Re: Effects of rising oil prices on the economy

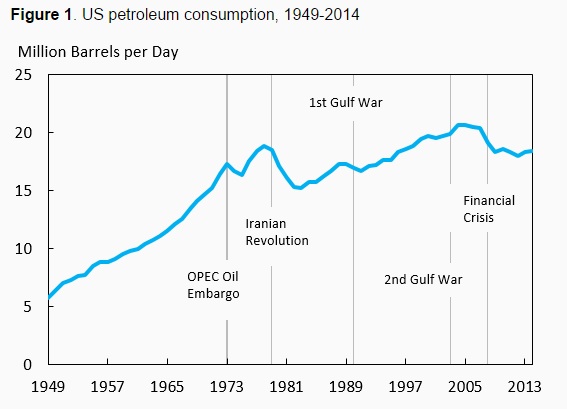

Darian S wrote:Outcast_Searcher wrote:GHung wrote:After 2008, consumption dropped significantly until QE and ZIRP kicked in, which is about the time oil prices jumped up as consumption began to rise. Hard to determine true cause and effect when markets and consumer confidence are being manipulated to such an extent.

Ah yes, that strawman again. If you don't like what the markets tell you or if you don't understand it, then blame the big "manipulation conspiracy", those shadowy figures that invisibly "manipulate" the markets in ways you dislike so.

Debt is up pretty much everywhere. Underemployment is rising. People are one check loss or emergency away from bankruptcy. The auto sales are down, phone sales are down, the retail apocalypse is going down. Exxon mobil failed to meet expectations despite rise of oil prices and has had to borrow to pay dividends.

That the global economy is stressed is evident. Spiralling debt is a sign that the can was kicked because the world could not afford.

Seems O_S is missing the part where QE, ZIRP, and NIRP were indeed market manipulation. Or maybe he's not man enough to admit it, and that this manipulation did help support consumption levels at high prices. He resorts to framing this as some conspiracy theory, "shadow figures",, all that. What a chump. This was market manipulation on a massive scale, in his face, and transparent for all to see. Further, those high oil prices were enabled, in part, by mass injections of conjured capital into markets.

The very real fact that O_S frames anything that doesn't fit his narrative as doomerism or conspiracy theories reveals he holds the same paranoia he accuses others of.