– Peak gold – Biggest gold story not being reported

– Gold ‘Mining Zombie Apocalypse’ caused miners to slash exploration budgets

– Decline in gold production at world’s top 10 gold mining companies – Byron King

– “No new big mines being built in the world today” – Glencore CEO Glasenberg

– Primary global gold output declined in 2016 – Thomson Reuters via Mining.com

– 2016 was first year of fall in mine production since 2008

– Rising safe haven demand from ‘Trumpflation’ and geopolitical tensions and falling mine supply should lead to “much higher gold prices”

– What happens when the unstoppable force of robust global demand for gold meets the immovable object of a small, finite, rare and dwinding supply of physical gold?

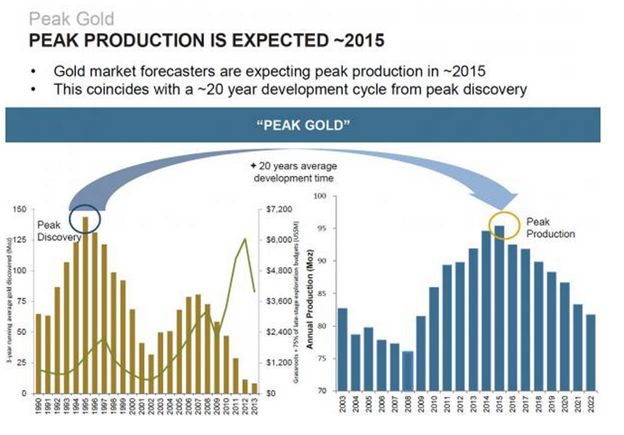

We have written about ‘peak gold’ and the ramifications of the underappreciated peak gold phenomenon for the gold market since 2008. The risk of falling gold production and a consequent reduction in supply are slowly percolating into the mainstream and analysts are asking whether 2015 or 2016 marked the year of peak gold production.

Byron King has written about this increasingly important supply factor in the gold market and brings together the views and research of Glencore CEO, Ivan Glasenberg, Thomson Reuters GFMS and others.

Goldman Sachs

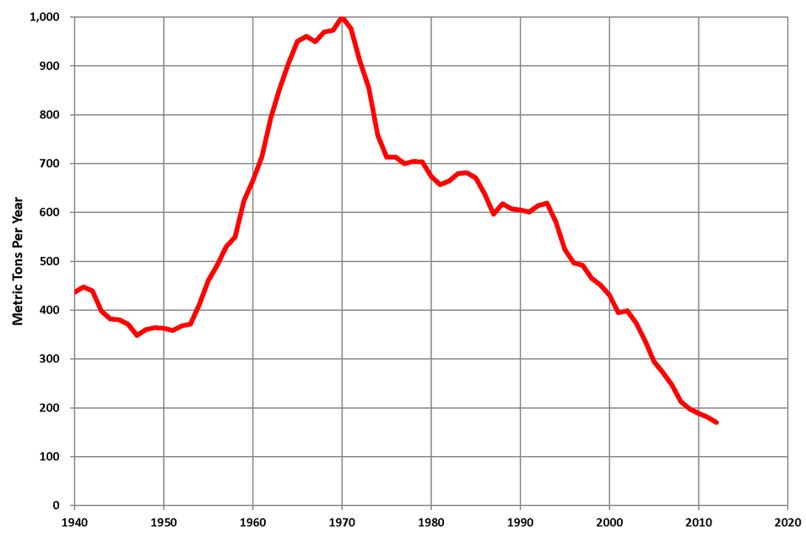

The collapse in South African gold production (see chart above) is the ‘classic canary in the coal mine’ and likely foreshadows the coming decline in global gold production.

South Africa produced over 1,000 tonnes of gold in 1970 but production has fallen to below 250 tonnes in recent years (see chart above). This is a collapse as these are levels last seen in 1922 and happened despite the massive technological advances of recent years and more intensive mining practices.

Regarding global gold production, the world’s largest gold producer and now the world’s largest gold buyer China, has been the only major producer to see an increase in gold production in the last few years.

There has been a huge increase in Chinese gold mining supply in recent years. We wonder about the accuracy of some of this data and whether the figures are being exaggerated by gold mining companies in China and by bureaucrats. Gold mining companies sometimes exaggerate the scale of their assets in the ground and sometimes of their production as was seen in Bre-X, recently popularized in the movie ‘Gold’.

There is concern that gold production in China may actually be declining as older mines see reduced production.

From the Daily Reckoning:

Gold has performed exceedingly well since last Wednesday’s much-anticipated rate hike. It shot up about $25 Wednesday alone. Today it’s up another three bucks, to $1,233.

The most common argument for gold is fairly well-known. Trump’s massive new spending proposals will goose inflation, meaning a higher gold price.

But while most investors focus on the potential for increasing demand, few consider if supplies will be able to meet that demand. And if supplies can’t keep up with demand, that should lead to much higher gold prices.

After three years of drifting lower, gold prices began to recover last year. Still, despite last year’s gold price move, the world’s top 10 gold mining companies were focused more on cost cutting. The result was a decline in gold production from mines run by majors.

And Ivan Glasenberg, CEO of mining giant Glencore, says that “there are no new big mines being built in the world today.” That’s because the industry downturn between 2012 and 2015 — the Mining Zombie Apocalypse, as I like to call it — caused miners to slash exploration budgets, in essence storing up trouble for the future.

Thus, it’s worth taking note of a recent article at Mining.com by Frik Els — with whom I spent a week in the Yukon last summer.

Frik dissects a recent report by Thomson Reuters about how primary global gold output declined in 2016. Specifically, Mining.com sums up the report: “World gold mine supply fell by 22 tonnes, or 3%, year on year according to the GFMS Gold Survey, to 827 tonnes in the third quarter of 2016.

By all indications, mine supply contracted in the fourth quarter of 2016 as well.

That means 2016 was the first year of a fall in mine production since 2008.

And according to the Thomson Reuters report, there are “few new projects and expansions expected to begin producing this year, and those in the near-term pipeline are generally fairly modest in scale, hence our view that global mine supply is set to continue a multiyear downtrend in 2017.”

Read article on Daily Reckoning

We live on a small, finite planet which is confronted by massive population growth, a near infinite growth in global currency supply and in financial instruments such as derivatives. We are consuming all our natural resources in a completely unsustainable manner.

Now might be a good time to ask the important question

What happens when the unstoppable force of robust global demand for gold meets the immovable object of a small, finite, rare and dwinding supply of physical gold?

News and Commentary

Stocks Retreat, Havens Gain as Trump Trade Wobbles: Markets Wrap (Bloomberg)

Gold holds firm as equities slide on Trump policy worries (Reuters)

U.S. Stocks, Dollar Slump as Reflation Trade Fades | March 21, 2017 (Bloomberg)

ICE delays launch of clearing for London gold benchmark: sources (Reuters)

10, 000 pieces of 300 year old gold & silver treasure found in Chinese river (RT.com)

Biggest Gold Story Not Being Reported – Peak Gold (Daily Reckoning)

What’s next after stock market’s sharp drop? Here’s what history says (Marketwatch)

It’s quiet out there. Too damn quiet (Moneyweek)

Gold is marooned between U.S. rates and India demand (Reuters)

Gold Price Target Unchanged at $10,000/oz (Goldseek)

Gold Prices (LBMA AM)

22Mar: USD 1,246.10, GBP 999.50 & EUR 1,154.76 per ounce

21Mar: USD 1,232.05, GBP 989.21 & EUR 1,141.37 per ounce

20Mar: USD 1,233.00, GBP 993.92 & EUR 1,146.57 per ounce

17Mar: USD 1,228.75, GBP 991.85 & EUR 1,140.53 per ounce

16Mar: USD 1,225.60, GBP 998.74 & EUR 1,143.24 per ounce

15Mar: USD 1,202.25, GBP 986.69 & EUR 1,132.04 per ounce

14Mar: USD 1,203.55, GBP 992.33 & EUR 1,130.86 per ounce

Silver Prices (LBMA)

22Mar: USD 17.58, GBP 14.12 & EUR 16.30 per ounce

21Mar: USD 17.31, GBP 13.88 & EUR 16.01 per ounce

20Mar: USD 17.23, GBP 13.92 & EUR 16.03 per ounce

17Mar: USD 17.40, GBP 14.08 & EUR 16.21 per ounce

16Mar: USD 17.46, GBP 14.21 & EUR 16.28 per ounce

15Mar: USD 16.91, GBP 13.87 & EUR 15.92 per ounce

14Mar: USD 17.00, GBP 14.02 & EUR 15.99 per ounce

Recent Market Updates

– Silver 1/ 70th The Price of Gold – Silver Eagles Sales Jump

– The Best Ways to Invest in Gold Today

– Gold Cup – Horse Racing’s Greatest Show, Gambling and ‘Going for Gold’

– Gold Up 1.8%, Silver Up 2.6% After Dovish Fed Signals Slow Rate Rises

– Most Overvalued Stock Market On Record — Worse Than 1929?

– EU Crisis Is Existential – Importance of Tomorrow’s Vote

– Digital Gold On Blockchain – For Now Caveat Emptor

– Gold $10,000 Coming – “Time To Prepare Is Now”

– Silver Very Undervalued from Historical Perpective of Ancient Greece

– Gold Investing 101 – Beware Unallocated Gold Accounts With Indebted Bullion Banks and Mints (Part II)

– Gold Investing 101 – Beware eBay, Collectibles and “Pure” Gold Coins that are Gold Plated

– “Think About and Prepare For” Euro Catastrophe

– Silver On Sale – 4% Fall On Massive $2 Billion of Futures Selling

Go Speed Racer on Thu, 23rd Mar 2017 2:32 am

There’s no gold shortage.

I was at Home Depot

there was plenty of gold spray paint.

forbin on Thu, 23rd Mar 2017 5:45 am

I kinda like this bit

“We live on a small, finite planet which is confronted by massive population growth, a near infinite growth in global currency supply and in financial instruments such as derivatives. We are consuming all our natural resources in a completely unsustainable manner.

Now might be a good time to ask the important question”

then go onto gold – buy buy buy ……

( bye bye bye ? )

so MSM can accept peak gold but not peak oil ?

funny that

Forbin

Wildbourgman on Thu, 23rd Mar 2017 6:58 am

Maybe we just haven’t found that we can extract Shale gold through gold fracking yet?

tk on Thu, 23rd Mar 2017 7:19 am

Yeah, gold is for sure, most important.

“Gold ‘Mining Zombie Apocalypse’ caused miners to slash exploration budgets”

“…slash exploration budgets”

“…slash … budgets”

“… budgets”

hmm, that word should be replaced with:

available utilizable energy amount

just to “demonetize” the language

sidzepp on Thu, 23rd Mar 2017 10:57 am

It is always PEAK something. Kind of like something gate after Watergate. There is only one peak and that is humanity, though the vast majority have not come to the realization that everything is about to change. Then there will be plenty of oil and gold in the ground and plenty of soil on top and the earth will continue to orbit the sun for several more billion years.

Stay thirsty my friends!

penury on Thu, 23rd Mar 2017 11:26 am

If they really need a peak to concern themselves with they should go with “silver”. Gold is great for coinage and jewelry but silver is a ingedient in a lot of commercial applications and is going to be in very short supply soon.

Alice Friedemann on Thu, 23rd Mar 2017 11:38 am

Peak Gold Kerr, R. A. March 2, 2012. Is the World Tottering on the Precipice of Peak Gold? Science Vol. 335: pp. 1038-1039.

http://energyskeptic.com/2013/peak-gold/

marmico on Thu, 23rd Mar 2017 12:07 pm

Yo Alice, are the trucks still running?

Are the truckers duking it out with the farmers and railroaders at the refinery gate for diesel fuel?

https://www.eia.gov/dnav/pet/pet_cons_821dst_dcu_nus_a.htm

ROTFLMFAO

GregT on Thu, 23rd Mar 2017 2:55 pm

“Maybe we just haven’t found that we can extract Shale gold through gold fracking yet?”

But we can extract gold from seawater. Unfortunately, it isn’t very profitable, and producers would end up going into debt by doing so.

Boat on Thu, 23rd Mar 2017 5:13 pm

I can buy a 3 oz pack of ramen noodles for 16 cents or buy 3 oz of gold for around $3,800. You can’t eat gold.

Outcast_Searcher on Thu, 23rd Mar 2017 5:47 pm

Boat, given what Ramen Noodles do for your health, you’d be better off swallowing a bit of gold. It’s chemically inert, so it would just go through you.

Is all long term freeze dried type food really bad for you? Jerky certainly is.

Somehow having cases of that around for “just in case” and eating your way through that periodically sounds a lot less smart, given the cost of health care and the odds that actual societal “collapse” happens within a decade or two.

Outcast_Searcher on Thu, 23rd Mar 2017 5:50 pm

Gold is intert. It doesn’t go away. It can be recycled.

If it were really badly needed for manufacturing, a high enough offer price would bring in a LOT of jewelry. There is a LOT of it sitting around in vaults, much of which could be had for the right price.

Somehow this does NOT seem worth any short or even medium term panic — though that’s what Zerohedge sells. Incorrect proclimations of short term disaster, month after month, and year after year.

Are these folks EVER right about anything significant?

Davy on Thu, 23rd Mar 2017 6:51 pm

“Incorrect proclimations of short term disaster, month after month, and year after year. Are these folks EVER right about anything significant?”

OS, are you saying everything is fine? No disasters? Month after month of no bad climate news. Year after year of no economic decline. I think maybe you visit occasionally because you are worried deep down. I am fine with someone saying things are not too bad at least for now but someone like you is an example of what is wrong with humanity today. Pure delusional status quo fake reality and cocky on top of it. Besides, you are one of the world’s lucky billion most at risk from a big step down in living standards. You would be wise to show more humility.

GregT on Thu, 23rd Mar 2017 10:51 pm

“I can buy a 3 oz pack of ramen noodles for 16 cents or buy 3 oz of gold for around $3,800. You can’t eat gold.”

You can’t buy ramen noodles without money. Gold can be converted into any currency.

Much better to have 3 ounces of gold, than 23,750 packages of ramen noodles. Much easier to carry.

GregT on Thu, 23rd Mar 2017 11:09 pm

I was also going to mention that gold is inert and doesn’t breakdown or decay, but I’m not so sure if ramen noodles might have the same characteristics.

Dooma on Thu, 23rd Mar 2017 11:13 pm

How do these “ads” manage to sleeze their way on to this forum?

Midnight Oil on Thu, 23rd Mar 2017 11:18 pm

Remember a story from a man in a coin shop that he shared with me. His family easy escaping from Germany and was Jewish. The were in Poland and needed a place to stay and hide out. A farm was the only place around and as his Family was approaching the Farmer came out to chase them off the property. Well, his Father had a nice small decorated wooden box.

Within, hidden, were gold coins. As soon as the Farmer caught a glimpse of the gold he hurried them inside.

Enough said, lesson learned.

GregT on Thu, 23rd Mar 2017 11:51 pm

I know of several families that fled South Africa during the 1980s. They brought their wealth with them in the soles of their shoes, and sewed into the seams of their clothing.