Page added on December 21, 2013

Will US Light Tight Oil Save The World?

There has been plenty of hoopla lately concerning the boom in shale (LTO) oil production. From the New York Times: Surge Seen in U.S. Oil Output, Lowering Gasoline Prices

Domestic oil production will continue to soar for years to come, the Energy Department predicted on Monday, scaling to levels not seen in nearly half a century by 2016.

The annual outlook by the department’s Energy Information Administration was cited by experts as confirmation that the United States was well on its way — far faster than anticipated even a year ago — to achieving virtual energy independence.

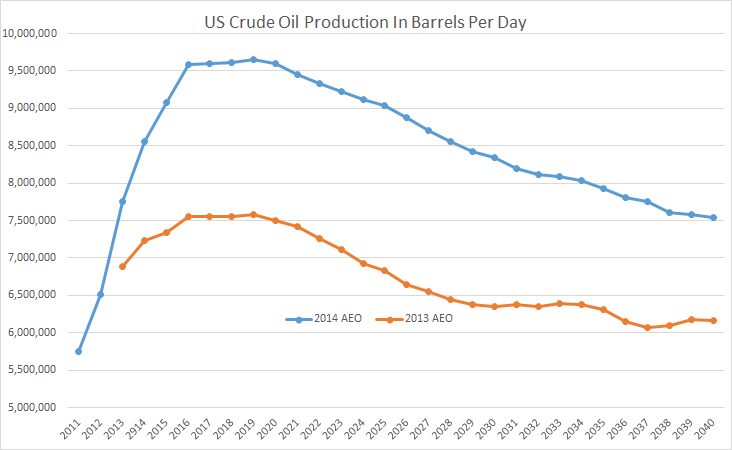

What the EIA is actually predicting: AEO2014 EARLY RELEASE OVERVIEW. The data is C+C.

The first two points were what was actually produced in 2011 and 2012 and the rest of the blue line is what they are predicting for the future. The orange line is what they predicted last year. The predicted numbers this year are a lot higher but the shape of the curve looks the same. They predict US Crude + Condensate will plateau in 2016, actually peak in 2019 and by 2021 be headed for a permanent decline.

Note the difference between AEO 2013 and AEO 2014. The difference rises to just over 2 mb/d and holds that difference util 2030 when it slowly closes down to 1.37 mb/d in 2040. And everything above about 5 mb/d is all Shale, or Light Tight Oil. They expect LTO to rise to about 4.5 mb/d by 2016, hold that level for almost 5 years and for LTO to still be above 2.5 mb/d by 2040.

Anyway here is what Saudi Arabia thinks about it all. Saudi will not be affected by shale oil output: report:

“Since we doubt that tight oil production will grow as much as most commentators surmise, and since we believe that tight oil production will keep representing only about 3% of total liquids supply, we do not believe that the growth in oil production from tight rock formations in the US, or from shale formations elsewhere, will materially affect Saudi Arabia’s long-term position in the oil industry,” Jadwa said in a study.

And questions are being raised elsewhere: Shale well depletion raises questions over US oil boom

In October, the government began issuing a monthly report on drilling productivity that charted declines in six major U.S. shale plays. The U.S. Energy Information Administration estimates that it takes seven of every 10 new barrels produced in those areas just to replace lost production.

Of course this article is quoting the EIA and their new Drilling Productivity Report.

Speaking of that report, Steve’s blog, SRSrocco Report, has this headline: Eagle Ford Shale Decline Shoots Up A Stunning 10% in One Month!

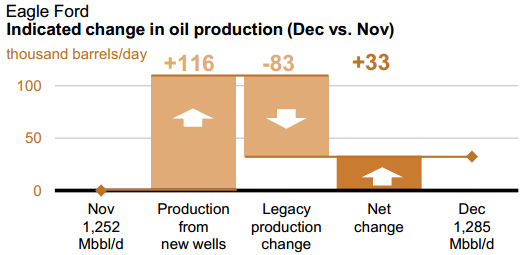

What Steve is talking about is this. First from last month’s Drilling Productivity Report:

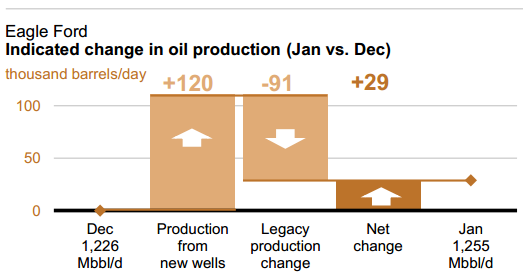

And see the difference from the latest report:

But getting back to the statement in the “Fuel Fix” article that it takes seven of every 10 new barrels produced in those areas just to replace lost production. If the EIA is correct in their latest report it takes a bit more than 7 of every 10 barrels just to make up for the declines of old wells. If their figures are correct, in Eagle Ford, it takes almost 7.6 barrels of every 10 barrels from new wells just to make up for the decline in production from old wells. And of course that number increases every month.

If the EIA’s decline rates are anywhere close then the Bakken should reach her peak at about 1.25 mb/d and Eagle Ford at about 1.6 mb/d, or at some point very close to those numbers.

Bottom line, all the hype is just hype. The US will likely never reach 4.5 million barrels per day of shale oil, the peak will not be spread out over five years as the EIA believes, and the decline will be a whole lot steeper than the chart above indicates. Shale oil may delay the peak of world oil production for one year, or two at the most.

While it is true that only the Light Tight Oil is keeping Peak Oil from being an obvious fact, that can only last for a year or two, then the US, along with almost every other nation in the world will be in decline.

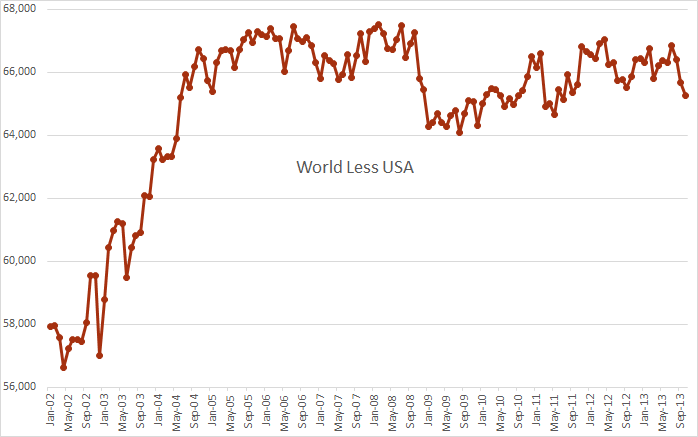

The EIA’s International Energy Statistics is about a month late already. International oil production data is a really low priority with the EIA. They are much more concerned with the price of kerosene and other such matters than they are with world crude oil, the lifeblood of every economy in the world. So we will have to do without it until they get around to posting that data, if ever. But in the meantime I have constructed the below chart using mostly JODI data, with some EIA data used for countries that do not report to Jodi. I use it just to show what the world oil supply would look like without US Light Tight Oil.

According to JODI, the world less USA peaked in January of 2008 and almost reached that point again in July of 2008. In October of 2013 we are down about 2.25 mb/d from that point. Interesting to note also that the world less USA has dropped some 1.5 mb/d since July. July was the last month the EIA’s International Data Statistics has data for.

12 Comments on "Will US Light Tight Oil Save The World?"

Makati1 on Sat, 21st Dec 2013 2:23 pm

Hahahahahaha…

dissident on Sat, 21st Dec 2013 2:48 pm

But policy makers and the media treat these ludicrous projections as hard data on which to make optimistic decisions. We will be in a world of hurt around 2020. The current surge is the last dying gasp.

DC on Sat, 21st Dec 2013 3:01 pm

LoL! No…

shortonoil on Sat, 21st Dec 2013 3:24 pm

To state a volume of petroleum production without stating an associated energy value, is providing incomplete information.

Tight oil is a product that does not contribute to the overall economy; it does not act as an energy source. The majority of it never participates in the energy production process.

Newfie on Sat, 21st Dec 2013 4:10 pm

My 400 horsepower 8 cylinder Hummer is up for sale if anyone is interested.

J-Gav on Sat, 21st Dec 2013 4:28 pm

Will money start growing on trees?

GregT on Sat, 21st Dec 2013 6:09 pm

“The annual outlook by the department’s Energy Information Administration was cited by experts as confirmation that the United States was well on its way — far faster than anticipated even a year ago — to achieving virtual energy independence.”

With THAT, we can also expect a “virtual’ economy, with ‘virtual’ jobs, and perhaps we can even all live off of ‘virtual’ food.

shortonoil on Sat, 21st Dec 2013 8:55 pm

Their whole argument is ridiculous. Any junior engineering student could see the fallacious of their statements if they looked into it to any degree. The whole charade is an obvious attempt at an obfuscation of the truth. Such blatant, irresponsible reporting can only be construed as an indication of their growing desperation!

Davy, Hermann, MO on Sat, 21st Dec 2013 11:38 pm

optimism is contagious

rollin on Sun, 22nd Dec 2013 2:06 am

The short answer is no.

In fact tight oil is destroying the world as other fossil fuels do. Luckily it will be a flash in the pan compared to conventional oil.

With conventional fields falling at about 6% per annum (400K bpd in the US, 4 million bpd world wide) I don’t see a small short term spurt as making much difference in the world oil production over the long run.

FloridaGirl on Sun, 22nd Dec 2013 3:42 am

Hmmm, note that last month production was predicted to increase 33 thousand barrels/day but instead it decreased by 26 thousand barrels.

rockman on Sun, 22nd Dec 2013 1:49 pm

And the simple facts again: shale are by far the most common sedimentary rock in the US and on the planet. All the US shales formations (there are many dozens of them) have had their hydrocarbon potential evaluated. And yet more than 80% of oil production still comes from just two formations…the Eagle Ford and Bakken. Shales are not prolific producers of oil/NG. A very few shales exist under conditions conducive to significant production.

But we don’t know how many prolific shales exist outside of the US since little significant drilling has been done. But we do know that the vast majority of the drilling infrastructure needed to develop any of these unproven formations exists in the US. So even if some are proven viable their development couldn’t match the rates seen in the US.