We are in a global recession

Re: We are in a global recession

http://www.globalresearch.ca/nothing-is ... lt/5501779

“Nothing Is Moving,” Baltic Dry Index Crashes as Insiders Warn International “Commerce Has Come To a Halt”

“Nothing Is Moving,” Baltic Dry Index Crashes as Insiders Warn International “Commerce Has Come To a Halt”

"We are mortal beings doomed to die

-

onlooker - Fission

- Posts: 10957

- Joined: Sun 10 Nov 2013, 13:49:04

- Location: NY, USA

Re: We are in a global recession

Oil tumbles below $ 30 per barrel

https://www.washingtonpost.com/news/ene ... er-barrel/

With ol's news, the signs are starting to all point in a certain direction...

https://www.washingtonpost.com/news/ene ... er-barrel/

Oil plunged sharply below $ 30 per barrel Friday after flirting with that level all week, as the market anticipated a flood of new Iranian oil due to the lifting of sanctions.

Brent crude on the Intercontinental Exchange in London dropped as low as $ 28.82, and was down over 6 percent Friday early afternoon. West Texas Intermediate crude, on the New York Mercantile Exchange, fell as low as $ 29.13.

The moves accompanied a broader plunge in the U.S. markets, with the Dow Jones industrial average breaking below 16,000, and off over 300 points overall.

The oil price decline in 2016 has been remarkable. Brent closed out 2015 at $ 37.28 per barrel on Dec. 31. Its low so far Friday was nearly $ 8 cheaper, a decline of some 21 percent.

There’s a “trifecta going on here” in terms of factors that are driving down oil prices, said Tom Watters, a managing director at Standard & Poor’s specializing in the oil and gas sector. The three factors are a “stronger dollar, concerns about demand growth, and of course, supply,” he said.

A stronger dollar makes oil more pricey for purchase in other currencies, which decreases global demand. Worries about whether demand will grow more broadly, meanwhile, are closely tied to China and the sense that a major consumer of the commodity may want less oil than previously thought.

And then, of course, there’s supply, supply, supply, which has been the bottom line here since the oil price plunge began back in late 2014. OPEC’s strategy of maintaining market share, adopted last November, is not having as fast an effect as may have been originally anticipated when it comes to pushing other producers to back down as prices plunge.

Russia is at “record output,” Watters said, and U.S. shale has been surprisingly resilient. And now, next up is Iran, which could see sanctions lifted in the next few days.

As for the current price and how low it could go, that’s becoming a subject of very hot discussion, with most observers and analysts still feeling that oil won’t go below $ 20, said Michelle Michot Foss, chief energy economist at the Bureau of Economic Geology at the University of Texas at Austin. But some think it will fall farther than that.

“Everybody is searching for a floor, and we just haven’t gotten to it,” says Foss.

“It’s going to be a hard landing because of everything else that’s going on out there.”

With ol's news, the signs are starting to all point in a certain direction...

-

dohboi - Harmless Drudge

- Posts: 19990

- Joined: Mon 05 Dec 2005, 04:00:00

Re: We are in a global recession

onlooker wrote:http://www.globalresearch.ca/nothing-is-moving-baltic-dry-index-crashes-as-insiders-warn-international-commerce-has-come-to-a-halt/5501779

“Nothing Is Moving,” Baltic Dry Index Crashes as Insiders Warn International “Commerce Has Come To a Halt”

Read this before jumping to that conclusion

http://www.snopes.com/cargo-ships-atlantic-map/

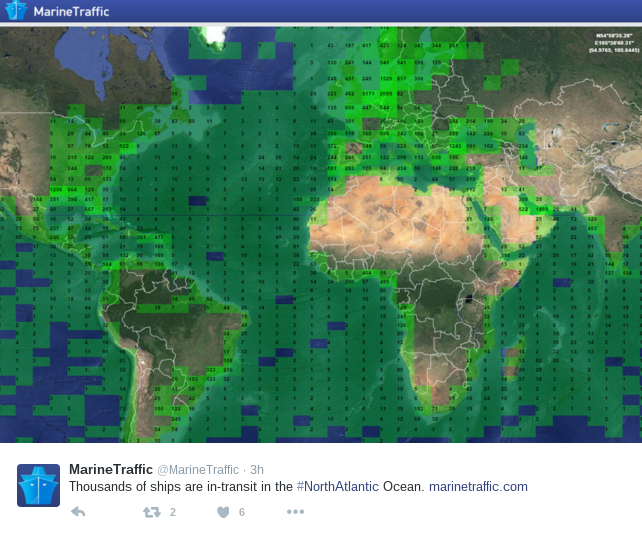

An AIS system is not ideal for tracking cargo ships in the middle of the ocean. Luckily, AIS also uses satellite information to track ships. On 12 January 2016, Marine Traffic posted an image to Twitter along with a message stating that there were "thousands of cargo ships in-transit" in the North Atlantic:

Religion is regarded by the common people as true, by the wise as false, and by rulers as useful.:Anonymous

Our whole economy is based on planned obsolescence.

Hungrymoggy "I am now predicting that Europe will NUKE ITSELF sometime in the first week of January"

Our whole economy is based on planned obsolescence.

Hungrymoggy "I am now predicting that Europe will NUKE ITSELF sometime in the first week of January"

-

dolanbaker - Intermediate Crude

- Posts: 3855

- Joined: Wed 14 Apr 2010, 10:38:47

- Location: Éire

Re: We are in a global recession

Thanks Dolan, so we all must now be diligent in interpreting the method of tracking!

"We are mortal beings doomed to die

-

onlooker - Fission

- Posts: 10957

- Joined: Sun 10 Nov 2013, 13:49:04

- Location: NY, USA

Re: We are in a global recession

Looks like we need to use the same diligence that we would use to read any political manifesto, in other words they usually only contain half of the truth!

Religion is regarded by the common people as true, by the wise as false, and by rulers as useful.:Anonymous

Our whole economy is based on planned obsolescence.

Hungrymoggy "I am now predicting that Europe will NUKE ITSELF sometime in the first week of January"

Our whole economy is based on planned obsolescence.

Hungrymoggy "I am now predicting that Europe will NUKE ITSELF sometime in the first week of January"

-

dolanbaker - Intermediate Crude

- Posts: 3855

- Joined: Wed 14 Apr 2010, 10:38:47

- Location: Éire

Re: We are in a global recession

Thanks for the correction, db. But the Baltic Index has indeed been dropping rather precipitously since the 6th or so, and is at historical lows--lower than during the crash of '08.

http://www.bloomberg.com/quote/BDIY:IND

But perhaps this indicates other things than predictions of future traffic?

http://www.economist.com/blogs/economis ... explains-7

http://www.bloomberg.com/quote/BDIY:IND

But perhaps this indicates other things than predictions of future traffic?

http://www.economist.com/blogs/economis ... explains-7

-

dohboi - Harmless Drudge

- Posts: 19990

- Joined: Mon 05 Dec 2005, 04:00:00

Re: We are in a global recession

Too many ships chasing too little trade, more a sign of slow growth than anything else.The current malaise is much more a result of the overall supply of ships than a harbinger of doom for the world economy. In the run up to the financial crisis,

Which I believe many of us said here after the last crisis that growth will never recover in the same way that it did after previous recessions.

Religion is regarded by the common people as true, by the wise as false, and by rulers as useful.:Anonymous

Our whole economy is based on planned obsolescence.

Hungrymoggy "I am now predicting that Europe will NUKE ITSELF sometime in the first week of January"

Our whole economy is based on planned obsolescence.

Hungrymoggy "I am now predicting that Europe will NUKE ITSELF sometime in the first week of January"

-

dolanbaker - Intermediate Crude

- Posts: 3855

- Joined: Wed 14 Apr 2010, 10:38:47

- Location: Éire

Re: We are in a global recession

More evidence of shipping slowdown:

Chinese Shipyards See New Orders Fall by Almost Half in 2015

http://www.bloomberg.com/news/articles/ ... lf-in-2015

Chinese Shipyards See New Orders Fall by Almost Half in 2015

New orders received by Chinese shipbuilders fell by nearly half last year from 2014, suggesting more consolidation is in order as the country’s appetite for raw materials wanes and shipping rates languish at multiyear lows.

http://www.bloomberg.com/news/articles/ ... lf-in-2015

-

dohboi - Harmless Drudge

- Posts: 19990

- Joined: Mon 05 Dec 2005, 04:00:00

Re: We are in a global recession

dohboi wrote:More evidence of shipping slowdown:

Chinese Shipyards See New Orders Fall by Almost Half in 2015

New orders received by Chinese shipbuilders fell by nearly half last year from 2014, suggesting more consolidation is in order as the country’s appetite for raw materials wanes and shipping rates languish at multiyear lows.

http://www.bloomberg.com/news/articles/ ... lf-in-2015

New ships are only needed for one of two reasons. Either an old ship sinks/gets scrapped or the market is bigger and you need additional ships to fulfill demand.

The thing people so often fail to grasp is ships do not need as much increase in crew size per ton capacity as they get larger. A Very Large Crude Carrier (VLCC) has about the same size crew as a Seawaymax Cargo ship coming into the Great Lakes, but its cargo capacity is 5 to 10 times larger. Thus for about the last 40 years there has been a transition to the largest cargo capacity designs that could function in a given route situation, Seawaymax ships are built to get the most capacity possible connecting the upper lakes to the Atlantic Ocean. Panamax ships were designed to fit ever possible cubic meter of the original lock system. Suezmax ships were designed to be just small enough to pass through the Suez canal. ChinaMax ships were designed to just fit into the deep water ports in China and the west coast of the USA/Europe.

Panamax ships will become a new higher number in the middle of 2016 when the upgraded canal opens for business in just a few months. Suezmax ships today are larger than they were 40 years ago, the canal has been widened and deepened several times in the last 40 years. Chinamax ships have resulted in port improvements in places like Long Beach, California to improve the handling capacity of the port. About the only part of the system that has not been improved is the Seaway system linking the upper lakes to the Atlantic, there have been proposals for an improved system but neither Canada nor the USA have taken action either individually or jointly to improve the system. Older and smaller ocean freight can still use the Seaway, but the number of these ships is declining every year as the shipping companies seek to maximize efficiency with the largest ships they can fit through the system they use the most.

The USA used to lead the world on big infrastructure projects, now we are left further and further behind.

Alfred Tennyson wrote:We are not now that strength which in old days

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

-

Tanada - Site Admin

- Posts: 17055

- Joined: Thu 28 Apr 2005, 03:00:00

- Location: South West shore Lake Erie, OH, USA

Re: We are in a global recession

Older and smaller ocean freight can still use the Seaway, but the number of these ships is declining every year as the shipping companies seek to maximize efficiency with the largest ships they can fit through the system they use the most.

Why does this invoke to me also the pattern of using less workers and getting more work or productivity out of those lesser workers. This country seems to be the last one practically to really embrace cost cutting but now it really seems to be doing this across the board. Even some packaged food I still buy like cereal seems to contain less cereal per box.

"We are mortal beings doomed to die

-

onlooker - Fission

- Posts: 10957

- Joined: Sun 10 Nov 2013, 13:49:04

- Location: NY, USA

Re: We are in a global recession

onlooker wrote:Older and smaller ocean freight can still use the Seaway, but the number of these ships is declining every year as the shipping companies seek to maximize efficiency with the largest ships they can fit through the system they use the most.

Why does this invoke to me also the pattern of using less workers and getting more work or productivity out of those lesser workers. This country seems to be the last one practically to really embrace cost cutting but now it really seems to be doing this across the board. Even some packaged food I still buy like cereal seems to contain less cereal per box.

I remember a study I read years ago about when the big packaged food companies in the USA hired accountants to maximize their profit. The company in question sold jars of olives and the accountants recommended that by putting one less olive in every jar they could increase profits by 3 percent or some such figure, because the consumers would never notice a single olive difference.

Well at this point it is no longer an unnoticable difference, cereal boxes are less full, coffee cans that used to be 3 pounds are now 1 kg (2.2 pounds), and a can of the olives I liker, well lets just say when I pull the lid off the gap after draining is quite obvious.

Alfred Tennyson wrote:We are not now that strength which in old days

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

-

Tanada - Site Admin

- Posts: 17055

- Joined: Thu 28 Apr 2005, 03:00:00

- Location: South West shore Lake Erie, OH, USA

Re: We are in a global recession

Can we nudge this back towards oil?

This seems pretty level headed to me.

This seems pretty level headed to me.

Since New Year’s Day Australia’s blue-chip stocks have sunk almost 10 per cent, reflecting similar falls in Europe and the US. While Australians were enjoying their summer BBQs, the real discounted future flow of expected company earnings (what share prices are broadly meant to reflect) very noticeably collapsed.

The apparent cause? Further falls in the prices of shares in China’s Shanghai exchange, tweaks to the value of the yuan, and an unexpectedly low oil price below $US30 a barrel. Yet these factors don’t justify the latest sell-off. Little that actually matters in the real economy has changed (or even could have changed in so short a time).

Chinese shares prices are sensibly returning to earth after ballooning 250 per cent between late 2014 and the middle of last year. And for all the air that has seeped out since, the market is still almost 50 per cent higher. Barely more than 10 per cent of Chinese even own shares in their highly speculative market, which helps contain any fallout. Even the US October 1987 stockmarket crash, largely inexplicable and much larger, had little enduring economic impact.

The ultra-low oil price is not the product of some global deflationary spiral but the machinations of Saudi Arabia to price out higher-cost competition in the US, and soon Iran. In any case the oil-rich kingdom’s considerable financial resources won’t be able to plug budget deficits of more than $US100 billion a year forever.

In the meantime, the cheaper petrol should boost discretionary spending in oil-importing countries (the overwhelmingly majority).

This week the International Monetary Fund will pencil in global growth of more than 3 per cent this year, little changed from last year. Jobs growth remains strong here, the US, and is even improving in Europe.

Financial prices notoriously veer widely from the value of the underlying assets they represent; they are much less “rational” than the efficient markets hypothesis, which contends share prices are the best reflection of all available information at a given time suggests.

As Keynes once quipped — himself a successful trader — markets can stay irrational for longer than you can stay solvent.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: We are in a global recession

I totally agree that it is not all 'rational market' stuff. But I am equally wary of people just blaming the Saudis (much as I loath the bastards). And I would say that news of slowdown in shipping certainly is relevant to oil. Don't the boats mostly run on oil? And of course a slow down would also mean that there is less being produced and transported on land, as well, all things that tend to use a lot of oil and oil products.

-

dohboi - Harmless Drudge

- Posts: 19990

- Joined: Mon 05 Dec 2005, 04:00:00

Re: We are in a global recession

What I am apprehensive about is pretty simle. Despite all the wailing and knashing of teeth about deflation effects we know the Stock Market fell about 50 percent when the housing bubble popped. Then the FED intervened with monetary policy and pumped the stock market back to where it had been and then even higher.

In a normal business cycle a 50 percent drop would have taken a much longer time to recover, and it would have been a slow process with market corrections rationalizing prices all along the way.

Now here we sit with world markets all artificially inflated looking for the pin pop. Will they go down 50 percent like 08-09 or will they stall before that? Or will they deflate even further than 50 percent because the national banks/FED are all out of policies to pump them up?

In a normal business cycle a 50 percent drop would have taken a much longer time to recover, and it would have been a slow process with market corrections rationalizing prices all along the way.

Now here we sit with world markets all artificially inflated looking for the pin pop. Will they go down 50 percent like 08-09 or will they stall before that? Or will they deflate even further than 50 percent because the national banks/FED are all out of policies to pump them up?

II Chronicles 7:14 if my people, who are called by my name, will humble themselves and pray and seek my face and turn from their wicked ways, then I will hear from heaven, and I will forgive their sin and will heal their land.

- Subjectivist

- Volunteer

- Posts: 4701

- Joined: Sat 28 Aug 2010, 07:38:26

- Location: Northwest Ohio

Re: We are in a global recession

KSA/OPEC was merely responding to the increase in US production of 4mmbd in just a few years, which reduced imports of OPEC oil, especially Arab Light oil.

OPEC didn't have much option, pretty hard to undercut WTI from an Atlantic away when WTI was landlocked. So they increased production and waited for low prices to kill the more expensive product.

Makes perfect sense.

OPEC didn't have much option, pretty hard to undercut WTI from an Atlantic away when WTI was landlocked. So they increased production and waited for low prices to kill the more expensive product.

Makes perfect sense.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: We are in a global recession

Well put, Pops and Sub...

and now this: Iran will begin to ship 500,000 barrels per day, starting immediately, and plans to add another half a million barrels per day within a few months time:

http://www.bloomberg.com/news/articles/ ... lobal-glut

and now this: Iran will begin to ship 500,000 barrels per day, starting immediately, and plans to add another half a million barrels per day within a few months time:

http://www.bloomberg.com/news/articles/ ... lobal-glut

-

dohboi - Harmless Drudge

- Posts: 19990

- Joined: Mon 05 Dec 2005, 04:00:00

Re: We are in a global recession

Dow crashing again--down nearly 2%, most of that in the first few minutes of trading.

Down over 2000 since it's high at the end of last year, that's nearly a 12% 'correction' so far...

Artist's Impression Of The Stock Market "Correction"

Worth a thousand words...

Down over 2000 since it's high at the end of last year, that's nearly a 12% 'correction' so far...

DEFINITION of 'Correction'

A reverse movement, usually negative, of at least 10% in a stock, bond, commodity or index to adjust for an overvaluation. Corrections are generally temporary price declines interrupting an uptrend in the market or an asset. A correction has a shorter duration than a bear market or a recession, but it can be a precursor to either.

Artist's Impression Of The Stock Market "Correction"

Worth a thousand words...

-

dohboi - Harmless Drudge

- Posts: 19990

- Joined: Mon 05 Dec 2005, 04:00:00

Re: We are in a global recession

As far as "corrections" go, I suspect that we've a long way to go.

Religion is regarded by the common people as true, by the wise as false, and by rulers as useful.:Anonymous

Our whole economy is based on planned obsolescence.

Hungrymoggy "I am now predicting that Europe will NUKE ITSELF sometime in the first week of January"

Our whole economy is based on planned obsolescence.

Hungrymoggy "I am now predicting that Europe will NUKE ITSELF sometime in the first week of January"

-

dolanbaker - Intermediate Crude

- Posts: 3855

- Joined: Wed 14 Apr 2010, 10:38:47

- Location: Éire

Re: We are in a global recession

Maybe, Wall Street figured it out that it gets pretty lonely when you're the only game left in town.

The things that will destroy America are prosperity-at-any-price, peace-at-any-price, safety-first instead of duty-first, the love of soft living, and the get-rich-quick theory of life.

... Theodore Roosevelt

... Theodore Roosevelt

-

Lore - Fission

- Posts: 9021

- Joined: Fri 26 Aug 2005, 03:00:00

- Location: Fear Of A Blank Planet

Who is online

Users browsing this forum: No registered users and 115 guests