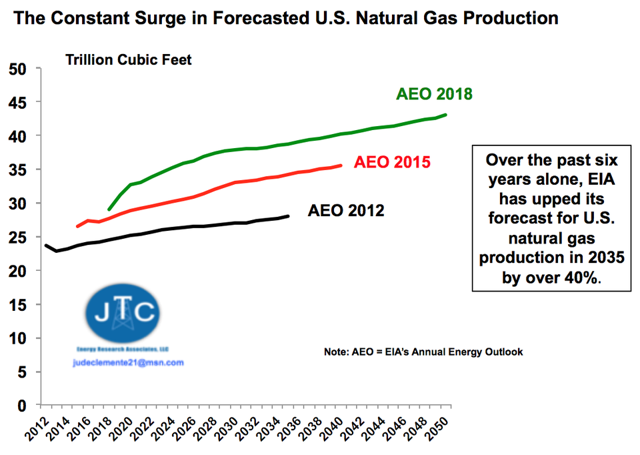

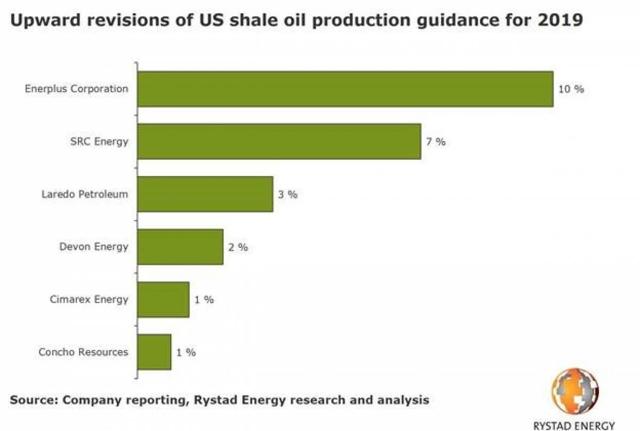

People have been calling for the depletion of the shale industry since 2012. The U.S. is currently producing at levels 30% higher than the EIA estimated, upping the 2019 production forecast by 7%. There are still structural challenges, including “insufficient pipeline and export infrastructure in the Permian and Gulf Coast, to excessive gas flaring in Bakken“. However, the companies don’t seem to be bothered by the headwinds, as evidenced in the chart below.

(Source: Forbes)

Investing in Shale: Growth Opportunities Despite Headwinds

When investing in oil, it’s best to look for larger companies with diverse revenue streams, which can operate even as commodity prices fluctuate. Shale production is expected to increase 16% by the end of the year. Several companies have revised their production estimates upwards, with Enerplus Corporation (ERF) revising the most at 10% positive guidance.

(Source: Oil Price)

This might provide incentive to some of the Big Oil majors to get into U.S. shale oil. Shale is a “short-cycle” upstream asset”, meaning that it doesn’t take huge amounts of capital or years of planning to get started after the initial investment decision is made.

Geopolitical risk is also very low in the U.S., especially compared to the top competitors. Trump has made it clear that he favors oil and gas development, especially in pursuit of U.S. “energy dominance”. BP plc (BP), Exxon (XOM), Shell (RDS.A, RDS.B), and Chevron (CVX) have all started exploring shale opportunities.

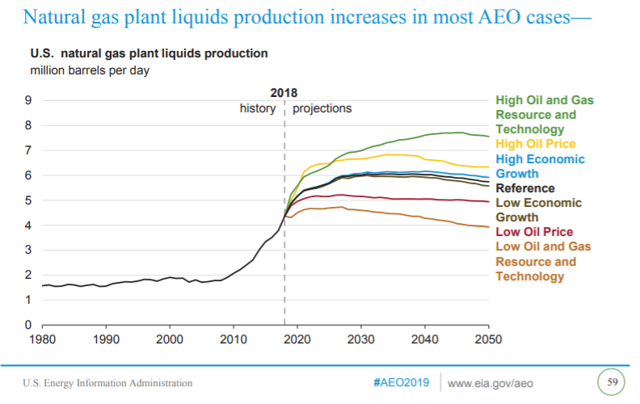

The EIA estimates that the continued development of oil and shale gas resources will increase natural gas plant liquids (NGPL) production to 6.0M b/d by 2050, which is almost a 32% increase from 2018 levels. That’s just the base case. If technology continues to improve and recovery estimates increase, NGPL production could increase 73% by 2050.

(Source: EIA)

The growth opportunities are there, and the majors are beginning to step into the game. The shale industry has more productive years in its future, and getting exposure to that should be beneficial to investors’ portfolios. There are some companies that currently dominate the space and should do well even if the majors decide to enter.

Conclusion: How To Profit From Shale

The tough thing is that nobody really knows where oil is going to go. Random events, like the Strait of Hormuz explosion, can send prices swinging. Prices could go to $40 or they could go all the way to $80, or anywhere in between. Shale oil fracking is the most expensive of all the oil production processes, and the companies tend to sit idle when oil prices are too low. When oil prices rise, shale ramps up production.

Sri Thiruvandanthai summarizes it well:

When the US was a net importer of oil, keeping oil prices low benefited US consumers. Now, keeping oil prices high will mean higher profits for shale oil (and overall US corporates) and better fundamentals for HY and leveraged loan backed by shale producers.

Higher oil prices are good for shale companies because they mean higher revenues. EOG Resources is one company poised to take advantage of those opportunities, even if oil prices don’t rise. Its 2019 plan does not change if oil prices rise, still delivering 14% oil growth, as well as higher investment in premium exploration opportunities.

(Source: Company Presentation)

The company is actively reducing costs across all production environments, and it has a relatively low finding and development cost that has decreased 39% since 2014. Operating costs have decreased 28% over the same time period, driven primarily by a decline in transportation costs.

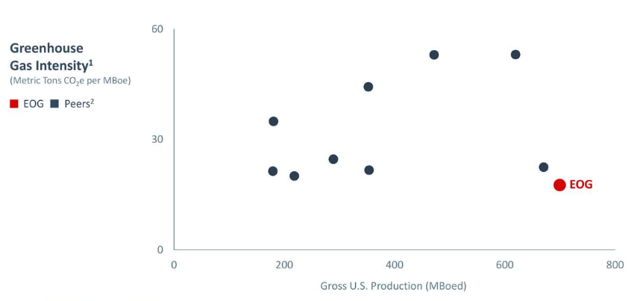

Oil production is not the best industry for the environment, and as an investor who worries about our world, that bothers me. However, EOG is committed to minimizing emissions and reducing its greenhouse gas intensity rate. Given the amount of oil that the company produces, it emits a relatively low amount of CO2 compared to its peer base.

(Source: Company Presentation)

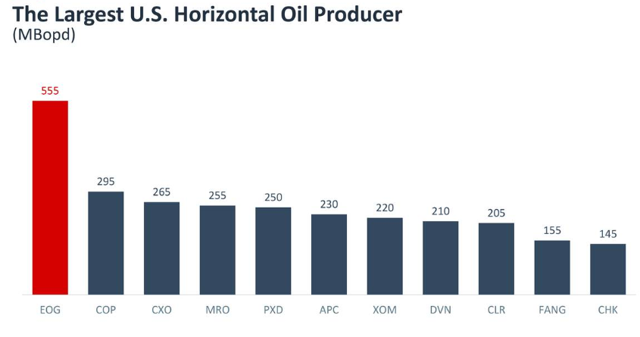

EOG has been able to reduce costs while increasing output, and that enables the company to control a large amount of premium wells, which could earn a 30% rate of return with oil as low as $40 per barrel. Shale is expected to contribute heavily to global oil growth, and EOG is in a prime spot to benefit from that.

(Source: Company Presentation)

Based on my discounted cash flow valuation, I calculate the company as having a target price of $91.97, which gives it an 8% upside from the current share price of $85.

(Source: Author)

There are also several ETFs that give exposure to the shale market, including the iShares U.S. Oil & Gas Exploration & Production ETF (IEO), the Energy Select Sector SPDR ETF (XLE), and the Invesco Dynamic Energy Exploration & Production Portfolio ETF (PXE). IEO has 0.91 correlation to EOG, meaning that the two move closely together most of the time. IEO is currently trading near a 52-week low.

4 Comments on "Well, It’s Growing: The Shale Revolution"

Sissyfuss on Tue, 18th Jun 2019 9:31 am

Article states there are growth opportunities in shale despite only 10% of companies making money. Shale oil or snake oil, you make the choice.

CAM on Tue, 18th Jun 2019 1:59 pm

One question not addressed! Of the 10% of shale oil companies that are “making money”, do any of them have other sources of income such as conventional oil or gas wells etc. that alone allow them to show a current profit?

Coffeeguyzz on Tue, 18th Jun 2019 1:59 pm

People who continue to put attention on the oil aspects of this Shale Revolution are apt to be completely blind sided when its natgas cousin displaces oil in more and more downstream applications.

The 2 biggest factors – amongst several – that make this a no brainer are …

1) The vast, vast amounts of recoverable gaseous hydrocarbons around the globe and ..

2) The extraordinary price spread (currently about 4 to 1) for heat energy in gaseous form versus liquid

Compounding these realities are both the stunning pace and scope of hardware and process technologies that are bringing natgas to markets all over the globe.

Some – far from all – of these developments include FSRUs, FLNGs, micro, mid, and small scale liquefaction processes/hardware, and expanding markets – prominently in the transportation realm – using natgas for the fuel source.

Just one example is the rapid adoption and deployment of FSRUs in Pakistan (putting out its 3rd), Bangladesh, (deploying its 2nd), Turkey, Argentina, Jamaica, Poland, heck, even freakin’ Kaliningrad is setting up LNG terminals via an FSRU.

The Port Kembla, Australia LNG FSRU terminal is especially noteworthy as its cost – $170 million – and speed – under 18 months – are paradigm shattering.

Coupled with fit for purpose CCGT plants, electricity is now available on a global scale heretofore unimaginable.

The massive – 1,500 Mw – plant at Sergipe, Brazil (biggest in South America) is the first of 3 proposed FSRU terminals in Brazil. (Belem and Santa Catarina hosting the others).

Age of Oil may be sunsetting in the coming decades … but natgas is already positioning to take its place.

Twocats on Thu, 20th Jun 2019 9:40 am

Why would you want to go with any sort of boutique investment strategy when there is explicit talk about keeping “stocks” up. Most or all of your money should just be in s&p etc. They are literally “targeting” the indexes. If anything any split out should be in defensive stocks as they are cutting into the what is already the largest longest expansion ever.