Page added on April 27, 2014

Is Peak Oil Waiting for Godot?

Waiting for Godot was a two act play by Samuel Beckett where two men kept waiting for Godot and they just kept waiting and waiting and waiting… And no, I don’t think we will be kept waiting and waiting like the characters in that play. Peak oil is about to arrive, in my opinion anyway.

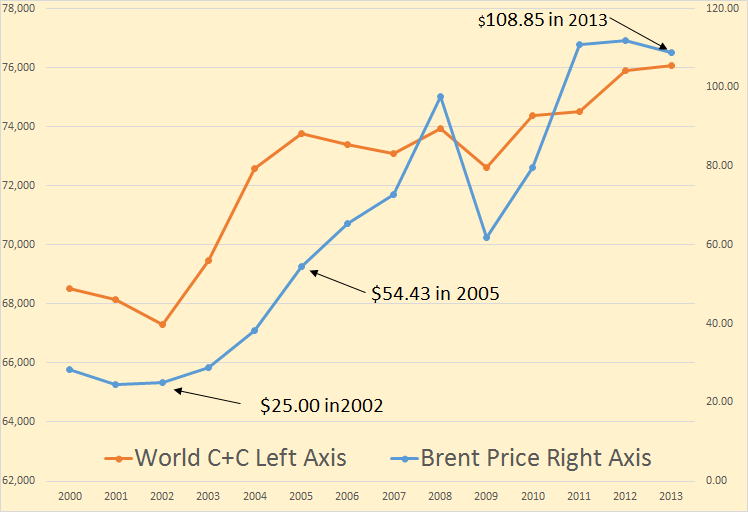

Way back in 2005 we thought it likely that crude oil production had peaked at just under 74 million barrels per day. During the preceding three years C+C production had risen by 6,481,000 barrels per day or 2,160,333 barrels per day per year. The reason for that dramatic increase was a doubling in the price of oil from $25 per barrel in 2002 to $54.43 in 2005.

So oil production depends, to a great extent, the price of oil. The more money the more oil. However… The C+C data in all charts below are in thousand barrels per day.

You can see that another doubling of Brent oil price in the next 8 years brought only 1,283,000 bp/d of new oil on line, or an average of 160,375 bp/d per year.

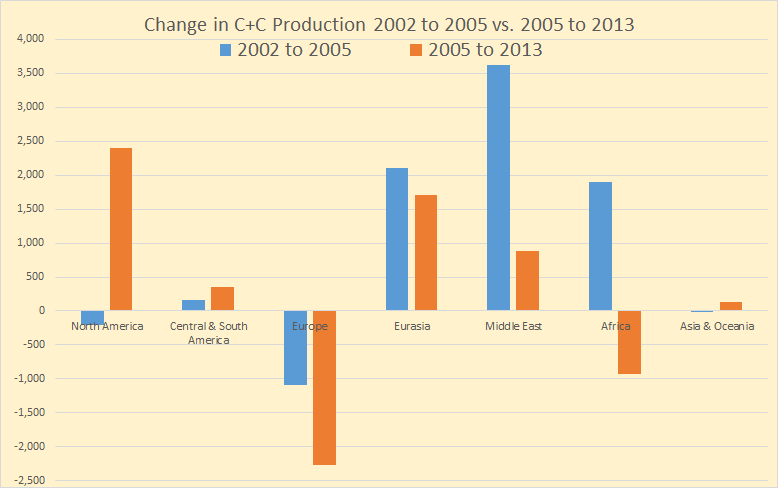

So where did the increase in C+C come from between 2002 and 2005, and where has it come from since.

You can see the major addition to World C+C between 2002 and 2005 was from Eurasia, (FSU) the Middle East and Africa. The only major decline was from Europe, primarily the North Sea. Since 2005 the major gainers were North America followed by the Middle East and Eurasia, which we used to refer to as FSU. But 8 years is a long time, what has happened during those 8 years.

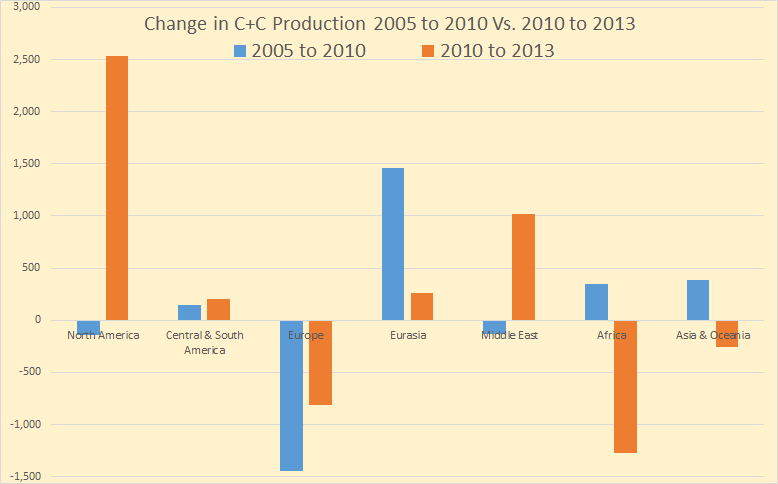

This is the chart that really tells the tale. During the last three years the lions share of all gains in C+C production has come from North America. The Middle East has shown some increase but everyone else is flat to down except for a slight increase from Eurasia, or primarily Russia. So lets look at the combined production of those five geographical areas.

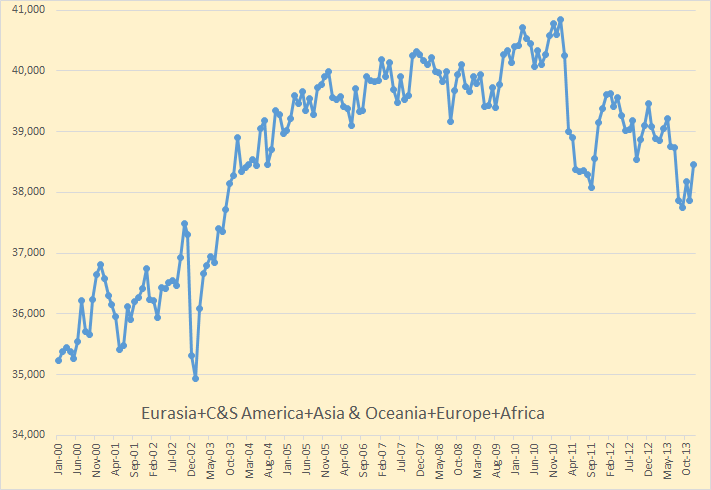

These five geographical areas, all except North America and the Middle East, product 51% of the world’s oil, down from 54% in 2010. They are down over two million barrels per day since 2010 and they, combined, are clearly in decline. In fact Russia, the world’s largest producer of C+C, is believed to be in decline, starting this year.

Leaving out the Middle East for a moment, the question is: Can North America continue to increase production as fast as these five geographical areas decrease production? With Russia now likely to join the decline club, I think that is extremely unlikely.

The Middle East is a question mark. Iraq is likely to increase production but by no great amount. Iran is a political question mark but I doubt if anything will happen there within a year or so. And when sanctions are finally lifted they will still not produce what they did before sanctions. They were clearly in decline before sanctions but a good maintenance contractor could get them back to 3.75 million barrels per day in a few years. That is about 1 million bp/d from where they are today.

I don’t expect any huge drop in Middle East production any time soon. By the same token there is not likely to be any great increase in their production either. Every nation there, including Saudi Arabia, is producing every barrel they possibly can. Kuwait and the UAE have had huge infill drilling programs going for several years now and that has increased their combined production by about 400,000 barrels per day over what they were capable of producing prior to the collapse of 2008. But they both show signs of peaking and will likely see a decline this year.

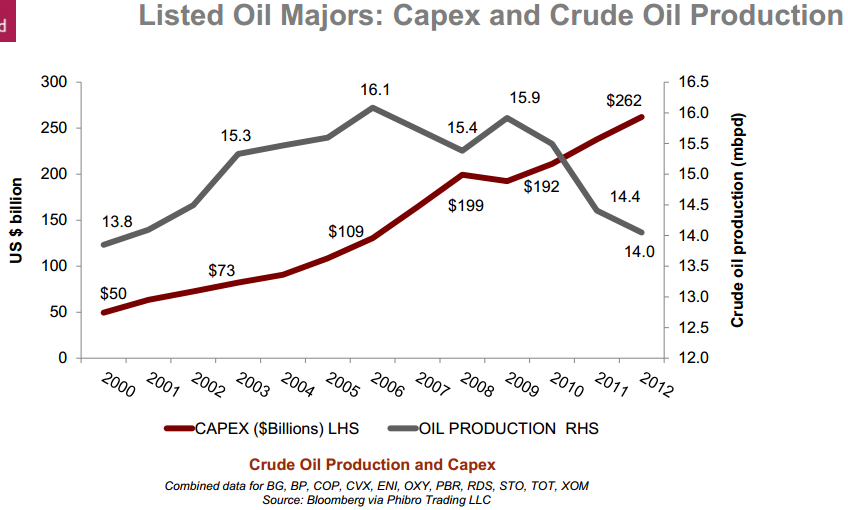

But what I am trying to show is that every nation on earth is straining to produce every barrel they can. With Oil pushing $110 a barrel they are not holding back. And they are spending a lot more money in that attempt.

The combined capex of the 11 majors listed under this chart has increased 5 fold. And for all that money their production has declined by over 2 million barrels per day. Steve Kopits says:

• Costs have outpaced revenues by 2-3% per year. Profitability is down 10-20%.

• The vast majority of public oil & gas companies require oil prices of over

$100/bbl to achieve positive free cash flow under current capex and dividend

programs.

• Nearly half of the industry needs more than $120/bb. The 4th quartile, where

most US E&Ps cluster, needs $130/bbl or more.

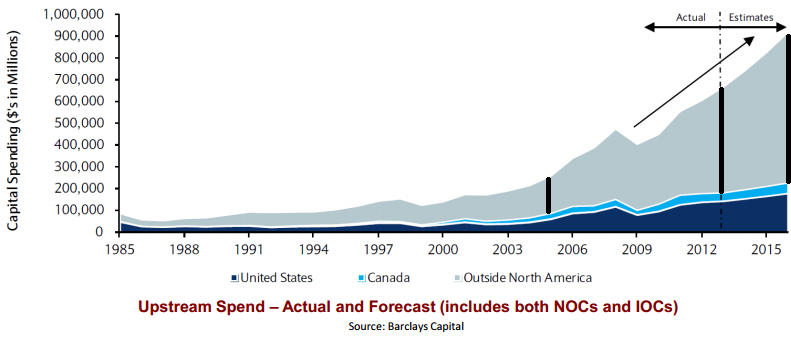

The bold lines on the chart below are mine. I want to show the difference in what was spent in 2005 and today outside North America for no gain in production.

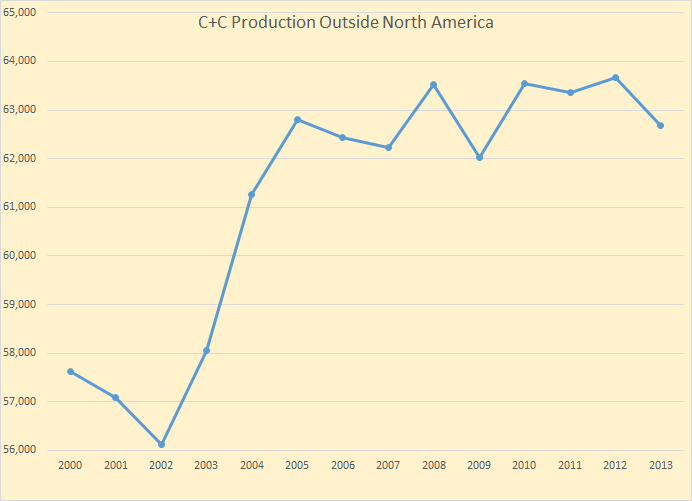

Capital expenditures continue to rise yet the price of oil hasn’t increased for over three years. And notice the chart above, from Steven Kopits slides, shows the lions share of capex is being spent outside North America yet 2013 C+C production outside North America is actually below where it was in 2005.

Production is not rising. The price of oil is not rising. Capital Expenditures are rising dramatically. This cannot continue.

It is my opinion that Godot will arrive no later than 2017 but I expect him a year earlier.

Peak Oil Barrel by Ron Patterson

5 Comments on "Is Peak Oil Waiting for Godot?"

GregT on Sun, 27th Apr 2014 6:47 pm

Since 2000, population growth has added another 1.5 billion people to the planet, increasing the demand side of the equation. The perfect storm is brewing on the horizon.

forbin on Mon, 28th Apr 2014 6:04 am

its seems Limits to Growth was taken as action plan and not a warning ….

forbin

eugene on Mon, 28th Apr 2014 8:04 am

Also helps when you switch from counting oil to counting oil plus condensate. All the endless talk is really just reality avoidance.

MSN fanboy on Mon, 28th Apr 2014 11:56 am

Don’t worry: I am positively sure 5 new Saudi Arabia petro states will be found and bought online between 2015 – 2030.

HARM on Mon, 28th Apr 2014 4:21 pm

“its seems Limits to Growth was taken as action plan and not a warning .”

Where? Certainly not in anywhere the U.S., Middle East, Asia, Africa or South America.