Page added on April 5, 2014

The Insanity Of U.S. Energy Independence & Cracks Beginning To Appear In The Natural Gas Industry

The notion of future U.S. Energy Independence will seriously disappoint the market and American public. This strategy of energy independence put forth by the energy industry and U.S. Govt may buy some time for our anemic economy and the U.S. Dollar, but will back-fire in a big way when overall oil and gas production declines much sooner than expected.

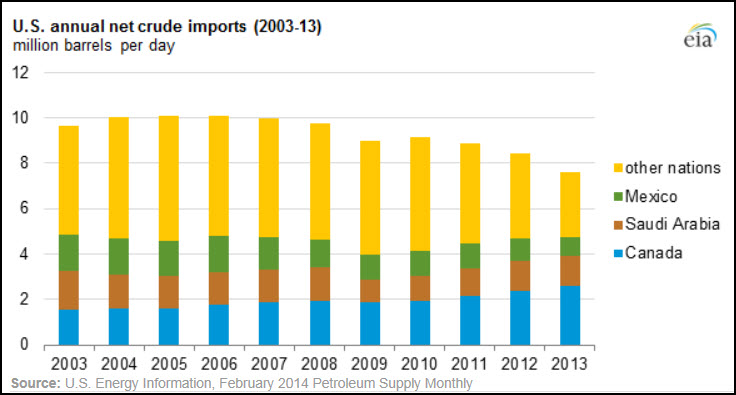

If we take a look at the chart below, recently released by the U.S. Energy Information Agency (EIA), the United States still imports a net 7.5 million barrels a day (mbd) of crude oil.

Now, if we go by a total NET BASIS, the U.S. imported 6.2 mbd of petroleum products in 2013. Still, this is a long way away from energy independence.

The United States never produced more than 10 mbd of crude oil when it peaked back in 1971. So, not only does the U.S. oil industry need to surpass the 10 mbd peak, it would have to reach nearly 14 mbd.

Oil production from shale oil fields such as the Bakken and Eagle Ford pushed total U.S. crude oil supply up to 8 mbd presently. While production from these two fields are forecasted to increase, it may only be for a few more years.

According to energy analysts such as David Hughes and Art Berman… the Bakken and Eagle Ford have a limited number of drilling locations and the wells in these field suffer extremely high decline rates. The shale energy companies exploited the SWEET SPOTS first, so the remaining locations will be less productive.

If we consider these factors, shale oil production in the U.S. will more than likely peak 2015-2016. It will be extremely difficult for the domestic oil industry to surpass the 10 mbd peak set in 1971… and impossible to ever reach the 14 mbd to become energy independent.

The sooner we wake up to this realty, the better we can prepare for a much more LOCAL and SUSTAINABLE living arrangement.

Cracks Beginning To Appear In the U.S. Natural Gas Industry

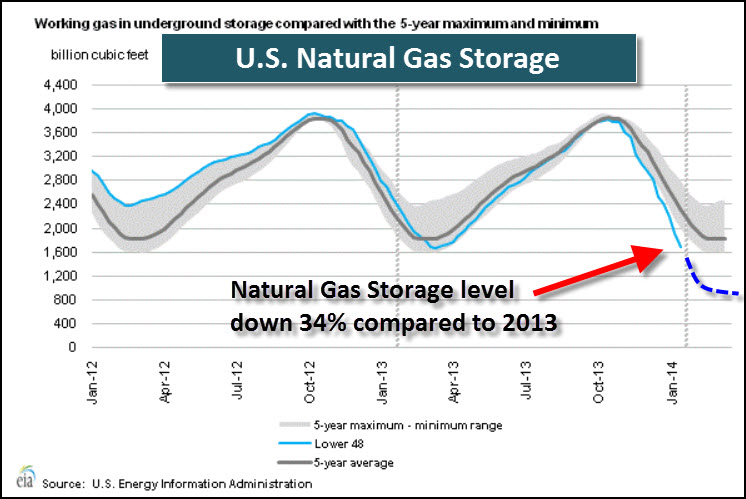

2014 may turn out to be a pivotal year for the U.S. natural gas industry. After the record cold winter, U.S. natural gas underground storage levels are 51% lower than where they were the same time last year.

After I spoke with energy analyst Bill Powers back in the beginning of the year, I made this chart estimating where U.S. underground gas storage level would reach by the end of the withdrawal season:

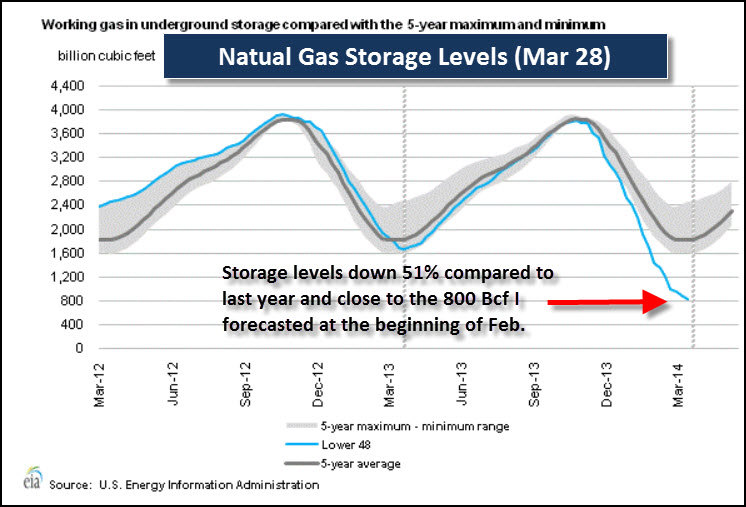

I estimated underground gas levels would reach 800 Bcf by the end of March. The EIA came out with their forecast of a low of 965 Bcf (beginning of March). Here is the chart from their most recent report released yesterday:

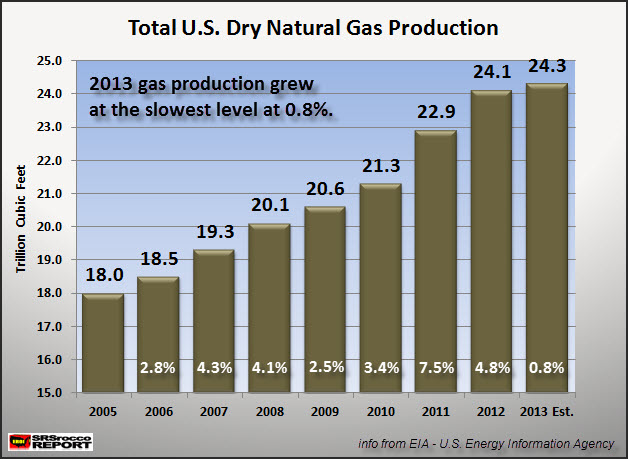

Even though this was an extremely cold winter, the industry will have to try and make up this shortfall. Furthermore, U.S. natural gas production grew at its slowest annual rate in 2013 (0.8%) since 2005:

If you think decline rates in shale oil fields are high… they are even higher in shale gas fields. And the higher the industry pushes overall gas production, the higher the annual losses due to a 24% decline rate (Citi Research- 2013).

Simple cocktail napkin calculations means the U.S. natural gas industry will have to replace nearly 100% of gas production in the next four years. Think that is possible? I don’t.

Folks, I believe the U.S. natural gas industry is heading for serious trouble. If we continue to see record heat and droughts during this summer as we experienced last year, the build of underground gas storage levels may be critically low going into the next winter season.

I discuss this in much more detail in my U.S. & GLOBAL COLLAPSE REPORT.

14 Comments on "The Insanity Of U.S. Energy Independence & Cracks Beginning To Appear In The Natural Gas Industry"

Makati1 on Sun, 6th Apr 2014 11:01 am

The faster we run, the behinder we get….

rollin on Sun, 6th Apr 2014 11:13 am

Predictions of US energy independence in the future will come true. As demand is destroyed, industry diminishes and imports vanish – independence will occur. It’s inevitable if not pretty.

At some point there will be a rush to conserve, to implement renewables on a grand scale, to change our ways at least somewhat. But I think we are so far out on the limb now that at least a large amount of pain will happen before things equilibrate.

rockman on Sun, 6th Apr 2014 12:14 pm

Rollin – So true. As Janis said: Freedom is having nothing else to lose. LOL. And there’s another couple of ways to approach this word game. First, “independence” implies we are free of needing any energy. Of course, that’s not what they mean but that’s exactly what they are saying. Not really a trivial point when you consider the propaganda value of such a tag.

So they really mean independent from importing oil. And what does this gain other the not depending on oil from other countries? That has been an issue only once in the last 100 years of oil consumption in the US. That can certainly have an advantage at times but it neither decreases the amount of energy that is required to run the economy nor the cost of that energy. There seems to be an implication in that phrase of cheaper energy costs. But there is no certainty that independence would equate to lower cost. Consider how much closer we’ve come from being independent of imported oil in recent years. And what has the movement given us? A 300% increase in the price of domestic oil. One has to ask how much more “independence” can the US economy afford. LOL.

And there this angle: independence also implies having what you need. In that sense the US already has a fair degree of energy independence because we are financially capable outbidding the vast majority of the planet for the energy we want.

Davy, Hermann, MO on Sun, 6th Apr 2014 12:38 pm

Rock said – And there this angle: independence also implies having what you need. In that sense the US already has a fair degree of energy independence because we are financially capable outbidding the vast majority of the planet for the energy we want.

Rock the US is well positioned in the realm of energy. A diverse mixture from hydro, nuk, coal, gas, AltE and oil. We have one of the best portfolios of energy resources in a many and variable sense. We have the economy with a strong financial sector to bid on these energy sources. The US has much low hanging fruit of energy efficiency and life style changes to adapt to a net energy decline. These folks on here bashing the US for economic decline and energy depletion effects are short sighted for these comparative advantages the US has. We are especially dominant with the new tool of global strength and that is food. China should think twice about a trade war or a hot war when so much of their food comes from across the Pacific!

Sudhir Jatar on Sun, 6th Apr 2014 12:44 pm

It is time that we realise that one of the important factors to attain ‘energy independence’ is also demand management. We have got so enamoured with shale and with damning the ‘peakists’ that we only talk of supply management as far as energy independence is concerned.

Demand management goes beyond legislations for improving energy efficiency or km/litre in transportation. Also, substitution of petroleum with non-renewable sources without working out ERoI or LFRoI is not being energy independent.

Another important aspect is ‘energy intensity’ of nations where “Energy intensity is a measure of the energy efficiency of a nation’s economy. It is calculated as units of energy per unit of GDP. High energy intensities indicate a high price or cost of converting energy into GDP”. The energy intensity of the US is rather high at 221.7 (Wikipedia) in spite of all the brouhaha about shale petroleum.

Nony on Sun, 6th Apr 2014 1:04 pm

First, I don’t think Srirocco is a serious analyst. He’s more like a commenter hoi polloi like us.

Concerning gas, the “oh my god, have to replace all the production in X years” is a meme that has been going round since at least 1919. This means little. Compare it to the proven reserves or even to the 2P/3P resources. If there were a gas crisis, the futures market would show it. It doesn’t. Not short term, not long term. Are the markets infallible…no. But if you’re really smarter than them, go long on the commodities or better yet buy some options and really clean up.

On the oil, 14 or even 10 will be tough. Still, if you’d said we would be 8 right now, back in 2005 or 2008, they’d have looked at you like you were crazy. None of the doomers predicted that. The US peak and decline was part of their Hubbard example toolkit and none of them saw the shale coming in. Heck, I can go back to TOD and see all the articles (and commentes) poo-pooing it even as the production growth was underway.

SRSrocco on Sun, 6th Apr 2014 1:59 pm

Nony,

You fail to mention that the U.S. cannot afford a percentage of the oil it’s consuming. You can thank the FED for printing our way into producing and consuming expensive energy.

While you make the rounds on all the energy blogs playing the ANTI-PEAK OIL GADFLY… you fail to connect the Financial-Energy Dots.

Some believe we can be energy independent if domestic demand falls. The one TIDBIT that is missing from this equation is the DEATH of the U.S. PETRO-DOLLAR — which is currently taking place now at a faster clip.

Not only will demand fall in the country, but so will supply. The shale gas industry will not be able to finance the huge amount of debt when interest rates rise to normal levels.

When the whole HOUSE OF CARDS comes crashing down, I imagine so will a good bit of the high-cost oil & gas supply.

I will say this, very few could predict how bad things got in 2008-2009 when the entire U.S. banking and financial system almost collapsed. I gather the same will occur in the future.

Things will probably be much worse than most forecasts or predictions when the next financial collapse comes.

paulo1 on Sun, 6th Apr 2014 2:19 pm

Nony,

re: “He’s more like a commenter hoi polloi like us.”

Like us, who have nothing to gain by seeing and expressing the truth in an effort to help folks make some decisions which will help all of us going forward, imho.

Should we say nothing when we see danger? Misery? Loss? Rapid change?

Not that any of us can stem the decline, however, we can do our best to lay a groundwork to eventually do better than if we do nothing. We may be off a few years, but the facts still stand quite tall as far as I am concerned. Your arguments are always, “but wait, future discoveries will be much better than forecast because the dreaded and forecasted decline has yet to appear”. Maybe, but when Art Berman lays down an argument and/or Ron P posts a graph that says otherwise, I will stick with their current and accurate data.

Paulo

bobinget on Sun, 6th Apr 2014 3:42 pm

I’ll argue it was cheap imported goods, most certainly oil, that propelled US growth to the point of hubris.

marmico on Sun, 6th Apr 2014 4:15 pm

U.S. cannot afford a percentage of the oil it’s consuming

Real personal consumption by households on energy goods and services, which includes petroleum products, does not seem elevated relative to last 15 years.

FRED graph

Back of the envelope, oil consumption of 15.5 mb/d x 365 days x $100/b equals $565 billion. $565 billion in a $17 trillion economy does not seem expensive to me.

SRSrocco on Sun, 6th Apr 2014 10:09 pm

marmico,

Funny how you forget these few TIDBITS in your analysis:

1) Inflation is understated

2) GDP is over stated because inflation is understated

3) U.S. budget deficit increased $6.5 trillion since 2008

4) Fed printing allowed deficit to continue

5) Fed props up entire asset market, thus allows Americans to continue BAU – Business As Usual

6) Fed also made tens of $trillions in currency swaps with foreign countries since 2008 to keep global financial

system from imploding.

7) Fed purchases MBS and Treasuries to keep interest rates artificially low.

8) Higher interest rates would Kill Shale Gas Industry in U.S.

9) The Whole System is a Ponzi Scheme.

10) Petro-Dollar on its last legs as China & Russia now hold the cards.

Your back of the envelope calculation becomes meaningless when Petro-Dollar dies and along with it the U.S. Treasury Market.

shortonoil on Sun, 6th Apr 2014 11:27 pm

“Funny how you forget these few TIDBITS in your analysis:”

Actually you missed one. Global debt is now over $100 trillion, and has increased by $30 trillion since 2008. By our calculation (which produce an exponential function) at the present rate, every asset on the planet ($2430 trillion) will be mortgaged over the next 20 years. Which, coincidentally, will be just about the end of the oil age, which is determined by some completely different calculations.

http://www.thehillsgroup.org/

.

Makati1 on Mon, 7th Apr 2014 1:20 am

Ah, then… what is the NET energy in the US today. Not the barrels recovered, but the net energy recovered. I can say I recovered 1 million barrels per day, but. if I subtract the 350,000 barrels of oil energy I used to get those million, it is not so positive.

The US is lying through it’s teeth with every report and statistic it puts out and is only kept alive by the Fed printing presses. Those will eventually cause even a greater crash and suffering in the near future.

BTW:

The US imports $7,000.00 worth of goods per capita. ($400.00 is food)

China imports $1,300.00 worth of goods per capita. ($60.00 is food )

The Philippines imports $600.00 worth of goods per capita. ($60.00 is food)

marmico on Mon, 7th Apr 2014 12:36 pm

TIDBITS in your analysis. They are called facts not suppositions. You are nonresponsive to empiricism, and therefore, are not a “serious analyst”.

For instance, you suppose that inflation is understated because the ShadowStats Man told you. If you understood the accounting identity that expenditures equal income, you must say that measured income has declined at the same rate as measured expenditures. It defies credulity that real household income has cumulatively declined by 75% since 1990.

Oil expenditures are about 4% of the U.S. economy. In contrast, health expenditures are about 17% of the economy.