- 1998: IEA forecast peak oil in 2020

- how far was the IEA off? IEA projected demand at 111 bopd by 202; in fact, current demand is struggling to hit 99 bopd

- today: IEA says CAPEX slumped in past two years due to price downturn; price downturn “pulled the rug out from under upstream spending and investment decisions”: IEA sees a potential oil supply “gap” of 16 million bopd by 2025

- the gap of 16 million bopd by 2025 threatens new spike in oil prices

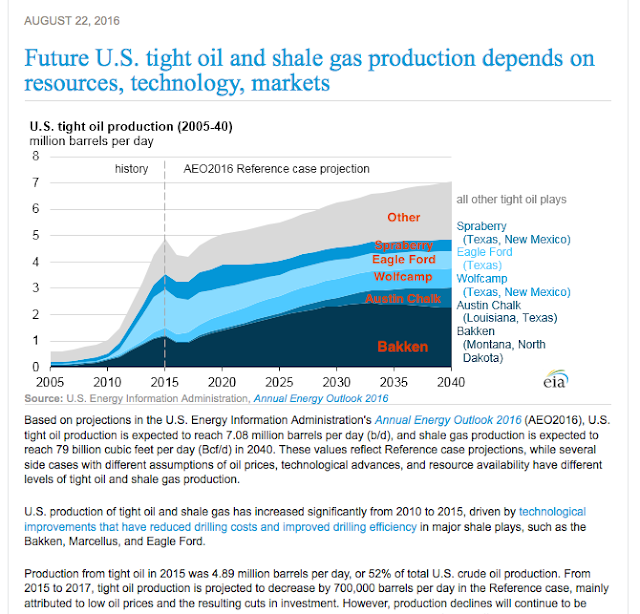

- global tight oil: 4.6 million bopd in 2015; will peak at 7.5 million bopd in 2035

- IEA predicts decline by 23.7 million bopd over the next decade alone, the IEA forecasts, the equivalent of losing the entire output of Iraq every two years

So, we’ll see.

Back-of-the-envelope:

- the Bakken: 2 million bopd

- the Eagle Ford: 2 million bopd (EIA: suggests about 1 million bopd)

- the Permian: 4 million bopd (EIA: suggests about 2 million bopd)

- subtotal: 8 million bopd in three plays

I can’t even begin to count all the other tight plays in the US, but one could start with SCOOP and STACK. The IEA folks need to get out and about.

penury on Thu, 22nd Dec 2016 2:20 pm

Having no knowledge of the oil business, I will accept that the information provided is true and accurate, However I have noticed that EIA has to adjust their figures and the great majority of adjustments are to the downside. Any forecast for 2040 can be considered dubious at best and should be ignored.

shortonoil on Thu, 22nd Dec 2016 3:39 pm

“Back-of-the-envelope:”

The shale industry has invested over $1 trillion to be able to generate annual gross sales of $363 billion. If they could return a 10% profit margin on those sales, and paid no interest on that money, it would require 27 years to return what has been invested.

It is interesting that the EIA does not seem to be the least bit concerned with the profitability of the industry that it reports on. They simply want to assume that these money losing enterprises will continue on forever. It is also interesting that so many people want to claim that what is obviously a losing endeavor is actually a raving success.

A society that was once the industrial engine of the world, is now the epitome of a cognitive dissonance champion. The highway to “oblivion” has been relabeled; “Heaven one mile”!

Sissyfuss on Thu, 22nd Dec 2016 4:38 pm

There is an aged man lying in his hospital bed with a melange of needles and tubes supplying him with the necessaries to keep him alive. The tube feeding him blood is still flowing but the potency of the liquid is a fraction of what it used to be. The tradjedy of this is that a great many depend on this soon to be rotting still breathing corpse like being. His name is Capitalism.

rockman on Thu, 22nd Dec 2016 4:54 pm

p – “I will accept that the information provided is true and accurate”. Why? Read the article again with this in mind: I do know you understand that oil production has always been dependent on the price of oil more then any other factor. So lots of projections and charts in the article: how many of them state the future oil price assumption used to make each projection?

As stated by the Rockman many times before every projection of future oil production rates is essentially also a projection of future oil prices. So, for instance, that prediction of tite oil production in 2040: what is the predicted oil prices over the next 23 YEARS? You don’t know? And if you did what would be you’re confidence level in such price prediction?

Hmm…I wonder 23 years ago in 1987 when oil was $18/bbl who was predicting $90+/bbl in 2010? Or even 13 years earlier when oil was $17/bbl? Or in 2008 when oil hit $136/bbl oil I wonder who (like the IEA, EIA, etc) predict $28/bbl just 7 years later?

I think you’re a lot smarter then you give yourself credit.

Truth Has A Liberal Bias on Thu, 22nd Dec 2016 5:34 pm

Hopium fiend has a rig drawn up for you and you can main line it right into the jugular.

https://robertscribbler.com/2016/12/22/this-is-what-the-resistance-looks-like-cities-states-and-nations-run-on-100-percent-renewable-power/

What a goof. I guess all those gas stations in those cities that are running on 100% renewable are just figments of my imagination.

Anyone who thinks renewable energy, whatever the fuck that is, can power modern industrial civilization AND produce enough surplus energy to account for its own manufacture, distribution and maintenance is a retard.

Scribbler is a shill. Probably getting paid by parties invested in solar and wind. Scribblers a fucking clown.

makati1 on Thu, 22nd Dec 2016 5:36 pm

Scribble for $$$$$. The present career goal of most writers. Bullshit for cash. Fairy tales for snowflakes and techie deniers.

Truth Has A Liberal Bias on Thu, 22nd Dec 2016 5:40 pm

IEA can’t find its ass in the dark with both hands. Their purpose is to convince everyone that the road ahead is safe while you speed towards a cliff in the dark. Nothing they have ever predicted has occurred. Why would anyone consider anything they have to say worthy of thought. I suppose if you’re interested in knowing what isn’t going to happen you could enquiry to see what IEA thinks is going to happen. I imagine their HQ is just one big circle jerk.

sam on Thu, 22nd Dec 2016 8:49 pm

The State of Nevada’s 2015 energy report shows the state’s energy comes 64% from Natural Gas, 18% from COAL, and only 4.5% from solar, the remainder being from geothermal. Hardly something to brag about.

Revi on Thu, 22nd Dec 2016 9:58 pm

Great graph! I like the way it dips now, but then starts going up and up into the future! I guess there is nothing to worry about now, is there?

antaris on Thu, 22nd Dec 2016 10:54 pm

Sam, they are f**ked. Maybe it is late tonight, but I thought a lot of Nevadas electric came from the Hoover dam.

Nony on Fri, 23rd Dec 2016 1:22 am

Segue:

US is now a natgas net exporter:

http://www.wsj.com/articles/new-milestone-the-u-s-is-now-a-net-exporter-of-natural-gas-1480258801

joe on Fri, 23rd Dec 2016 8:22 am

Their prediction could be right, as long as the debt based fiat currency economy continues as is, uninterrupted, as long as no other energy sources interrupt demand. Population growth will level off going forward, so demand growth is already leveling off. People see tight oil as an answer to the peak easy oil problem, im not buying it. Theres already a problem that tight oil has caused a glut of easy oil because of high prices. Tight oil will cause prices to be cheaper as its an alternative energy to easy oil with different processes involved.