MADOR

MADOR

I first tossed out this concept some time ago: Mutually Assured Distribution Of Resources. Similar to the MAD concept developed during the Cold War. Not so much a prediction but just a possible development as resources, especially energy, become scarce beyond the result of pricing. A world where having the capital to acquire commodities doesn’t necessary get a nation what it needs. It’s a world where there isn’t enough for all countries but where two of the most “powerful” dominate such acquisition capability. One possible permutation would be a US/China on top with the rest of the economies (at least the net energy importers) vying for the leftovers.

Other than both the economies of the US and China having the financial strength to dominate I didn’t really flesh out the exact mechanism. But lately I’m seeing one avenue the Chinese are developing: locking up energy, especially oil, not only with acquiring reserves in the ground but thru the new refinery JV’s. Add to that exploration/production JV’s like their recent domination of contracts that now allow them to export the majority of the oil production of the new big kid on the block – Iraq. The US would earn their spot via a combination of domestic reserves, financial strength and perhaps proximity to the Canadian oil sands.

Again more of a lazy day dream then anything concrete. And then I just saw a rather amazing news story: the US govt has just invited the Chinese to join it in naval war games off Hawaii in 2014. This is one of those rare moments when I’m lost for words. The floor is open for comments.

Other than both the economies of the US and China having the financial strength to dominate I didn’t really flesh out the exact mechanism. But lately I’m seeing one avenue the Chinese are developing: locking up energy, especially oil, not only with acquiring reserves in the ground but thru the new refinery JV’s. Add to that exploration/production JV’s like their recent domination of contracts that now allow them to export the majority of the oil production of the new big kid on the block – Iraq. The US would earn their spot via a combination of domestic reserves, financial strength and perhaps proximity to the Canadian oil sands.

Again more of a lazy day dream then anything concrete. And then I just saw a rather amazing news story: the US govt has just invited the Chinese to join it in naval war games off Hawaii in 2014. This is one of those rare moments when I’m lost for words. The floor is open for comments.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: MADOR

It's more likely a financial elite cutting across different countries on top, with governments and military forces working with them to control most of the population. After that, governments fall apart, money loses its value, and military forces or organized armed groups take over. From there....

-

ralfy - Light Sweet Crude

- Posts: 5600

- Joined: Sat 28 Mar 2009, 11:36:38

- Location: The Wasteland

Re: MADOR

The EIA has released their 2012 production & consumption numbers.

But first some definitions:

GNE = Global Net Exports (Top 33 net exporters in 2005, EIA Data)

ANE = Available Net Exports (GNE less Chindia's Net Imports, CNI)

Net Exports = Total Petroleum Liquids + Other liquids (EIA) less consumption

ECI = Ratio of production to consumption

CNI = Chindia's (China + India's) Net Imports

2012 was pretty much a continuation of the 2005 to 2011 trend.

GNE:

2005: 45.5 mbpd & ECI of 3.7

2012: 43.0 & ECI of 3.1

ANE:

2005: 40.7 & GNE/CNI of 9.5

2012: 34.4 & GNE/CNI of 5.0

The GNE/CNI ratio is still on track to approach 1.0, and thus zero ANE, in the year 2030, 17 years hence.

Chindia (China + India):

2005:

Consumption: 9.21

Production: 4.41

CNI: 4.8

2012:

Consumption: 13.67

Production: 5.07

CNI: 8.6

Note that the EIA data for recent Chinese consumption are wrong, at least the last time I checked the website. I obtained (hopefully) more accurate data from the EIA, via email.

Saudi Arabia:

Production (P) - Consumption (C) = Net Exports (total petroleum liquids + other liquids, mbpd)

ECI Ratio = P/C

2005: 11.09 - 1.96 = 9.13

ECI = 5.66

2011: 11.15 - 3.0 = 8.15

ECI = 3.72

2012: 11.54 - 3.22 = 8.32

ECI = 3.58

Note that the increase in Saudi net oil exports from 2011 to 2012 was only 170,000 bpd, and note that their ECI ratio declined from 2011 to 2012. So, despite a small increase in net exports from 2011 to 2012, Saudi Arabia remains on an undulating glideslope toward an ECI ratio of 1.0, when net oil exports would theoretically be zero.

At the 2005 to 2011 rate of decline in the Saudi ECI ratio (EIA data), Saudi Arabia would approach zero net oil exports around 2030.

At the 2005 to 2012 rate of decline in the Saudi ECI ratio, Saudi Arabia would approach zero net oil exports around 2032.

But first some definitions:

GNE = Global Net Exports (Top 33 net exporters in 2005, EIA Data)

ANE = Available Net Exports (GNE less Chindia's Net Imports, CNI)

Net Exports = Total Petroleum Liquids + Other liquids (EIA) less consumption

ECI = Ratio of production to consumption

CNI = Chindia's (China + India's) Net Imports

2012 was pretty much a continuation of the 2005 to 2011 trend.

GNE:

2005: 45.5 mbpd & ECI of 3.7

2012: 43.0 & ECI of 3.1

ANE:

2005: 40.7 & GNE/CNI of 9.5

2012: 34.4 & GNE/CNI of 5.0

The GNE/CNI ratio is still on track to approach 1.0, and thus zero ANE, in the year 2030, 17 years hence.

Chindia (China + India):

2005:

Consumption: 9.21

Production: 4.41

CNI: 4.8

2012:

Consumption: 13.67

Production: 5.07

CNI: 8.6

Note that the EIA data for recent Chinese consumption are wrong, at least the last time I checked the website. I obtained (hopefully) more accurate data from the EIA, via email.

Saudi Arabia:

Production (P) - Consumption (C) = Net Exports (total petroleum liquids + other liquids, mbpd)

ECI Ratio = P/C

2005: 11.09 - 1.96 = 9.13

ECI = 5.66

2011: 11.15 - 3.0 = 8.15

ECI = 3.72

2012: 11.54 - 3.22 = 8.32

ECI = 3.58

Note that the increase in Saudi net oil exports from 2011 to 2012 was only 170,000 bpd, and note that their ECI ratio declined from 2011 to 2012. So, despite a small increase in net exports from 2011 to 2012, Saudi Arabia remains on an undulating glideslope toward an ECI ratio of 1.0, when net oil exports would theoretically be zero.

At the 2005 to 2011 rate of decline in the Saudi ECI ratio (EIA data), Saudi Arabia would approach zero net oil exports around 2030.

At the 2005 to 2012 rate of decline in the Saudi ECI ratio, Saudi Arabia would approach zero net oil exports around 2032.

- westexas

- Expert

- Posts: 248

- Joined: Tue 04 Jun 2013, 06:59:53

Re: MADOR

In regard to Brazil + Iraq to the rescue . . . some data from the EIA follow (total petroleum liquids + other liquids for production):

Production (P) - Consumption (C) = Net Exports (NE)

ECI = P/C

Brazil:

2008: 2.4 - 2.2 = 0.2 mbpd

2012: 2.6 - 2.9 = -0.3

Iraq:

2008: 2.4 - 0.6 = 1.8

2012: 3.0 - 0.9 = 2.1

Brazil + Iraq Net Exports:

2008: 2.0 mbpd & ECI ratio of 1.71

2012: 1.8 mbpd & ECI ratio of 1.47

Note that combined net exports from Brazil + Iraq fell from 2.0 mbpd in 2008 to 1.8 mbpd in 2012 (even if we count biofuels as production in Brazil). Or, the post-2008 increase in net exports from Iraq could not even offset the post-2008 decline in net exports from Brazil.

At the 2008 to 2012 rate of decline in the their combined ECI ratio, Brazil & Iraq would collectively approach zero net exports in about 10 years.

Production (P) - Consumption (C) = Net Exports (NE)

ECI = P/C

Brazil:

2008: 2.4 - 2.2 = 0.2 mbpd

2012: 2.6 - 2.9 = -0.3

Iraq:

2008: 2.4 - 0.6 = 1.8

2012: 3.0 - 0.9 = 2.1

Brazil + Iraq Net Exports:

2008: 2.0 mbpd & ECI ratio of 1.71

2012: 1.8 mbpd & ECI ratio of 1.47

Note that combined net exports from Brazil + Iraq fell from 2.0 mbpd in 2008 to 1.8 mbpd in 2012 (even if we count biofuels as production in Brazil). Or, the post-2008 increase in net exports from Iraq could not even offset the post-2008 decline in net exports from Brazil.

At the 2008 to 2012 rate of decline in the their combined ECI ratio, Brazil & Iraq would collectively approach zero net exports in about 10 years.

- westexas

- Expert

- Posts: 248

- Joined: Tue 04 Jun 2013, 06:59:53

Re: MADOR

Folks – I know it will take a bit of effort to get familiar with westexas’ nomenclature but it will be well worth it. I’ve followed his analysis for a couple of years and it’s the real deal. In particular take note of the net export numbers. I do not believe these take into account the oil that China is trying up through its various JV's.

And: I think I may understand the reason for the US invitation to China to participate in those naval war games. China’s efforts to expand their sphere of influence financially is obvious…it’s in the news almost weekly. They have shown a willingness to back those efforts with some relatively minor military interventions in the past. Not too difficult to imagine this dynamic escalating as we head further down the POD path.

Now flash back to 1988 when a US Navy vessel, the Vincennes, shot down an Iranian commercial airliner killing about 300. The ship’s radar detected an aircraft it mistakenly ID’d as a fighter. There apparently was no IFF broadcast from the Airbus and it appeared to be taking an attack profile. The plane was 6 miles away so there was no opportunity for a visual...just a blip on the screen. The ship had just had a firefight with several Iranian patrol boats so tensions were high. An attempt to contact the Airbus over radio went unanswered. Splash one Airbus.

I suspect the joint naval exercise will be designed to teach each navy how to communicate with each other. Something as simple as having a standard radio frequency could be the difference between a misunderstanding and a firefight. It the Falklands the Brits learned a hard lesson what a relatively cheap missile can do to a ship of the line. All it could take is a single weapons release to rack up a very big body count. It may also allow each force to understand the other’s rules of engagement. Often times in such situations the unknown is more dangerous than the facts. It seems inevitable that the two naval forces will end up in close proximity during some period of heightened tensions. Might be the Sea of Japan, the Arctic or off the coast of Iran. A miscommunication and a nervous trigger finger during a weapons hot situation could be very costly for both sides.

So the plan may not be so much a joining of minds but more preventive medicine.

And: I think I may understand the reason for the US invitation to China to participate in those naval war games. China’s efforts to expand their sphere of influence financially is obvious…it’s in the news almost weekly. They have shown a willingness to back those efforts with some relatively minor military interventions in the past. Not too difficult to imagine this dynamic escalating as we head further down the POD path.

Now flash back to 1988 when a US Navy vessel, the Vincennes, shot down an Iranian commercial airliner killing about 300. The ship’s radar detected an aircraft it mistakenly ID’d as a fighter. There apparently was no IFF broadcast from the Airbus and it appeared to be taking an attack profile. The plane was 6 miles away so there was no opportunity for a visual...just a blip on the screen. The ship had just had a firefight with several Iranian patrol boats so tensions were high. An attempt to contact the Airbus over radio went unanswered. Splash one Airbus.

I suspect the joint naval exercise will be designed to teach each navy how to communicate with each other. Something as simple as having a standard radio frequency could be the difference between a misunderstanding and a firefight. It the Falklands the Brits learned a hard lesson what a relatively cheap missile can do to a ship of the line. All it could take is a single weapons release to rack up a very big body count. It may also allow each force to understand the other’s rules of engagement. Often times in such situations the unknown is more dangerous than the facts. It seems inevitable that the two naval forces will end up in close proximity during some period of heightened tensions. Might be the Sea of Japan, the Arctic or off the coast of Iran. A miscommunication and a nervous trigger finger during a weapons hot situation could be very costly for both sides.

So the plan may not be so much a joining of minds but more preventive medicine.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: MADOR

ROCKMAN wrote:I first tossed out this concept some time ago: Mutually Assured Distribution Of Resources. Similar to the MAD concept developed during the Cold War.

I have thought of this before as well. In the interest of preserving the vested interests of all the segments of the economy outside the energy sector and in order to maintain some semblance of social stability we could see this emerge. This would still be an attempt to keep the status quo stable in terms of the global economic model and the global corporate structure and governance.

This would be a pragmatic although the beginning of desperate attempts to cope with tightening resources while not wanting to threaten the existing paradigm.

Makes sense to me since all the power brokers will remain in control.

Patiently awaiting the pathogens. Our resiliency resembles an invasive weed. We are the Kudzu Ape

blog: http://blog.mounttotumas.com/

website: http://www.mounttotumas.com

blog: http://blog.mounttotumas.com/

website: http://www.mounttotumas.com

-

Ibon - Expert

- Posts: 9568

- Joined: Fri 03 Dec 2004, 04:00:00

- Location: Volcan, Panama

Re: MADOR

ROCK as I've said before I think command economies are in a better position for decline because the capitalists imagine the market always wins - even though they are always getting caught rigging it, LOL. And not that the US can't fumble around with ham-handed controls like in the '70's but capping prices and whatever other demand controls are a far cry from acquiring physical supply.

China's President is meeting with the Mexican President this very day.

China is buying Ecuadorian rainforest oil leases.

China owns $15B worth of oil sands.

China bought $1 billion worth of Chesapeake oil leases in Oklahoma for cripes' sake.

Really the US is going in the opposite direction of nationalization at the moment - unless you count allowing china to nationalize our "local" resources. The political push right now is to privatize everything - didn't I just hear a congressman suggest we sell off the SPR?

I'm thinking there is nothing assured about our supply. As the blogger at CrudeOilPeak noted, the oil majors have been in decline for several years.

--

Welcome Mr WestTexas!

Your adaptation of the ELM to ANE was very prescient and it is apropos here.

China's President is meeting with the Mexican President this very day.

China is buying Ecuadorian rainforest oil leases.

China owns $15B worth of oil sands.

China bought $1 billion worth of Chesapeake oil leases in Oklahoma for cripes' sake.

Really the US is going in the opposite direction of nationalization at the moment - unless you count allowing china to nationalize our "local" resources. The political push right now is to privatize everything - didn't I just hear a congressman suggest we sell off the SPR?

I'm thinking there is nothing assured about our supply. As the blogger at CrudeOilPeak noted, the oil majors have been in decline for several years.

--

Welcome Mr WestTexas!

Your adaptation of the ELM to ANE was very prescient and it is apropos here.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: MADOR

Rock,

The Brazil + Iraq extrapolation (on track to collectively approach zero net oil exports in about 10 years) shocked even me.

The following chart shows normalized liquids consumption, with 2002 consumption set equal to 100%, for China, for India, for the (2005) Top 33 net exporters and for the US, from 2002 through 2011, versus annual Brent crude oil prices, shown as a red bar chart:

http://i1095.photobucket.com/albums/i47 ... 059c52.jpg

As Brent prices more than quadrupled from 2002 to 2011, here are the 2011 consumption levels as a percentage of 2002 consumption:

China: 185%

India: 146%

(2005) Top 33 Net Exporters: 129%

US: 95%

As Brent prices stayed high in 2012, averaging $112, here are the 2012 consumption levels as a percentage of 2002 consumption:

China: 193%, versus 185% in 2011

India: 152%, versus 146% in 2011

(2005) Top 33 Net Exporters: 135%, versus 129% in 2011

US: 94%, versus 95% in 2011

In other words, a continuation of recent consumption trends, but of course, the $64 trillion question is what happens between 2012 and 2022, and in later years.

I don't think that China and India will actually be consuming 100% of Global Net Exports of oil (GNE) in 2030, but I do expect recent trends to more or less continue, at least for several years, as developing countries, led by China, continue to consume an increasing share of a (so far) declining post-2005 volume of GNE. The flip side of that is that developed net oil importing countries like the US would continue to be gradually shut out of the global market for exported oil.

The Brazil + Iraq extrapolation (on track to collectively approach zero net oil exports in about 10 years) shocked even me.

The following chart shows normalized liquids consumption, with 2002 consumption set equal to 100%, for China, for India, for the (2005) Top 33 net exporters and for the US, from 2002 through 2011, versus annual Brent crude oil prices, shown as a red bar chart:

http://i1095.photobucket.com/albums/i47 ... 059c52.jpg

As Brent prices more than quadrupled from 2002 to 2011, here are the 2011 consumption levels as a percentage of 2002 consumption:

China: 185%

India: 146%

(2005) Top 33 Net Exporters: 129%

US: 95%

As Brent prices stayed high in 2012, averaging $112, here are the 2012 consumption levels as a percentage of 2002 consumption:

China: 193%, versus 185% in 2011

India: 152%, versus 146% in 2011

(2005) Top 33 Net Exporters: 135%, versus 129% in 2011

US: 94%, versus 95% in 2011

In other words, a continuation of recent consumption trends, but of course, the $64 trillion question is what happens between 2012 and 2022, and in later years.

I don't think that China and India will actually be consuming 100% of Global Net Exports of oil (GNE) in 2030, but I do expect recent trends to more or less continue, at least for several years, as developing countries, led by China, continue to consume an increasing share of a (so far) declining post-2005 volume of GNE. The flip side of that is that developed net oil importing countries like the US would continue to be gradually shut out of the global market for exported oil.

Last edited by westexas on Tue 04 Jun 2013, 08:29:19, edited 1 time in total.

- westexas

- Expert

- Posts: 248

- Joined: Tue 04 Jun 2013, 06:59:53

Re: MADOR

Pops,

Howdy.

Following is a link to a long paper (with about 24 figures) on the Export Capacity Index (ECI) concept:

http://peak-oil.org/2013/02/commentary- ... ity-index/

Howdy.

Following is a link to a long paper (with about 24 figures) on the Export Capacity Index (ECI) concept:

http://peak-oil.org/2013/02/commentary- ... ity-index/

- westexas

- Expert

- Posts: 248

- Joined: Tue 04 Jun 2013, 06:59:53

Re: MADOR

To flesh out westexas’ link:

“Chinese President Xi Jinping is meeting with his Mexican counterpart Enrique Peña Nieto on June 4, part of Xi’s first official trip to the Western Hemisphere. The visit has been billed as a chance to “relaunch” the countries’ relations after a decade in which fierce competition for export markets and a growing trade deficit begat a distant, wary relationship. Both countries have something to gain by closer ties, but seizing the opportunity will require dropping long-held preconceptions about the commercial relationship. Given this backdrop, it is not surprising that Sino-Mexican relations have been less than cozy in recent years. Leaders made regular official visits, interacted in forums such as APEC, and even signed a Strategic Partnership Agreement in 2003. But the trade issue overshadowed all else. Mexico has initiated 17 actions against China in the WTO, and vows to “rebalance” the countries’ commercial relationship dominate Mexico’s discourse on China. “

So Mexico has a grudge against China. The trade deficit isn’t good. So how does one fix a trade deficit? Easy: sell more “stuff” to the other country. Maybe stuff like oil. Maybe by selling Mexican oil to China and not the US.. Win-win? Selling "oily stuff" to China will make Mexican trade officials happy.

But PEMEX is struggling to keep production up. The Mexican govt drains them of their cash flow to support 40% of the national budget. And adding to the trade balance problem: Mexico has to buy refined products from US companies made from their own oil. If only PEMEX didn’t have a monopoly on oil development and refining. Hmm…I just remembered: both national parties and the current govt have started conversations about removing some of those restrictions. If there were only some country with a lot of capex and a proven history of doing refinery JV’s as well as lending financial support to resource development. Maybe when they visit today the Mexican president can ask the Chinese leader if he knows of anyone. if not maybe he can ask the president of Iraq. I think they have some similar deals working with another country.

Interesting that the leader of the economic powerhouse of the East is meeting with the president of Mexico before meeting with the leader of the economic powerhouse of the West.

“Chinese President Xi Jinping is meeting with his Mexican counterpart Enrique Peña Nieto on June 4, part of Xi’s first official trip to the Western Hemisphere. The visit has been billed as a chance to “relaunch” the countries’ relations after a decade in which fierce competition for export markets and a growing trade deficit begat a distant, wary relationship. Both countries have something to gain by closer ties, but seizing the opportunity will require dropping long-held preconceptions about the commercial relationship. Given this backdrop, it is not surprising that Sino-Mexican relations have been less than cozy in recent years. Leaders made regular official visits, interacted in forums such as APEC, and even signed a Strategic Partnership Agreement in 2003. But the trade issue overshadowed all else. Mexico has initiated 17 actions against China in the WTO, and vows to “rebalance” the countries’ commercial relationship dominate Mexico’s discourse on China. “

So Mexico has a grudge against China. The trade deficit isn’t good. So how does one fix a trade deficit? Easy: sell more “stuff” to the other country. Maybe stuff like oil. Maybe by selling Mexican oil to China and not the US.. Win-win? Selling "oily stuff" to China will make Mexican trade officials happy.

But PEMEX is struggling to keep production up. The Mexican govt drains them of their cash flow to support 40% of the national budget. And adding to the trade balance problem: Mexico has to buy refined products from US companies made from their own oil. If only PEMEX didn’t have a monopoly on oil development and refining. Hmm…I just remembered: both national parties and the current govt have started conversations about removing some of those restrictions. If there were only some country with a lot of capex and a proven history of doing refinery JV’s as well as lending financial support to resource development. Maybe when they visit today the Mexican president can ask the Chinese leader if he knows of anyone. if not maybe he can ask the president of Iraq. I think they have some similar deals working with another country.

Interesting that the leader of the economic powerhouse of the East is meeting with the president of Mexico before meeting with the leader of the economic powerhouse of the West.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: MADOR

The argument against LNG export potential aside, here is evidence of exporting US resources that has actually been going on for quite some time, with plans for significant escalation:

http://stateimpact.npr.org/texas/2013/0 ... skyrocket/

Mr. Westexas, I am thrilled you are here. Our relationship with Mexico is very complex, socially and economically. Most of us that live along the Mexican border recognize the situation with our friends from the south is, for lack of a better word, a ticking time bomb. We import I believe 10% of our total oil import needs from a fragile economy that relies on oil export revenue in significant ways, whose population continues to grow and will look to the US more and more for...solutions and escape. There is a storm brewing and it is not a norther, IMO.

Please if you would, what is the ECI ratio for Mexico now compared to 2005?

http://stateimpact.npr.org/texas/2013/0 ... skyrocket/

Mr. Westexas, I am thrilled you are here. Our relationship with Mexico is very complex, socially and economically. Most of us that live along the Mexican border recognize the situation with our friends from the south is, for lack of a better word, a ticking time bomb. We import I believe 10% of our total oil import needs from a fragile economy that relies on oil export revenue in significant ways, whose population continues to grow and will look to the US more and more for...solutions and escape. There is a storm brewing and it is not a norther, IMO.

Please if you would, what is the ECI ratio for Mexico now compared to 2005?

- Oily Stuff

- Peat

- Posts: 122

- Joined: Wed 17 Apr 2013, 14:24:43

- Location: Texas

Re: MADOR

Hi westtexas!

Rockman I still think you are all wet, the game the PRC is playing in my mind is more in kin with monkey in the middle aka keep away. You know the game kids your age and my age played where one unfortunate soul ran around in circles trying to catch the ball or frisbee the other players tossed back and forth to each other.

PRC China is happily sowing up the future oil supply and lining up players to be on her side. The USA is spinning around leaping this way and that not really sure where the game will take us next. The rules of the game have changed since 2008 but our leadership, and I mean Congress/President AND Business/Wall street still have not caught on.

We owe them BIG BUCKS! They know this and they are working very hard to extract themselves from this situation. Our political wrangling and our tendency to shift direction with the breeze of media attention without ever dealing with the fundamental issues makes them nervous.

Way back in April 2007, when Bush was still President and I thought Hillary was the up and coming first female President I wrote about what I see as our future

post453254.html

I still stand by it, the countries with the long view like the PRC are going to be the superpowers of this century, and they have earned that position because we threw away all our advantages in pursuit of bread and circuses. They are going to have control over the oil resources of the rest of this century because they are flush with cash, they take the long view, and they know time is a taskmaster who never pauses going forward. If you want access to resources you position yourself to have those resources for as long as you can into the future.

Foolish Americans like the guy who wants to sell off the SPR for a quick buck that Pops pointed out are the last gasp of the old American lifestyle. Pretty soon those days will be long gone, because we will have had our leadership sell off anything someone else wants to buy one more election from the voters with low taxes or increased social spending.

Rockman I still think you are all wet, the game the PRC is playing in my mind is more in kin with monkey in the middle aka keep away. You know the game kids your age and my age played where one unfortunate soul ran around in circles trying to catch the ball or frisbee the other players tossed back and forth to each other.

PRC China is happily sowing up the future oil supply and lining up players to be on her side. The USA is spinning around leaping this way and that not really sure where the game will take us next. The rules of the game have changed since 2008 but our leadership, and I mean Congress/President AND Business/Wall street still have not caught on.

We owe them BIG BUCKS! They know this and they are working very hard to extract themselves from this situation. Our political wrangling and our tendency to shift direction with the breeze of media attention without ever dealing with the fundamental issues makes them nervous.

Way back in April 2007, when Bush was still President and I thought Hillary was the up and coming first female President I wrote about what I see as our future

post453254.html

I still stand by it, the countries with the long view like the PRC are going to be the superpowers of this century, and they have earned that position because we threw away all our advantages in pursuit of bread and circuses. They are going to have control over the oil resources of the rest of this century because they are flush with cash, they take the long view, and they know time is a taskmaster who never pauses going forward. If you want access to resources you position yourself to have those resources for as long as you can into the future.

Foolish Americans like the guy who wants to sell off the SPR for a quick buck that Pops pointed out are the last gasp of the old American lifestyle. Pretty soon those days will be long gone, because we will have had our leadership sell off anything someone else wants to buy one more election from the voters with low taxes or increased social spending.

Alfred Tennyson wrote:We are not now that strength which in old days

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

-

Tanada - Site Admin

- Posts: 17055

- Joined: Thu 28 Apr 2005, 03:00:00

- Location: South West shore Lake Erie, OH, USA

Re: MADOR

Re: Mexico's ECI (ratio of production to consumption, as defined above, EIA):

2004: 1.85

2005: 1.78

2006: 1.73

2007: 1.60

2008: 1.46

2009: 1.44

2010: 1.42

2011: 1.38

2012: 1.36

Based on EIA data, Mexico's net exports fell from 1.76 mbpd in 2004 to 0.76 mbpd in 2012, although the rate of decline has slowed in the last three years. In any case, based on the 2004 to 2012 rate of decline in the ECI ratio, Mexico would approach zero net exports in about 8 years. Their post-2004 CNE (Cumulative Net Exports), based on this extrapolation, are probably at least 60% depleted.

Note that combined net exports from Canada + Mexico fell by 300,000 bpd from 2004 to 2012.

2004: 1.85

2005: 1.78

2006: 1.73

2007: 1.60

2008: 1.46

2009: 1.44

2010: 1.42

2011: 1.38

2012: 1.36

Based on EIA data, Mexico's net exports fell from 1.76 mbpd in 2004 to 0.76 mbpd in 2012, although the rate of decline has slowed in the last three years. In any case, based on the 2004 to 2012 rate of decline in the ECI ratio, Mexico would approach zero net exports in about 8 years. Their post-2004 CNE (Cumulative Net Exports), based on this extrapolation, are probably at least 60% depleted.

Note that combined net exports from Canada + Mexico fell by 300,000 bpd from 2004 to 2012.

Last edited by westexas on Tue 04 Jun 2013, 09:36:49, edited 1 time in total.

- westexas

- Expert

- Posts: 248

- Joined: Tue 04 Jun 2013, 06:59:53

Re: MADOR

^Sorry Tanada, this is another huge misconception that's lost on doomers....

Actually, We Owe It All to Ourselves

http://www.thebigquestions.com/2012/01/ ... ourselves/

Actually, We Owe It All to Ourselves

http://www.thebigquestions.com/2012/01/ ... ourselves/

It’s true that foreigners now hold large claims on the United States, including a fair amount of government debt. But every dollar’s worth of foreign claims on America is matched by 89 cents’ worth of U.S. claims on foreigners. And because foreigners tend to put their U.S. investments into safe, low-yield assets, America actually earns more from its assets abroad than it pays to foreign investors. If your image is of a nation that’s already deep in hock to the Chinese, you’ve been misinformed. Nor are we heading rapidly in that direction.

All true, but all beside the point. Even if 100% of U.S. debt were held by foreigners, and even if Americans had no offsetting claims on foreigners whatsoever, the U.S. debt would still be money we owe to ourselves.

"The human ability to innovate out of a jam is profound.That’s why Darwin will always be right, and Malthus will always be wrong.” -K.R. Sridhar

Do I make you Corny?

"expect 8$ gas on 08/08/08" - Prognosticator

Do I make you Corny?

"expect 8$ gas on 08/08/08" - Prognosticator

-

TheAntiDoomer - Heavy Crude

- Posts: 1556

- Joined: Wed 18 Jun 2008, 03:00:00

Re: MADOR

TheAntiDoomer wrote:^Sorry Tanada, this is another huge misconception that's lost on doomers....

Actually, We Owe It All to Ourselves

http://www.thebigquestions.com/2012/01/ ... ourselves/It’s true that foreigners now hold large claims on the United States, including a fair amount of government debt. But every dollar’s worth of foreign claims on America is matched by 89 cents’ worth of U.S. claims on foreigners. And because foreigners tend to put their U.S. investments into safe, low-yield assets, America actually earns more from its assets abroad than it pays to foreign investors. If your image is of a nation that’s already deep in hock to the Chinese, you’ve been misinformed. Nor are we heading rapidly in that direction.

All true, but all beside the point. Even if 100% of U.S. debt were held by foreigners, and even if Americans had no offsetting claims on foreigners whatsoever, the U.S. debt would still be money we owe to ourselves.

Actually, no. We own paper assets of variable exchange rate value. The PRC is buying up real property and real commodities and arranging real long term trade deals with their American income. We are trusting in fiat wealth that is only worth what everyone agrees it is worth. When they all decide our paper is worth less or possibly even worthless then the people with the real assets are left with real assets and we are left with digital numbers on a computer screen.

I would far rather be the one with the real assets and the military to back up my ownership than the one with the digital/paper assets nobody else wants.

Alfred Tennyson wrote:We are not now that strength which in old days

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

-

Tanada - Site Admin

- Posts: 17055

- Joined: Thu 28 Apr 2005, 03:00:00

- Location: South West shore Lake Erie, OH, USA

Re: MADOR

^Uh no.....

http://www.businessinsider.com/myths-an ... 013-4?op=1

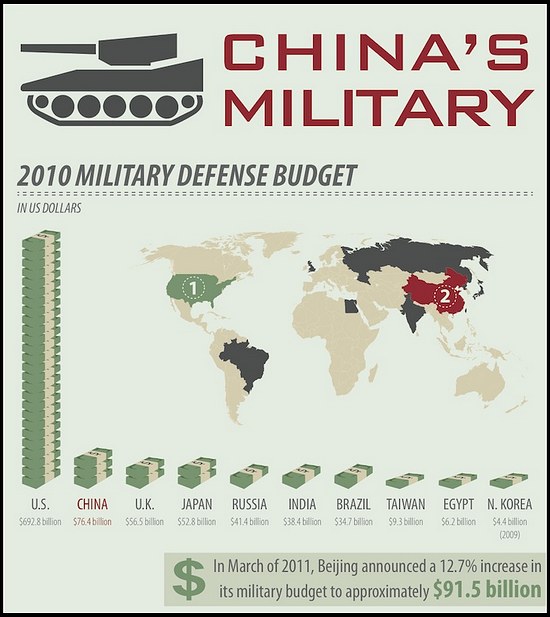

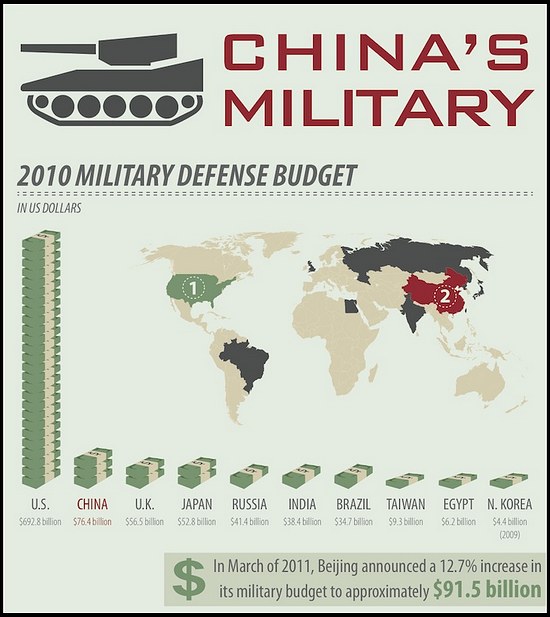

Infographic: China Military vs. U.S. Military

http://micgadget.com/24215/infographic- ... -military/

http://www.businessinsider.com/myths-an ... 013-4?op=1

Infographic: China Military vs. U.S. Military

http://micgadget.com/24215/infographic- ... -military/

"The human ability to innovate out of a jam is profound.That’s why Darwin will always be right, and Malthus will always be wrong.” -K.R. Sridhar

Do I make you Corny?

"expect 8$ gas on 08/08/08" - Prognosticator

Do I make you Corny?

"expect 8$ gas on 08/08/08" - Prognosticator

-

TheAntiDoomer - Heavy Crude

- Posts: 1556

- Joined: Wed 18 Jun 2008, 03:00:00

Re: MADOR

Thank you, Mr. Texas. I just felt a cold wind blow up my backside.

- Oily Stuff

- Peat

- Posts: 122

- Joined: Wed 17 Apr 2013, 14:24:43

- Location: Texas

95 posts

• Page 1 of 5 • 1, 2, 3, 4, 5

Return to Geopolitics & Global Economics

Who is online

Users browsing this forum: No registered users and 26 guests