Bakken, What Is The Data Telling Us?

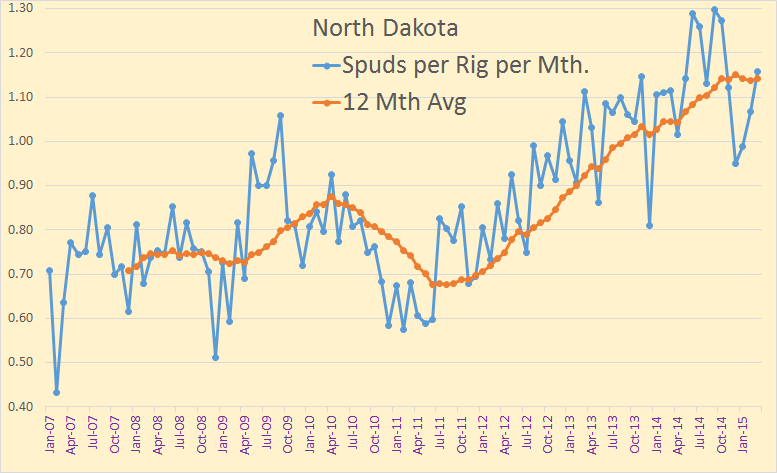

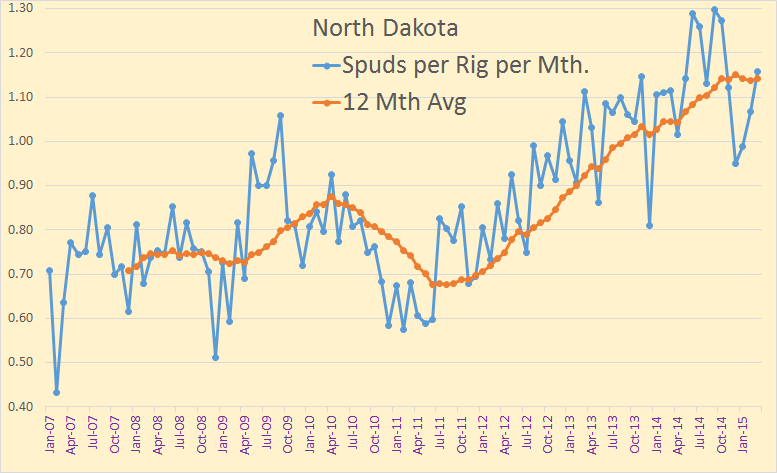

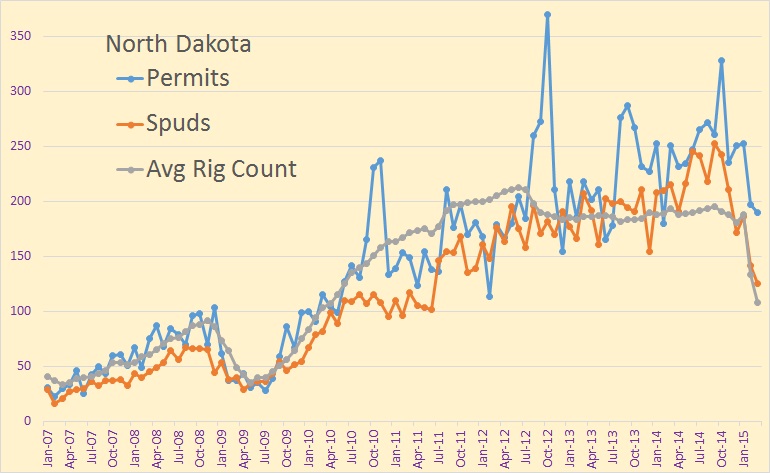

North Dakota publishes, every month, a Monthly Statistical Update from which we can gather a wealth of data if we dig deep enough. They publish the number of spuds, that in new wells started, each month, along with the average number of rigs that month. From this we can glean the average number of days each rigs spends on each well.

The last data point is March, 2015. Through 2011 a rig could drill about .75 wells per month, or about 40 days spud to spud. Today that figure is about 1.14 wells per month or about 26.3 days spud to spud.

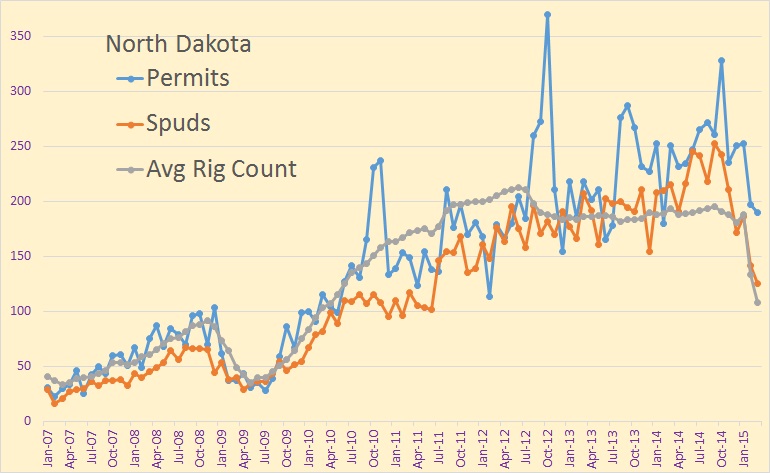

Again, the data is through March. We can see the falloff of spuds, rigs and permits in February and March. April and May should show a further decline in all three.

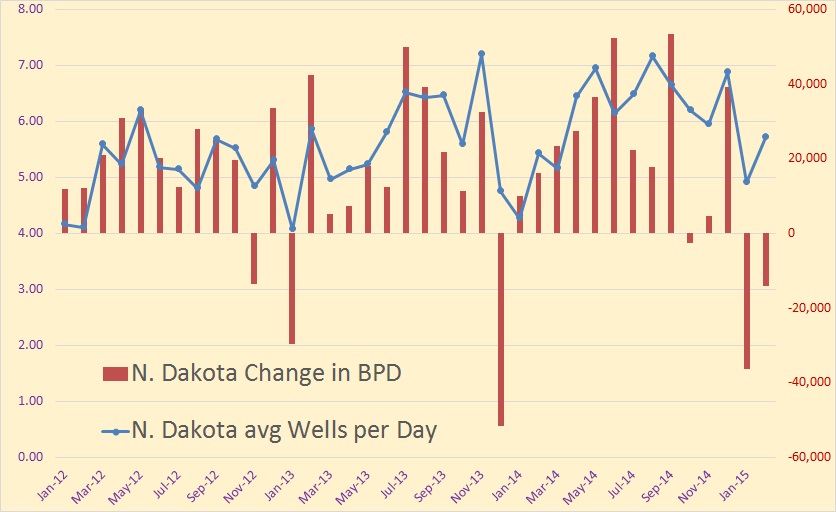

Just how many rigs per month does it take to hold production flat in the Bakken and Eagle Ford? We don’t have much data from Eagle Ford but we do have a lot of data from North Dakota.

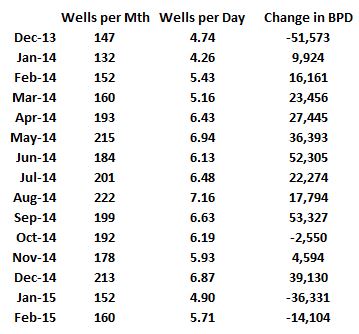

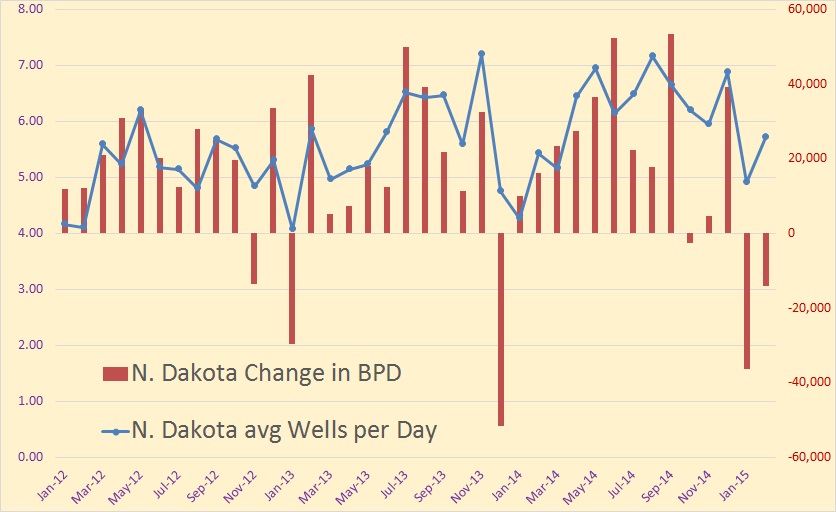

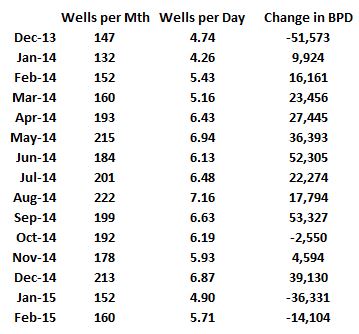

Different days in each month can give a wrong impression, especially in February. So I have changed the data to wells per day to clarify things. I think we can clearly see that it takes a lot more wells per day, or month, to keep production flat than many believe.

In October and November 2014 they averaged about 6 wells per day or 180 wells per month and held production basically flat. In December the average was almost 6.9 wells per day and production jumped by 39,000 bpd. Then in January wells per day dropped to 4.9, or by almost 2 wells per day, and production fell by over 36,000 bpd. In the average month, 30.417 days, that comes to 149 wells per month! In February things improved to 5.71 wells per day. That comes to almost 174 wells per 30.417 day month. Yet production still fell by over 14,000 barrels per day.

Tough one cannot directly convert the number of new wells to an increase of decrease in barrels per day, I think it obvious, from the chart above, that there is a general correlation between new wells and change in the production numbers.

Of course all wells are not the same. And production per new well sometimes varies greatly from month to month as in December 2013 an January 2014. But if production per well stays close to what the average has been in the last 5 months, then it will take 160 to 180 new wells per month to stay even.

However, there is some evidence that only the very best wells are now being fracked from the pool of over 800 drilled but unfracked wells in North Dakota. So under those circumstances I would expect the number of new wells to keep production flat to be somewhat lower, perhaps in the neighborhood of 140 or so.

North Dakota publishes a lot of information but if you dig deep enough you can also get some data out of Texas.

Here are some of the March stats according to the Texas RRC

The Railroad Commission of Texas issued a total of 923 original drilling permits in March 2015 compared to 1,894 in March 2014.

In March 2015, operators reported 1,547 oil, 305 gas, 109 injection and nine other completions compared to 2,965 oil, 272 gas, 131 injection and 13 other completions in March 2014.

Total well completions for 2015 year to date are 5,946 down from 10,130 recorded during the same period in 2014.

Operators reported 551 holes plugged and zero dry holes in March 2015 compared to 743 holes plugged and zero dry holes in March 2014.So in March Texas permits are down by more than 50% and well completions down by almost half.

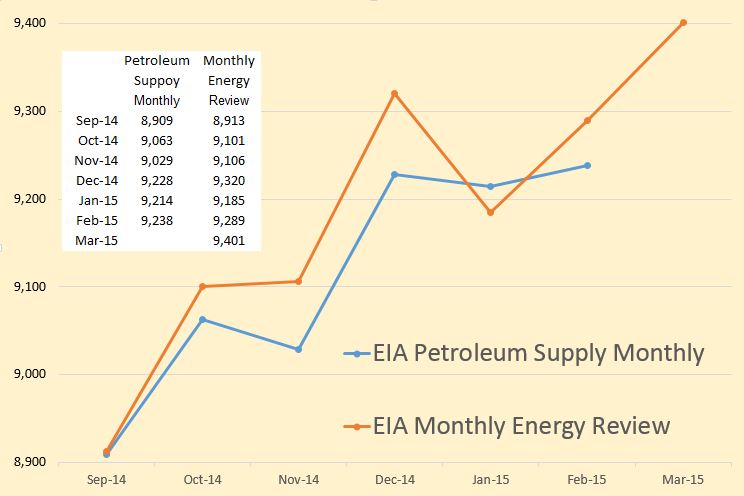

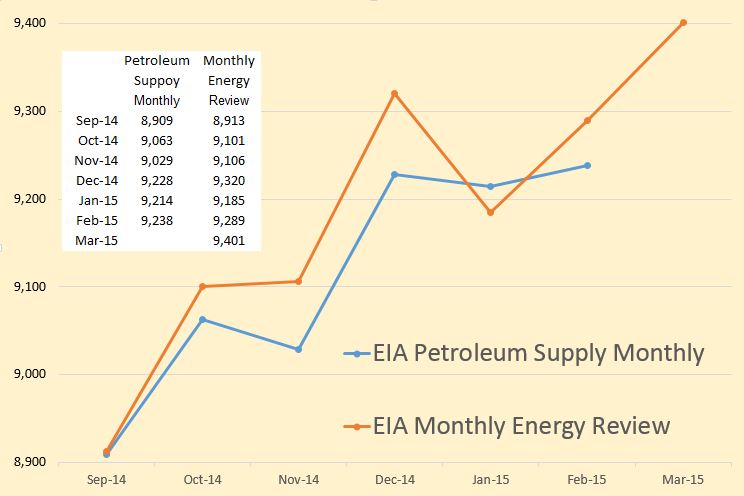

The EIA Petroleum Supply Monthly, which I consider the most accurate of all the EIA’s different reports of the same data, has production basically flat since December. However the EIA’s Monthly Energy Review has US crude production taking a drop in January but up over 200,000 barrels per day in the next two months.

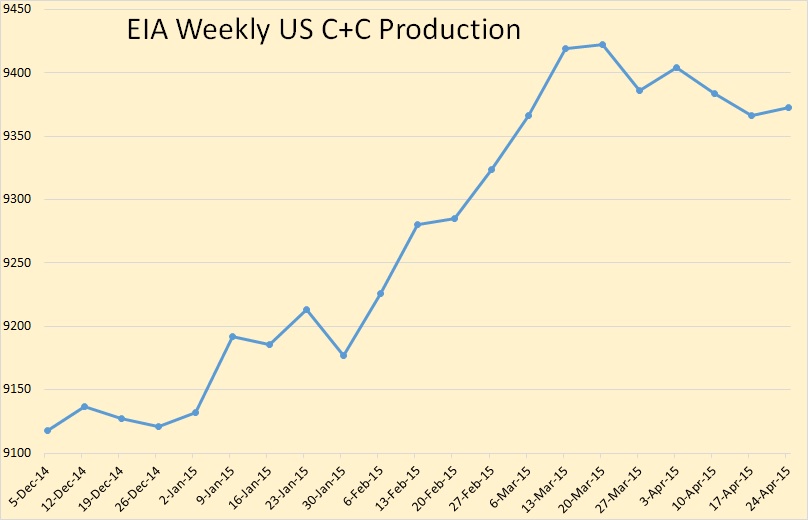

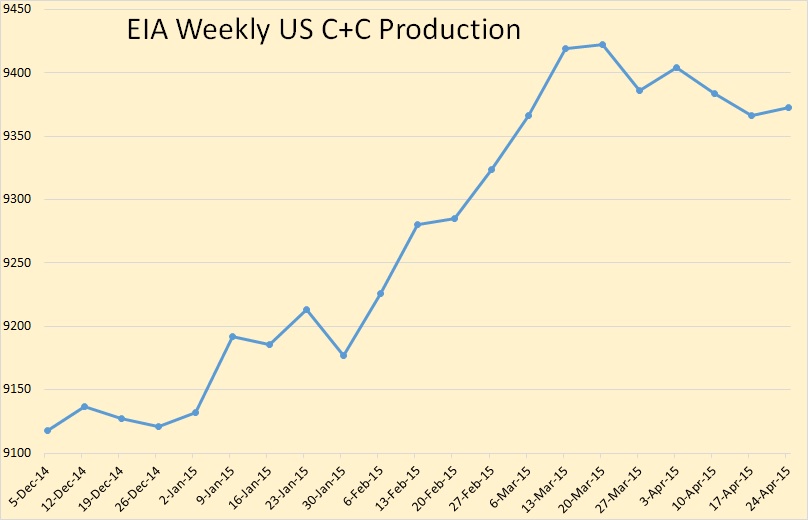

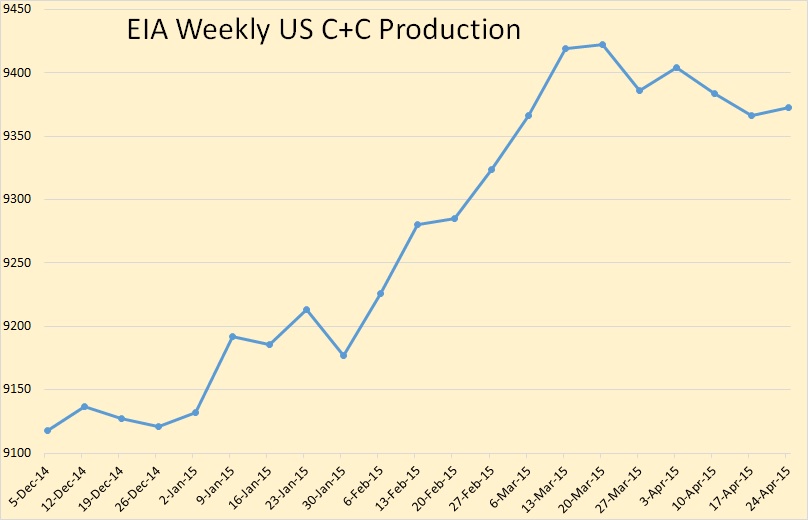

However the EIA’s Weekly Petroleum Status Report has US crude production peaking in mid-March and declining by 50,000 barrels per day since.

However the EIA’s Weekly Petroleum Status Report has US crude production peaking in mid-March and declining by 50,000 barrels per day since.

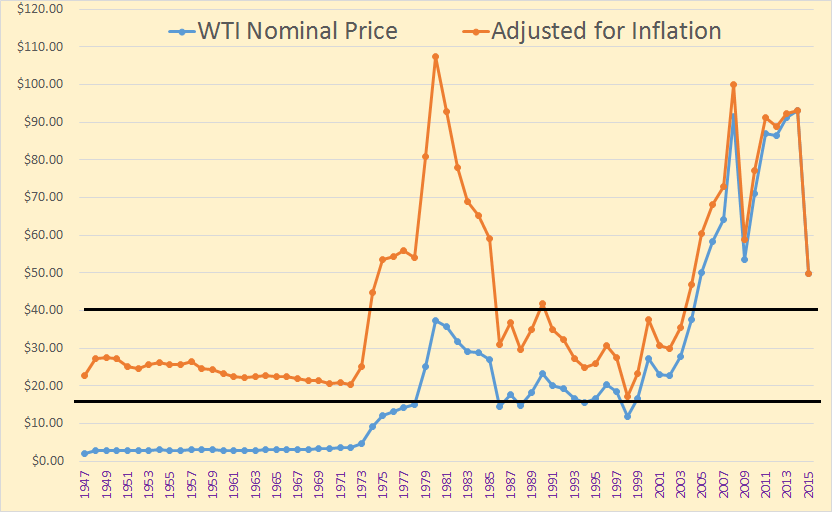

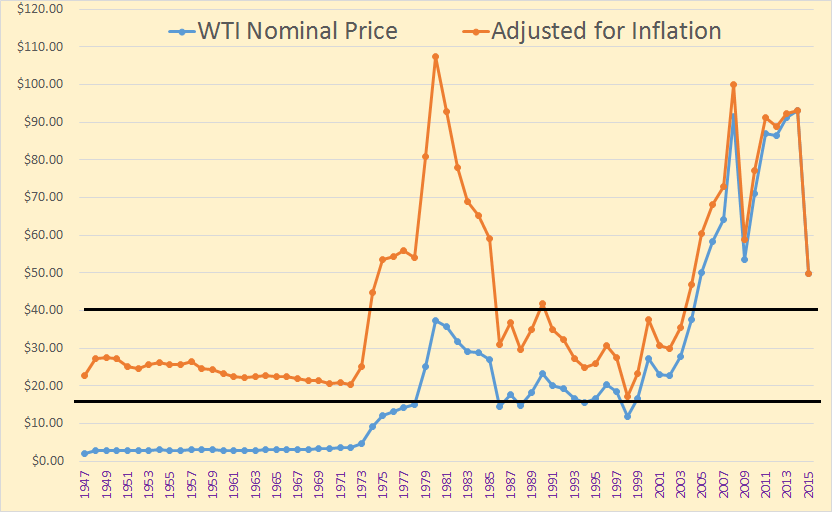

Between the two heavy lines in the chart above, that’s the range where oil companies used to make piles of money when oil traded in that range. Now some companies go bust at twice that price.

For many decades, and well into this century, it was very profitable to produce oil at well below $40 a barrel in 2015 dollars. Then early in this century we reached peak conventional crude oil. To supply the world with enough oil, the price had to rise, and it did. But that raised havoc with many world economies. The price crashed along with a lot of economies in 2008. Then it recovered but crashed again in 2015.

* The 2015 price in the chart above is the average through April 24th.

Perhaps 15% or more of the world’s oil production is uneconomical at today’s prices. That is tight oil, tar sands oil and deep water oil. The price will have to rise again or production will fall. But if prices rise again then many fragile economies will likely collapse. We live in interesting times.

And a word from James Kenneth Galbraith courtesy of Art Berman

The world oil market is undergoing a fundamental structural change in response to expensive oil. Producers are trying to survive by limiting expenditures. While analysts have been focused on rig counts, deferred completions have emerged as the initial path to lower U.S. oil production. This unanticipated outcome suggests that others may follow. While everyone is waiting for higher oil prices and for things to return to normal, what we may be witnessing is the end of normal.

peak oil barrel

dave thompson on Thu, 30th Apr 2015 8:36 am

“Perhaps 15% or more of the world’s oil production is uneconomical at today’s prices”. OH? Really? How much production of energy is net negative? What is the world EROEI and where is it headed? Up? or DOWN!?

shortonoil on Thu, 30th Apr 2015 10:49 am

“Perhaps 15% or more of the world’s oil production is uneconomical at today’s prices”

Definitely one of the understatements of the week. Any conventional well with a water cut greater than 90%, operating on a full life cycle bases, is in the Red in this price environment. That includes more than half of US fields, almost all of the North Sea, and much of Russia. Venezuela, and Kazakhstan go without saying. The implications of the present price decline is being overlooked by almost everyone related to the petroleum industry. The impact on future production from reduced E&D expenditures seems to be something that no one wants to comment on. Without price relief, tomorrow’s oil will stay right were it is now; in the ground.

nony on Thu, 30th Apr 2015 11:25 am

Why will those economies crumple from a price rise even they survived last four years?

Nony on Thu, 30th Apr 2015 12:22 pm

Not a bad article, actually. (serious, not being snarky.) If Dennis says 120 and Ron says 140, I’m inclined to go with Dennis. He does more work on this sort of thing. Ron has had some mistakes before and been very firm about them (Texas RRC, TF not getting its oil from Bakken shale, Russian in decline, etc.) Also, tends to be a little more pessimistic (bias). not, bad, actually, though. There is also the factor that producers will try to high grade(i.e. the projects cut will be the more marginal ones…so your 140 or 120 are not average wells but a little tilted to the better part of the distribution).

GregT on Thu, 30th Apr 2015 12:48 pm

“The price will have to rise again or production will fall. But if prices rise again then many fragile economies will likely collapse.”

Either way, we’re in for a world of hurt in the not so distant future.

GregT on Thu, 30th Apr 2015 12:52 pm

“Why will those economies crumple from a price rise even they survived last four years?”

Because Nony, for one, many of those economies did not survive, and two, many more are hanging from the threads of easy credit and exponentially growing mountains of debt.

beammeup on Thu, 30th Apr 2015 2:02 pm

I don’t think the major economies will crumple, but I think they will (continue to) fare poorly. They certainly piled on massive debt during the recent years of high prices and continue to struggle with real unemployment.

BobInget on Thu, 30th Apr 2015 2:16 pm

As for Natty;

Working Gas in Underground Storage Charts (BCF)

East: 597

West: 361

Producing: 752

Total: 1710

Total Implied Change: 81

Year Ago: 969

5 Year Average: 1785

Source: EIA Weekly Natural Gas Storage Report

GregT on Thu, 30th Apr 2015 2:22 pm

The major economies will ‘crumple’. It is only a matter of time. The eCONomists with their never ending growth mantra will make sure of it.

Infinite exponential growth in a finite environment is a mathematical and physical impossibility. Growth is necessary for the continuation of BAU. Growth is not sustainable.

BobInget on Thu, 30th Apr 2015 2:36 pm

shortonoil is forgetting some mighty big, as yet unexploited fields. Argentina’s shale, Venezuelan oil sands heavy, where water flood isn’t at issue.

While the world’s economies are not crying out for more oil now, growth goes on, all be it slowly.

Is that not what ‘we’ here have been hoping for?

Slower growth seems to be corresponding nicely with slower oil production.

Here’s another ‘defense’ related item crossed my screen minutes ago;

PS.. there are no Iranian Navy ships in the area.

U.S. Navy to accompany U.S. ships passing through Strait of Hormuz

Reuters Middle East

22 minutes ago

WASHINGTON, April 30 (Reuters) – U.S. Navy ships will start accompanying U.S.-flagged commercial vessels passing through the Strait of Hormuz after Iran’s seizure of a Marshall Islands-flagged vessel two days ago, a U.S. defense official said on Thursday.

The official said the measure was expected to be in force for a limited time and was measured, adding ships would not be “escorting” the American vessels but only keeping them within eyeshot. Navy vessels already in the area would be tasked with the job, the official added. (Reporting by Phil Stewart and David Alexander; Editing by Sandra Maler)

Davy on Thu, 30th Apr 2015 2:36 pm

Beamer, you got a time frame or do you believe in consistent progress and growth albeit difficult with pain? That would be wonderful for me but I can’t buy into that.

If I were to be optimistic I would say 10 years. That will be achieved by massive wealth transfer, social fabric triage, and discarded non critical counties. All countries are more or less critical but some can be cast off within a 10 year time frame.

apneaman on Thu, 30th Apr 2015 2:36 pm

Get jobs, get married, buy house, shit out kids, fill house with consumer goods and throw in a remodel and new car every 5-10 years. The 20th century is over. Talking heads can try and explain it away any way they want – it’s overshoot. Can’t be repeated. You will not see that way of life again.

Millennials shun the new home sales market: in the face of tight inventory, why are builders not building new homes?

http://www.doctorhousingbubble.com/millennials-shun-the-new-home-sales-market/

Homeownership rate lowest in 25 years

http://www.cnbc.com/id/102627205

Davy on Thu, 30th Apr 2015 2:41 pm

Bobby, you are not listening to Short. Heavy oil and non US shales are dead in the water until prices go up and way up. If prices go up the economy sputters. Catch 22 from the oil patch.

BobInget on Thu, 30th Apr 2015 3:38 pm

Davy, while you and shorty are watching the store, how will we fill that one million barrel per day gaposis created by twenty more years fighting over scarce resources like water and oil?

Home sales, employment, car sales, pharma and

health care all going strong. EIA is showing double digit oil consumption increases over 2014. Yet, all we hear here is there will be no money to extract oil needed to keep eating and killing Muslim villagers.

You dudes don’t get it. A person dying if thirst

doesn’t ask the price of an offered bottle of water.

Politicians don’t care how much fuel a Abrams Tank or F18 costs to operate. They really don’t.

A corporate farm employee operates a 300 HP tractor. His job may be taken by a robot any day

but that self steering tractor will still need fuel.

A self steering oil tanker still needs fuel, it may be frozen gas but still.

Forget-about-it. Funding to save costal cities from flooding will be found.

It’s a falsely propagated oil surplus that caused

oil to half in price. When reality strikes, when

even the staunchest denial fails, markets will react despite manipulation of heroic proportions.

I invite you to look at reality in the face, not ass.

http://investors.euronav.com/company-news-and-reports/conference-call.aspx?sc_lang=en

http://www.livecharts.co.uk/MarketCharts/brent.php

http://www.brookings.edu/blogs/markaz/posts/2015/04/30-saudia-arabia-salman-yemen-pollack

Davy on Thu, 30th Apr 2015 4:02 pm

Bobby, lay off the BAUtopian punch bowl. You are drunk with delusions of growth and progress. You want cake and to eat it. You think free lunches work today because we are modern humans with technology and markets to make them from nothing.

If things are so great why can’t the Feds raise rates? The phony unemployment excuse don’t work with me. Employment has always been the hat trick to fool the masses. The deeper reason is debt service economy wide and at all levels. Demand is in the tanks and global finance is unravelling. Good luck with your hopium. It don’t fly with me.

Dredd on Thu, 30th Apr 2015 4:24 pm

“Bakken: verb, to repeat the same mistake over again without realizing it.”

JuanP on Thu, 30th Apr 2015 4:41 pm

Bob “shortonoil is forgetting some mighty big, as yet unexploited fields. Argentina’s shale, Venezuelan oil sands heavy, where water flood isn’t at issue.”

I beg to disagree, Bob. Argentina and Venezuela are an effing mess. Argentina is extremely unlikely to ever export a drop of oil in the future. Venezuela is a collapsing failed state, and its oil exports are diminishing and at risk of being completely lost.

If you are counting on Venezuela or Argentina to save the day, you will be badly let down. Those guys can’t even save themselves, man.

JuanP on Thu, 30th Apr 2015 4:54 pm

Bob “Forget-about-it. Funding to save costal cities from flooding will be found.”

I don’t want to pick on you, but I have to disagree again. I have lived through the destruction and reconstruction of Miami caused by Hurricane Andrew. It will NOT happen again. Andrew hit in the South were the farms were, and it was a frigging disaster that took more than a decade to recover from. You saw what happened later in New Orleans with Katrina, another freaking mess.

I recently sold my Miami Beach condo and am now renting. I couldn’t live in peace with all my money tied up in such a risky investment. I advice people that own similar properties to sell them and invest further from the coast and in higher ground instead.

If a major category 5 hurricane with a large storm surge were to hit downtown Miami today, it would bankrupt the city, county, state, and nation, including all the companies that have insurance policies here. Fat chance of getting through that unscathed.

Davy on Thu, 30th Apr 2015 5:11 pm

Juan, the new normal will be destructive change without reconstruction. In the not too distant future locations that are not sustainable or located in natural disaster areas will not be rebuilt. They may be reinhabited but that is a different situation.

steve on Thu, 30th Apr 2015 8:12 pm

Juan it is hard to say what to invest in; you could sell all property and sit on cash but the FED might soon make cash worth less than toilet paper…the biggest thing to invest in these days is your health and happiness….

Davy on Thu, 30th Apr 2015 9:23 pm

Steve, I recommend the dentist. Folks take care of those teeth.

GregT on Thu, 30th Apr 2015 10:28 pm

Better yet Davy.

If you have any dental issues now, get them pulled and get dentures.