Page added on October 22, 2014

Increasing Oil Reserves and Peak Oil

In public lectures that I give about global energy, I often note that since the writing of A Cubic Mile of Oil the global reserves of oil have increased, not decreased, despite the fact that in the intervening time (i.e., between 2007 and 2013) the world has consumed about 7.5 cmo. In this post I want to dig deeper and look at the changes that have brought about this paradox, and what it means for Peak Oil.

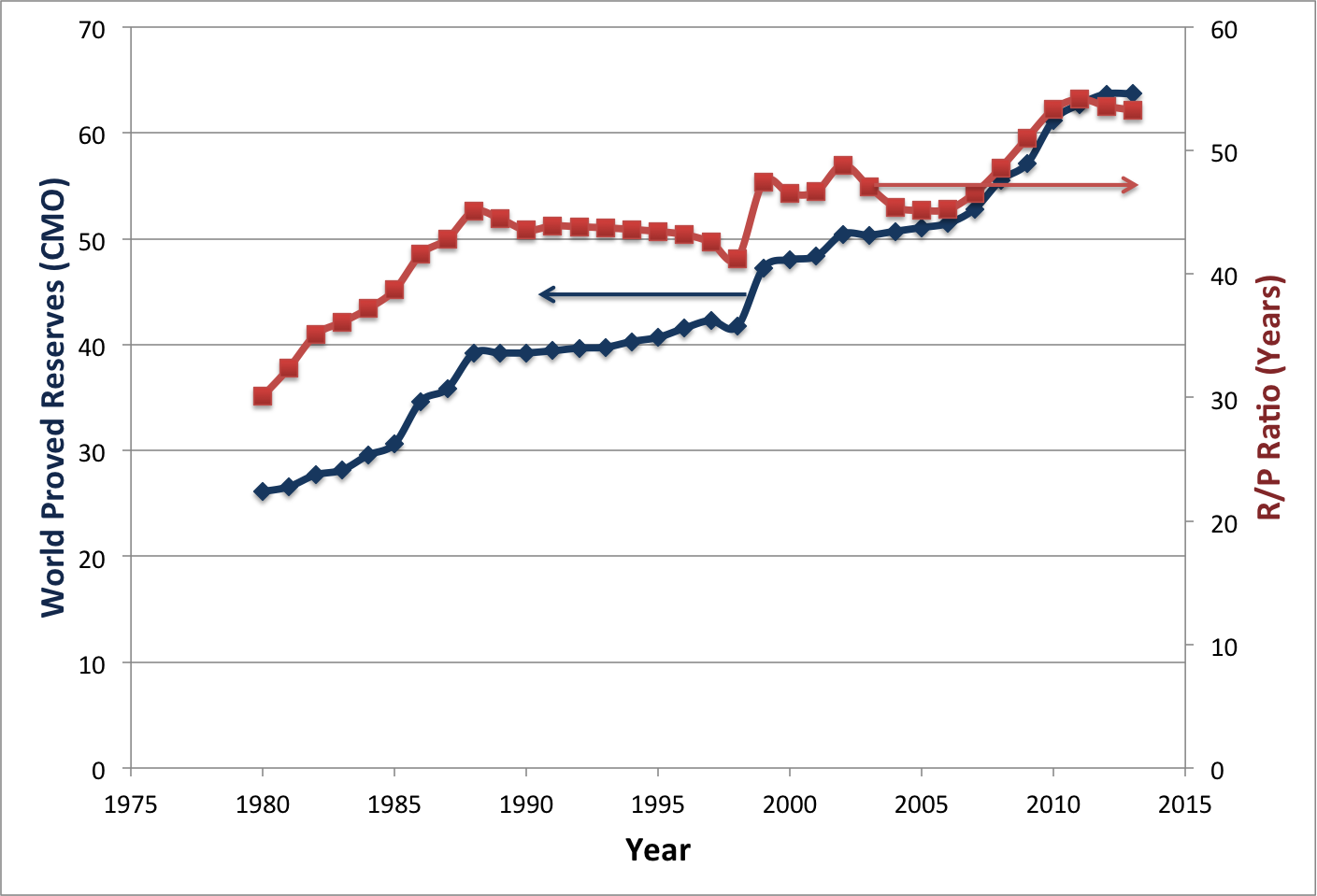

As I explain in the book, reserves have a special meaning refer to those geologic accumulations that can be economically extracted with the current technology. With the development of technology and/or changes in the price of oil, geologic accumulations that were once only part of the larger resource base may get transferred to the reserves. Focusing only on the reservesis apt to give a wrong impression about the total availability of oil. The chart below shows the historic data from the 2014 edition of the BP Statistical Review of Global Energy (BP2014) for the World Proved Reserves and the Reserves to Production (R/P) ratio. This ratio has often been mistakenly interpreted as the years to exhaustion.

Likewise, current price of oil largely reflects the immediate surplus or shortage of supplies, and reflects more on the conditions above ground (in the supply chain) than on the geologic endowment of the resource.

That said; let’s begin by taking stock of how the world reserves of oil have changed in the last seven years. According to BP2007 world reserves of petroleum in 2006 stood at 1,208 billion barrels (45.6 cmo), and that’s the number I used in the book. The BP2014 edition lists the 2006 reserves at 1,364 billion barrels (51.5 cmo), and the 2013 reserves at 1,688 billion barrels (63.7 cmo). The upward revision of 156 billion barrels for the 2006 reserves resulted largely from reclassifying about 160 billion barrels of Canadian tar sands from the category of unconventional resource to the reserves pool. Although production of synthetic crude from tar sands had already begun to be commercialized, BP did not include them in the World Total of oil reserves until 2009. To a large extent the reclassification was aided by the maturing of the technology, and also by the rise in the price of oil. In 2006 oil was selling at around $40/ barrel, and that price was barely enough to make Tar sands operations economical. By 2009 had already spiked to above $140/barrel; since 2010 it has been hovering around $95±10/barrel. Smaller upward revisions were also made to the reserves of Venezuela and the Russian Federation, while there was a downward revision of the Kazakhstan reserves (ca. 30 billion barrel).

The increase of 324 billion barrels in the global reserves between 2006 and 2013 as listed in BP2014 edition is largely due to Venezuelan oil. The heavy oil in the Orinoco Belt was very uneconomical to produce, but has been less so since 2009 and the reserves in the Orinoco Belt have increased by over 220 billion barrels (8.3 cmo). Iraq, Iran, and the US have also registered increases in the reserves of 35, 19, and 15 billion barrels respectively.

The shale oil development in the US had received much attention in the media, but it is sobering to realize that its contribution to the reserves has been rather modest (<1.0 cmo). It has, however, had a more profound and immediate impact on the US oil production, which has increased by about 3.2 million barrels/day, whereas the Venezuelan and Iranian productions have each decreased by about 0.7 million barrels/day. Oil production in Iraq, which was close to its low point in 2006 following the Gulf War, did recover and increased production by about 700 million barrels/day. Total world production increased by 4.2 million barrels/day, and had the US shale oil not developed the world supply would have been much constrained, and we probably would have seen much higher oil prices.

The recent news of abundant oil supplies has once again called into question the Peak Oil theory. Writing for the Wall Street Journal, Russell Gold recently provided a nice perspectiveon why peak oil predictions have not come true. I agree with him on most points, but would quibble with him on the role of technology. He ascribes the increased production to the advent of hydraulic fracturing and horizontal drilling, and places faith in technology to provide developments that will unlock further resources of oil. Perhaps just as important to consider is the price change, which responds more to the global demand for the commodity than anything else. Producing shale oil is not inexpensive; the cost can be upwards of $60/barrel. As mentioned above, prior to 2008 the oil price hovered around $40/barrel, and after some spikes it has been above $80/barrel since mid 2009; evidently the global market seems to be willing to pay this high price to support production of expensive oil.

Distinct from geologic and economic limits, which have dominated the Peak Oil debate, is the energy limit. I am referring to the energy return on (energy) invested, or EROI. It takes energy to extract oil, and easy oil—the kind that gushes out of wells can have an EROI values around 100, meaning that for each barrel of oil energy invested, the well produces 100 barrels of oil. Current global average of producing conventional oil has EROI of 20, while the more difficult to extract Alberta tar sands and shale oil have EROI between 5 and 7.

While it is true that oil may still be extractable at higher prices, oil ceases to be a source of energy when the energy required in recovering it exceeds what it can deliver. Now, there still maybe an economic incentive for continuing to produce a fuel from sources with EROI of less than 1 as long as the product fuel provides sufficient value—corn-derived ethanol is a prime example of that. I should note that I was incorrect in the book to say that once the EROI is less than 1, “there will no longer be an incentive to extract it regardless of price.” I should have said that oil ceases to be a contributor to global energy supply when its EROI drops below 1.

12 Comments on "Increasing Oil Reserves and Peak Oil"

louis wu on Wed, 22nd Oct 2014 9:21 am

“The recent news of abundant oil supplies has once again called into question the Peak Oil theory.”

No it has not.The peak oil “theory” was derived from the direct observation of the phenomenon of extraction rates eventually maxing out and then going into decline due ultimately to geologic and thermodynamic constraints.It never had anything to do with amounts of oil.And the peak due soley to those constraints is the best case scenario.When politics and economics(the human dumbass factor) comes into play you don’t even get to that best case.

JuanP on Wed, 22nd Oct 2014 9:27 am

Very interesting article. The writer is accurate and well informed. I find no wrong calculations, incorrect language or factual inaccuracies. The paragraphs are too long and need editing.

JuanP on Wed, 22nd Oct 2014 9:36 am

The article he links to is a PO denialist post,

http://online.wsj.com/articles/why-peak-oil-predictions-haven-t-come-true-1411937788

His conclusion on PO is inexplicable considering this guy’s knowledge and intelligence unless it is intentional.

“… why peak oil predictions have not come true. I agree with him…”

As I see things PO is happening, crude has been on a plateau since 2005. Without the USA’s LTO the global situation would be very different today.

westexas on Wed, 22nd Oct 2014 9:49 am

In addition to actual global crude oil production (45 and lower API gravity crude) being on an “Undulating Plateau” since 2005 (even as annual Brent crude oil prices doubled from $55 in 2005 to the $110 range for 2011 to 2013), by definition the remaining supply of economically recoverable global crude oil reserves has declined, the only question is by how much.

Charlie Bucket on Wed, 22nd Oct 2014 10:05 am

Peak discovery happened 40 years ago! How can people not understand peak production is soon to come. It takes an unbelievable amount of cognitive dissonance to convince ones self that we are not on the end of the bumpy plateau and about to head down the other side of the production curve. Without another 2 or 3 Ghawar discoveries it’s over (no matter what new “technology” they come up with) – and that ain’t going to happen!

shortonoil on Wed, 22nd Oct 2014 11:23 am

“The BP2014 edition lists the 2006 reserves at 1,364 billion barrels (51.5 cmo), and the 2013 reserves at 1,688 billion barrels (63.7 cmo).”

A rather disingenuous statement, which is used repeatedly to prove a plethora of opinions. This projection does not take into consideration that production costs are rising faster than price. As we have been stating recently price has already reached the maximum level that the economy can sustain. 1,688 Gb is not the amount of oil that will be extracted, it is the amount that BP thinks could be extracted at today’s price, and production cost. Tomorrows price and production costs will be much different. Our analysis, which incorporates increasing production costs, and maximum pricing levels indicates that BP’s “today” estimates will be in error by about 350% when applied to the final full production cycle .

http://www.thehillsgroup.org/

meld on Wed, 22nd Oct 2014 3:15 pm

If peak oil isn’t real then the only other logical alternatives are

a) oil is infinite

b) We’ll go from lots of oil to no oil over night.

I think I’ll stick with the peak oil theory thanks

Stercusferi on Wed, 22nd Oct 2014 4:38 pm

Off setting decreasing production by increasing reserves to holdup corporate share value. Easy to see.

Perk Earl on Wed, 22nd Oct 2014 4:52 pm

Reserve numbers are only as good as the affordability to substantiate their extraction/production. If oil price dropping is any indication, affordability is declining (and that should not be a surprise as EROEI declines, keeping wages fairly stagnant while products & service costs rise).

It’s a case of plotting X reserves available in today’s economy vs. declining Y reserves into the future. It’s going to arc down, but how sharply will be the tale of the tape.

Rivaz Ahmed on Wed, 22nd Oct 2014 6:42 pm

Venezuela the World #1 country in Oil Reserves is importing oil from other countries.

http://www.argusmedia.com/News/Article?id=935915

Reason : The Oil they have is extra heavy crude oil that needs to be blended with lighter crude to product motor fuels.

Canada the #3 country in oil reserves also has similar type of oil.

So this will increase the price of lighter crudes further.

Nony on Wed, 22nd Oct 2014 7:54 pm

Please format the articles so that paras have a white space line between. Unreadable as is. Unread.

Perk Earl on Wed, 22nd Oct 2014 10:55 pm

http://ourfiniteworld.com/

I haven’t read it yet, but Gail has a new article posted. Last one was back on the 6th, so just thought I’d put out a heads up.

http://ourfiniteworld.com/