Page added on November 19, 2012

Deutsche Bank: Don’t bet on the IEA’s prediction of U.S. oil dominance

Reading the pages of the Business Spectatorin recent months I’ve noticed a seemingly endless stream of articles by Robert Gottliebsen claiming the US “shale gas revolution” will result in US energy independence, a resurgence in US domestic manufacturing and the demise of Australia’s LNG export industry (unless the unions are crushed and construction costs dramatically lowered).

I usually just write these sort of crazed ramblings off as some sort of PR campaign on behalf of BHP in particular (someone needs to give Marius Kloppers some good press) and the mining and energy industries in general, as they fight the endless battle of capital against labour.

Maybe I’m missing something but from my high level understanding of the US gas industry, the natural gas “cliff” predicted by the likes of Julian Darley never eventuated courtesy of the shale gas boom – however US gas production isn’t making new highs (so where is the glut people keep claiming exists ?) – instead the price collapsed due to a combination of manufacturing moving offshore (particularly gas intensive industries like fertiliser and chemicals) and the recession in the US causing demand to slump. Should the US return to growth and industry return based on the lure of cheap gas I think we’ll find gas prices climbing rapidly again.

The IEA gave this sort of delusional thinking (US energy independence ahoy !) more momentum recently with the new World Energy Outlook report echoing Citibank’s claims earlier this year that the US will soon be the world’s leading oil producer (again, thanks to shale oil). Its probably worthwhile remembering that 10 years ago the IEA was claiming global oil production would now be over 100 million barrels per day (currently it stands at 90 million barrels per day, with significant contributions from biofuels and natural gas liquids).

Technology Review has a look at the report – Shale Oil Will Boost U.S. Production, But It Won’t Bring Energy Independence.

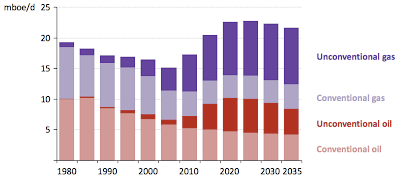

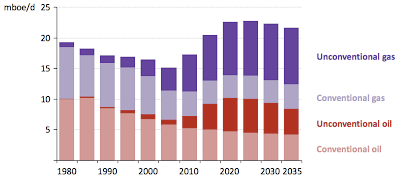

The idea that the U.S. could overtake Saudi Arabia, even temporarily, is a stunning development after years of seemingly inexorable declines in domestic oil production. U.S. production had fallen from 10 million barrels a day in the 1980s to 6.9 barrels per day in 2008, even as consumption increased from 15.7 million barrels per day in 1985 to 19.5 million barrels per day in 2008. The IEA estimates that production could reach 11.1 million barrels per day by 2020, almost entirely because of increases in the production of shale oil, which is extracted using the same horizontal drilling and fracking techniques that have flooded the U.S. with cheap natural gas.As of the end of 2011, production had already increased to 8.1 million barrels per day, almost entirely because of shale oil. Production from two major shale resources in the U.S.—the Bakken formation in North Dakota and Montana and the Eagle Ford shale in Texas, now total about 900,000 barrels per day. In comparison, Saudi Arabia is expected to produce 10.6 million barrels per day in 2020.The shale oil resource, however, is limited. The IEA expects production to start gradually declining by the mid-2020s, at which time Saudi Arabia will reclaim the top spot. …

The other potential issue is whether opposition to fracking in local communities might put the brakes on shale oil development, Sears says. Concerns that fracking will contaminate drinking water have led to objections in some areas, as have concerns that shale oil requires far more drilling wells than conventional oil production. Even if the U.S. is able to quickly develop its shale oil resource, it isn’t likely to be enough to completely eliminate oil imports. The IEA expects that the U.S. will still import 3.4 million barrels per day in 2035. The U.S. consumes nearly 19 million barrels per day, leaving a gap of more than 7 million even at the expected peak in shale oil production in the mid-2020s. However, the IEA expects the gap will be reduced partly by increased use of biofuels and natural gas in transportation, as well as improved vehicle efficiency, which could lower demand for oil.

The IEA does conclude that the United States will nearly be energy self-sufficient by 2035, but that’s after offsetting oil imports with exports of coal and natural gas. To be truly energy independent, the United States would have to invest in technology for converting natural gas and coal into the liquid fuels needed for transportation, or have other technical breakthroughs, such as improved batteries or biofuels, that would quickly reduce the demand for oil.

The Globe and Mail reports that Deutsche Bank analysts aren’t convinced by the IEA’s predictions for US oil production – Don’t bet on U.S. oil dominance.

An influential report arguing that the U.S. will soon become the world’s largest oil producer made a lot of headlines, especially in Canada where the implications are huge.Too bad its findings are wrong, argue the energy analysts at Deutsche Bank.

It’s not that the oil isn’t there, but the conditions needed to develop it are lacking, Deutsche Bank analysts Paul Sankey, David Clark and Silvio Micheloto write in a note entitled ‘Why the U.S. WON”T surpass Saudi Arabia as Number 1 oil producer.’ (The emphasis is the authors’. And if you’re wondering if these guys know what they are talking about, Mr. Sankey has been ranked No. 1 for the last two years by Institutional Investor for coverage of integrated oil companies.)

A combination of U.S. policy restricting exports and sagging domestic U.S. demand for oil products will keep prices soft relative to the rest of the world, making the projects needed to create the huge U.S. supply growth uneconomical, they wrote Thursday in their critique of the report by the International Energy Agency which pointed to a huge shift toward North America in oil production.

“We don’t think the U.S. can become the largest oil producer in the world. Why not? Price, cost and returns. None are really dealt with by the IEA.”

OilPrice.com has an interview with longtime shale gas critic Arthur Berman – Shale Gas Will be the Next Bubble to Pop – An Interview with Arthur Berman.

The “shale revolution” has been grabbing a great deal of headlines for some time now. A favourite topic of investors, sector commentators and analysts – many of whom claim we are about to enter a new energy era with cheap and abundant shale gas leading the charge. But on closer examination the incredible claims and figures behind many of the plays just don’t add up. To help us to look past the hype and take a critical look at whether shale really is the golden goose many believe it to be or just another over-hyped bubble that is about to pop, we were fortunate to speak with energy expert Arthur Berman.Arthur is a geological consultant with thirty-four years of experience in petroleum exploration and production. He is currently consulting for several E&P companies and capital groups in the energy sector. …

Oilprice.com: How do you see the shale boom impacting U.S. foreign policy?

Arthur Berman: Well, not very much is my simple answer.

A lot of investors from other parts of the world, particularly the oil-rich parts have been making somewhat high-risk investments in the United States for many years and, for a long time, those investments were in real estate.

Now these people have shifted their focus and are putting cash into shale. There are two important things going on here, one is that the capital isn’t going to last forever, especially since shale gas is a commercial failure. Shale gas has lost hundreds of billions of dollars and investors will not keep on pumping money into something that doesn’t generate a return.

The second thing that nobody thinks very much about is the decline rates shale reservoirs experience. Well, I’ve looked at this. The decline rates are incredibly high. In the Eagleford shale, which is supposed to be the mother of all shale oil plays, the annual decline rate is higher than 42%.

They’re going to have to drill hundreds, almost 1000 wells in the Eagleford shale, every year, to keep production flat. Just for one play, we’re talking about $10 or $12 billion a year just to replace supply. I add all these things up and it starts to approach the amount of money needed to bail out the banking industry. Where is that money going to come from? Do you see what I’m saying?

Oilprice.com: You’ve been noted suggesting that shale gas will be the next bubble to collapse. How do you think this will occur and what will the effects be?

Arthur Berman: Well, it depends, as with all collapses, on how quickly the collapse occurs. I guess the worst-case scenario would be that several large companies find themselves in financial distress.

Chesapeake Energy recently had a very close call. They had to sell, I don’t know how many, billions of dollars worth of assets just to maintain paying their obligations, and that’s the kind of scenario I’m talking about. You may have a couple of big bankruptcies or takeovers and everybody pulls back, all the money evaporates, all the capital goes away. That’s the worst-case scenario.

Oilprice.com: Energy became a big part of the election race, but what did you make of the energy policies and promises that were being made by both candidates?

Arthur Berman: Mitt Romney, particularly, talked about how the United States would be able to achieve energy independence in five years. Well, that’s garbage.

The Oil Drum also has some cynical words about the potential of shale gas – Tech Talk – Global Oil Supply .

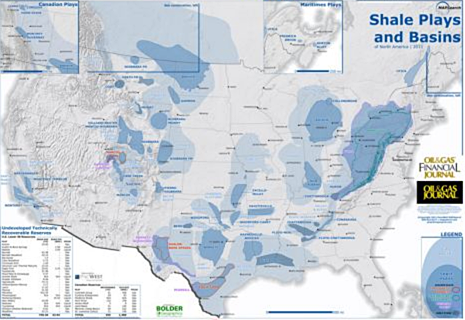

One of the headlines this week from the IEA Report suggests that the United States will be the top global oil producer in five years. Yet back in DeSoto Parish in Louisiana, where the Haynesville Shale discovery in 2008 started the bonanza, revenues are now falling and school board budgets are strapped as the end of the glory days are beginning to appear.Just this week Aubrey McClendon said that Chesapeake’s prospects for oil in Ohio, where Chesapeake had high hopes for the Utica Shale, are now dim. It is easy to look at one of the large maps showing all the shale deposits in the United States that the Oil and Gas Journal include in their print editions, and to be carried away (as the IEA apparently are) with the vast acreage that is shaded on the map. Unfortunately, as we can see, reality tells another story. The size of the resources have been measured in the past, and with the best plays being given preference, the recognition of decline rates and unprofitable wells have not yet been given the prominence in the popular press that they will ultimately draw.

It seems unrealistic to anticipate the levels now being projected for future North American production of oil. Nevertheless, these projections do tend to crowd conflicting stories on the subject out of the spotlight. Further, if the predictions for American production gains, even in the short term, turn out to be optimistic, then the impacts may be even more exaggerated than is currently appreciated. Consider that OPEC now expects that North America will continue to provide the greatest y-o-y increase in supply over other nations, and there are in fact, few other nations that will contribute much more in the next year.

I am less persuaded myself that using a thousand oil rigs to generate an extra one million barrels per day of oil is necessarily a sign of a large and long-term sustainable increase in US oil production (as opposed to, say, frenzied scraping of the bottom of the barrel). But, still, I’m not certain beyond a reasonable doubt just how deep this particular barrel can be scraped.At any rate, one thing that is interesting is that the chart above shows the US second peak just reaching 10mbd of oil, and yet the US will be the largest producer of oil. Since the IEA says Saudi production is currently at 9.5mbd and Russia at 10.75mbd, the implication is that neither Russia or Saudi Arabian production will increase at all between now and 2020 when the US will surpass them.

Apparently, the strategy of massed hordes of drilling rigs fracking for shale oil can only be of benefit in the United States.

It used to be Saudi Arabia that was used to fill in the wedge between desired supply and expected demand in official energy projections. Apparently the agencies have now accepted that Saudi Arabia cannot or will not increase production and the US is now being assigned the role of supplier of last resort for future energy projections.

17 Comments on "Deutsche Bank: Don’t bet on the IEA’s prediction of U.S. oil dominance"

BillT on Mon, 19th Nov 2012 12:59 pm

The US will NEVER rise again in ANY arena.

It will NEVER have a growing economy again.

It WILL possibly have zero oil/natural gas imports eventually when they are too expensive for the average American to buy. So it will be because demand fell below the low production of the failing fields, not because the Us production covered a growing economy.

Arthur on Mon, 19th Nov 2012 2:24 pm

I do not think it is too far fetched that the US for a brief period could indeed become the world’s largest oil producer. If they produce 8.1 mbd now, then 10.7 by 2020 is not out of the question. But they will never become a net exporter. I hope the US will use this additional capital wisely and invest it in a renewable energy base, the only investment that makes sense.

Bor on Mon, 19th Nov 2012 2:54 pm

The most amazing thing is a level of illiteracy of so-called ‘analysts’, who speculate about our energy production and usage. They usually calculate everything in $$ instead of calculating in joules. Most of ‘new’ hydrocarbon energy sources are energy sinks i,e. their EROEI are less than 1 if calculated in units of energy. This fracking hoopla will be largely forgotten as has already forgotten great ‘hydrogen based energy sources’.

As long as the USA model of economy is based on perpetual growth, the USA digging its grave. There are no technological advancements of any kind that can deviate from the very basic truth – our world in general is running out of essential resources starting with fresh water, agricultural land, fossil fuel. We contaminate our environment with incredible and persistent stupidity. It is simply amazing…

Arthur on Mon, 19th Nov 2012 3:38 pm

“Most of ‘new’ hydrocarbon energy sources are energy sinks i,e. their EROEI are less than 1 if calculated in units of energy.”

Do you have any source that proves that your statement is not speculation? Even Richard Heinberg is waiting for reliable EROEI figures concerning this fracking business. Thanks in advance.

poaecdotcom on Mon, 19th Nov 2012 4:01 pm

QFT :”As long as the USA model of economy is based on perpetual growth, the USA digging its grave.”

But sadly, save Bhutan, I am not aware of any other working model out there…

I personally have hope (and believe) that the US and other developed countries will rise again but it will be from a state of collapse and ‘rise’ will refer to Gross Domestic Sustainability.

There must be hope…

Go Local!

lump on Mon, 19th Nov 2012 4:16 pm

We are all doomed …run for the hills ..well,in about 200 years from now ..its your children s children that will see what a mess we have made..

Rick on Mon, 19th Nov 2012 4:32 pm

I agree with “lump” — many here seem to think the collapse will come overnight.

Don’t get me wrong, things are getting worse year after year. But many like JHK, Greer and some others feel the contraction will play out over decades.

And those who are still having children (stupid), or who are under 50, will have to deal with the mess. Providing the planet can still support some human life.

poaecdotcom on Mon, 19th Nov 2012 4:48 pm

Concisely, this is why I believe collapse will be more cliff like rather than over decades:

The EROEI of the barrel of oil on the margin today (Tar sands/Tight oil) is insufficient to support a complex enough society to extract that barrel of oil.

Plantagenet on Mon, 19th Nov 2012 5:06 pm

Obama promised he would make the USA energy independent.

Surely President Obama wouldn’t lie to the American people about an issue as important as this.

Dave Thompson on Mon, 19th Nov 2012 7:16 pm

If the US is going to lead when it comes to fossil fuels. We had better think about leading in conservation.

Bor on Mon, 19th Nov 2012 7:41 pm

I shall admit that I do not have sources for my speculations about EROEI on such new technologies as oil sand production and/or fracking. I do not. But one needs to remember that sophisticated infrastructures of all developed countries was built on EROEI much higher than a single digit. Numbers up to 100 could be found in many sources. At those good times the oil extraction was somewhat easy business. The only substantial efforts were to find new sources. The oil extraction itself was easy. The matter of fact it was coming out by itself! Today conventional oil is not coming out – it should be pumped out or pressured out either by water or by gas. Therefore EROEI is down to 10-15 at best (one can find sources for this number easily).

Now, let us look at tar sand, for instance.

1. Mining.

2. Transportation of tar sand to production facility.

3. Production (much more sophisticated than just feeling storage tanks!)

3.1 Mechanical process.

3.2 Adding a lot clean of water.

3.3 Heating of the mix – a lot of energy input.

3.4 Collection of tar from the mix surface.

3.5 And finally expensive and sophisticated oil making process (chemical additions, etc…).

Plus:

1. Building and maintenance of tailing ponds.

2. Land reclamation.

3. etc. etc.

My definition is not professional by any mean, but not far away from what this process actually is. BTW, it is all BEFORE any refinery. Of course, one can calculate that this process may be feasible when a barrel of oil price is high. But I’m not talking in terms of dollars. I’m talking about EROEI – ENERGY returned on ENERGY invested. It is very difficult to believe that this above mentioned process is NOT energy sink. I would like to repeat that conventional oil was (at still is in most of places) just ‘…drill and pump…’. Try to compare this process with the above mentioned definition.

Arthur on Mon, 19th Nov 2012 8:59 pm

“Therefore EROEI is down to 10-15 at best (one can find sources for this number easily).”

EROEI 10-15 is fine, hardly less good than 100. It is not so that EROEI of 100 is 10 times as good as EROEI of 10. Even EROEI of 5 is workable. Give me 1 unit, I will give you back 5. Give me 5 units I give you back 25 and so on. These are returns on investment the financial world can only dream about, better even than my gold investments of the past 8 years (but not much). And the higher the oil price the more profitable mining of low EROEI oil/gas becomes.

zann fox on Mon, 19th Nov 2012 9:27 pm

it’s 11:59 and all is OK

Dr. Albert A. Bartlett

Exponential growth

http://www.youtube.com/watch?v=F-QA2rkpBSY&feature=relmfu

MrEnergyCzar on Mon, 19th Nov 2012 10:29 pm

That shale map is nice, tell you where not to live..

MrEnergyCzar

MrEnergyCzar on Mon, 19th Nov 2012 10:30 pm

That shale map is nice, tells you where not to live..

MrEnergyCzar

BillT on Tue, 20th Nov 2012 2:09 am

The EROEI seldom takes in the mining of all of the metals that go into each of thousands of wells or the equipment used to strip mine the sands. Nor does it account for the energy required to maintain the personnel needs, (they consume energy to live and work) the less of precious water, the deaths caused by the residue, the offices and money handling to make it all possible, etc. No, it does not take much thought to see that the EROEI could easily be negative if ALL factors are added in.

GregT on Tue, 27th Nov 2012 8:26 pm

Zann fox,

Exactly.

Exponential growth in a finite environment will lead to very undesirable consequences, and we are trying our best to keep growth alive, at all costs.