Page 1 of 1

THE Demand Destruction Thread Pt. 3

Posted:

Wed 09 Apr 2008, 18:27:58by Cid_Yama

<i>Over the last four weeks, crude oil imports have averaged nearly 9.4 million barrels per day, 925,000 barrels per day below the same four-week period last year.</i>

link

Just a flesh wound. The economy will be cruisin' right along by the 4th quarter.

http://www.youtube.com/watch?v=2eMkth8FWno

The Demand Destruction Thread Pt. 3

Posted:

Tue 31 Dec 2013, 15:21:48by Tanada

Given that it looks to me as if 2014 might be the year when we have to finally face price rationing I looked around for a Demand Destruction thread and this is the one I found.

We have done a hundred or so variations on the theme like the recent how much can you pay for a gallon of fuel thread, but demand destruction is a fundamentally simple concept with a complex result.

It isn't just how much you pay for fuel, it is how much you consume of everything else being limited by how much fuel you have to buy no matter what the cost. Heating in the winter is not optional for much of North America and Europe. Even if you are using cheap natural gas it isn't free, and if you are using Propane or Fuel Oil it is increasingly expensive. The more you spend on fuel the less you spend on everything else, and even worse the more everything else costs because somewhere along the line it is shipped too you with increasingly expensive fuel.

Re: Demand destruction: the flip side to the oil argument

Posted:

Tue 31 Dec 2013, 15:47:41by dolanbaker

Demand destruction is related to disposable income, when fuel costs were at an all time low (relative to income) many people started to spend the "extra" disposable income on more expensive housing and greater commutes. After the 50% drop in house prices (Rural Ireland) and with fuel prices effectively stuck at a high but stable level, the few who are buying rural houses now will have more of their income available after buying fuel than the previous generation.

Demand destruction will really only affect those who splashed out during the "Celtic Tiger" years and still have the big SUV and overpriced house in the country, many can't really afford to downsize as they'll still end up paying back the loans on stuff that lost about half of its of value. When they do eventually clear the loan, they'll still never get back what they paid for the house.

Fuel consumption in Ireland has already shown "demand destruction" in progress, it has dropped some 25% since the peak of the boom years.

Re: Demand destruction: the flip side to the oil argument

Posted:

Tue 31 Dec 2013, 18:23:19by Tanada

With the economy being what it is and the unemployment being what it is a lot of that disposable income has already left the market, at least in the midwest USA.

Re: Demand destruction: the flip side to the oil argument

Posted:

Tue 31 Dec 2013, 20:19:57by Pops

Actually I think demand will return some this year.

Right now home values have risen tremendously in the hardest hit areas as the vultures have swooped in and bought up the foreclosures. Lots of folks will get their head out of the water enough to be able to sell, that will free up lots of cash.

The equity market rose 24% in 2013 . . Bonds will rise on the Taper (bad if you are holding but good if you want to get some interest on your savings) . . GDP (FWIW) rose over 4% 3rd qtr, Consumer confidence is bound to rise I think, ditto faith in government after one of the least productive congresses ever, "uncertainty" is going to be passé so businesses won't have that excuse anymore - even Ted Cruz gave up on killing government for the time being

I think oil can rise some, if it doesn't move too fast, and folks will start to use a little more. That's the key, it has to move slow enough folks can cope. But of course there isn't much spare capacity to allow it to rise slowly unless Libya/Iran/Sudan/Nigeria loosen up some. US LTO might help a little next year but not too much.

My outrageous forecast is things look really peachy early next year and everyone gets into a feel good groove and demand creeps up and up and then *wham* spare capacity tanks, the price zooms up and dashes all their hopes for happy motoring! BWAHAHAHAHA!

Or maybe something slightly less dramatic, LOL

Re: Demand destruction: the flip side to the oil argument

Posted:

Tue 31 Dec 2013, 21:55:01by rockdoc123

Now we hear nothing from the Kingdom.

I don't think that is true as they added barrels when Libya was taken out of the equation and when Iran was sanctioned.

Their stated spare capacity is around 12 MMbbl/d which is precisely where they predicted back then in 2006 when they first started to work on the mega-projects.

As I've said for a long time they are caught between a rock and a hard place. If the price goes too low they don't have enough income to satisfy internal developments that keep the masses happy, if it goes too high it risks a demand collapse. I believe the Saudis have learned that it is better to work quietly in the background to achieve their goals rather than broadcast them which gives the traders all sorts of reason to screw around.

Re: Demand destruction: the flip side to the oil argument

Posted:

Tue 31 Dec 2013, 22:40:29by TheDude

Seems like the Saudis have run out of megaprojects to take out of mothball status - after Haradh, Manifa, Kurais, what's left in the way of aces in holes for them? There's always more EOR etc I suppose. Or addressing their own demand issues, the way things are going they won't have any oil left to export in 15 years or so, which doesn't seem like quite the eternity it used to. With such secular (long-term) issues they have a long long time to try and come up with solutions though, while still living like Kings with a Capital K and placating their populace with $.015/gal gasoline etc.

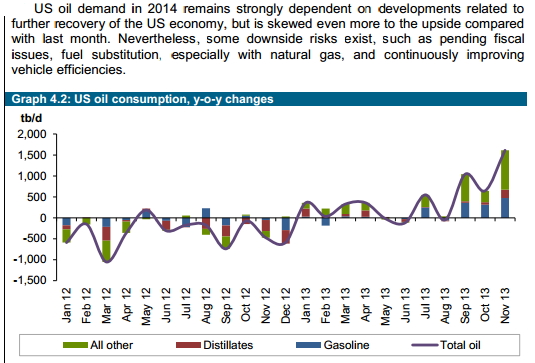

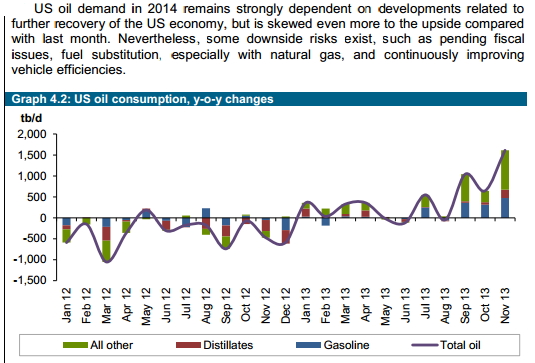

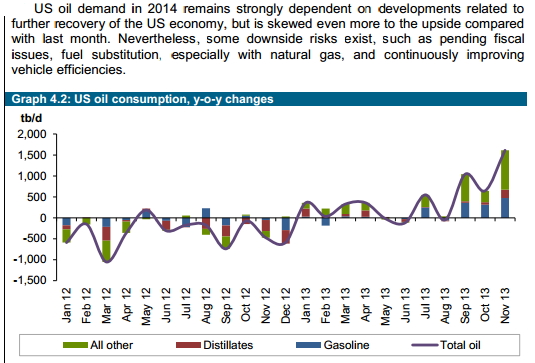

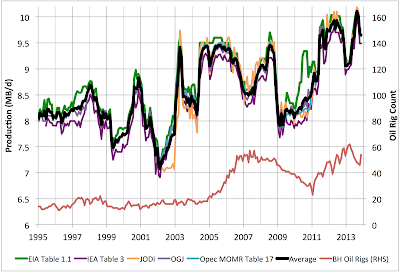

Regarding the US, yes, we are back to our old demand shenanigans:

Which isn't good for those forecasts that projected decades of never-ending air being taken out of the ODEC's demand needs while the BRICs etc gobble more and more, with some kind of bumpy stasis as a result.

I've always looked to the past for clues to the future - what else is there to do? After prices hit the local ceiling in 1981 demand slowly trended down before prices went through the floor in 1986. Substitute 2008 for 1981 and 2013 for 1986 and you don't get the same result at all, notice. Or anything like the same profiles demand/supply wise, either.

Re: Demand destruction: the flip side to the oil argument

Posted:

Wed 01 Jan 2014, 02:45:41by ralfy

Related:

http://ourfiniteworld.com/2013/04/11/pe ... e-problem/i.e., demand destruction for EU, US, and Japan, but increasing oil consumption for the rest of the world.

Re: Demand destruction: the flip side to the oil argument

Posted:

Wed 01 Jan 2014, 07:52:11by Tanada

TheDude wrote:Seems like the Saudis have run out of megaprojects to take out of mothball status - after Haradh, Manifa, Kurais, what's left in the way of aces in holes for them? There's always more EOR etc I suppose. Or addressing their own demand issues, the way things are going they won't have any oil left to export in 15 years or so, which doesn't seem like quite the eternity it used to. With such secular (long-term) issues they have a long long time to try and come up with solutions though, while still living like Kings with a Capital K and placating their populace with $.015/gal gasoline etc.

Regarding the US, yes, we are back to our old demand shenanigans:

Which isn't good for those forecasts that projected decades of never-ending air being taken out of the ODEC's demand needs while the BRICs etc gobble more and more, with some kind of bumpy stasis as a result.

I've always looked to the past for clues to the future - what else is there to do? After prices hit the local ceiling in 1981 demand slowly trended down before prices went through the floor in 1986. Substitute 2008 for 1981 and 2013 for 1986 and you don't get the same result at all, notice. Or anything like the same profiles demand/supply wise, either.

Nice graph. The thing that surprises me is the number of 'analysts' who crow about Libya or Iran coming back into the market increasing supply but ignore the fact that KSA likes prices where they are so they are motivated to produce less and offset those increases from Iran/ Libya/ Angola/ wherever.

Even if KSA can cut back 1 or 2 MMbbl/d as others come into the market to get a little spare capacity how much does it change the 2014 outlook? China's import demand growth is going to soak up a lot of world oil supply. Pretending otherwise is IMO extremely short sighted.

Re: Demand destruction: the flip side to the oil argument

Posted:

Wed 01 Jan 2014, 07:56:36by Pops

Here is a picture of demand destruction from Doug Short:

He has a good overview of now vs the '70s:

http://www.advisorperspectives.com/dsho ... Driven.phpAnd another on gasoline volume per capita:

http://www.advisorperspectives.com/dsho ... -Sales.phpAlthough he also talks a lot about secular changes, Boomers getting too old and feeble to drive, Millennials more interested in texting and twerking selfies, etc.

Re: Demand destruction: the flip side to the oil argument

Posted:

Wed 01 Jan 2014, 08:07:35by Tanada

Thanx Pops, if I am reading it correctly demand has leveld off at about the 1995 level and stayed there for the last year or so.

It occurs to me the USA burned a lot of fuel in 1995 so if demand is more or less stable here and growing in China the world needs to add more supply this year. The only two ways I know to do that are produce more, or use less. I don't think we will producing more.

Re: Demand destruction: the flip side to the oil argument

Posted:

Wed 01 Jan 2014, 08:33:22by Quinny

Don't know whether this is the right place, I'm impressed with Pop's wedge theory, but...

I can see a position where like Seagypsy described in Phillipines where the utility value of petrol can mean that much higher prices can be sustained where necessary. The high taxation in places like Europe show that this does happen.

My own personal situation anecdotal though it may be describes to a certain degree what I mean.

My fuel costs shot up as I had to search further afield for new customers and I was spending about 10% of income on fuel in UK. This was a very high figure that in fact left me with lots of surplus in relative terms. I now spend a much higher % but on lower income, and would have to pay higher just to get to work. I am car sharing ATM, but even if fuel costs went up significantly I would have to pay more.

Could necessity break the demand ceiling?

Re: Demand destruction: the flip side to the oil argument

Posted:

Wed 01 Jan 2014, 08:51:00by Pops

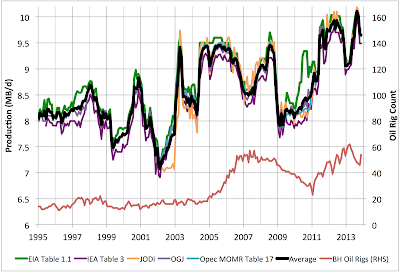

Tanada, KSA looks to be at 9.5 +/-.5, and they are drilling like mad. Does that mean they have any extra? I don't know.

But they are not immune to the law of supply and demand and can't defend a price point at any cost. They've gone from around 8Mbopd in the '90s to around 9.5 and the price has increased nicely as well but as their population grows (and becomes restless) and their cost to produce increases (like everyone else's) they may no longer have the luxury of being the price setter and may become a price taker: like everyone else. Ask the Texas Railroad Commission about that, LOL.

From Early Warning:

--

And certainly China is still growing but not at 17% any more:

Analysts surveyed by Bloomberg News this month see growth slowing to a 24-year low of 7.4 percent next year from 7.6 percent in 2013, based on median estimates, as leaders seek to de-emphasize expansion at any cost.

http://www.bloomberg.com/news/2013-12-2 ... -says.htmlAnd most of their energy growth is in coal:

http://ourfiniteworld.com/2012/12/06/en ... mployment/

http://ourfiniteworld.com/2012/12/06/en ... mployment/

Re: Demand destruction: the flip side to the oil argument

Posted:

Wed 01 Jan 2014, 09:06:38by Pops

--Q, The whole wedge bit is all about increasing utility vs demand destruction. How much can we increase utility while still producing the same (or increasing) amounts of stuff in the general economy. As I understand your situation, you are paying more and using less - That was exactly my conclusion in the "Price of Collapse" thread.

Paying more just to get to work even though you are using less fuel and as a result not supporting the other sectors of the economy. So even though you are conserving and being more efficient, it isn't enough to allow you to continue to support the other folks where you spent your Euros before. You are surviving higher oil prices at the expense of the overall economy. That is exactly how the Wedge squeezes GDP, declining GDP then lowers the total amount that can be spent on energy and so lowers demand. Lower demand in turn lessens the need for one more expensive marginal barrel and Voilá! the price ceiling stays in place and eventually, as GDP falls, the ceiling begins to fall as well.

So your situation is a great example of demand destruction in the general economy even with conservation in the energy economy.

Re: Demand destruction: the flip side to the oil argument

Posted:

Wed 01 Jan 2014, 09:21:27by Subjectivist

If China is growing at 7.4% then by the rule of 70 my math says they will double consumption in less than a decade. I know it is simplistic to say that and the real world is very complex, but growth with a declining resource is a problem even if the growth is very small.

World oil supplies have been nearly static since 2005, sure there has been a little growth but most of the supply cushion has come from recession driven conservation In my opinion.

Re: Demand destruction: the flip side to the oil argument

Posted:

Wed 01 Jan 2014, 10:46:46by Quinny

Get that and agree, but why does that necessarily translate to Oil price?

Pops wrote:--Q, The whole wedge bit is all about increasing utility vs demand destruction. How much can we increase utility while still producing the same (or increasing) amounts of stuff in the general economy. As I understand your situation, you are paying more and using less - That was exactly my conclusion in the "Price of Collapse" thread.

Paying more just to get to work even though you are using less fuel and as a result not supporting the other sectors of the economy. So even though you are conserving and being more efficient, it isn't enough to allow you to continue to support the other folks where you spent your Euros before. You are surviving higher oil prices at the expense of the overall economy. That is exactly how the Wedge squeezes GDP, declining GDP then lowers the total amount that can be spent on energy and so lowers demand. Lower demand in turn lessens the need for one more expensive marginal barrel and Voilá! the price ceiling stays in place and eventually, as GDP falls, the ceiling begins to fall as well.

So your situation is a great example of demand destruction in the general economy even with conservation in the energy economy.

Re: Demand destruction: the flip side to the oil argument

Posted:

Fri 03 Jan 2014, 16:48:00by TheDude

The graph I included at

this post shows how US motorists are managing to drive a bit more lately while using less mileage, thanks to the latest CAFE regulations kicking in, which would be of great benefit if we could drag it out for decades on end, but when has that ever happened? Shifting over to CNG or electricity would destroy more demand too of course. Haven't really kept on top of how that's coming along either - are inroads from EVs accounting for any of that VMT? I don't think they've made that big a dent as of yet, IIRC.

Peak oil demand, a theory with many doubters

Posted:

Wed 07 Mar 2018, 14:51:03by AdamB

When Haitham Al-Ghais, the director of market research for the Kuwait Petroleum Corporation, was asked about peak oil demand Monday, he smiled broadly and responded quizzically, "what demand?" Even as some oil companies like Royal Dutch Shell and BP predict oil demand will peak before 2040 - as electric vehicles hit the road and governments worldwide work to cut greenhouse gas emissions - there are plenty within the oil industry who view such predictions with a healthy skepticism. Helen Currie, the chief economist at Conoco Phillips, said her company had modeled electric car demand and other factors and "struggled with finding a peak," "anytime within the next 20 to 30 years," during a panel at the IHS Markit CERAWeek energy conference in Houston Monday. "We readily acknowledge it's plausible, but we really tend to see oil demand being fairly strong and robust," she said. The concept of

Peak oil demand, a theory with many doubters