Shale Gas May Be the Ticket

Shale Gas May Be the Ticket to Much Coveted Energy Independence for U.S., Says PIRA Energy Group Study

tmcnet

NYC-based PIRA Energy Group, an international energy consulting firm specializing in global energy market analysis and intelligence, announced the forthcoming release of a study on U.S. energy independence and the shale revolution.

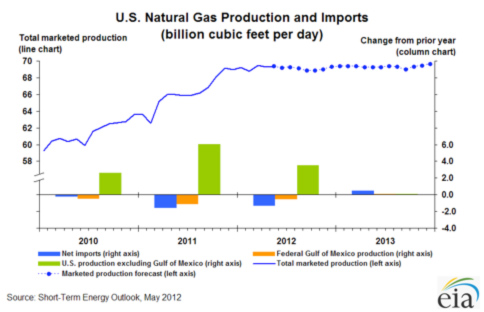

Entitled "The Road to U.S. Energy Independence: The Shale Revolution (News - Alert) and Its Implications for North America's Energy Markets," the study examines the nation’s energy policy that are arising from increasing oil and gas production and falling imports.

Over the past few years, improvements in technology have allowed the USA to discover and develop abundant supplies of natural shale gas across the United States and Canada.

Under this backdrop, the study also examines the complex implications for North American pricing parity, crude and product flows and refining behavior.

The preliminary findings of the study lead us to suggest that the current hype surrounding bio-fuel production will eventually die down and the U.S. will steadily emerge as the world’s next energy leader.

tmcnet