The Baker Hughes International Rig Count is out.

The rig count data in all charts below is through February 2016.

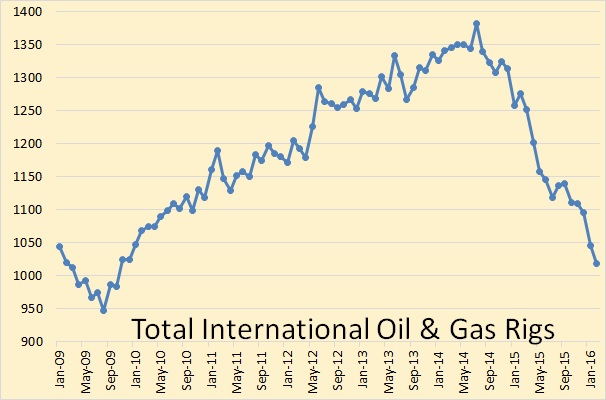

The Baker Hughes International Rig Count does not include the US, Canada, any of the FSU countries or inland China. It does include offshore China. That rig count peaked in July 2014 at 1,382 rigs and in February stood at 1,018, down 364 rigs from the peak.

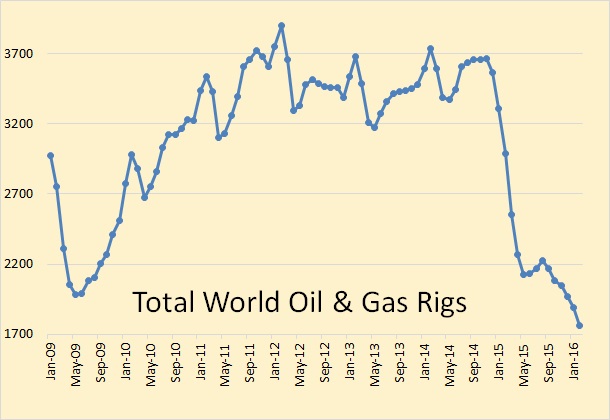

The Baker Hughes total world rig count does include US and Canada but not the FSU or inland China. That total oil & gas rig count stood at 1761 in February, down 52% since December of 2014.

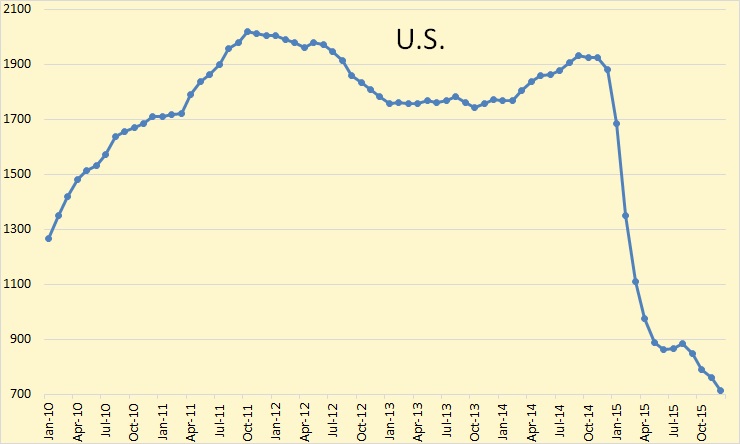

The US monthly total rig count stood at 532 in February, down 72% from November 2014.

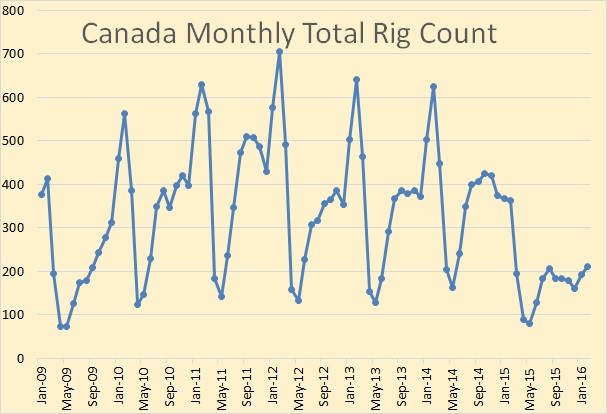

The Canadian total rig count usually peaks in February. It did not in 2015 but stood at 211 this February which will likely be the peak for 2016. That count is down from 626 rigs in February 2014, down over 66%. That was the last pre-price crash February peak.

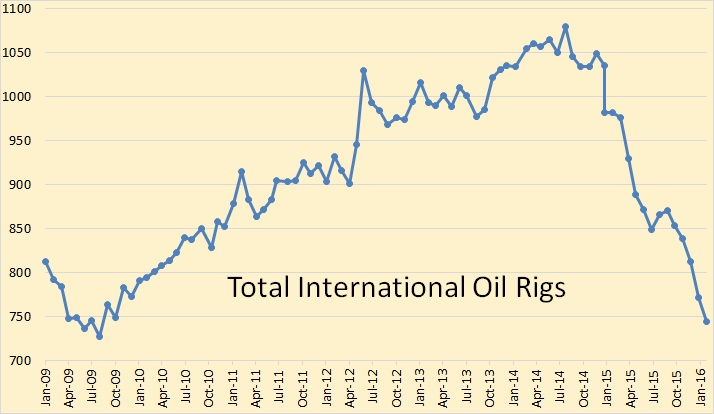

Looking at oil rigs only, total international oil rigs dropped another 28 rigs in February to 744 rigs. That is down 336 rigs or 32% since the July 2014 peak.

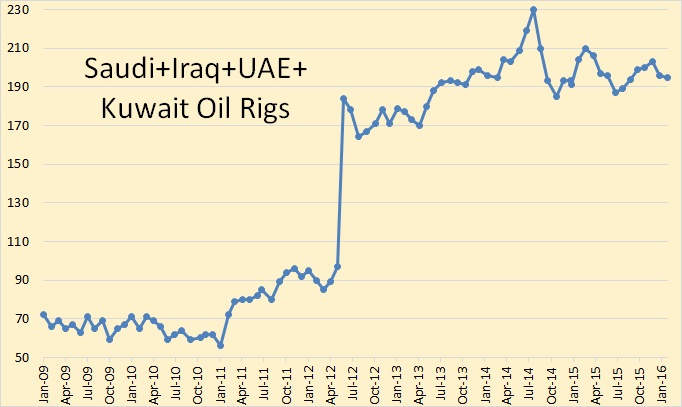

Four nations where the rig count has not collapsed is Saudi Arabia, the UAE and Kuwait and Iraq. The huge jump you see in June 2012 was due to Iraq going from 0 rigs to 78 rigs.

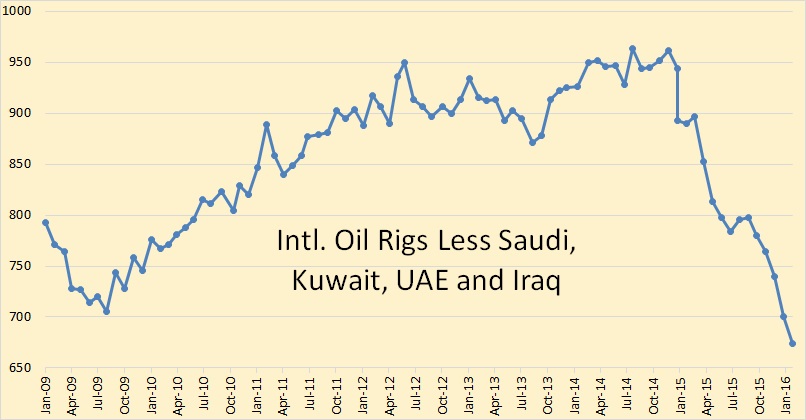

International oil rigs, less Saudi, UAE, Kuwait and Iraq peaked in July 2014 and have declined 30% since that date.

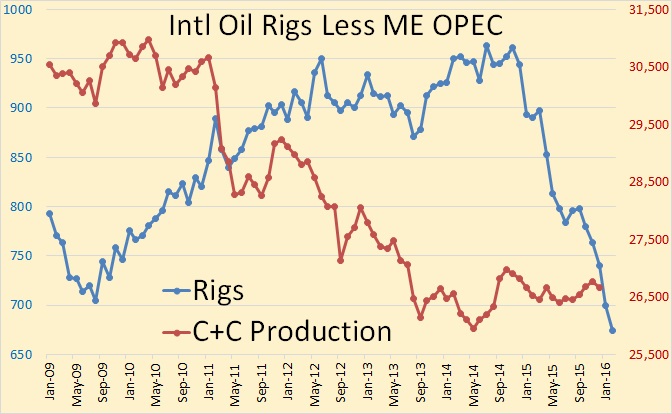

But what has all this done for production… so far.

The production data, right axis, in the above chart is only through December while the rig data, left axis, is through February. Production fell all through the rise in rig count then began to plateau in mid 2013. The rising rig count did not increase production but the falling rig count will almost certainly cause it to decline… after a delay of one to two years of course.

Again, the above oil rig only charts does not include the US, Canada, any FSU nation or China.

Nony on Mon, 7th Mar 2016 7:22 pm

Only one zero based chart! What’s with this guy? Has he got something against zero based charts!? Unbelievable!!

Truth Has A Liberal Bias on Mon, 7th Mar 2016 7:30 pm

You should start your own blog where you produce all the same data as Ron but with zero based charts. Then maybe we could all really start making some progress.

IFuckYouOver on Mon, 7th Mar 2016 10:01 pm

This is more or less what one person would expect once we run out of net available energy to extract natural resources.

twocats on Mon, 7th Mar 2016 11:21 pm

a delay of one to two years? why that would be sometime between Jan 16 to Jan 17. That’s like now. This is why I think “someone” is attempting to keep oil prices propped up for a few more months. they are hoping that production will finally start to fall, despite the addition of Iran, and keep the Energy Industry Bankruptcy Contagion from taking down the World Economy. The Invisible Hand just ain’t cutting it; Gotta shave the dice a bit.

As shallow sand and rockman predicted, February was a bruiser for bankruptcies. Gotta turn the tide in March or April at the latest. Heavy Weight Boxing Round 11 of a 12 round match.

In the black-gold corner, with a combined misallocation of unknown billions, putting 10s of 1,000s of people first into hookers, blow and casinos, and then out of work from Australia to Alberta, creating untold carnage in world markets, Energy “the Cyclone” Commoooodities!

And in the color-of-paper-money corner, boasting a record of multiple wins by QE, one by Operation Twist, weighing in at an unknown tonnage of fiat creation, Central “Doing God’s Work”, “The ZIRP that Hurts” Baaaaanks!

rockman on Tue, 8th Mar 2016 6:56 am

Truth – You shouldn’t be so hard on Nony. I myself am very interested to see what all the rig counts were in 1890. Things were really heating up in PA at that time. I think it would help explain the dynamics we’ve seen in the last 10 years or so.

Kenz300 on Tue, 8th Mar 2016 9:35 am

High cost producers are slowing going broke.

How long can tar sands producers in Canada hold on…..

They are the highest cost producers but they still continue to produce……………..

Deep pockets can hold out longer…….

joe on Tue, 8th Mar 2016 9:43 am

Doesnt matter what. If I sold pork bellies outside a mosque, im in business if i got credit…..

twocats on Tue, 8th Mar 2016 2:02 pm

recently we’ve been talking about oil price, bankruptcies, and the direction things are going. I noted that energy companies have been raising Billions in equity capital (in addition to open lines of credit in cov-lite loans), implying that they are aiming to survive for several more months. Well… this article further supports the “implosion is imminent” thesis:

http://www.zerohedge.com/news/2016-03-08/oil-short-squeeze-explained-why-banks-are-aggressively-propping-us-energy-stocks

to summarize, the short squeeze and equity sales are a push to raise capital for the energy companies so that the Banks can Cash Out, and get distance between themselves and the Pending Implosion.

This would still help contain contagion into the banking sector (more or less), but it probably won’t help these energy companies survive much longer.

March and April are sure to be very interesting. I guess we will find out if jumping into the claw-foot bathtub when a house explodes really works or not.

rockman on Tue, 8th Mar 2016 3:18 pm

Cat – A 20 year old story but fits your point perfectly. Company A owed its banker $60 million. Both management and the banker knew it was going to be difficult to cover it. Additionally Company A became the target of a hostile takeover. So simple solution: do a bond offering since the company was still looking like gold (actually it wasn’t) after the Rockman drill 4 nice conventional horizontal wells. So the brokers sold a $100 million bond with an 11% interest rate. After the brokers took their cut the company had about $76 million. So it paid off the $60 million bank note (8% interest) with the bond money (11% interest). And the bank thanked Company A by cancelling its credit line a month later. But the takeover was still successful and they took control of a company that had to eventually file bankruptcy and thus disappeared forever. Serves them right for being so “hostile”. LOL

The rule goes like this: if you’re going to screw someone over make sure it isn’t your banker: eventually you’ll be back in front of him looking for a credit line for your new company.

I hope you folks appreciate the Rockman’s stories. You won’t read about sh*t like this on Bloomberg. LOL. But understand nothing illegal was done…everything met SEC regs. Not very nice but still legal.

shortonoil on Tue, 8th Mar 2016 3:38 pm

“to summarize, the short squeeze and equity sales are a push to raise capital for the energy companies so that the Banks can Cash Out, and get distance between themselves and the Pending Implosion.”

There is obviously a short squeeze under way, and to guess who initialized it is not hard to image. But, if the banks believe that they can save their bacon from this conflagration by unloading their risk on to equity holders they have definitely partaken of too much of their own Kool Aid. Total equity raised to date has been less than $10 billion, while HY credit is over $360 billion, and total debt held by the industry is over $2.5 trillion. An $8 dollar increase in the price of crude is certainly not going to make up that difference!

As, we have been saying, to keep the world supplied with petroleum over the next decade will require new debt formation of $39 trillion. The financial industry’s $2.5 trillion contribution will just be small change in the total bail out package that must be secured to keep the world’s wheels turning. From, this point forward, as soon as the funding disappears so also will the oil. The TBTF Banks, Wall Street, and the pension funds will be contributing their last nickel to the oil fund. The coming end of the oil age will be preceded by a wake up call heard from the halls of the mighty to the borrows of the lowest among us. BAU was what was happening yesterday.

http://www.thehillsgroup.org/

Nony on Tue, 8th Mar 2016 5:20 pm

not my post above.

Nony on Tue, 8th Mar 2016 5:24 pm

I will take another NYR. No more posts from me. Any future posts in 2016 are from my ape.

geopressure on Tue, 8th Mar 2016 6:09 pm

of course the banks want to trigger short squeezes on things they own or have interest in… who would’t???

—

That article is propaganda that is actually trying to stop the commodity short squeeze… Zero Hedge has turned into an extension of the executive branch… There is No “Next Leg Down in Commodities”, just a Government who’s #1 goal is suppressing the price of oil… The Price of oil is poised to explode upward in an uncontrollable way whenever they MASSIVE # of Short Positions all rush to cover at the same time – This terrifies Obama…

Obama took action today to put the brakes on crude’s price advance & prevent too much momentum from being built up…

Today they executed a significant, coordinated effort to cast a bearish cloud over oil… Even Martha Stewart (of all people) was that people should short oil… The IEA released a bearish report on oversupply, The EIA’s report in the mooring will show huge builds… Obama had to hit crude & he had to hit it hard or else it was going to be trading @ $60/BBL by the end of next week…

It’s make or break time now though… low oil prices are almost at their end…

—

People, you cannot trust the IEA or the EIA, they have an agenda… The Cold War is back in full swing & most Americans do not even know it… The IEA & EIA are the tools that the US Government used to destroy the Soviet Union… They did so by lying about storage volumes to keep the price of oil down from 1986-2004… Now that the Cold War has started back up, if you think that the EIA & IEA are reporting factual numbers, then you are crazy…

The US Government is prone to reporting the Opposite of whatever the truth is… If we are experiencing Inflation, the FED swears that we are struggling against deflation… If the SPR & Commercial Storage are bone dry because it was wasted manufacturing a fake oil glut, then the EIA reports the opposite – they say that the Commercial Storage is about to overflow & that the SPR has not been touched…

You guys will see soon enough… We are already starting to see Refineries shutting down in the US… 3 so far in the US… The Oil Shortage is reaching our shores last…

If the negative push on oil does not hold tomorrow, then you are going to see the biggest short squeeze in the history of markets…

But I seriously doubt that Obama lets that happen – hence the coordinated effort to push crude oil down today…

twocats on Tue, 8th Mar 2016 6:55 pm

@geopressure

you’ve been making this claim of an imminent shortage for at least a few weeks, if not months.

Its a bit hard to believe such a massive conspiracy theory could hold since it would involve multiple countries. Is every country lying about its output at this point? Are the consumption figures also being made up?

I haven’t really noticed a significant shortage in drivers on the roads. Same traffic jams I’ve seen every day for two years on Highway 5, stretching in both directions simultaneously as far as the eye can see.

Are you a petroleum insider? Is this whistleblower-level stuff? Is your life in danger by making these posts?

Northwest Resident on Tue, 8th Mar 2016 7:28 pm

twocats — One thing I have noticed on this site for quite a while. When commentary or articles posted get too close to the exposed nerve of the PTB, absurd posts are sure to follow, as in the three posts directly above yours. The goal, I am guessing, is to distract and to deflect attention away from damning fact or opinion that “they” would rather not get too much attention. Just a guess on my part, but one based on constant observation of this site for a couple or more years. That the owner/operator of this forum allows such trollish B.S. to continue is a crying shame.

Boat on Tue, 8th Mar 2016 8:21 pm

twocats,

Geopressure is another bat shyt crazy poster. He is a fun read though.

geopressure on Tue, 8th Mar 2016 10:24 pm

You guys/girls are incredibly gullible… Literally ALL articles regarding oil & gas prices or crude oil supply/demand that can be found from any Western Media News Source is guaranteed to be incorrect…

Because if any story even approaches the truth or hints at it, then it is deleted, or never posted to begin with, or Google stops recognizing it – which mean it will never be found by our eyes…

—

It is kinda crazy that yall have been posting here day in & day out for years (probably), but you still have no idea what is really going on…

Your about to find out though…

Or you might remain in denial… It is pretty evident that no matter how many US Refineries are closed down, no matter how frequent the Brownouts become, the EIA is not going to stray from their course of reporting the absolute opposite of the truth. They will still be claiming that the SPR & Commercial Storage are overflowing when we are all waiting in gas lines…

twocats on Tue, 8th Mar 2016 11:55 pm

NW Res – are you suggesting geo is either a robot or a paid-troll? Your point is definitely true whenever the Russia/Turkey thing happens, and some other issues. It’s like there are 1000’s of cockroaches in the walls and only when we kick some of the loose drywall do a pocket of them drop onto the floor.

As far as Geo – I don’t know, it seems he’s gotten more … intense… in the past couple months, and I’m actually a bit worried about him (potential manic or schizophrenic episode). Not that he’s going to take anything I say as anything but an insult, so I’m fucked. I don’t mind him posting since he doesn’t really attack other people, mainly makes his points and moves on. I guess it takes all stripes.

I guess there’s no way he can post any evidence whatsoever since this is such a vast global conspiracy that even affects Al-jazeera, RT, and all the independent services that track Oil Tankers, and so forth. [skeptical emoticon here]

Dredd on Wed, 9th Mar 2016 4:18 am

The graphs look like sea level change graphs.

Not only that, the explanations that deal with rise and fall numbers tend to graph a similar pattern.

The “why” reasoning in both cases is sketchy (Questionable “Scientific” Papers – 7).

Davy on Wed, 9th Mar 2016 5:22 am

“Russia’s Oil Dilemma, Explained”

http://www.bloomberg.com/news/articles/2016-03-09/russia-s-dilemma-squeeze-oil-industry-without-strangling-growth-ilk2y8i4

“The Russian budget is starving,” Nazarov said by e-mail. “The government understands that with a tax hike it would hurt future prospects, but it has no choice.”

“The Kremlin has been very clear that raising taxes isn’t an attractive option and they will only do it if they cannot balance the budget otherwise, said Ivan Mazalov, who helps to manage $2 billion at Prosperity Capital Management Ltd. The government is still able to cut spending, borrow, raise money from privatization and ask for higher dividends from state-controlled companies, he said.”

“The Energy Ministry expects the industry’s seven-year expansion to end this year, with output stable near 2015 levels. In the ministry’s worst-case scenario, where prices are still about $40 a barrel by 2020, production may slump 14 percent in the next five to 10 years.”

westexas on Wed, 9th Mar 2016 6:12 am

An article for Geopressure:

http://www.rigzone.com/news/oil_gas/a/143428/Kemp_Where_Has_The_Oil_Gone_Missing_Barrels_And_Market_Rebalancing

twocats on Wed, 9th Mar 2016 12:21 pm

@westexas – very good article. thank you.

GregT on Wed, 9th Mar 2016 1:06 pm

550 million “missing barrels of oil”?

Just think. If we could find them, that would be enough to keep the world supplied until sometime late next Tuesday afternoon.

That explains why the price of oil has recently dropped by some 70%. And to think that some people find this to be confusing?

charmcitysking on Thu, 10th Mar 2016 3:01 am

bye Nony