Page added on January 30, 2013

IMF and resource scarcity

During the past week the future of the world economy has been discussed in Davos, Switzerland. Below, I think it is appropriate to quote Christine Lagarde, the Managing Director of the International Monetary Fund (IMF). In her speech of 23 January she presented the following viewpoint:

The burning question is this: how we can make sure that all regions grow strongly, converge rapidly, and succeed in meeting the aspirations of their people? To answer this question, we need to reflect upon some of the megatrends shaping the future. Many thought leaders are pondering this issue, including here at the World Economic Forum. I would submit the following four pivot points:

• First, a growing demand for individual empowerment, including for women, and a growing sense of a single global community.

•Second, a reallocation of political and economic power across the world. By 2025, for example, two-thirds of the world’s population will live in Asia. This can lead to greater cooperation or to greater tension and competition.

•Third, a seismic shift in demographics, as the “youth bulge” in various emerging regions rubs up against the “graying” populations elsewhere. Sixty percent of the population in the Middle East and North Africa is under 30. It is 70 percent for sub-Saharan Africa. Again, either a great opportunity or a source of instability.

•Fourth, increasing vulnerability from resource scarcity and climate change, with the potential for major social and economic disruption. This is the real wild card in the pack.

The thing that interests us most at Global Energy Systems (GES) in Uppsala is what Lagarde called the ”wild card”, the fourth megatrend. For us, ”resource scarcity” is primarily associated with Peak Oil, Peak Gas and Peak Coal but there are other resources that can also be limiting. There is a person working at the IMF who is especially interested in this issue – Michael Kumhof, Deputy Division Chief at the Modelling Division of the IMF’s Research Department. Of those analyses upon which his research activity is focussed, we at GES are primarily interested in his attempt to include Peak Oil in the economic estimations of future changes in GDP. His work in this area has progressed as far as the publication of two ”working papers”.

The Future of Oil – Geology versus Technology: http://www.imf.org/external/pubs/ft/wp/2012/wp12109.pdf

Oil and the World Economy: Some Possible Futures: http://www.imf.org/external/pubs/ft/wp/2012/wp12256.pdf

I should mention that the IMF points out that, ”a Working Paper should not be reported as representing the views of the IMF. The views expressed in a Working Paper are those of the author(s) and do not necessarily represent those of the IMF or IMF policy. Working Papers describe research in progress by the author(s) and are published to elicit comments and to further debate.” We have been encouraged by the idea that the IMF desires input and debate in this area.

I met Michael Kumhof at the conference that was organised by ASPO-USA in Austin, Texas in November 2012. Of course, I appreciated that he had attempted to include Peak Oil in his analyses. We discussed the refinements that occurred to me at that time. When Michael mentioned that he was going to visit Stockholm, Oslo and Brussels at the end of January I invited him to visit us in Uppsala. For practical reasons he had planned to arrive in Sweden last Sunday but my invitation caused him to come a day earlier. The Sunday was then transformed into a working day with Michael. The GES group was able to hear an expanded version of the presentation that he will make on Wednesday for the European Commission. We were able ask questions and discuss his work and we soon began to discuss future research collaboration. Now it remains only to discuss how the collaboration will be organised in practice.

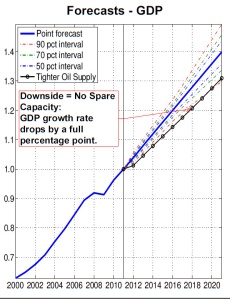

In order to include Peak Oil in economic calculations a model must include a mathematical description of future oil production. The simplest mathematical description, even if it has large deficiencies, is the Hubbert Model. I will not discuss all the equations that are included in the calculations that the IMF has made regarding Peak Oil (those who are interested can read the two articles above) but the final result was that future growth of GDP was influenced negatively by it. Michael Kumhof pointed out that a large problem is that economists and scientists speak different languages and his view was that it will be difficult to change the economic language. Together we will try to introduce new terms into the language of economics and one of those new terms is ”Peak Oil”.

3 Comments on "IMF and resource scarcity"

GregT on Wed, 30th Jan 2013 10:33 pm

“Fourth, increasing vulnerability from resource scarcity and climate change, with the potential for major social and economic disruption. This is the real wild card in the pack.”

It is the wild card that will eventually end growth. We can choose to soften the blow by ending growth now, or wait until climate change and resource scarcity forces us to.

If we wait, we risk losing a hospitable planet, and we will not have the resources available for transition. Sounds like a recipe for disaster to me.

BillT on Thu, 31st Jan 2013 1:18 am

Science and economics don’t mix. Oil and water. Reality and Money. The future and BAU. Nothing new here. The world is headed for the extinction cliff and elite of the world are pushing the gas peddle as hard as they can to keep it going because all they can see is the next quarter.

Keith_McClary on Thu, 31st Jan 2013 4:45 am

BillT:

“gas peddle”? I thought you misspelled “pedal”, but on second thought, “pushing the gas peddle” is appropriate:

Verb

1) Try to sell (something, esp. small goods) by going from house to house or place to place.

2) Sell (an illegal drug or stolen item). <—————-