by ROCKMAN » Thu 30 Oct 2014, 14:24:27

by ROCKMAN » Thu 30 Oct 2014, 14:24:27

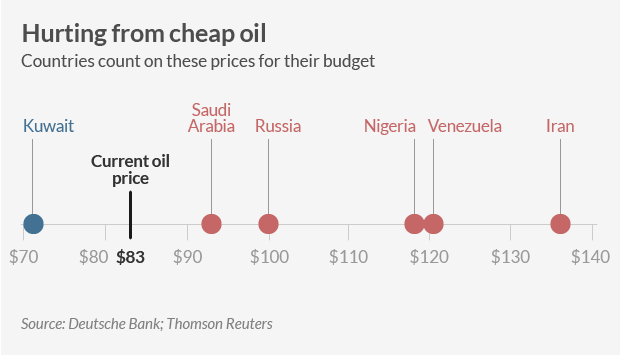

Ghung - So if I understand you the thought is that Iran needs $135/bbl for the oil from their eisting wells to meet their minimum budget requirements. Of course how do you define "minimum budget requirements": different folks have vastly different idea on what the govt MUST fund. Here's what I found on the subject of Iranian budgets. Apparently the Iranian govt doesn’t appear to be as concerned about dealing with the budget as do some other folks. Not that they have easy days ahead but it looks like they are beginning to do a good job getting control of the situation. How much oil they export and at what prices they must get isn’t determined by their budget requirements. It’s just the opposite: they are fixing their heavy handy govt spending habits. How that is received by the locals will be a different question. From last February:

Reuters - The first state budget proposed by Iranian President Hassan Rouhani has sailed through parliament, handing him a political victory as he seeks to build domestic support for international negotiations on the country's nuclear programme. Parliament approved on Sunday a budget bill worth 7,930 trillion rials ($319 billion at the official exchange rate) for the next Iranian calendar year, which starts on March 21, official media reported. The budget slows growth in spending in an effort to repair state finances that have been ravaged by economic sanctions. Expenditure is to rise about 9 percent from the original budget plan for the current year - not nearly enough to keep pace with inflation, which is running near 40 percent.

Rouhani, who took power last August after elections, needed only 10 days of debate to get his budget passed, an apparent endorsement of his administration as it tries to get the sanctions lifted by reaching a deal with world powers on Iran's disputed nuclear plans. By contrast Rouhani's predecessor Mahmoud Ahmadinejad, who took a hard line with the West, continually feuded with parliament over economic issues including the budget, which was passed with delays of several months.

Rouhani told parliament in December that Ahmadinejad had squandered oil revenues on cash handouts and housing projects, and that Iran faced a mix of high inflation and stagnating growth, with the economy shrinking 6 percent in the past year. His budget suggests he views spending discipline as key to rescuing the economy; the 9 percent rise in his plan is much lower than the 31 percent increase envisaged in Ahmadinejad's last budget. Iranian-born economist Mehrdad Emadi, of the Betamatrix consultancy in London, said that after years in which Ahmadinejad tried to offset the economic sanctions with huge jumps in government spending, Rouhani was starting to reimpose normal budget constraints, a process that would take years. Last week parliament approved politically sensitive plans to slash subsidies on fuel and food, potentially saving some 630 trillion rials annually in subsidy payments.

Implementation of the reform has been delayed for several months while authorities try to soften the blow to consumers by handing out food packages to over 15 million poorer families. Next year's budget plan projects a rise in spending on government operations of about 14 percent to 1,950 trillion rials.

{The recent drop in oil prices might force them to lower that amount}