Page added on December 23, 2017

The Bakken Strikes Back

Summary

October production data for the Bakken validates operators’ claims of strong early-time well performance in the play’s core.

Current prices provide a powerful growth stimulus not yet reflected in the volumes.

Continental Resources has advertised 15-month payouts for its wells in the Bakken Core in a $50 per barrel WTI environment, which implies exceptional returns.

Predictable Surprise

The report by the Industrial Commission of North Dakota last Friday likely left some shale growth skeptics puzzled.

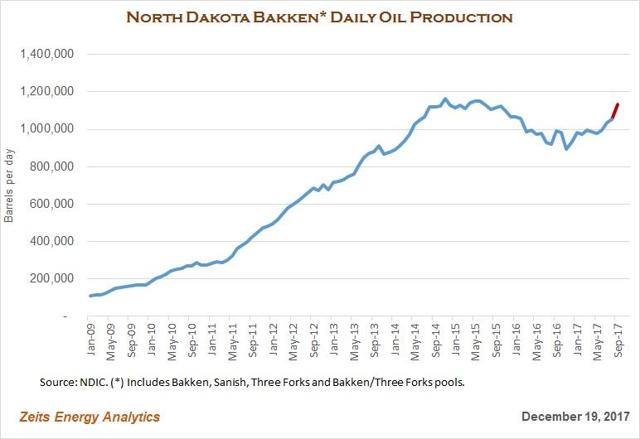

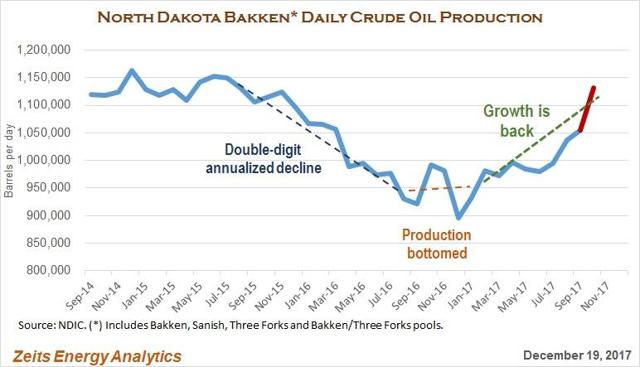

The preliminary data shows a ~76,000 barrel per day step up in October for production from the Bakken. This equates to ~7.2% growth – in one month.

At 1.13 million barrels a day in October, the Bakken is just few short steps away from a new production record. For reference, the high watermark for monthly production was set in November 2014 at 1.16 MMb/d.

The report gives fresh food for thought to those investors who have written the Bakken off as a play that is running out of prolific locations, is uneconomic at current oil prices and therefore is irrelevant as a contributor to supply growth unless oil prices rise significantly above the recent levels.

The report gives fresh food for thought to those investors who have written the Bakken off as a play that is running out of prolific locations, is uneconomic at current oil prices and therefore is irrelevant as a contributor to supply growth unless oil prices rise significantly above the recent levels.

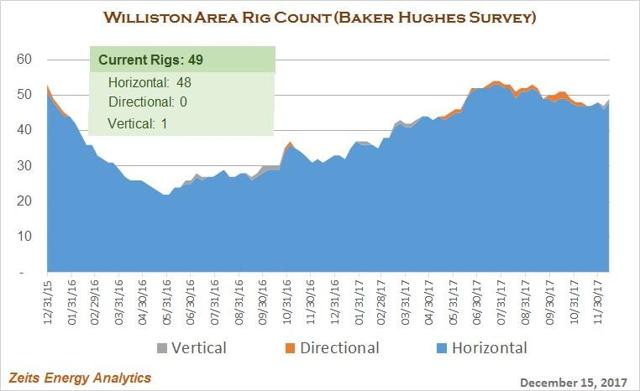

The report also sends a warning with regard to the supply growth potential of the U.S. shale oil industry as a whole. Indeed, among major U.S. resource plays, the Bakken has been a laggard in terms of drilling activity. In 2017, the Williston rig count averaged just 45 rigs drilling horizontally, according to Baker Hughes. To put this figure in perspective, there are 650 rigs drilling horizontally in the Lower 48 currently, ~14 times the current Bakken count.

In terms of the number of active rigs, the Bakken is currently lagging each of the Midland Basin, Delaware Basin, STACK/SCOOP and Eagle Ford. It is also lagging the D-J Basin and Powder River Basin in the number of rigs relative to existing oil production base.

In this context, the strong growth momentum regained by North Dakota in the second half of this year is impressive and exhibits the same trend the U.S. E&P industry has already demonstrated in natural gas shales: it can accomplish more with less, particularly once the full field development mode is achieved.

In this context, the strong growth momentum regained by North Dakota in the second half of this year is impressive and exhibits the same trend the U.S. E&P industry has already demonstrated in natural gas shales: it can accomplish more with less, particularly once the full field development mode is achieved.

Obviously, it would be a big mistake to annualize the October data point for North Dakota, as production growth tends to be lumpy. However, the NDIC’s report convincingly demonstrates that claims of production stagnation in the Bakken are strongly exaggerated.

“You Ain’t Seen Nothing Yet”

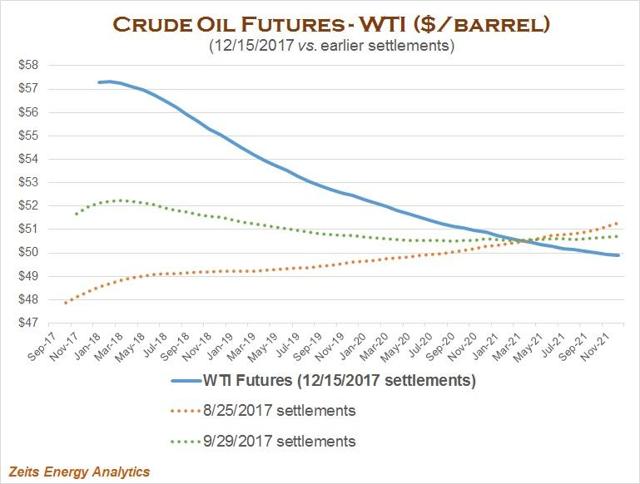

It is important to note that the reported recovery in production in North Dakota does not reflect the powerful encouragement from higher oil prices that operators received in the last three months. In fact, the vast majority of operating decisions underpinning the reported increases in volumes were based on WTI futures curves below $50 per barrel or barely above that level (as one can see from select curves below).

They’ve Told You So

This solid growth in production would not be particularly surprising had one followed signals from Bakken operators regarding strong well performance improvements in the play.

Investors often take operators’ type curves – which drive EURs – with skepticism. This is understandable. However, early-time production metrics are relatively easy to observe and validate. Based on OIL ANALYTICS’ estimates, in the current price environment, new Bakken wells that can be expected to produce 225,000 barrels of oil in the first two years would pass thresholds for capital deployment for many operators.

In this assessment, we assume the cost to drill, complete and connect a new well of $7.5 million. Such wells are likely to reach payout in less than three years. In our assessment, many new wells in the Bakken Core would fall within that category (excluding infill wells in existing drilling units on tight downspacing, which may fall short of this threshold).

Recent investor communications indicate that E&P companies often have much higher ambitions as it relates to early-time cumulative volumes. In its November 28, 2017 presentation, Continental Resources (CLR), a leading Bakken operator, highlights a payout expectation of 15 months for its wells with enhanced completions (pages 11 and 22 of the 11/28/17 presentation). In the world of resource plays, this kind of payout – if it can be indeed achieved and sustained – is as close as it can get to a financial perpetuum mobile.

In simplified terms, a 15-month payout means that every one year and three months, the operator can recoup its entire investment in the new well and also keep the entire massive cash flow tail from the well as the return on the investment. The recovered cash can be used to pay service providers for a new similar well that has already been drilled and completed. The reinvestment sequence continues until one runs out of such locations.

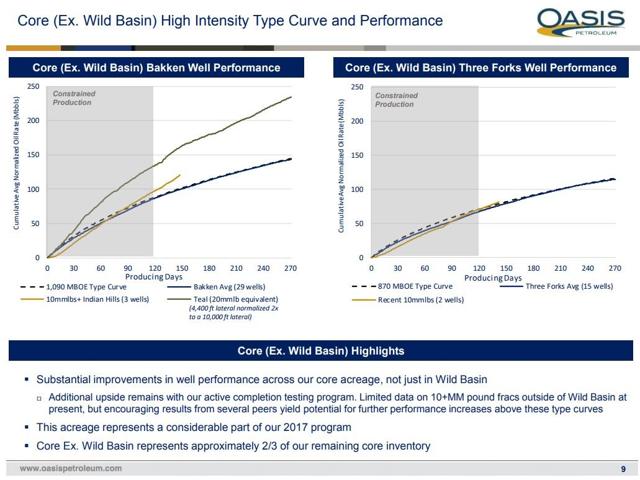

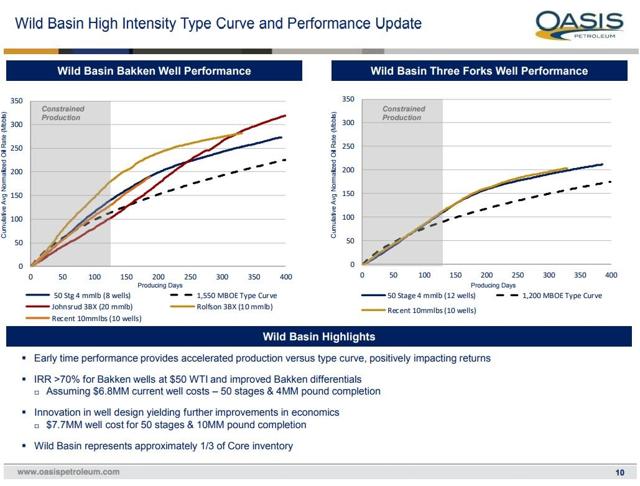

To add few more illustrations of advertised strong well performance, Oasis Petroleum (OAS) is using a type curve for its Middle Bakken wells outside Wild Basin that calls for ~140 thousand barrels of oil to be produced in the first nine months online.

For Wild Basin, which is Oasis’ most prolific asset and is located in the deep, high-pressure part of the Williston, the type curve calls for even stronger early-time volumes. Please note that the graphs show oil volumes only and do not include natural gas volumes.

For Wild Basin, which is Oasis’ most prolific asset and is located in the deep, high-pressure part of the Williston, the type curve calls for even stronger early-time volumes. Please note that the graphs show oil volumes only and do not include natural gas volumes.

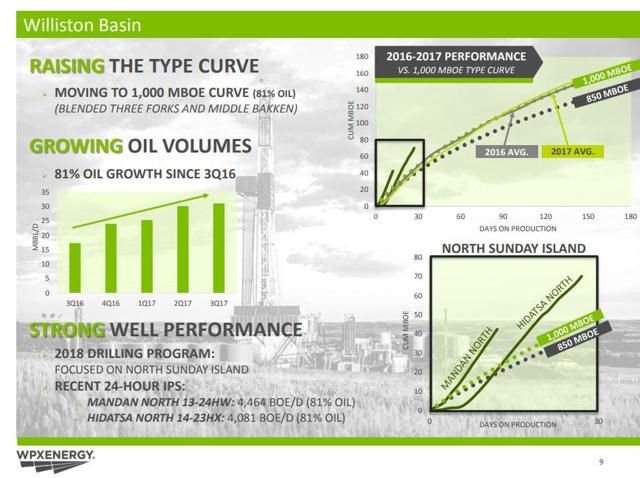

Strong early-time volumes are also advertised by WPX Energy (WPX) (volumes on the slide below are shown in BOEs)…

Strong early-time volumes are also advertised by WPX Energy (WPX) (volumes on the slide below are shown in BOEs)…

(Source: WPX Energy, Q3 2017 Investor Presentation)

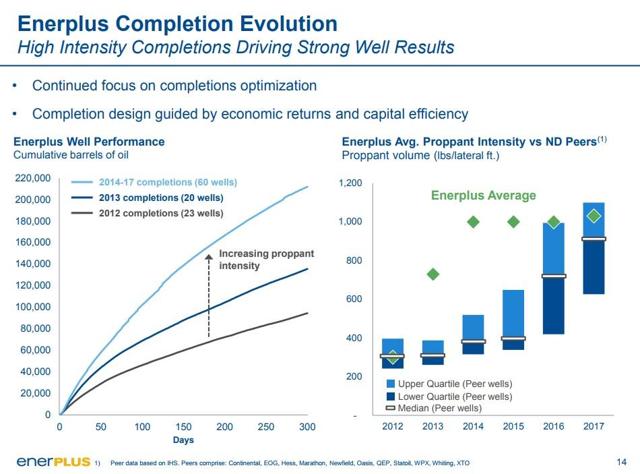

… and Enerplus (ERF) (the slide below is showing oil only)…

(Source: Enerplus, November 2017 Investor Presentation)

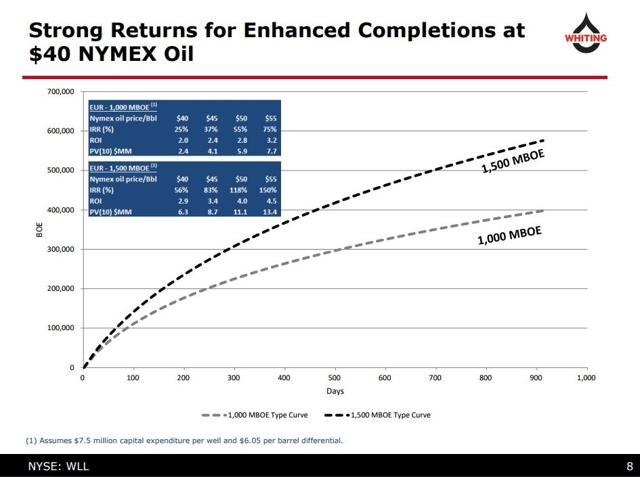

… and Whiting Petroleum (WLL) (volumes in BOEs)…

(Source: Whiting Petroleum, December 2017 Investor Presentation)

(Source: Whiting Petroleum, December 2017 Investor Presentation)

… just to mention a few.

Even if one were to “haircut” operators’ advertised type curves, projected volumes are strong enough to allow for acceptable drilling returns even after some risking.

Did It Once, Will Do It Again

In the context of operator reports, production growth in the Bakken is not particularly surprising. In fact, this recent growth is just a replica of the historical growth rates achieved in the play during the years of its early development (the difference of course is the amount of capital required to achieve the same result and the price environment).

U.S. Oil Shales On Production Tsunami Watch

A case can be made that the Bakken – and other established shale oil plays for that matter – have not shown their full growth capacity yet. Growth has just started and may continue (if, of course, one believes that the current oil prices will be sustained or increase further).

13 Comments on "The Bakken Strikes Back"

dave thompson on Sun, 24th Dec 2017 3:17 am

This article makes the oil extraction industry look so promising. LOL

Bruce Oksol on Sun, 24th Dec 2017 10:28 am

Well, the US shale revolution certainly disrupted OPEC. Saudi Arabia has still not recovered from their trillion-dollar mistake (2014 – 2016) when they flooded the market with oil, hoping to bankrupt US shale.

Anonymous on Mon, 25th Dec 2017 9:59 am

Here’s Art Berman in February of this year saying the Bakken would never recover.

“The decline in Bakken oil production that started in January 2015 is probably not reversible.”

http://www.artberman.com/the-beginning-of-the-end-for-the-bakken-shale-play/

And Bakken is almost back to the record production of DEC14, 3 years ago. Man, that Berman is just wrong, wrong, repeatedly wrong!

Ghung on Mon, 25th Dec 2017 10:08 am

“Probably not” does not equal “never”, as much as you want it to.

Anonymous on Mon, 25th Dec 2017 10:19 am

Has ASPO USA died?

The site lists Jan Lars Mueller as the director. But his LinkedIN page says he left DEC16. And it doesn’t even list ASPO per se but the “Energy Exchange” (a project of ASPO). Maybe he doesn’t want to be labelled with the peak oil tinfoil hat?

The site itself gets regular sanitary blurbs of various peak oil stories. Lot of content really, but short of new analysis. Looks like Tom Whipple is on autopilot. Site’s home page doesn’t show the Whipple new content and last update is from SEP16. (The Energy Exchange’s last content is from MAY16). The ASPO site also has some anacronysms like saying they do a conference every year since founding (when the last one was 2012).

Davy on Mon, 25th Dec 2017 10:32 am

Nony, what is coming will make peak oil look like noise. What is ahead will be a stew of ingredients that will humble your cockiness. Peak oil is alive and well. All we need is a little economic turmoil and you will be whining. I remember the last time things were crashing you were so humble and meek. I commend you on your strength in adversity. You caught a lot of hell in the past and now you are shining. Enjoy your moment in the sun becuase the storm clouds never left the horizon.

JuanP on Mon, 25th Dec 2017 11:11 am

The curve on the first graph of Bakken’s oil production looks like the first half of a bell with an early dip because of economic issues. It looks like the Bakken will have a second peak soon. I expect this oil production growth to be short. This play is ready to begin slowing down. I hope I am wrong and it lasts another 20 years, though, or, ideally, until I die! 😉

fmr-paultard on Mon, 25th Dec 2017 1:37 pm

Merry Christmas supertards. And same to SENTAPBs and eurotards and aswang. Even though I’m no longer much of a believer, I stop finding reasons to stay away. That is easy. I will find reason to go back to my Church. This is what my parents gave me and I won’t give up easily. I hope Eurotardland find their way back to Christianity. Most dutchys are atheists and on top of the chopping blocks for Islam according to the holy books. Nope, not making this up. We may disagree on the timeline, feasability, and a million other factors pertaining to the implementation of Allah’plan but it’s written.

MASTERMIND on Mon, 25th Dec 2017 1:52 pm

Annoumouse

I am the ASPO now…I AM THE MOB

MASTERMIND on Mon, 25th Dec 2017 1:57 pm

Here are five peer reviewed scientific studies authored by top experts that conclude you will be dead by no later than 2030

NASA Study: Industrial Civilization is Headed for Irreversible Collapse (Motesharrei, 2014)

http://www.sciencedirect.com/science/article/pii/S0921800914000615

The Royal Society: Study, Now for the First Time A Global Collapse Appears Likely (Ehrlich, 2013)

http://rspb.royalsocietypublishing.org/content/280/1754/20122845

Study: Limits to Growth was Right. Research Shows We’re Nearing Global Collapse (Turner, 2014)

http://sustainable.unimelb.edu.au/sites/default/files/docs/MSSI-ResearchPaper-4_Turner_2014.pdf

Study: Financial System Supply-Chain Cross-Contagion: in Global Systemic Collapse (Korowicz, 2012)

http://www.feasta.org/2012/06/17/trade-off-financial-system-supply-chain-cross-contagion-a-study-in-global-systemic-collapse/

German Military (leaked) Peak Oil study concludes: oil is used in the production of 95% of all industrial goods, so a shortage of oil would collapse the world economy & world governments

https://www.permaculture.org.au/files/Peak%20Oil_Study%20EN.pdf

Now i have become death the destroyer of worlds!

antaris on Mon, 25th Dec 2017 2:13 pm

ASPO site looks alive.

Maybe some of you guys need to go to the JW site for some challenge, and tell them they are full of shit.

MASTERMIND on Mon, 25th Dec 2017 3:05 pm

The stagnation of conventional oil production around 2005 and the rise of non-conventional oil as a response to that material reality has created a Gordian knot of macro-economic and geo-political problems, the fallout of which pose a fundamental challenge to the assumption of progress embedded in western expectations of democracy.

Thompson, Helen. Oil and the Western Economic Crisis

Springer International Publishing

deadly on Mon, 25th Dec 2017 4:34 pm

In 2014 there were 8948 wells pumping out those million barrels each day, in 2017, it takes 11,713 wells to pump out those million barrels.

2,000 wells at 5,000,000 dollars each is another 10,000,000,000 USD in investment.

There are 2765 more wells, those 11,713 wells pumped an average of 1,131,189 barrels each day during October of 2017. Works out to 96.58 bpd.

In December of 2014, 8948 wells pumped an average of 1,164,539 bpd. Makes the average per well at 130.17 bpd.

Take away those 2765 well increase at 96.5 bpd you are then short about 260,000 bpd.

25 percent decline in three years will be noticed.

If you have to spend 10,000,000,000 more dollars to obtain about the same number of barrels, in three more years, you’ll need another 2765 wells.

Then it will be 14,000 Bakken wells at 75 bpd. Three more years once more, 16,765 Bakken wells producing 1.1 million bpd. 70 bpd average, always falling behind.

An additional 40 billion dollars to maintain 1.1 million bpd production. 3×2765=8295 wells, at five million per well, it’s 40 billion dollars and some more. Looks like you are looking at an almost fifty percent decline in ten years, maybe less.

A conundrum, as it were. In the long haul, it will be a tough row to hoe. It don’t look good.