jedrider wrote:KaiserJeep wrote:To the contrary, this thread is 12+ years old and the dollar has not collapsed yet. The world economy is enormous and the economic momentuum is also enormous. Speculation about sudden economic crashes and currency devaluations is rank foolishness.

Well, maybe not 'imminent' but, maybe, 'fast' as in 'fast crash'?

How fast can the dollar unravel? That would be an appropriate topic of discussion.

Given the reality of the foreign exchange markets, why should this cause it to anything remotely like "unravel"? It might cause it to dip somewhat: rapidly, over time, or both (mostly due to sentiment issues).

Over time, major currencies are all over the place (which is a key reason why the FX markets exist). So is this a big deal?

Will the US economy fundamentally change due to this? Of course not! Will the real world in terms of the make-up of the fundamental energy economy change because of this? Not in a meaningful way.

Will China gain some credibility and stature, as its economy becomes the largest in the world? Sure, although it's not like that trend is anything new.

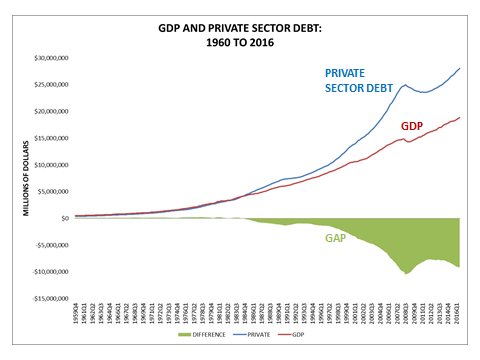

If endless, unwise, debt creation, occurring over many decades, despite whether supporting economic growth makes it sustainable isn't a major issue for the dollar, this minor event (in the scheme of things) isn't even close.