Page added on May 25, 2018

Economic Growth Chokes On Massive Debt Increases

The U.S. and global economies are choking on a massive amount of debt. While Wall Street and the Mainstream financial media continue to rationalize the skyrocketing debt as merely the cost of doing business, the disintegrating fundamentals point to an economic catastrophe in the making.

Of course, a full-blown economic meltdown may not occur this year or even next, but as time goes by, the situation continues to deteriorate in an exponential fashion. So, the cheerleaders for higher stock, bond, and real estate prices will continue to get their way until the economy is thrown into reverse as decades of increasing debt, leverage and margin finally destroy the engine for good.

Yes, I say for good. What seems to be missing from the analysis is this little thing called energy. The typical economist today looks at the global markets much the same way as a child who is waiting for the tooth fairy to exchange a tooth for a $20 bill. When I was a kid, it was $1 per tooth, but like with everything today, inflation is everywhere.

Mainstream economists just look at market forces, percentages, and values on a piece of paper or computer. When economic activity begins to fall, they try to find the cause and remedy it with a solution. Most of the time, the solutions are found by printing more money, increasing debt, changing interest rates or tax percentages. And… that’s about it.

There is no mention of what to do with energy in the economist’s playbook. For the typical economist, energy is always going to be there and if there are any future problems with supply, then, of course, the price will solve that issue. Due to the fundamental flaw in omitting energy in College economic courses; the entire profession is a complete farce.

Unfortunately, even the more enlightened pupils of the Austrian School of Economics fail to understand the Thermodynamics of value. Instead, we are only taught about SUPPLY & DEMAND to impact price. While supply and demand forces impact price, they only do so over a short period of time. However, the primary factor that determines price (for most goods, services, commodities, metals & energy) is the cost of production. Supply and demand only pull price above or push it below the cost of production trendline.

Regardless, you don’t have to take my word for it, just look at the following charts below.

U.S. Debt Per Dollar Of GDP Growth Goes Ballistic

The days of issuing a $1 of debt to get $1 or $2 of economic growth are long gone. Most may believe this was a grand conspiracy by the elite to control the masses. However, it was more a function of the Falling EROI – Energy Returned On Investment and the Thermodynamics of oil depletion. As the cost to produce oil consumed more energy, well, the best way to offset that was to issue more debt.

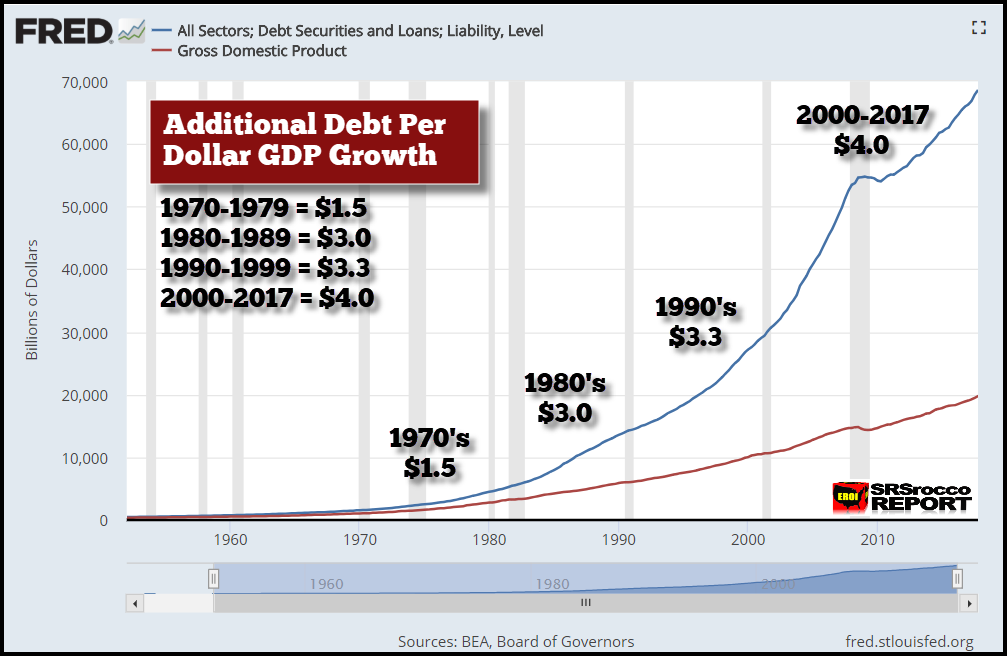

The following chart shows the relationship between total U.S. debt from all sectors (public and private) versus domestic GDP:

Total U.S. debt from all sectors is shown in BLUE while the U.S. GDP is in BROWN. You will notice that the total debt and GDP from 1950 to 1970 remained pretty even. It wasn’t until after 1970 did the debt increase more than the GDP. That was due to two reasons

- The U.S. Peaked in conventional oil production in 1970

- The U.S. EROI of oil fell considerably after 1970

Now, I did not include Nixon dropping the Gold-Dollar Peg in 1971, because that was a direct result of the two reasons listed above. We must understand that financial and economic policy is a direct reaction to the change in energy…. and not the other way around.

So, for the United States economy to offset falling oil production and the EROI, it was forced to add more debt per Dollar of GDP growth. In the 1970’s it took an average of $1.5 of new debt for each $1 of GDP growth but then doubled to $3 of debt per GDP growth in the 1980’s. However, debt really took off after 2000.

According to the data put out by FRED, the St. Louis Fed, the U.S. GDP increased from $10 trillion in 2000 to $19.7 trillion at the end of 2017. However, total U.S. debt (all sectors public and private) increased from $27.2 trillion to a staggering $68.6 trillion during the same period. Thus, total U.S. debt increased by $41 trillion versus approximately $10 trillion in GDP growth. That turns out to be $4 of debt for each $1 of GDP growth.

We also must consider the annual interest expense on the total U.S. debt of $68 trillion to be approximately $1.4 trillion based on a 2% interest rate. I have no idea what the average interest rate is on $68 trillion of debt and liabilities, but if the average interest rate rises to 5%, then the annual interest expense blows up to $3.4 trillion. As they say, a trillion here and a trillion there… adds up.

Unfortunately, the U.S. will not have the available cheap energy in the future to pay back this debt. Thus, as debt implodes, so will the GDP. Furthermore, if we were to adjust the GDP by the additional credit and debt, it would be a hell of a lot lower than its current value. But of course, the GDP figures are calculated by the very economists who are taught to disregard energy in their market studies in college.

Global Debt Per GDP Growth Hit A Record In 2017

According to the IIF, Institute of International Finance, total global debt reached a new record high of $237 trillion in 2017, up $21 trillion from the previous year. Now, compare that to the global GDP growth of $3.9 trillion in 2017, ($75.4 trillion in 2016 to $79.3 trillion last year). If we divide the $21 trillion of new global debt by the $3.9 trillion in global GDP growth, it equals an additional $5.4 for each new $1 of global GDP growth.

I arrived at the figures in the chart above the very same way as the U.S. Debt per GDP growth chart. Even though the values in the graph suggest that the debt per Dollar of GDP growth continues to move up at an ever-increase rate, the annual changes are more volatile. For example, the average global debt per Dollar of GDP increased more during the 2000-2009 period than from 2010-2017. This was also true for the United States.

However, the annual interest expense on global debt of $237 trillion has to be one hell of a lot. Again, I have no idea what the average interest rate is on that debt, but even if we assume a conservative 2%, that is $4.7 trillion. How could the world afford $4.7 trillion of an interest expense if the increase in global GDP was only $4 trillion last year???

Please understand, I am only making simple assumptions here. If the global debt is increasing, so must the interest expense to service this ever-increasing amount of debt. When the debt service starts to compete with global GDP growth, then we have a serious problem. And with the impact of the Falling EROI and Thermodynamics of oil depletion, global GDP growth will likely begin to stall over the next few years.

The notion put forth by some precious metals analysts that if the corrupt banking system would be allowed to go bankrupt (as it is bankrupt), then after the pain, the U.S. economy could grow once again. That will never happen. Why? Many in the alternative media and precious metals community still don’t understand the dire energy predicament. So, much like the college trained economists, they are making the same mistake by analyzing and forecasting the future of the markets without considering energy.

Unfortunately, when the massive amount of debt finally implodes, it will take down the values of most Stocks, Bonds, and Real Estate. This is not a matter of “IF,” it’s a matter of “WHEN.” And it seems as if the WHEN is quickly approaching.

24 Comments on "Economic Growth Chokes On Massive Debt Increases"

marmico on Fri, 25th May 2018 5:43 am

Debt to GDP is a leverage ratio (stock to flow). It is the same as it was 10 years ago in the US, 3.5 times, which means that the growth rate of debt has tracked the growth rate of GDP for the last decade.

https://fred.stlouisfed.org/graph/?g=jXKd

For all the babbling about “cheap” energy in the past, be advised that 2018 US energy spending of ~6.5% relative to GDP will be lower than any year prior to 1998. Don’t you just pine for 1981 when energy spending was 13.3% of the economy?

https://www.eia.gov/totalenergy/data/monthly/pdf/sec1_17.pdf

MASTERMIND on Fri, 25th May 2018 5:56 am

marmico

Oil Basics and The Limits to Economic Growth

The average real price of oil since 2005 is 2.5 times higher than in the period 1986-2004. Even at today’s depressed oil prices, the real price of oil-$55 per barrel—is 55% higher than the in 1986-2004 of $34 per barrel. Economists and politicians cannot understand why the economy won’t grow but never consider the underlying cost of energy.

Energy is the economy and oil is the master energy resource. The global economy developed when oil prices averaged $34 per barrel. When oil prices increased to more than $85 per barrel after 2005, economic growth could not continue. No business can withstand a 2.5-fold increase in underlying cost and make a profit. Although oil prices are lower since the price collapse in 2014, they are still 50% higher than in the 1990s.

Economic growth is unlikely at these underlying energy costs.

Source: Art Berman

http://www.artberman.com/oil-basics-the-limits-to-economic-growth/

Source: Hamilton (2009)

https://www.brookings.edu/bpea-articles/causes-and-consequences-of-the-oil-shock-of-2007-08/

Source: IEA

http://www.iea.org/textbase/npsum/high_oil04sum.pdf

Source: IMF

https://www.imf.org/external/pubs/ft/oil/2000/

MASTERMIND on Fri, 25th May 2018 5:57 am

During the mid/late 20th century (1960-1999), a barrel of oil cost $19 on average; during the years immediately prior to the Great Recession (2000-2008), the average price of a barrel of oil had increased to $47; and during the years immediately following the Great Recession (2010-2012), the average price of a barrel of oil had further increased to $81. During the same three time periods, the average price of a metric ton of copper increased from $3,085, to $3,713, to $6,817; the average price of a metric ton of iron ore increased from $36, to $57, to $124; and the average price of a metric ton of potash increased from $114, to $185, to $343. (Prices are inflation adjusted.)

The simple fact is that we cannot grow our global economy and improve our global material living standards on $55 oil, $6,817 copper, $124 iron ore, and $343 potash like we did on $19 oil, $3,085 copper, $36 iron ore, and $114 potash. It should come as no surprise that our Non Renewable Resource-dependent global economy experienced the Great Recession during 2009. Nor should it come as a surprise that we have yet to recover from the Great Recession. Nor will our industrialized and industrializing economies ever recover, so long as price levels associated with the vast majority of Non Renewable Resources remain at their inordinately high levels.

Christpoher Clugston

Scarcity: Humanity’s Final Chapter

https://imgur.com/a/pYxKa

MASTERMIND on Fri, 25th May 2018 5:58 am

Government Intervention is triggered by a Keynesian belief that aggregate demand can be increased by lower interest rates and by increasing government deficits thereby somehow spurring economic growth. Debt grows faster than income growth and eventually has to be restructured, i.e., everyone loses in the end. Since 2007, global debt has grown by US$57 trillion and it’s had disastrous results. Greece, Detroit, Puerto Richo, Venezuela are just the beginning of this trend. Soon, it will be followed by larger countries like China and United States.

https://www.perchingtree.com/return-of-great-depression/

‘WORSE THAN 2007’: Top central banker warns of looming wave of worldwide bankruptcies

http://www.businessinsider.com/worse-than-2007-top-banker-warns-of-looming-wave-of-worldwide-bankruptcies-2016-1

Perfect storm’: Global financial system showing danger signs, says senior OECD economist

https://www.brisbanetimes.com.au/business/the-economy/perfect-storm-global-financial-system-showing-danger-signs-says-senior-oecd-economist-20180123-p4yyr2.html

Janet Yellen: A debt crisis is coming

https://www.washingtonpost.com/opinions/a-debt-crisis-is-coming-but-dont-blame-entitlements/2018/04/08/968df5c2-38fb-11e8-9c0a-85d477d9a226_story.html

US Economy (GDP) Minus Federal Debt

https://seekingalpha.com/article/4109827-depression-borrowing-money-income

China central bank chief warns of ‘Minsky moment’

https://www.ft.com/content/4bcb14c8-b4d2-11e7-a398-73d59db9e399

The world is drowning in debt, warns Goldman Sachs

https://www.telegraph.co.uk/finance/economics/11625406/The-world-is-drowning-in-debt-warns-Goldman-Sachs.html

Davy on Fri, 25th May 2018 6:30 am

“Debt to GDP is a leverage ratio (stock to flow). It is the same as it was 10 years ago in the US, 3.5 times, which means that the growth rate of debt has tracked the growth rate of GDP for the last decade.”

Yea, but, what is the real number for GDP? I know it has not been fudge too much but it has been fudged. You also have to ask what is real debt and what is bad debt. What debt can and can’t be normalized IOW if rates went to 6% what debt would still be solvent? So, no way, the reality of 10 years ago is the reality of today. Debt forms have changed too with huge amount of debt like creatures lurking like unfunded liabilities, insolvent pensions, and illusions of safety nets.

Davy on Fri, 25th May 2018 6:40 am

“Italian Bonds Tumble, Triggering Goldman “Contagion” Level As Political Crisis Erupts In Spain”

https://tinyurl.com/yaad8ddw

“When it comes to the latest rout in Italian bonds, which has continued this morning sending the 10Y BTP yield beyond 2.40%, a level above which Morgan Stanley had predicted fresh BTP selling would emerge as a break would leave many bondholders, including domestic lenders with non-carry-adjusted losses… there has been just one question: when does the Italian turmoil spread to the rest of Europe?”

“SPANISH SOCIALISTS REGISTER NO-CONFIDENCE MOTION AGAINST RAJOY….CIUDADANOS WILLING TO BACK NO-CONFIDENCE VOTE AGAINST RAJOY Immediately after the news, the selling started with Spain’s 10Y bonds erasing day’s gains, with the yield now higher by 4bps on the day, while Spain’s Ibex slumped, falling as much as 0.9%. Which means that, while independent of the Italian bond rout, Europe’s political crisis may very soon have not one epicenter, but two: Rome and Madrid.”

marmico on Fri, 25th May 2018 6:52 am

So, no way, the reality of 10 years ago is the reality of today.

Interest rates were higher in 2007 than they are in 2017. With the same leverage ratio of 3.5, debt servicing (flow to flow)is lower today. As most debt interest is fixed, not variable, the economy has many years to adjust to higher interest rates.

MASTERMIND on Fri, 25th May 2018 7:08 am

marmico

Top Economist: America: The Future Looks Broke

Professor Laurence Kotlikoff from the University of Boston is, according to The Economist, one of the 25 most influential economists in the world. He says America’s official debt paints an untrue fiscal picture.

“The problem is the official debt is only the debts that politicians decide to put on to the books. Politicians are able and free to put whatever they want on to the books and keep other things off the books.”

What doesn’t get recorded is the value of all future government liabilities and the value of all future receipts, what he calls fiscal gap accounting. Future liabilities would be social security benefits, pensions, health care benefits and defence. These liabilities minus future receipts gives the true picture, Kotlikoff says.

“For the US, the fiscal gap is not $US20 trillion, which is the size of the official debt, but it’s $US200 trillion, ten times larger. So the country’s bankrupt.”

https://www.radionz.co.nz/national/programmes/ninetonoon/audio/2018632011/america-the-future-looks-broke

MASTERMIND on Fri, 25th May 2018 7:09 am

This chart is truly jaw dropping

US Economy (GDP) Minus Federal Debt

https://seekingalpha.com/article/4109827-depression-borrowing-money-income

MASTERMIND on Fri, 25th May 2018 7:10 am

US Debt VS Full Time Jobs Created

https://seekingalpha.com/article/4147977-america-go-bankrupt-slowly-first

Just Four Large Countries Have a Higher Debt Burden Than the U.S.

https://blogs.wsj.com/economics/2017/12/29/just-four-large-countries-have-a-higher-debt-burden-than-the-u-s/

MASTERMIND on Fri, 25th May 2018 7:11 am

In a decade, the federal debt held by the public will reach nearly $82,000 per American

https://www.washingtonpost.com/news/politics/wp/2018/04/09/in-a-decade-the-federal-debt-held-by-the-public-will-reach-nearly-82000-per-american/

eugene on Fri, 25th May 2018 8:54 am

Americans are living in a Hallmark movie. This will all end well with happiness everywhere. Laughter, giggling children, even the poor driving expensive electric cars, big homes for everyone and all will be wonderful. As the song says “don’t worry, be happy”. And if the fairytale isn’t true, we have drugs everywhere.

Cloggie on Fri, 25th May 2018 12:43 pm

European debt declined with one percent last year. Discipline, or should I say Disziplin, still exists in remote corners of the globe.

Davy on Fri, 25th May 2018 1:12 pm

Nederdummy, got a reference? I was curious just what kind of debt because you may not know there are many. Seems to me Europe has a full blown debt crisis in the making is the reality of it these days. I have referenced that already but I guess you ignored it.

Cloggie on Fri, 25th May 2018 2:02 pm

Nederdummy, got a reference?

Lazy Davy expects the world to do all the work for him. Why don’t you look up the data yourself?

Davy on Fri, 25th May 2018 2:31 pm

Dumb n Dutch, I thought so. You often don’t even realize your delusional bragging. You are so full of yourself it is understandable. 3rd world does the same thing, pre-dementia??

fmr-paultard on Fri, 25th May 2018 3:46 pm

i’m terrified of “brilliant flashes” and putin’s missiles which are based everywhere over PBBM’s eurotard “confederation”. I can’t sleep the next 30 years.

Bloomer on Fri, 25th May 2018 6:17 pm

Will the Chinese continue to be the lender of last resort when the US deficit spirals out of control? My guess is US supply of debt will be much greater then demand. Thus the Fed will have to further jack up interest rates to attract buyers. But that’s in the future, which isn’t here yet. No worries.

Davy on Fri, 25th May 2018 7:31 pm

China is not loaning the US, bloomer. Chinese have issues as large or larger than the US. It is unclear who will rescue who in the coming years.

Manila1 on Sat, 26th May 2018 5:31 am

DDT: Drugs/Debt/Terrorism = America today.

“Nebraska Troopers Seize Enough Fentanyl To Kill 26 Million Americans”

https://www.zerohedge.com/news/2018-05-25/nebraska-troopers-seize-enough-fentanyl-kill-26-million-americans

“A Summer Of Disappointments Will Lead To An Extended Economic Crash”

https://www.zerohedge.com/news/2018-05-25/summer-disappointments-will-lead-extended-economic-crash

“”Massacre” As Caribbean Pirate Attacks Up 160%”

https://www.zerohedge.com/news/2018-05-25/massacre-caribbean-pirate-attacks-160

Looks like a ‘hot’ summer in America. Maybe the Us navy should patrol the Caribbean instead of the South China sea. lol

Davy on Sat, 26th May 2018 5:53 am

Hitting the hedge hard today 3rd world aren’t we. grheggie will be pissed.

Manila1 on Sat, 26th May 2018 7:08 am

Hedge is a collection of sites and articles, not all from it’s owner. Facts and truth come in many places and forms. All it takes is some intelligence, experience and common sense to puck the wheat from the tares. You ain’t got any of those, Davy. Killing the messenger does not change the message. The message is that the Us is going down and taking you with it, not me. Frustrating, yes? LOl

Davy on Sat, 26th May 2018 7:25 am

“Hedge is a collection of sites and articles, not all from it’s owner. “

Dah, 3rd world, tell you boyfriend grehgie that.

“Facts and truth come in many places and forms. “

Dah, again, what a dumbass.

“All it takes is some intelligence, experience and common sense to puck the wheat from the tares. “

OH, isn’t that cute. Where is your intelligence, experience, and common sense then?

“You ain’t got any of those, Davy.”

Then why a do you spend so much time commenting on me dumbass?

“The message is that the Us is going down and taking you with it, not me. Frustrating, yes? Lol”

The message is you are showing your personality disorders for a failed life in the US. You try so hard to put the place down because most of your life is a big failure.

Free Speech Forum on Sat, 26th May 2018 7:26 am

White people support tyranny because they think it only applies to black people and black people hate freedom because they think liberty only benefits white people, but what if the police state punishes everyone and freedom benefits everyone?