don't think what, Pete?

a few years ago you said (as I did) that LTO wouldn't amount to a thing? its a thing

that reserves don't fluctuate with price/tech? pretty sure they do

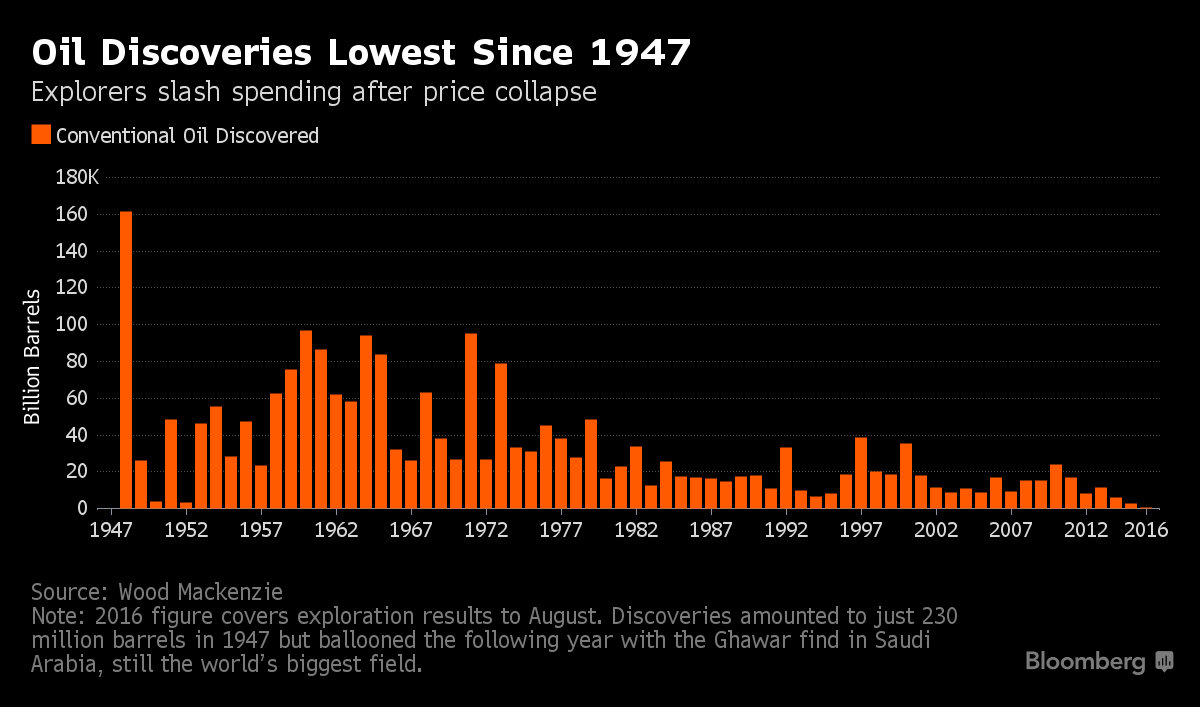

Laherrere "normalized " discoveries, what does that even mean?

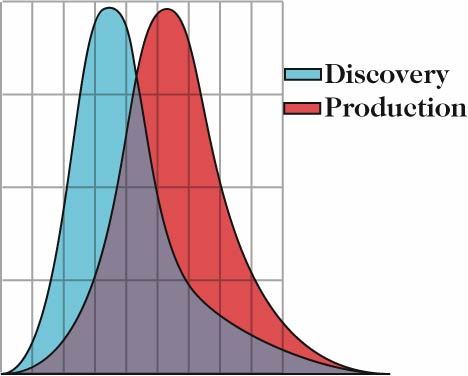

Campbell & Laherrere predicted an ultimate around 2T bbls and peak in the early oughts. That would have happened right on schedule if extraction mirrored discoveries with a 40 year offset. Thing is, h drilling and fracking came into range and the result is oil production grew past their '98 guess and pusholine is still $2/gallon.

Here is the '98 guess:

https://aleklett.wordpress.com/2015/02/ ... l-in-1998/

https://aleklett.wordpress.com/2015/02/ ... l-in-1998/If you look close you can see that they knew the N Sea would deplete but they guessed that FSU was toast - doesn't even look like the plot continues. Turns out that both the US and RU are closer to 10 than 5 and the world closer to 32B bbl/yr than 27

--Laherrere is the best. But he says

Don't even think about forecasting in less than trillion barrel units

Ultimate guess now may be somewhere around 3Tbbls, unless it's 4T

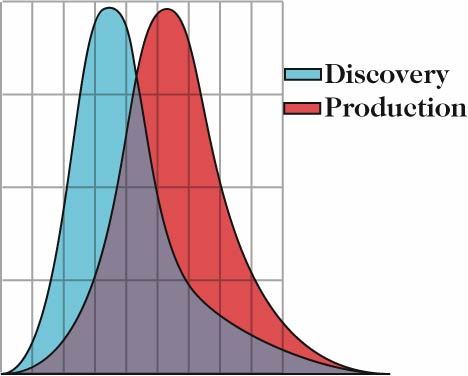

production follows discovery with about a 40 year lag (Hubbert did too)

The problem is reserves change with tech and price and exploration and infill and lots of stuff I don't know about but they all change backdated discoveries, If they didn't there would be some huge difference between some guy's WAG for a press release in 1942 and however much is finally extracted.

Really, that last point,

production curve must follow discovery curve is the bumper sticker that hooked me. It is the first PO pic I ever drew (and the closest to famous):

But the discovery curve keeps growing, so Laherrer's ultimate keeps growing and the peak keeps receding. Obviously, pointing to backdated discoveries has tarnished somewhat for me as a forecasting tool. Which isn't to say that when all is said and done that discoveries won't match extraction with a 40 year offset, just that it isn't the predictor I thought it was initially.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)