Page added on April 17, 2015

Unconventional but normal

WHEN the oil price crashed last year, many assumed that the earliest casualties would be the small, nimble American companies that specialise in getting “unconventional” oil out of shale, tar-coated sand and the like. After all, with their high production costs and heavy debts, these firms were inherently more vulnerable to price shocks than big oil companies, the thinking went. Indeed, Saudi Arabian officials even suggested that they were refusing to cut their output precisely in order to put such firms out of business.

Six months later, though, there is little sign of a bust in America’s shale basins, where horizontal drilling and hydraulic fracturing (fracking) have led to a boom in oil and gas production in the past five years. Scott Nyquist of McKinsey, a consultancy, says the price drop has not caused the “immediate distress” that was originally assumed. An analysis of 300 independent American oil and gas companies in the first quarter of this year showed that more than two-thirds had healthy balance-sheets, with at least as much equity as debt. By the same token, the debt of two-thirds of the midsized firms in the survey was trading at 80% or more of its face value, suggesting that investors are not too worried about their health. The firms that have been in trouble are those with dud leases, or which had embarked on big takeovers last year, just before the price began falling.

Figures compiled by investment bankers at Barclays tell a similar story. Although yields on the “junk bonds” issued by American energy firms spiked from a low of 5% in the summer to more than 10.5% in December, they have since fallen back to 8% (roughly the same as in mid-2012). It has become a little more expensive for frackers to borrow, in other words, but there is no sign of a crippling squeeze.

The number of rigs drilling for oil in America has fallen by half since October, from some 1,600 to 800; that will eventually sap output. For now, though, American oil production is still growing: in March it rose by 120,000 barrels a day (b/d).

One reason is that frackers have been able to cut costs, along with the rest of the oil industry, as the price of labour, steel and other inputs has fallen. That gives a one-off boost to their finances. They are also benefiting from continuing improvements in productivity. These include better seismic data, which means more fracks are successful, the ability to drill ever more wells from a single spot and, on the horizon, polymers and other fluids that cut water use or replace it altogether.

It is not all plain sailing. Oil reserves are valued in October, notes Michael Cohen of Barclays. Those priced last year, with oil around $100 a barrel, will be worth a lot less this time round. But even troubled firms do not necessarily cut production. New owners can purchase their assets cheaply and keep pumping.

The main lesson is that although the price drop has been bad for producers in such places as the North Sea, it has not derailed America’s oil boom. Indeed, America is replacing Saudi Arabia as the world’s swing producer. Frackers have drilled lots of wells and then plugged them, waiting for the price to rise again. If it does, Mr Cohen expects between 300,000 and 800,000 b/d of production to start up.

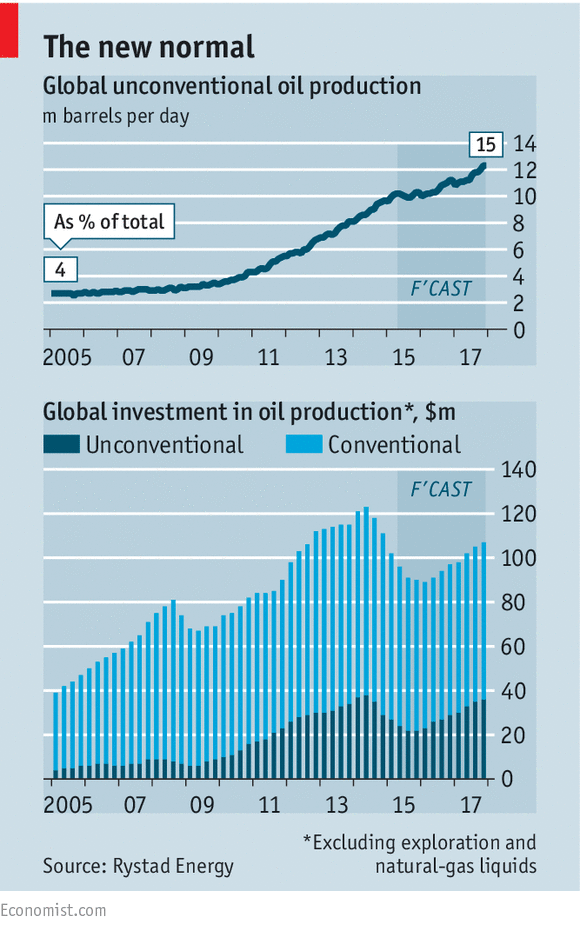

Nor is there any sign of a shift away from unconventional oil in terms of capital investment. Unconventional oil has been gaining an increasing share of the pie in recent years (see chart). Investment of all kinds will dip this year but Rystad Energy, a research firm, sees it rising strongly again thereafter. A new forecast from America’s Energy Information Administration reckons rising production and greater efficiency mean that the country will stop importing energy between 2020 and 2030, depending on the price.

This contributes to a picture in which oil prices—barring big geopolitical upsets—look unlikely to rise sharply. True, global demand for oil is set to rise, and old oilfields are depleting, meaning that much of the industry needs to run in order to stand still. But the message from America is that finance and technology combined are more than a match for geology.

16 Comments on "Unconventional but normal"

rockman on Fri, 17th Apr 2015 11:24 am

One more fool who doesn’t understand the time lag between drilling and first production. Or just one more spinmeister trying to deceive the sheeple.

shortonoil on Fri, 17th Apr 2015 12:42 pm

The shale industry now has at least $1 trillion in debt that it can obviously not repay. It has never turned a profit! The TBTF banks got into the shale game early, and have huge exposure to this asset class. This article has one purpose, and one purpose only. To keep investors into shale until the banks can liquidate their holdings. With decline rates of up to 60% for the first year, rig count down 50%, storage for a product that has little market filling up, and inventory of drilled but yet to completed wells declining the end is not far away. This is going to be crash you don’t want to be invested in.

apneaman on Fri, 17th Apr 2015 1:09 pm

Everything, individuals & institutions, is papered over.

Credit Scoooooooooore!

http://www.dailyimpact.net/2015/04/17/credit-scoooooooooore/#more-2848

Northwest Resident on Fri, 17th Apr 2015 1:35 pm

“But the message from America is that finance and technology combined are more than a match for geology.”

Short term.

Long term, geology wins, guaranteed.

Kind of like a weight lifter all juiced up on steroids can pump more iron than he could do otherwise, but just for a little while.

The economy IS and HAS BEEN on debt-induced steroids. The effect is wearing off fast. Debt has allowed us to drag future consumption into the present, but you know what, we’re just about out of future to consume.

rockman on Fri, 17th Apr 2015 2:29 pm

NR – I might still say geology wins short term. Ignore the price of oil, the rig count, the price of Chesapeake stock, etc. A shale well will still produce (if not produce) the same amount oil. The geology doesn’t change. IOW despite all the variables that make up the POD the geology and the hydrocarbons contained within the rocks doesn’t change. Nothing going to make Mother Earth change her nature. But it’s the money (or lack of) that changes man’s interaction with the geology.

Northwest Resident on Fri, 17th Apr 2015 3:17 pm

rockman — Yeah. Guys like the writer of this article just *think* we’re more than a match for geology. We’re chipping away at the thin outermost layer of earth’s surface, not even a fraction of 1%, and we have guys like this bozo bragging about how we’re taking on geology in a head-to-head matchup. Puny humans. Huge egos. Giant sized dreams and fantasies. Somewhere, the Gods are laughing. Mother Nature will swat those pesky humans soon enough, and when she does, geology will still be there solid as rock. Whether humans will be or not is another question.

Nony on Fri, 17th Apr 2015 3:52 pm

I don’t think you can call people not completed drilled well or curtailing their 2015 program of identified drill sites as “short term geology winning”. That is a financial decision not to extract a known resource because of investment cost.

Nony on Fri, 17th Apr 2015 4:05 pm

Cornies have always agreed that the Bakken would turn off at low prices (we SAW it happen in 2009!) But that is not the same thing as the people who claimed that even at 100+, it would be a flash in the pan, would run out of sweet spot, etc. Those people (Rune, Piccolo, etc.) have gotten their butts kicked.

P.s. Other than that, I agree that it is silly to assume drilling rigs falling in half won’t lead to reductions and that this guy is one more guy not considering lag time.

shallow sand on Fri, 17th Apr 2015 5:27 pm

Also, most companies are not going to just up and BK 6 months after price crash. Many will have negative EPS this quarter and will next quarter too. Cash drain will be even more significant. But many are diluting their shareholders now, and that is buying time. Also, debt principal not due for most in near future.

Issue long term is whether they will be able to maintain or grow production so when debt comes due, they will be able to retire and/or roll over at favorable terms. Of course, that will all depend on oil price in next 4-5 years.

Speculawyer on Fri, 17th Apr 2015 6:47 pm

“Six months later, though, there is little sign of a bust in America’s shale basins, where horizontal drilling and hydraulic fracturing (fracking) have led to a boom

…

The number of rigs drilling for oil in America has fallen by half since October, from some 1,600 to 800”

Really? You don’t see signs of a bust when the rig count dropped in half?

Bob Owens on Fri, 17th Apr 2015 6:59 pm

Ask the oil field and service industry employees, who have been laid off by the tens of thousands, how they feel about the oil bust. I suspect they will say they are busted, along with their companies.

shortonoil on Sat, 18th Apr 2015 8:06 am

The shale industry had already lost over $1 trillion on $360 billion in annual sales BEFORE a 50% decline in price. If one can’t find a problem with that they need to redo the sixth grade; they missed something in the add and subtract department. Shale was never a product with a future; nature did not give it the molecular structure that it needed to power a civilization. It was the last dregs of liquid hydrocarbons to be scrapped out of the earth. It was the last futile attempt to keep something going when it is ending.

Nony on Sat, 18th Apr 2015 3:08 pm

Shortonoil,

That was not lost money. It was capital investment. 😉

Davy on Sat, 18th Apr 2015 3:51 pm

Capital investment that is bad debt being extended and pretended. NOo you may be a finance Buffy but I bet you never collected money. You probably never had to take non performing loans and redo them. That was my job once upon a time.

I extended and pretended with very few because the banks new what was up. They turned a blind eye on a few but just a few. Nowadays extend and pretend is the name of the game in the new normal. It still don’t make it right. Bad debt is a bad investment. Have you ever tried putting perfume on a turd and calling it sweet mud?

Nony on Sat, 18th Apr 2015 6:07 pm

got to risk money to make money

Davy on Sat, 18th Apr 2015 7:54 pm

NOo, who’s money and who’s profit? I think we know that answer. Snake oil