Page added on October 23, 2017

Oil: This Time It’s Different

Summary

In this piece, I decided to tackle some recent oil-related data that shows a continued recovery in the market.

Prices aren’t responding, but the underlying data suggests the recovery in the market now is real.

I anticipate further improvements moving forward that will prove bullish for oil investors.

Another week, another set of mostly good news for oil investors. Even though market participants right now appear to be mostly bearish or, at best, neutral regarding oil, bullish data continues to hit us on an almost weekly basis. In what follows, I will dig into some of these numbers and give my thoughts on why, right now, we could probably justify higher energy prices than what we are currently seeing.

Inventories took a tumble

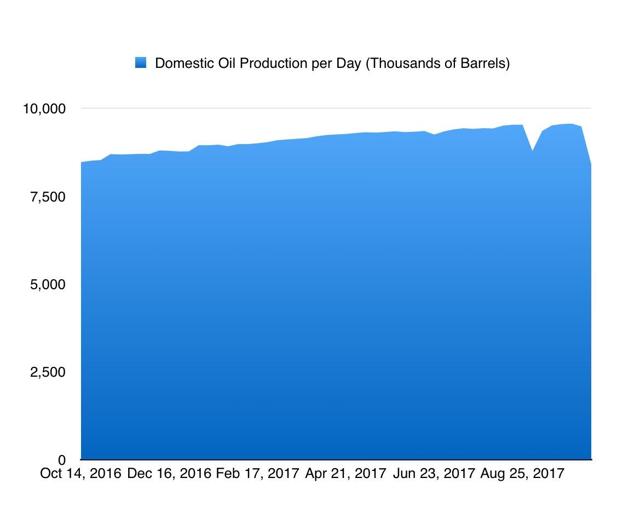

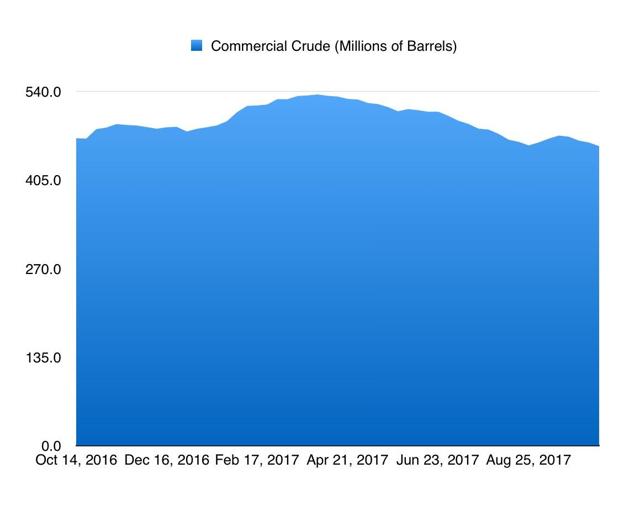

*Created by Author

In my mind, the single most important thing right now for the oil market is what inventories stand at. So far, the results are looking positive. If the EIA’s (Energy Information Administration’s) numbers are accurate, crude stocks last week managed to fall by 5.7 million barrels, dropping from 462.2 million barrels down to 456.6 million barrels. While this decline is smaller than the 7.1 million barrel drop estimated by the API (American Petroleum Institute), it was quite a bit bigger than the 3.2 million barrel decline forecasted by analysts. In the graph above, you can see the trend that stocks have taken over the past 52 weeks and, in the graph below, you can see the same graph but zoomed-in on so that you can more easily see weekly fluctuations.

Interestingly, crude wasn’t the only category to drop during the week. If the EIA’s estimates are correct, the “Other” category of petroleum products saw stocks dip 1.5 million barrels down to 294.3 million barrels. This matched the 1.5 million barrel decline from kerosene-type jet fuel (down to 43.1 million barrels) and was a bit larger than the 1.2 million barrel drop in residual fuel, which ended the week at 34.6 million barrels. In last place, we had propane/propylene stocks, which declined 0.1 million barrels down to 78.8 million.

While all of this data is great, there were a couple of areas that worsened. According to the EIA, motor gasoline stocks managed to rise by 0.9 million barrels, closing out to 222.3 million barrels. In addition to that, they saw distillate fuel stocks inch up by 0.5 million barrels to 134.5 million. Fuel ethanol, meanwhile, saw its inventories end the week flat at 21.5 million barrels. Despite the noted increases in inventories, though, the decreases from elsewhere resulted in the sum of crude and petroleum product stocks falling by 8.6 million barrels from 1.2927 billion barrels down to 1.2841 billion barrels. This was all in spite of the fact that the US government unloaded 0.7 million of its own barrels onto the market during the week.

Interesting movements elsewhere

While inventory data was undeniably bullish, some areas were weak. Take, for instance, distillate fuel demand. During the week, the four-week average demand figure averaged 3.720 million barrels per day, a decrease of 6.4% compared to the 3.975 million barrels per day seen the same time last year. That said, motor gasoline demand, while weaker at 9.136 million barrels per day compared to the 9.480 million barrels per day seen a week earlier, was stronger year-over-year compared to 2016 when it averaged 8.798 million barrels per day. The four-week average figure, according to the EIA, came out to 9.345 million barrels per day, up 2.9% from the 9.083 million barrels per day seen during the same four weeks of 2016.

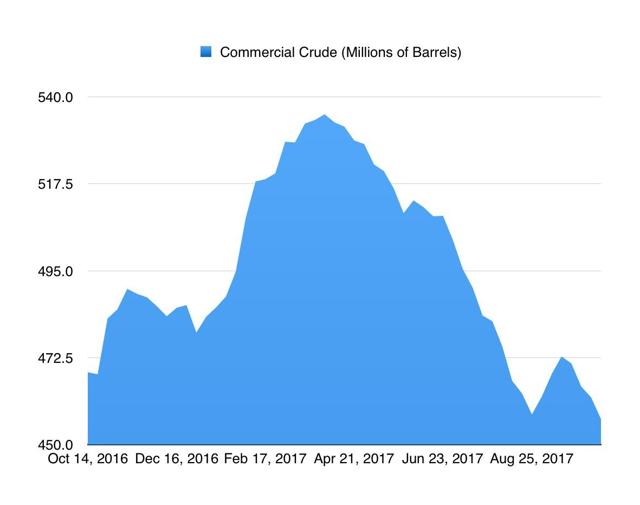

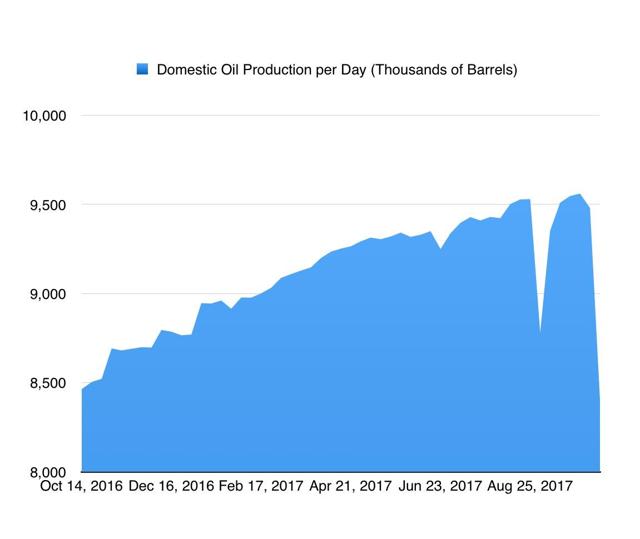

*Created by Author

Even though demand was mixed, production was quite positive. According to the EIA’s numbers, domestic oil output came out to 8.406 million barrels per day. This represents a drop of 1.074 million barrels per day (or 7.518 million barrels for the week) compared to one week earlier when it came out to 9.480 million barrels per day. While this decrease is great to see, investors shouldn’t get used to it because these results were affected by temporary shutdowns in Gulf of Mexico output caused by Hurricane Nate. In the graph above, you can see the trend that production has taken over the past 52 weeks and, in the graph below, you can see the same graph but zoomed-in on so that you can more easily see weekly fluctuations.

*Created by Author

Yet another drop in the rig count

In addition to the largely positive data looked at so far, I also examined data provided by Baker Hughes, a GE Company (BHGE). According to the firm, the oil rig count in the US fell by 7 units during the week, dropping to 736. This represents just the latest in a series of rig count falloffs this year, but it should be mentioned that we are still quite a bit above the 443 units in operation the same time last year. Meanwhile, in Canada, the oil rig count dropped by 5 units to 107. This too is positive, but it is still above the 69 units operating during the same week last year.

An interesting observation

One thing I noticed of significance about this data was that the sum of crude and petroleum product stocks, which came out to the 1.2841 billion barrels I mentioned above, is now below the 1.286 billion barrels the EIA thought it should be by the end of this year. This is odd because the EIA has been forecasting a pretty sizable drop in total inventories from the third quarter to the fourth, so I decided to look into things a bit more. In its latest Short-Term Energy Outlook, the organization stated that inventories at the end of the third quarter this year came out to 1.328 billion barrels.

This is odd because data thus far shows a far different picture from that. In the week ending September 29th, inventories totaled 1.2945 billion barrels. And in the week ending October 6th, they came out to 1.2927 billion barrels. So, unless we had a really large short-term spike, something’s off. If this difference were caused by a change in the EIA’s expectations regarding where inventories are today, I imagine those numbers would have been accounted for in the weekly numbers by now, but that is simply not the case. Instead, we are left with a scenario where, in its monthly report, stocks are being overstated by between 33.5 million barrels and 35.3 million barrels.

This data means, in my view, that if the weekly numbers are correct (and I can’t see why they wouldn’t be given the EIA’s time to change them if they’re not), it would be shocking if we don’t see some sort of inventory drop moving forward. I echoed this stance in a prior article, but at that time I had not paid attention to the third quarter difference reported by the EIA. If my view on this is correct, I believe that we could see inventories approach the 1.25 billion barrel mark by the end of this year, meaning that we should average continued declines of around 3 million barrels per week for the rest of this year, if not more.

Takeaway

Based on the data provided, it’s clear now that oil is recovery fundamentally. That said, we have seen no such change reflected in price that seems to recognize this fact. While not everything is perfect, and there’s plenty of room for improvement, the fact of the matter is that matters are getting better and, in all likelihood, will continue to get better moving forward.

35 Comments on "Oil: This Time It’s Different"

Hello on Mon, 23rd Oct 2017 5:24 pm

>>>>> the fact of the matter is that matters are getting better and, in all likelihood, will continue to get better moving forward

I’m confused. Weren’t high oil prices used to be bad? For the economy and all? And now all of a sudden rising oil prices is good?

The reality is that oil price doesn’t matter much for the economy. It’s the large and frequent swings (up and down) which suppressed economic activity.

Give me stable $400/barrel oil and I give you full employment with a humming economy.

makati1 on Mon, 23rd Oct 2017 6:03 pm

Hello, ‘Seeking Alpha’, should read ‘Seeking Paradise’. And using EIA numbers is like guessing. Pure fiction.

Your ‘$400 oil’ would last one day. Then you could watch the final collapse of everything. The end.

MASTERMIND on Mon, 23rd Oct 2017 6:10 pm

makati1- CitiBank CEO is warning of worldwide oil shortage by next year. When that happens all of the worlds people are going to panic. And there is nothing any policy maker can do or say to ease their worried minds. They will suffer a spiritual death. And then all bets are off!

MASTERMIND on Mon, 23rd Oct 2017 6:13 pm

CitiBank CEO warns of oil shortages coming as soon as 2018

https://www.bloomberg.com/news/articles/2017-09-25/citi-says-get-ready-for-an-oil-squeeze-than-an-opec-supply-surge

Madkat1 now you listen and you listen good. This world will burn!

Davy on Mon, 23rd Oct 2017 6:18 pm

“EIA numbers is like guessing. Pure fiction.”

More from the drama queen himself. “Pure fiction”, lol, you are a fictional personality in your own mind. Go back down to the pool and drink your San Miguel.

Davy on Mon, 23rd Oct 2017 6:32 pm

“The 4 Possible Channels For A Chinese Financial Crisis”

http://tinyurl.com/ycat3yow

“The reality, however, is that China’s true leverage picture is far worse, and while there are far more aggressive and pessimistic estimates in the public domain, we have chosen the latest number calculated by Victor Shih from the Mercator Institute for China Studies, who in a just released report calculates that total non-financial credit in China stood around 254 trillion RMB as of May 2017, equivalent to 328% of 2016 nominal GDP, or nearly 100% higher than the official IMF estimate. This is also 34% increase as a share of GDP compared with the end of 2015.”

“how much longer can this go on?” and answers that “the amount of interest that debtors in China must pay creditors provides clues on the costs of such a high debt level. If interest servicing exceeds incremental increase in nominal GDP, the debtor would need to pursue one of two courses of action to avoid a crisis. This ultimately goes to the question whether China has hit its “Minsky Moment” or is still in the Ponzi Finance stage, a discussion popularized by Morgan Stanley first in 2014. Here are Shih’s observations: First, creditors can extend even more credit to the debtors so that interest payments are serviced with new credit. This mechanism renders China more of a Ponzi unit, which requires new credit to service interest payments. Alternatively, a rising share of income for households, firms, or government will go toward servicing interest. While the first dynamic would cause the acceleration of debt accumulation, the second dynamic is tantamount to a massive tax which will slow growth for an extended period.”

“So what ends the bubble? According to the Merics analysis, there are 4 possible channels for a financial crisis in China. First, it should be noted that despite the enormous debt load, a domestically triggered crisis is not likely in the next five years. Trouble is more likely to come from some combination of capital flight and sudden withdrawal of external credit.“

“With that in mind, the crisis scenarios are as follows:”

“Sharp household deleveraging: Because Chinese household debt is still a relatively small share of banking sector assets, a rise in distressed household debt by itself will not impact the financial system by much. Beijing has guarded against this by requiring high down payments from home buyers.”

“Panic in shadow-banking sector: Off-balance-sheet non-standardized credit to the corporate and government sectors has reached 50 trillion RMB by May of 2017, or 64% of GDP. Despite the enormity of shadow credit, as long as the flow of liquidity continues from the banking sector, shadow finance is unlikely to implode in the near future. However, given the enormity of shadow finance and the PBOC’s periodic tightening, miscalculation by the PBOC can cause a temporary panic.”

“Capital flight: China’s foreign exchange reserve now totals only 10% of money supply and 30% of household savings, leaving China vulnerable to capital flight that depletes liquid foreign exchange reserves. If large outflows resume despite capital control measures, ”maxi-devaluation” and external defaults may be the only means of preserving China’s reserves.”

“Withdrawal of credit by international lenders: Including net Hong Kong-domiciled debt, Chinese external debt exceeded 1.9 trillion USD, 1.2 trillion of which in short-term debt to Chinese financial institutions. Additional external borrowing muted the impact of capital flight to the tune of 140 billion dollars in the past two years. Sudden withdrawal of foreign credit would immediately lead to severe reserve depletion, which can only be stopped by “maxi-devaluation” and defaulting on external debt.”

Davy on Mon, 23rd Oct 2017 6:37 pm

Part 2

“Shih’s conclusion: As credit in China continues its rapid build-up, an increasing number of scholars, policy makers, and investors wonder how long China can sustain such a high pace of leveraging before a financial crisis. Yet, analysts of past bubbles also underestimate the extent to which the ruling Chinese Communist Party controls nearly every aspect of the financial system through party committees in every financial institution in China. This control decreases the chance of panic selling, often the trigger of a crisis. In the analysis I calculate outstanding debt and interest payments, followed by analysis of four plausible scenarios of financial crisis in China: household defaults, shadow banking panic, capital flight, and a sudden stop of international lending.”

“I conclude that China’s greatest vulnerability resides in its dwindling foreign exchange reserve and escalating external debt, which one day can trigger a confluence of maxi-devaluation, external defaults, and sharp asset price depreciation.”

Outcast_Searcher on Mon, 23rd Oct 2017 6:50 pm

Mastermind, because magically, no substitutes will be possible. Driving less won’t be possible. Carpooling will be impossible. Using alternate transportation won’t be possible. The pricing mechanism magically will fail to work.

Do doomers like you ever bother to do just a little bit of critical thinking, or is the idea of doom so attractive to you that it makes such thinking impossible?

Or do you really expect all non-doomers to accept such a silly premise on its face because doomers act like zerohedge and similar blogs are the fount of all truth and wisdom?

makati1 on Mon, 23rd Oct 2017 7:00 pm

“…all of the worlds people are going to panic.”

Really? ALL. How about the billions that have no use for oil? I won’t panic. And, I would bet most will not even notice in the “developed” world other than gasoline prices will go up.

“ALL”is an gross exaggeration, not fact.

MASTERMIND on Mon, 23rd Oct 2017 7:07 pm

Outcast and Makati1

I am not a doomer I am a human being. And based on two studies done at UC Davis and University of Chicago it will take well over another 100 years if ever to replace oil. And look what happened in North Korea when they lost their oil supplies…Nuff said…Like I said…This world will burn! The Bloodthirsty US public will DEMAND SOLUTIONS! And if they are not available they will DEMAND BLOOD. Someone is going to have to pay dearly when they find out little bubba and little Charlotte won’t have nice things like electricity…American’s are already divided, angry, and armed to the teeth. Throw in the mother of all energy black swans. And all bets are off! And for the record outcast I never ever quote zero hedge and never will. I sourced Bloomberg.

makati1 on Mon, 23rd Oct 2017 7:09 pm

Davy, I don’t give a damn if the whole financial system goes down today. Whether China is the first domino or the US. It should and eventually will. If you are not prepared for that, then you will suffer, not me.

You are the one grasping for any straw that might keep BAU going for the rest of your lifetime. It is too late. It is going to end and with it your lifestyle and that of most of the West and the wannabees.

Run to Italy if you want, but that too is going to be 3rd world. We have done it to ourselves and have no one to blame. I’m prepared to ride out the storm. Are you … really? I doubt it.

MASTERMIND on Mon, 23rd Oct 2017 7:10 pm

UC Davis Study: It Will Take 131 Years to Replace Oil with Alternatives (Malyshkina, 2010)

http://pubs.acs.org/doi/abs/10.1021/es100730q

University of Chicago Study: predicts world economy unlikely to stop relying on fossil fuels (Covert, 2016)

https://www.aeaweb.org/articlesid=10.1257/jep.30.1.117

German Government (leaked) Peak Oil study concludes: oil is used directly or indirectly in the production of 90% of all manufactured products, so a shortage of oil would collapse the world economy & world governments

https://www.permaculture.org.au/files/Peak%20Oil_Study%20EN.pdf

I could post a million peer reviewed studies and little babies like MadKat and outtolunch will deny them…..

makati1 on Mon, 23rd Oct 2017 7:13 pm

MM, I agree on most of your points. It is too late for Americans to save their lifestyle, at any cost. Internal division is going to tear it apart.

I only hope that there is enough sanity left in the military that they don’t use nukes as a last resort. That is why I cheer for a financial collapse to happen soon. To make foreign wars financially impossible.

MASTERMIND on Mon, 23rd Oct 2017 7:15 pm

This is how the collapse will happen.

1. Oil shortages

2. Spiritual Death

3. Social Collapse

4. Anarchy

The End of the Human Race will be that it will Eventually Die of Civilization

–Ralph W Emerson

Davy on Mon, 23rd Oct 2017 7:21 pm

What’s da matter mad katter is reality setting in that Asia is no better than the US. When Asia declines people will starve. If you are lucky you will catch a flight home before you become trapped in famine and social disorder that will visit your 20mil Manila megaregion of overshoot.

makati1 on Mon, 23rd Oct 2017 7:45 pm

Davy, I have always seen the real Asia and world. You are the one with phobias and denials. Knowing all that, the Ps is STILL a much better place to live than the US Police State. I have freedoms you can only dream of. I also will not freeze to death, be shot by a drugged up terrorist or starve, much as you seem to think so.

Every comment you make only proves my description of you. A self centered 1%er that is seeing his world evaporate. Delusional, phobic and an egocentric bully. A perfect example of a 21st century American warmonger/pirate/murderer. Anything to keep BAU. LOL

Davy on Mon, 23rd Oct 2017 8:07 pm

What’s da madder mad katter, did I peg ya. You are in the middle of some of the worst overshoot in the world . You pretend and brag but the numbers don’t lie. You lie though and mostly to yourself. You will run back to the US with your tail between your legs if you live that long.

TommyWantsHisMommy on Mon, 23rd Oct 2017 8:40 pm

Electric cars not going to help? I figured we’d all have Teslas and not need oil.

Cloggie on Tue, 24th Oct 2017 2:44 am

“India To Auction 4.5 Gigawatts Of Wind Power Projects By February 2018”

https://cleantechnica.com/2017/10/23/india-auction-4-5-gigawatts-wind-power-projects-february-2018/

“Indian Module Makers Beat Chinese Prices In 300 Megawatt Tender”

https://cleantechnica.com/2017/10/23/indian-module-makers-beat-chinese-prices-300-megawatt-tender/

India is competing with cheap labor on world markets with China, which btw is a good thing for the West and the world: 30 $ cents per Watt. Prices for standard 160 x 100 cm panels are moving in the direction of $100. Renewable energy generation (wind & solar) is already the cheapest form of energy generation. The remaining bottleneck is storage, but per kWh prices are rapidly decreasing on that front as well. A smooth energy transition is still the likeliest outcome, absent of war. The world needs an area like Spain covered with solar panels to replace ALL energy consumed today. China and increasingly India could deliver that.

“Here’s Why The Middle East Leads In Lowest Solar Tariffs”

https://cleantechnica.com/2017/10/23/heres-middle-east-leads-lowest-solar-tariffs/

Lowest solar tender in history: $1.78 per kWh in KSA for a 300 MW project.

Cloggie on Tue, 24th Oct 2017 2:54 am

Huge trend: big companies providing for their own energy:

https://cleantechnica.com/2017/10/21/jeff-bezos-launches-253-mw-amazon-wind-farm-texas-300-feet/

Amazon, Google, Apple, Dutch Rail, Carlsberg, IKEA, the list goes on and on. This trend is probably at least as important than private citizens installing a few solar panels on their roof.

Davy on Tue, 24th Oct 2017 5:04 am

“The remaining bottleneck is storage, but per kWh prices are rapidly decreasing on that front as well. A smooth energy transition is still the likeliest outcome’

“KWH prices are rapidly decreasing” do you know what that means? I doubt it. Price is not the real indicator of value and productivity. There is so much more to it because price is manipulated by multiple different conditions. Don’t argue price in a world that is still driven by fossil fuels and repressed cost of money with corresponding quantitative easing. You are just cheerleading. I am not saying at all that the renewable transformation is bad. I am all for it. Just don’t act like it is the silver bullet that will save us. You are just a science denier trumpeting something that is vital to your fantasy future of a Paris Berlin Moscow pan European empire. It is your way of justifying the economic and energy side of this empire dreaming. Europe will be saved by renewables and become a new Empire because of it per the anti-American extremist.

“The world needs an area like Spain covered with solar panels to replace ALL energy consumed today.”

What a friggen joke. Throw in all the other elements that are needed to support solar panels on an area the size of Spain. You can’t even decouple from fossil fuels yet and you are already crowing about how all we need is to cover Spain in solar panels and we can power the world. How are you going to pay for that, IMA? Why not tell others what you really mean and that is Europe will enjoy the affluence and the rest of the world will be in darkness.

“China and increasingly India could deliver that.”

China and India are in a slow motion economic meltdown. Don’t expect them to save us. They will be lucky to save themselves from the worse. There is plenty of evidence to support what I just said. I post articles every day showing this. Of course this site never posts China negative news. Most negative news here is of the American versions. No wonder this site is an extremist magnet. You never say anything negative about China. Why, because again China fits into your fantasy future nonsense of a Paris Berlin Moscow pan European Empire. China is the counterweight to the US that will allow Europe to break away establishing its own empire. Then in your mind it is a battle of a European Empire with a Chinese one in a bipolar balance. LOL. You want very much to see a Chinese/American war so in your mind a destroyed America can be mopped up and reintegrated into Europe as a vassal sate. What a friggen joke. If any of this happens we all collapse into a postmodern civilization TOGETHER.

Davy on Tue, 24th Oct 2017 5:32 am

We are in a slow motion financial meltdown and cornucopians dismiss and discredit this reality every chance they get. Why do they do this, they do it because their dreams depend on it. Renewables and EV’s depend on it. Fossil fuel world of growth depends on it. All this will be stymied by a financial meltdown and this meltdown doesn’t have to be a collapse. All it needs to be is a bad recession. If we have a bad recession then will all the debt, unfunded liabilities, and stretched safety nets we will never recover. We know a recession will come someday.

We know the central banks are running out of tools to boast liquidity and extend and pretend nonperforming debt. What happens when China can no longer maintain the debt injections it is making to support its multiple bubbles? Europe and the US are talking tapering. What they are really talking is a controlled recession. That is likely wishful thinking because it is not at all apparent if we can ever have a recession again without losing control. The only thing holding this façade together is human nature management by central banks. They are maintaining the allusions of affluence. This is being done with wealth transfer to maintain adequate growth for a small segment of the population as other segments are bled dry.

This dangerous game could go on for years but as it goes on the degree of decline is likely to be that must worse. Instead of a more gradual decline we may be looking at worse. I do not think this economic facade can be maintained much longer. A few years at most. I do not know how bad it will get and how quickly. I am telling you all now this does not look good and anyone who treats the economy as a constant in their calculations for a solution to our many problems is in a fantasy world. This goes for all those fake greens preaching a renewable world with a Paris accord that will solve our carbon problem. This is all a tragic joke we are playing on ourselves. You need to be laughing at yourself not praising yourselves.

“Gundlach Warns “The Order of The Financial System Is About To Be Turned Upside Down”

http://tinyurl.com/y8fkpg7k

“Gundlach urged investors to be “light” on bonds. As Vanity Fair’s William Cohan reports, Gundlach admitted “I’m stuck in it,” of his massive bond portfolio, adding that interest rates have bottomed out and been rising gradually for the past six years. Gundlach said his job now, on behalf of his clients, “is to get them to the other side of the valley.”

“But it can’t end well. To illustrate his point about the risk in owning bonds these days, Gundlach shared a chart that showed how investors in European “junk” bonds are willing to accept the same no-default return as they are for U.S. Treasury bonds, pointing out that this phenomenon has been caused by “manipulated behavior” by central banks. European interest rates “should be much higher than they are today,” he said, “…[and] once Draghi realizes this, the order of the financial system will be turned upside down and it won’t be a good thing. It will mean the liquidity that has been pumping up the markets will be drying up in 2018……Things go down. We’ve been in an artificially inflated market for stocks and bonds largely around the world.”

Cloggie on Tue, 24th Oct 2017 5:34 am

I am not saying at all that the renewable transformation is bad. I am all for it. Just don’t act like it is the silver bullet that will save us.

Why shouldn’t I? There is no alternative. Prices are now affordable and the whole world (minus Syria and the US) wants the transition. You cannot wish for better conditions.

You are just a science denier

What science am I denying?

Europe will be saved by renewables and become a new Empire because of it per the anti-American extremist.

Renewables yes; again not empire but confederation; I am anti-Washington. You are anti-European with your raysism baloney.

You can’t even decouple from fossil fuels yet

Think again:

http://www.independent.co.uk/environment/scotland-renewable-wind-energy-power-electricity-three-million-homes-118-per-cent-of-households-a7855846.html

Why not tell others what you really mean and that is Europe will enjoy the affluence and the rest of the world will be in darkness.

Never said that. European affluence will last for a decade at most, then the demographic winter will set in.

China and India are in a slow motion economic meltdown.

Sure, the tired old collapse narrative. Wishful thinking.

Don’t expect them to save us.

Never said they will “save us”. Only that they are going to deliver cheap solar panels to us at particleboard prices.

I post articles every day showing this.

Yeah, financial articles only, the core of your intellectual universe. My point is that financial collapse/debt jubilee will not be the end of the world. Factories, workers, infrastructure will continue to exist and operate. Wages will be lowered, pensions cancelled, credit will be more difficult to become, but the world will carry on, just like Russia carried on during the nineties after which it experienced a rebirth.

Most negative news here is of the American versions.

Because the US is the most prominent example of decline. The big picture is that the world is moving from US hegemony towards multipolarism, with China the most powerful state in a few decades.

because again China fits into your fantasy future nonsense of a Paris Berlin Moscow pan European Empire.

You wouldn’t like that eh, so it is not going to happen.lol

China is the counterweight to the US that will allow Europe to break away establishing its own empire. Then in your mind it is a battle of a European Empire with a Chinese one in a bipolar balance. LOL.

Nope. The US, not China, is going to break apart for demographic reasons, or “raysism” in your outdated 1%-er-wannabee lingo. Before 1991 you could kiss your career goodbye if in the USSR you were accused of begin a “class enemy”. In a couple of years the idea of “racist”, the battle cry of the US empire, will go the way of the dodo’s as well. Good riddance to the most useless concept in world history, invented by the youknowwhos, just like “class enemy”.

Then in your mind it is a battle of a European Empire with a Chinese one in a bipolar balance.

Not a battle, just balancing act. Since there no youknowwhose in China, China doesn’t want to rule the world.

You want very much to see a Chinese/American war so in your mind a destroyed America can be mopped up and reintegrated into Europe as a vassal sate.

That’s an infame accusation. I was merely talking about “junior partner”.

If any of this happens we all collapse into a postmodern civilization TOGETHER.

Oh, modernity and globalism and liberalism and a few isms more are going to collapse alright. ISIS is just a small sign of things to come. And ethnicity is going to be on top of the agenda.

Davy on Tue, 24th Oct 2017 6:00 am

“Why shouldn’t I? There is no alternative.”

So that means you should deny science and live in a fantasy?

“the whole world (minus Syria and the US) wants the transition.”

Please reference where the US does not want a transition. Is Trump the US? Is the Paris accord real science and policy? Hell no. Last I looked we are a leader in renewables. We are not the top but we are a significant player. Go climb back in your extremist hole.

“What science am I denying?”

You are a climate denier. You deny the physics that argue against a 100% renewable world. You are a human science denier with your white racist Eurotard BS. You are a denier of the reality of a very bad economic situation. You talk about a golden decade in Europe and always talk up China. You do this for emotional reasons that support your personal agenda of a European empire.

“My point is that financial collapse/debt jubilee will not be the end of the world.”

Wow, now you spilled the goods. You are banking on a debt jubilee. LOL. You think we can just keep rolling over debt forever. Do you understand linearity and what exponential increases mean? You dismiss diminishing returns and think substitution and technological innovation can continue on and on.

Cloggie, your views are mostly based on revised history, a disregard for current reality, and a fantasy future. In fact you are already in your fantasy future. You live that daily instead of the reality of the world we are in. You are all about the European empire that is not here and a renewable world that is not here. You are all about a Chinese and European bipolar superpower that is not here. You are all about a destroyed American you are going to mop up with that grand Eurotard army that is not here yet. There is no grand Eurotard army cloggie. You been reading too much about Napoleon and forgetting that was a different century.

Davy on Tue, 24th Oct 2017 6:20 am

“Italian Migration Crisis: The Big Picture”

http://tinyurl.com/y9rkoplh

GG: That is going to be the final blow to our society as we know it today. Those who are in favour of this law are quite careful in not mentioning the alarming situation in western EU countries. They don’t tell the general public that from France to Sweden, not to mention other countries, there are areas, so called no-go zones, that are practically off-limits to local law enforcement agencies, as the local Muslim communities have declared those areas under their control. We still don’t have that in Italy. Everybody knows by now that the left in Italy is pushing hard for this law because they think that, once naturalized, an immigrant will vote for those parties that granted him or her the citizenship. But with these hopes they are naive, or stupid at the same time.

Cloggie on Tue, 24th Oct 2017 6:21 am

KSA announces a giant new city state called Neom in the NW, encompassing KSA, Jordan and Egypt with an independent judiciairy. Investment: 500 billion $. Size 26,000 km2. Phase 1 to be completed in 2025. Renewable energy only.

http://www.spiegel.de/wirtschaft/saudi-arabien-plant-mega-city-neom-fuer-500-milliarden-dollar-a-1174419.html

http://saudigazette.com.sa/article/520137/SAUDI-ARABIA/8-things-you-need-to-know-about-Saudi-Arabias-innovative-NEOM-project

(KSA version of April 1 joke?)

Davy on Tue, 24th Oct 2017 6:31 am

“Largest U.S. Grid Operator Opposes Perry’s Plan to Save Coal”

http://tinyurl.com/y7tns66c

“The biggest U.S. grid operator is asking regulators to reject Energy Secretary Rick Perry’s plan to prop up ailing coal and nuclear plants. “I don’t know how this proposal could be implemented without a detrimental impact on the market,” Andrew Ott, who heads up PJM Interconnection LLC, told reporters by phone Monday. Perry’s proposal is “discriminatory” and inconsistent with federal law, Ott said”

“Murray Energy Corp. wrote in support of the rule. The company is among coal producers and related industries that are “threatened with bankruptcy and significant economic harm” if U.S. coal-fired power plants are “forced out of the market by unreasonable and unsupportable market pricing mechanisms,” it said. FirstEnergy Corp., which operates numerous coal-fired plants in the PJM market, filed comments in support of Perry’s plan, saying that coal and nuclear retirements will put the electric grid at risk.”

Davy on Tue, 24th Oct 2017 6:38 am

“Developers Plan Wind Farms Off Jersey Shore as Christie Era Ends”

http://tinyurl.com/y9vo6gpw

“New Jersey has all the classic elements for offshore wind to work,” said Paul Rich, director of project development for US Wind Inc., one of two developers with federal leases to build off New Jersey. “The time is right, and the market is ripe.”

Cloggie on Tue, 24th Oct 2017 6:38 am

Please reference where the US does not want a transition. Is Trump the US?

He is the government.lol

You are a climate denier.

No I am not. Why do you think I devote so much time maintaining my blog? What I do deny is that a few doomers with private psychological issues here have accurate knowledge about what is going to happen and that everything is lost.

You deny the physics that argue against a 100% renewable world.

That physics doesn’t exist.

You talk about a golden decade in Europe and always talk up China.

I didn’t figure that out, but quoted from a bright guy who manages the largest money bag in the world:

https://www.youtube.com/watch?v=PM9_PrBoq9Q

You are all about the European empire that is not here and a renewable world that is not here.

You are all about a collapse that is not here.

There is no grand Eurotard army cloggie

There are certainly European armed forces, significantly larger than US forces, but they are not yet integrated. Macron wants to chance that.

https://en.wikipedia.org/wiki/Military_of_the_European_Union

https://en.wikipedia.org/wiki/United_States_Armed_Forces

EU military: 1.8 million active

US military: 1.2 million active

Russia has 1.0 million active

The US is wasting 40% of its resources on a useless navy.

I think that an integrated EU army + Russian forces can achieve a lot on US soil, if the US descends in the coming chaos of ethnic conflict. Purpose European presence: managing the USSR-style breakup.

https://www.youtube.com/watch?v=ZGSAhNZnisk

https://www.youtube.com/watch?v=rrm_JAnVKzI

Cloggie on Tue, 24th Oct 2017 6:42 am

“Developers Plan Wind Farms Off Jersey Shore as Christie Era Ends”

Good news! With sufficient European developer support this is bound to become a success.

Davy on Tue, 24th Oct 2017 6:45 am

cloggie, you can do better than that. You know you are winning when the quality of the response drops off the cliff. Try again

Cloggie on Tue, 24th Oct 2017 6:53 am

cloggie, you can do better than that. You know you are winning when the quality of the response drops off the cliff. Try again

Davy declares himself the winner in the ongoing debate.

You know that in real life references from yourself or mum don’t count, now do you?

makati1 on Wed, 25th Oct 2017 6:06 pm

In real news…

“Our Ever-Deadlier Police State”

https://www.globalresearch.ca/our-ever-deadlier-police-state/5614990

“Police forces in the United States—which, according to The Washington Post, have fatally shot 782 people this year—are unaccountable, militarized monstrosities that spread fear and terror in poor communities. By comparison, police in England and Wales killed 62 people in the 27 years between the start of 1990 and the end of 2016.”

“The criminal justice system, at the same time, refuses to hold Wall Street banks, corporations and oligarchs accountable for crimes that have caused incalculable damage to the global economy and the ecosystem. None of the bankers who committed massive acts of fraud and were responsible for the financial collapse in 2008 have gone to prison even though their crimes resulted in widespread unemployment, millions of evictions and foreclosures, homelessness, bankruptcies and the looting of the U.S. Treasury to bail out financial speculators at taxpayer expense. We live in a two-tiered legal system, one in which poor people are harassed, arrested and jailed for absurd infractions, such as selling loose cigarettes—which led to Eric Garner being choked to death by a New York City policeman in 2014—while crimes of appalling magnitude that wiped out 40 percent of the world’s wealth are dealt with through tepid administrative controls, symbolic fines and civil enforcement.”

Third World America…

MASTERMIND on Wed, 25th Oct 2017 6:56 pm

makati1

I love my country and president with 100 percent of my heart. (His exact words). You can’t get any more brainwashed then that. Its impossible. You have official left the ship of fools…Take a bow…You are a class traitor

Davy on Wed, 25th Oct 2017 6:57 pm

http://tinyurl.com/y9cobvh7

Globalresearch is an “anti-Western” website that can’t distinguish between serious analysis and discreditable junk — and so publishes both. It’s basically the moonbat equivalent to Infowars or WND.

While some of GlobalResearch’s articles discuss legitimate humanitarian concerns, its view of science, economics, and geopolitics is conspiracist — if something goes wrong, the Jews West didit! The site has long been a crank magnet: If you disagree with “Western” sources on 9/11, or HAARP, or vaccines, or H1N1, or climate change, or anything published by the “mainstream” media, then GlobalResearch is guaranteed to have a page you will love.

The website (under the domain names globalresearch.ca(link), globalresearch.org(link), globalresearch.com(link), and sister site mondialisation.ca(link)) is run by the Montreal-based non-profit The Centre for Research on Globalisation (CRG) founded by Michel Chossudovsky,[2][3] a former professor of economics at the University of Ottawa, Canada.[4]