Page added on July 30, 2022

Peak Gold and Peak Oil are Here

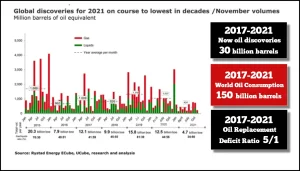

With the world consuming five times more oil than it is discovering, Peak Oil and Peak Gold have finally arrived. However, the world hasn’t figured this out yet, but it will. And, when it does, we will see much higher prices for precious metals in the future. Why? Peak oil equals peak gold and peak silver production.

If we look at the following chart, it doesn’t take a brain surgeon to realize, the world is consuming a great deal more oil than we are discovering. While part of the reason for the record low global oil discoveries is due to ESG and Green Energy, the oil industry had difficulty replacing reserves a decade ago when they invested lots of money. A decade ago, we were consuming 2.5 times the oil we were finding now; it’s five times.

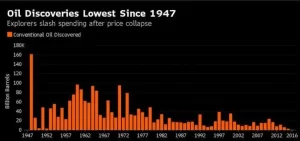

Don’t take my word for it… look at the following chart below showing global conventional oil discoveries since 1947.

Unfortunately, there just isn’t that much good quality oil remaining in the world, which is why Russia is trying to access oil in the Frozen Arctic. Why are we going to the Arctic to get oil if there is plenty on land? There isn’t… LOL. So, while a good percentage of individuals in the world think peak oil is a grand conspiracy, the data suggests otherwise. But, who goes by facts anymore??

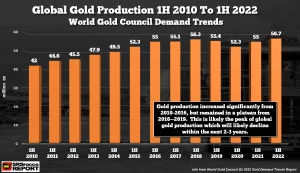

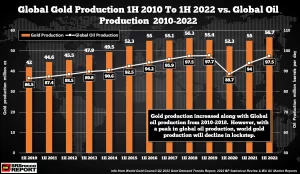

With Peak Oil, we get Peak Gold. Why? Because the massive increase in global oil production has allowed an enormous increase in world gold production (and silver production). The World Gold Council just released their Q2 2022 Gold Demand Trends Report, including gold mine supply for the first half of the year. Let’s first look at Global Gold Production from 1H 2010 to 1H 2022.

From 2010 to 2018, global 1H gold production increased significantly but plateaued and declined slightly in 2019. Gold production fell even more during the pandemic shutdown, but has been steadily higher in the past two years. Interestingly, we can clearly see a correlation between the rise in global oil production and world gold production.

It takes a massive amount of petroleum to extract gold from the ground and transport it to the mine for milling and processing. Furthermore, the gold mining industry continues to consume a tremendous amount of materials, supplies, and equipment to produce metal. When global oil production peaks and declines, not only will the gold mining industry have less fuel to extract gold, it will also suffer from a decrease in the amount of materials, supplies, and equipment. Thus, less oil means fewer goods and services.

Welcome to the ENERGY CLIFF…

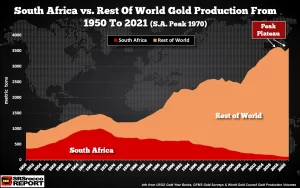

If we look at the following chart showing South African gold production versus the Rest of the World, we can clearly see a peak and plateau over the past several years.

South African gold production peaked in 1970 at a record staggering 1,000 metric tons. Thus, there is no coincidence that the gold price really began to take off during the 1970s after South Africa peaked. With skyrocketing oil prices during the 1970s, the cost to produce gold increased dramatically. Add this to surging gold investment demand and falling global supply; this pushed the gold price from $40 in $1970 to a high of $850 in 1980.

I see the same price dynamic occurring in the future as investment demand for gold surges while global mine supply declines. However, this time around, the world will not be able to increase oil or gold production as it did from the 1980s to 2020. Folks, we are reaching the ULTIMATE PEAK in GLOBAL OIL & GOLD PRODUCTION…

Place your bets wisely… I got mine in physical gold and silver bullion.

3 Comments on "Peak Gold and Peak Oil are Here"

BRAKING supremacist muzzies is roasted in kabul on Wed, 3rd Aug 2022 12:01 am

sources high up in USN says seal team successfully retried supremacist muzzie carcass and will perform burial at sea according to muzzies custom

but this is not muzzie. it’s a muzzie but it’s not a muzzie.

please feel at ease we’re all lovers of supremacist muzzies here.

heardle game on Wed, 10th Aug 2022 2:26 am

It is not for nothing that such a burden due to servitude often goes hand in hand with a drop in the value of residential property, because it makes it considerably more difficult to sell the property. And such topics must always be discussed in detail with the future employee. It’s possible that if she had known about your ambitions, she would have turned down the offer.

Spinner Tools on Thu, 22nd Jun 2023 11:11 pm

Very nice, indeed.