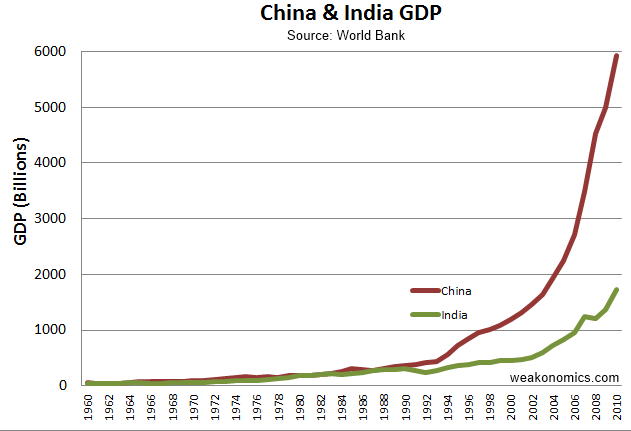

This chart shows the run up in gas prices following the peak in US oil production in 1971, the gas crisis in 1973, and the abandonment of the gold standard in 1971. Notice how low and stable they were for decades.

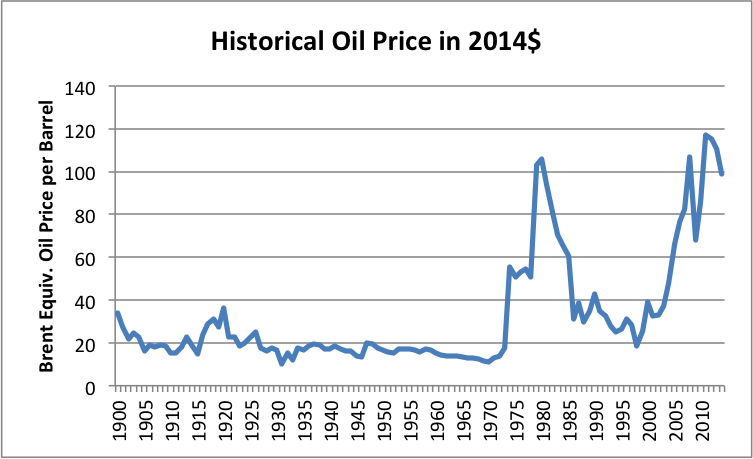

This chart shows the run-up in oil prices during the same era. Notice the decades long stability in price.

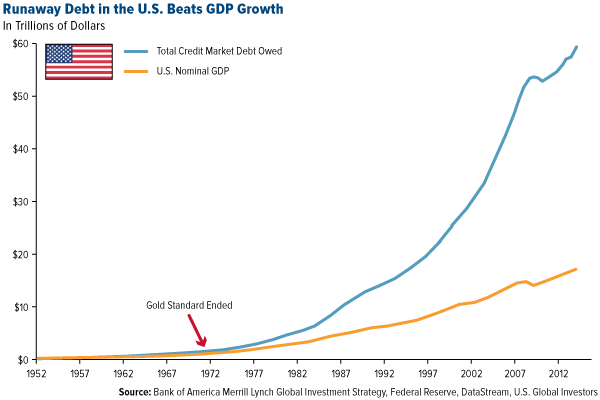

And this chart shows a corresponding increase in the debt to facilitate GDP growth as the ROI and EROEI wealth generating effect declined. It is no coincidence.

The change in the oil EROEI wealth creation, following the decline in US production in 1971, lower EROEI of oil production and rising oil prices, caused a new focus on service industries and on industries with little oil usage. Efficiency gains and outsourcing of oil energy industries soon followed. Still stymied by stagnation, financial speculation and huge increases in debt were employed to continue GDP growth. These measures help grow GDP–at least until the borrowers start defaulting on their loans or the market crashes due to being overpriced. Then, we bailout the markets; rinse and repeat, driving debt ever higher.

The problem with adding additional debt is that it at some point the amount of debt becomes too much for holders of the debt to service, and they start cutting back on other purchases. Debt saturation. Enter QE, ZIRP, NIRP, and now the talk of helicopter money.

In a recent study Awara Group Link reveals that the real GDP growth of Western countries has been in negative territory for years. The study has found that the Western countries have lost the capacity to grow their economies. All they have left is a capacity to pile up debts.

This chart shows that Russia has been able to deliver real non-debt fueled GDP growth, whereas the Western countries are running huge deficits. Russia’s debt is only $515 billion dollars, close to US debt in the early 1970's.

Western countries have currencies that the rest of the world still largely trusts as reserve currencies, allowing them to to gain access to cheap debt and fuel their economies with central bank financing (quantitative easing or “printing of money”). Will the West soon forfeit this privilege? What would follow is higher interest rates, and possibly, hyperinflation as the eventual outcome.

I guess we will try to keep up a semblance of prosperity with ever new debt, until we cannot.