Page added on July 18, 2016

The limits to society’s attention span: peak oil ten years after the ASPO-6 meeting in Pisa

Ten years ago, only five years had passed from the 9/11 attacks. We were still reeling from discovering that the collapse of the Soviet Union didn’t mean the “End of History”, and that there would be no “peace dividend” for us. At that time, the concept of “peak oil” was new, interesting, and being explored by a group of smart people who were interested in the future of humankind. The Pisa meeting, in 2006, was a high point of this wave of interest.

In the ten years that followed, history moved forward at an incredible pace with wars, revolutions, financial crisis, and changes of all kinds. We saw oil prices spiking up to $150 per barrel in 2008, then crashing down, and then restarting the cycle. We saw the US production reborn from its ashes with the great “shale oil” revolution that should have lasted for centuries but that, right now, is collapsing. We saw the Macondo oil spill in the Gulf of Mexico, we followed the story of the great oil field of Kashagan in the Caspian sea, once touted “the New Saudi Arabia” that still has to deliver its first barrel. We saw the collapse of oil producing regions such as Egypt, Syria, Yemen, and Venezuela, all accompanied by political turmoil. And, more than all, we saw Climate Change moving from a side threat to a major challenge for civilization.

In this great turmoil, the peak for conventional oil seems to have appeared, more or less, when it had been originally predicted, around 2005-2008. But the old forecasts had not taken into account the dogged reaction of the industry and of the financial system, that pushed for producing combustible liquids from anything that could even remotely produce it. As a consequence, “peak liquids” has been postponed of about a decade, and it seems to be here, right now.

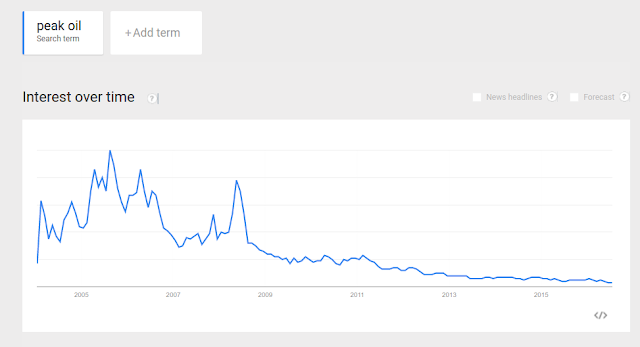

But, with all this turmoil ongoing, people simply forgot about peak oil, that receded beyond the event horizon, as if it had been sucked in by a black hole, leaving only a faint glow behind it. Nobody seems to be interested in peak oil any longer, as you can see from the results of Google Trends, shown at the beginning of this post

This peculiar blindness of our civilization appears not just for peak oil, look at how people have lost all their interest in Global Warming, just now that we see everything melting around us

So, as usual, we are moving into the future blindfolded, head first, and at full speed. What we will find there, is all to be seen.

_______________________________________________________________

In the following, comments by some of the participants in the ASPO-6 conference in Pisa received in occasion of the 10th anniversary. If you were there and you wish to add your recollections, write them in the blog comments.

_____________________________________________________________________

Colin Campbell

I have the best of memories of the Pisa Conference which was excellent in regards to both contents and location. It is true that ASPO seems to have passed its peak as there have not been any recent international conferences, although ASPO USA remains very active. I think it is now widely accepted that so called Regular Conventional Oil passed its peak in 2005. I think that the peak of all categories is imminent, if not already passed last year, but that will not be recognised for a few years down the other side. I will be 85 years of age next month and am certainly too old to do much more on this subject, although I do try to update my depletion model. The last version was for 2014 but for some reason I cannot at the moment access the EIA website to get updated production, consumption and reserves data for 2015 by country.

______________________________________

I do remember the Pisa meeting, though mainly because it was my first visit to Pisa and meet you, more than for anything I learned about peak oil. I was already well informed and convinced about peak oil. And I did not need more professional contacts in the field. So the meeting was interesting to me, but not especially influential for me. It was well run, and I appreciated that you created the chance for me to run a STRATAGEM session.

It is unfortunate that peak oil has suffered the same fate as all other limits. Between those who are ideologically opposed, those who profit from the current system, and those who just don’t think about it, the issue has essentially disappeared.

The pretext is low gas prices in the US and the (short) burst of production from shale. But if that pretext had not appeared, some other one would have been found. This world is simply not equipped to do the sort of short-term sacrifice and long-term planning required for an adequate preparation for the end of an era of cheap energy. Add to that the fact that the future without cheap energy will definitely be much less fun for the rich than the present one, and you have a guarantee of denial.

What lies ahead? I would guess that another profound financial crisis is coming. It will depress energy demand enormously. And it will attract all the attention, just as the pain receives the attention of someone with cancer. They treat the pain, not the cancer, perhaps even becoming addicted to pain killers, without ever understanding the true nature of the problem. And in every time of crisis control of the political system drifts towards simplistic authoritarians. You had Berlusconi; we are likely to get Trump.

I read John Michael Greer’s books as they come out. They stimulate me to think about that future without abundant oil. I expect that will be evident by 2030.

EROI is a key concept that could bring clarity to the situation. But it will not be pursued, because it just brings bad news. Politicians only like good news stories.

___________________________________________

Pedro Prieto

I remember from the Conference the carps in San Rossore, good weather, Denis Meadows signing to my colleague Daniel a first edition of the Limits of Growth, some interesting talks, as usual in all the ASPO meetings, the surprising disappearance of Ali Samsam Bakthiari, Robert Hopkins in his probably last intervention out of the transition town where I suppose he lives since then, some high expectations on the KiteGen from Alessandro, that I am afraid have not yet materialized, a set of electric motorbikes, and me driving one of them.

Sad that ASPO web page is fading if not completely disappeared now. I am not so sure that we can say yet in ASPO, as George W. Bush said on the air carrier: “Mission Accomplished” on the end of military activities in Iraq in 2003.

___________________________________________

Robert Hirsch

I remember the conference very positively. Yes, a great deal has happened since the conference. Some comments in italics:

— How did you find your experience in Pisa? Very positive. It is a beautiful city and the arrangements were fine. Most of the conference was worthwhile but, as always, some of the presentations were of little value.

— What has changed during the past ten years in your worldview? The drop in oil prices took the wind out of “peak oil” to the point where it is not now given much credence. That’s extremely unfortunate in my opinion, because the problem has not gone away. It seems likely that OPEC spare capacity will be gone within the next year or two, and oil prices will escalate. Thereafter, some production will come back on line but large scale bounce-back is generally a slow process, as you know. It is likely that the onset of the decline in world oil production will occur within a matter of years, but then again, most who have forecast that date have been proven wrong in the past!

— How do you think that the peak oil idea has evolved and changed the world? See above. Also, the concept has lost popular credibility. That likely won’t change until oil prices escalate dramatically, likely a few years from now.

All the best, Bob

Charlie Hall

My response would be similar to Bob’s — I found it wonderful! I remember the big tent (which worked very well), the thrilling speakers like Colin and Jean and Ugo and Rui and Chris Screbowski, the wonderful new friends and the urgency of the topic. I was not alone or crazy (well…). And the Italian food!! [I looked for my presentation (probably something on EROI (yawn) but could not find it on my present computer. I probably could if anyone cares.] Not to mention Pisa itself. I had no idea the tower was so beautiful, leaning or not. My wife and I then visited the Carerra Marble mines (with lots of old pictures of pre fossil fuel mining) and then Lucca, where Puccini was born (and his duck hunting retreat on the big Lake to the North). I broke the rules and touched the piano on which (I think) Madama Butterfly was written!

Cassandra’s legacy by Ugo Bardi

23 Comments on "The limits to society’s attention span: peak oil ten years after the ASPO-6 meeting in Pisa"

HARM on Mon, 18th Jul 2016 4:25 pm

Cassandra’s Curse combined with the fact that previous forecasts of a global peak (~2005) all turned out to be spectacularly wrong.

Oil @~$45/BBL and a worldwide glut is not going to rekindle interest in Peak oil anytime soon. When the actual peak arrives, it will be too late to do anything about it –as Ugo said, “we will be caught with their[sic] pants down.”

shortonoil on Mon, 18th Jul 2016 6:34 pm

The oil age does not end when the world runs out of oil. It ends just the way that it is now ending. When producers can no longer make money producing oil, and when the economy can no longer pay them enough to produce it.

Peak Oil is not a barrel phenomena, and never was. The economy does not use oil, its only interest is in the energy that it receives from it. It is that energy contribution that will determine when the pumps shut down.

http://www.thehillsgroup.org/

Apneaman on Mon, 18th Jul 2016 7:26 pm

short, I’m seeing more mentions of you, the hills group and the ETP model on the many doomish site I visit while wasting my pathetic life away online (beats working). Hooray! Another small handful clue in after it’s too late.

Davy on Mon, 18th Jul 2016 8:34 pm

The sheeple attention is influenced by crisis. The high prices of 07 got their attention. Post 08 their attention was the economy. Central bank easing and repression reflated the bubble and as far as the sheeple was concerned the crisis subsided. High-ish oil prices were ok post 08 because it was a sign the economy was lifting. Many were benefiting. The markets were on fire. Peak oil attention span revolves around crisis and high prices. We are not in a crisis as far as the sheeple is concerned. He thinks things are bad but we are not in crisis. Oil prices are low. Peak oil awareness is near the bottom of the sheeples list of worries. Give it a year or two when the 1st oil shortage hits then the interest will rocket once again.

Northwest Resident on Mon, 18th Jul 2016 8:51 pm

Davy, you are right about the mass levels of ignorance and outright denial. But I think an argument could be made that we are already experiencing oil shortages and have been for quite a while. I guess it depends on how we define “oil shortage”. Energy use per capita — oil use per capita — has been declining for a long time, and the decline as we know is picking up speed rapidly. In that respect, I guess we already have an oil shortage. But I get your point. One day no doubt within the timeline you suggest, gas lines will form, vehicles will run out of gas and get stranded on the side of the road, deliveries won’t get made. By then, we’ll know that the final phase of collapse has begun in earnest!

Davy on Mon, 18th Jul 2016 8:57 pm

NR, you and I know what a systematic shortage is. The sheeple’s version is clear cut and in your face. If the pumps have plenty of gas and at the right price then what’s the problem thinks the sheeple. You and I live doom and we know better. We know the illusions of plenty and the reality of crisis ahead.

shortonoil on Mon, 18th Jul 2016 9:12 pm

“short, I’m seeing more mentions of you, the hills group and the ETP model on the many doomish site I visit while wasting my pathetic life away online (beats working). Hooray! Another small handful clue in after it’s too late. “

A model based on sound fundamental physical laws, mathematically verifiable, and testable against the best data available, and a few people start to catch on? It certainly isn’t surprising that we are in the predicament that we have reached. The chances of saving this industrialized behemoth that has been built are approaching null to zero. We have built a civilization were most of its inhabitants think that an electric light switch is what controls something called electricity that is grown on trees.

The best that we can hope for is that our predecessors aren’t reduced to fishing in termite mounts and eating each other. Our contribution will probably be reduced to the preservation of the knowledge of how to make ketchup.

We tried??

Northwest Resident on Mon, 18th Jul 2016 9:32 pm

shortonoil — Did you read this article:

Why Oil Prices Might Never Recover

“Energy is the economy. Energy resources are the reserve account behind currency. The economy can grow as long as there is surplus affordable energy in that account. The economy stops growing when the cost of energy production becomes unaffordable. It is irrelevant that oil companies can make a profit at unaffordable prices.”

Sounds like Berman has been reading your posts!

http://oilprice.com/Energy/Energy-General/Why-Oil-Prices-Might-Never-Recover.html

rockman on Mon, 18th Jul 2016 10:56 pm

NR – You’re very correct: the is s big shortage of oil…of $12.50/bbl oil like we had in 1998. Just as we also have a huge surplus of $100/bbl oil today. And, of course, we have a balanced market today at $45-$59 per bbl since the world is buying every bbl it can afford. In fact oil consumption has never been this high for this long in the entire history of the oil age.

What I find interesting is how no one proclaimed there was a surplus of oil in the summer of 2009 when oil was selling at the same price as today. So if a “surplus” isn’t defined by price then maybe it the amount of oil producers are able to sell. But that wouldn’t indicate a surplus today since not one producer has claimed any lack of buyers for its oil. In fact the huge gain in stored oil (oil bought from producers and stored by speculators) has helped producers reach record sales levels. Operators back in 1998 certainly would have loved to see speculators send a similar amount of oil to storage. That would have provided some relief from the $12.50/bbl price they were getting at that time.

Oil is “cheap” today? LMFAO. According to the EIA the current price of oil is about 20% higher then the inflation adjusted WEIGHTED average price of oil over the last 60 years. For 18 years (1986-2004) the IA price of oil was less the $40/bbl. Why don’t we bring up the “cheap oil” theme when oil holds at $30 IA for, let’s say, 5 years, Of course that would really not be “cheap” oil but just cheaper oil. For “cheap” oil we’ll need to wait for the price to hold at $20/bbl IA, let’s say, for 3 years. But that might be a while since that has never happened over THE LAST 70 YEARS. LOL.

Northwest Resident on Mon, 18th Jul 2016 11:29 pm

Hey rock, great info. But I’m not sure how much of that oil in storage (the glut) is due to speculators. The floating storage for sure is very expensive — hard to believe speculators would take such a big risk, paying so much just waiting/hoping for the price of oil to go back up. But then again, speculators aren’t always brilliant, so who knows. What percent of “the glut” would you contribute to speculators, versus flat out no buyers at going rates?

Northwest Resident on Mon, 18th Jul 2016 11:33 pm

P.S. The ongoing trend around the world is plunging transportation, decreasing trade, fewer shipments, retail dropping like a rock, falling buying power for most Americans — the list goes on and on. All of this equates to rapidly decreasing demand for energy/oil. The quote above by Berman is correct: “The economy stops growing when the cost of energy production becomes unaffordable.” That is exactly what is happening, isn’t it?

Davy on Tue, 19th Jul 2016 4:17 am

Lots of talk about “energy is the economy”. We know a species must have an energy source to survive. In that respect humans have our various energy sources with oil being the foundational source. What is less talked about is the economy makes oil and other fossil fuels what they are. It is the correlation and systematic condition of an economy needing and producing oil that makes oil economic. Oil is economic and has value is clear but without an economy needing the oil and capable of producing oil then oil is not of value.

It is this mutual relationship now more than ever that is coming into play. The economy is in deflation and physical decay. There are a variety of reasons for this. We know the primary reasons are debt and malinvestment and the extending and pretending of the resulting problems. We know oil is under pressure from depletion this is manifested in various peak oil dynamics. The most profound of which in my opinion is found in the Hill’s group ETP model. To get an accurate picture of oil and the economy we must see them in isolation and correlation. In isolation they have particular problems unrelated to the other. Oil has depletion issues with new sources of unconventional oil replacing higher quality oil. These unconventional sources have less chemical qualities and are more expensive to produce. In the economy we have debt and non-preforming debt. We have a global currency and debt problem between nations. You then take these oil and economy problems and mix them systematically. We then see a dangerous negative feedback of converging reinforcing problems. As the economy and oil decay physically and systematically we have a magnification of the problems of both in isolation and in combination.

We are truly in a predicament with this macro oil and economy situation. It is possible one could support the problems with the other but in our case they are in negative reinforcement not mitigation and adaptation from the health of the other. Oil depletion is taking its toll on the economic quality of oil but at the same time the economy is less potent in its use of oil because it has lost its productive potential to systematic decay. Likewise as deflation and physical decay cause destructive change to the economy the economic side of the oil complex is finding less investment potential in new technology. Investment capex is diminished lowering E&P efforts. Infrastructure is not invested in and repairs not made. Education and human resources are in decline.

When you mix these negative systematic conditions together you see the potential for a vicious supply demand cycle of destructive forces which is likely now an inertia on growth. It appears we are still growing in aggregate but this growth is stagnating. It appears this growth contains significant malinvestment to be considered false growth. If we weigh these conditions we can argue we are in a bumpy plateau or a bumpy descent but not a solid growth trend. That appears to have economically ended pre 08 financial crisis and with oil in and around 05 peak conventional oil.

At some point the inertia to growth will become the momentum of decline and then we are finished. It is the approach and the vicinity of this inflection point that is the danger zone. There are unknown thresholds of stability after which we break to a new range of potentiality with oil and the economy. This zone is not something we can know because the variables are too diverse and in flux. When you have multiple variable in flux and reacting to mutual trends then predictions become beyond the human scope at least longer term. Models and mathematics lose effectiveness at some point leaving the science open to speculation. Currently all we have is speculation hence all the discussion and the reason for a site like this.

The element of denial and dysfunction makes this even more problematic. Humans have a great potential to influence the economy and oil with irrational decisions and actions. This is something we should get a handle on is an understatement. Individuals are in a delocalized local world of global dependence without exception. A destroyed global system will touch everyone even the most remote. We will have a significant global die off when globalism ends. The degree and duration of this is unknown for many reasons but the biggest issue is how will human react in a die off situation?

There are many question that are beyond modeling. We can compare this to climate models and their variance. It is revealing how climate change is worse and happening sooner despite a huge investment in research. This does not have to be the case with oil and the economy but it is surely the case with the social narrative of oil and the economy. Here we have denial that is systematic and pervasive. It is this way in once sense because if our social narrative faced the reality of climate, economy, and oil the global world would quickly self-destruct in panic and loss of confidence. In this respect is it any wonder why the authorities are so quiet and negligent with the truth.

Kenz300 on Tue, 19th Jul 2016 7:23 am

The less the world relies on oil from the middle east the better…………

It is time to speed up the transition to safer, cleaner and cheaper alternative energy sources………..

Electric cars, trucks, bicycles and mass transit are the future…..fossil fuel ICE cars are the past…………..

Think teen agers vs your grand father…………………. cell phones vs land lines…….

NO EMISSIONS……..climate change is real………

Save money……no stopping at gas stations…..no oil changes……..less overall maintenance……

shortonoil on Tue, 19th Jul 2016 7:47 am

““The economy stops growing when the cost of energy production becomes unaffordable.” “

The oil industry is not even receiving enough revenue at present prices to replace the reserves that they are extracting, so I ask, how can they be making money? They aren’t! What they are doing is putting in the reserves that they are extracting at their original cost, even if to presently replace them, would cost 10 times as much.

This is all a bookkeeping shell game; it makes them look good while they die. The value of a barrel of oil depends on the economic activity it can power. If it requires $2 in oil to produce a $1’s worth of goods and services you are going broke on the fast track. That is what determines the maximum allowable price of oil, not some Wall Street speculator.

Because of the “quarkyness” of a debt based financial system it is possible to show a profit until the last barrel that can be pumped has been removed. Essentially, we have a monetary system that no longer works in a world of diminishing resources. It is showing gains where in actuality we are producing loses. What we said a couple of years ago is that the whole economic theory that is being employed would be turned upside down once we pasted the energy half way point in 2012. Once it is no longer possible to accumulate capital the time value of money goes negative. The whole thing starts running backwards.

With growth impossible to achieve the world begins to consume the assets that it has spent the last 150 years accumulating. We begin turning the assets that have been used to produce wealth into the consumables required to maintain the civilization. This whole cannibalization process ends when oil can no longer supply the energy needed to power the system that is doing the cannibalizing. By our calculations that is not very far into the future.

If everything now seems to be some sort of a big Ponzi scheme, that is because it is!

http://www.thehillsgroup.org/

marmico on Tue, 19th Jul 2016 8:41 am

You are so fucking full of shit, that’s why you are known as the ETP fuctard. I ripped Arnoux’s ass to shreds, motherfucker.

http://cassandralegacy.blogspot.ca/2016/07/some-reflections-on-twilight-of-oil-age.html?showComment=1468764605088#c5243595373854116619

JuanP on Tue, 19th Jul 2016 8:57 am

Hey Marmi, Losing it again?

GregT on Tue, 19th Jul 2016 9:10 am

“Hello Anonymous, (marmi-dolt)

“Of course, oil refineries are fairly efficient. In its report the Hill’s Group stresses that much. I and others say ditto. This is not what we are talking about here. We are considering the whole system, from oil exploration to end-users. The matter is that relative to the early stages in the development of the oil industry, the total energy costs of producing the energy reaching end-users has been increasing steadily barrel after barrel and we are now getting close to a point when no significant energy will reach end-users. We expect that the industry will breakdown well before this critical point is reached.”

—Dr Louis Arnoux

You seem to be having problems again marmico. Not much of a big picture guy, apparently. Stick to your comforting little freddy charts.

marmico on Tue, 19th Jul 2016 10:43 am

JuanP uses toe nail entrails and the ETP fuctard uses reservoir temperatures. Who could guess which one is the most retarded when it comes to net energy delivered to the consumer (end user).

Arnoux is another fuctard! Period. When it comes to empiricism they always hide behind mommy’s apron.

So GreggieTee have a go at empirical data. What was well head and refinery EROI in 1973?

shortonoil on Tue, 19th Jul 2016 11:17 am

“So GreggieTee have a go at empirical data. What was well head and refinery EROI in 1973? “

To answer that we would have to know how many refineries you visited that year, and how many pipes you pissed on while there.

We take the entire systems approach.

rockman on Tue, 19th Jul 2016 11:45 am

NR – OK if the bulk of the oil isn’t owned by speculators then who? The producers? Why would they produce oil they couldn’t sell and then pay to store it? They would just leave it in the ground for free, right?

What about refineries? They always have some oil in storage but that’s working storage…not long term. But if they do have some in long term then it’s either done on speculation or just stocking up on cheaper oil. But so what: that still makes them oil buyers…right?

Back to the same question: how is a “surplus” defined? By consumption? No surplus there: consumers are buying as much as they can afford as fast as they can. By price? As the well documented data shows current prices are well above the long term average. So now you define “surplus” as a high price period? That makes no sense.

So I’ll keep irritating folks who keep using “surplus” by always asking the same question: on what basis do we have a surplus. Sales volume? Production volume shut in? Prices that are lower then historical average.

Take note: no one has yet to logically answer such basic questions, have they? It real easy IMHO: it’s when the PRODUCER of a commodity has a big volume of inventory he can sell. Which isn’t the case of oil producers today, is it? Or when the PRODUCER has to lower prices below historic averages. Which isn’t the case today, is it? Consider the KSA: the vast majority of the production recovered 100% of their development costs decades ago. BTW most of which wasn’t paid for by the KSA. And they certainly aren’t sell oil at a lost: current prices are at least several times greater then their lease operating expenses. Of course their revenue might be less then their budget plans but that obviously has nothing to do with defining a “surplus”, does it?

GregT on Tue, 19th Jul 2016 12:13 pm

Where’s planter with her repetitive expert ‘analysis’?

Glut-glut-gluttilty-glut-glut-glut.

Glut!

Cheers!

JuanP on Tue, 19th Jul 2016 12:22 pm

Marmi, Your multiple personality disorder and your toenails fetish make you one of the funniest freaks I have ever met in my life. I am clipping my toenails today, if you post your address here I will mail them to you. You can PM me if you are too shy! LOL!

JuanP on Wed, 20th Jul 2016 8:07 am

“The Peak Oil Paradox – Revisited” by Euan Mearns

https://www.theautomaticearth.com/2016/07/the-peak-oil-paradox-revisited/

This article was posted by Raul Ilargi over at The Automatic Earth. I sorely miss the days when we had them, and Nicole Foss and many others, over at The Oil Drum. The articles and the comments threads were so good and so long there that I spent almost a decade reading them without posting more than a handful of comments over the years. I felt I had little to add to the conversation by the time I was done reading.