Page added on September 28, 2013

Iran: Rapprochement Crucial To Avoiding Peak Oil And Global Crisis This Decade

Given the overwhelmingly positive perception created around the issue of future global oil supply prospects recently, one would think that it is a waste of time to continue worrying about where the next barrel comes from. Since the 2008 scare when oil prices spiked to almost $150 a barrel, many developments contributed to pushing aside fears of impending liquid fuel shortages and resulting economic collapse. The one development which made the most sensational headlines as well as a significant actual difference was the shale oil boom in the US, which might even extend to other places, such as Argentina and Russia. The Bakken and Eagle Ford fields might collectively produce as much as 1.8 million barrels per day by the end of this year, with more production to be added in the next few years, before both fields will probably reach a peak by the end of this decade. These two fields alone will make up 2% of global liquid fuels production by December. If the optimists are right, we could see as much as 5 million barrels per day from shale oil by 2020, although I think people let the euphoria get ahead of reasonable analysis on this one.

There are other positive stories worth mentioning, including the Iraq surge in production, which should continue for the rest of the decade in the absence of a civil war breaking out. The fact that Saudi Arabia defied expectations of imminent production decline and has even shown some modest ability to increase production has also contributed to the current positive mood. The Canadian oil sands, Russia’s continued modest increases in production, which everyone seems to think that it cannot go on much longer, or expectations of seeing oil from Kazakhstan’s Kashagan field, which has been under development for thirteen years now, are just some of the additional reasons why people now perceive the concept of peak oil to have been just a hoax or scare tactic meant to achieve some political goal.

Given the overwhelmingly positive perception created around the issue of future global oil supply prospects recently, one would think that it is a waste of time to continue worrying about where the next barrel comes from. Since the 2008 scare when oil prices spiked to almost $150 a barrel, many developments contributed to pushing aside fears of impending liquid fuel shortages and resulting economic collapse. The one development which made the most sensational headlines as well as a significant actual difference was the shale oil boom in the US, which might even extend to other places, such as Argentina and Russia. The Bakken and Eagle Ford fields might collectively produce as much as 1.8 million barrels per day by the end of this year, with more production to be added in the next few years, before both fields will probably reach a peak by the end of this decade. These two fields alone will make up 2% of global liquid fuels production by December. If the optimists are right, we could see as much as 5 million barrels per day from shale oil by 2020, although I think people let the euphoria get ahead of reasonable analysis on this one.

There are other positive stories worth mentioning, including the Iraq surge in production, which should continue for the rest of the decade in the absence of a civil war breaking out. The fact that Saudi Arabia defied expectations of imminent production decline and has even shown some modest ability to increase production has also contributed to the current positive mood. The Canadian oil sands, Russia’s continued modest increases in production, which everyone seems to think that it cannot go on much longer, or expectations of seeing oil from Kazakhstan’s Kashagan field, which has been under development for thirteen years now, are just some of the additional reasons why people now perceive the concept of peak oil to have been just a hoax or scare tactic meant to achieve some political goal.

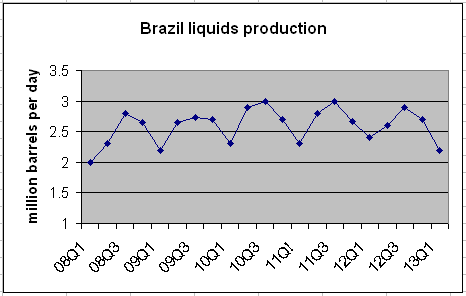

There are also some stories, which turned out to be more hype than reality. Brazil’s expected rise to major oil exporter status never materialized.

Note: Data for Brazil production from EIA

It seems the $100 oil environment, which made many of the other good news stories come true, was not enough for Brazil’s deep-water fields discovered in the past decade. Brazil’s production profile is less than impressive for the past few years. The technical challenges presented by the giant fields discovered off their shores, so far proved to be too challenging. I don’t know if anyone has noticed the fact that while the Bakken and Eagle Ford success stories have been much heralded, the Brazil story, which initially was a darling for oil enthusiasts when the big discoveries were announced, has been flying under the radar since it turned out that Brazil will not be producing great additional amounts of oil any time soon.

The fact that more and more companies are abandoning the much hyped oil shale deposits also known as kerogen (not to be confused with shale oil which is produced through fracking) is also something that received little media attention. Shell Oil is the latest quitter, after years of research led them to believe that their efforts will not pay off. Despite stories of potentially trillions of barrels of recoverable oil from the oil shale deposits, to date there are no commercial projects being planned, after decades of failed research.

Continued need for increased liquid fuel production

“Peak demand” became another darling slogan meant to counter peak oil arguments. It is a claim that suggests we no longer need to achieve continued increase in global oil production to keep the economy going, because we are now becoming just so darn efficient that we can grow on the back of efficiency gains alone. Looking at the data from past years, I see no evidence of this being true.

Since 2008, yearly global economic growth rate has been a relatively modest 2.9%. During the same period since 2008, global growth in liquid fuels demand grew at about 1% per year. I often pointed out in articles on my personal blog that current global liquid fuels demand relationship to potential economic growth can be expressed in this formula:

1.5 + (percentage yearly growth in liquid fuels supply) x 2 = potential yearly global economic growth rate

The 1.5 value stands for the average yearly potential economic growth rate achieved through efficiency gains and structural changes to economic activity patterns. Looking at the data since 2008, we can see that the relationship I expressed between liquid fuels demand and average yearly economic growth is reasonably accurate. This relationship may change in time, but for many decades already, it has proven to be constant if long-term averages are considered. No evidence of “peak demand” any time soon based on data available to us, despite what we have been told.

Keeping much needed stability for the rest of the decade

Prior to 2008, global economic growth rate was running at a yearly average of about 4% since the end of the Second World War. There is no chance in my view that we will ever get back to that rate of average growth, but we do need to achieve about 3% just to keep the world’s finances and society stable. As I pointed out, part of the challenge will be to continue to provide yearly average growth rates in liquid fuels supplies of about 1%. Unconventional sources as well as the continued ramp-up in production in Iraq will play a great role in meeting this target, but it may not be enough, because there is much room for disappointment for technical and geopolitical reasons.

This is why we need rapprochement with Iran. Since the sanctions were introduced, Iran’s petroleum production declined by about 25%. We could gain that amount back instantly if we were to put an end to the sanctions. We could gain another million barrels or even more in the next few years if we were to allow for technological transfers in the oil extraction field to occur.

It is possible that even without Iranian oil we could achieve the 1% yearly increase in global liquid fuels supplies for the rest of the decade, giving us the much-needed time to recover from the 2008 crisis and get ready to meet the many challenges awaiting us in the following decade. It is a possibility based on too many factors that could go wrong however, so a 2% gain in global liquids or even more, courtesy of Iran and their eagerness to escape current sanctions so they can deal with their own internal economic problems, would be very welcome news. I know it is hard for many to understand just how crucial this is for the global economy and its odds of avoiding another major economic crisis for the next few years. Having been bombarded for years now with fracking euphoria and myths about peak demand stories, led to a distortion of people’s perception of the global liquid fuels situation. Seeing the recent signs of efforts from both the leadership elites of the United States and Iran of willingness to compromise and normalize relations gives me hope that at least some of our elites are still in touch with reality.

3 Comments on "Iran: Rapprochement Crucial To Avoiding Peak Oil And Global Crisis This Decade"

CAM on Sat, 28th Sep 2013 3:20 pm

So, Maybe we can eke out a 1 or 2 percent gain in oil production through the end of this decade which is crucial to the world economy and makes us that much more dependent on oil! THEN WHAT?! Doesn’t sound like much of plan to me!!

GregT on Sat, 28th Sep 2013 6:11 pm

“but we do need to achieve about 3% just to keep the world’s finances and society stable.”

Yet another writer that clearly has no understanding of exponential growth. If it were possible to maintain a 3% annual growth rate, the entire economy would need to double in size in about 24 years.

The author himself, is completely out of touch with reality.

BillT on Sun, 29th Sep 2013 2:50 am

Another lost sheep…

Iran is on the list to be ‘saved from … er …FOR Democracy. Why?

1. It is NOT connected to the Western Central Banking Cartel and still has control of it’s finances. (N.Korea is also not connected, but they have Nukes. Nuff said.)

2. It is selling oil for other than US dollars. Another No-no if the Empire is to survive. See Iraq and Libya for examples. (Also were not tied to the Central Banking Cartel before ‘liberation’ from Democracy.)

3. It is allied with the new ‘Axis of Evil’, China and Russia. (Who are both working to destroy the dollar.)

4. It has vast supplies of that addictive substance, oil. (And the Saudis want it controlled by their Masters, not Iran.)

Did I miss something?