Re: Fallout from Crude Price Crash Pt. 2

The fact that Central Banks are willing to buy ever-more financial assets doesn't change their underlying value. Paying a trillion dollars for a brick doesn't make the brick worth a trillion dollars...

Exploring Hydrocarbon Depletion

https://peakoil.com/forums/

https://peakoil.com/forums/fallout-from-crude-price-crash-pt-2-t72581-40.html

pstarr wrote:radon1 wrote:You run an oil rig. Your diesel engine is powered by the crude you extract from the ground. All that drilling requires 1 barrel crude/day. You produce a 1 barrel per day. Guess what?

You won't be producing this oil, unless you are doing this for self-entertainment. So what? What are you trying to say?

You don't see how your predicament may reasonably be proposed for larger complex oil plays? Or oil regions?

pstarr wrote:ennui2 wrote:This is going in circles. Rockman already explained that the oil usage in extraction is far less than doomers claim it does. "cost" tends to manifest itself in other aspects of overhead besides the wellhead.

Don't drag RM into this. He is not on your side.

ennui2 wrote:pstarr wrote:ennui2 wrote:This is going in circles. Rockman already explained that the oil usage in extraction is far less than doomers claim it does. "cost" tends to manifest itself in other aspects of overhead besides the wellhead.

Don't drag RM into this. He is not on your side.

He's not an ETP believer, therefore he's on my side in this thread, that's for sure.

Oger has been hit hard by a slowdown in the Saudi construction sector due to low oil prices and state spending cuts, and wage payments to thousands of its workers have been delayed for months, according to Saudi media and the workers themselves.

A Lebanese newspaper quoted unnamed sources as saying that talks between Hariri and the Saudi government were in their final stages.

More than 30,000 Saudi Oger workers have filed official complaints with the Labour Office over alleged non-payment of wages few days back.

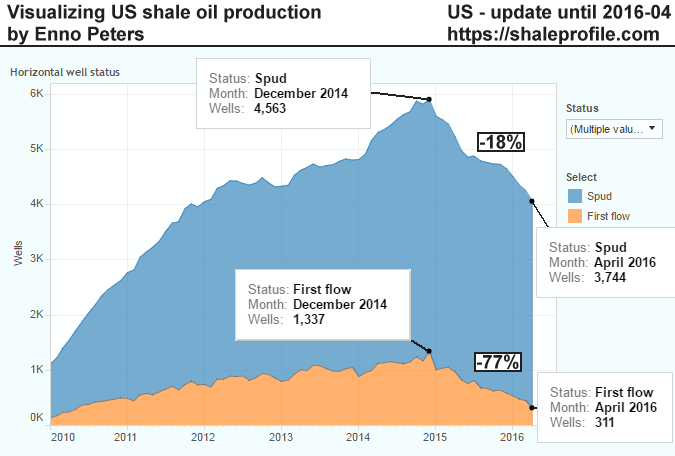

ROCKMAN wrote:This look like a pretty good review of the relatively new and EXISTING WELLS that are the basis of the recent production surge. How many new wells are drilled and what they'll add is a different question and will take time to answer. But this report does a good job of documenting how the existing surge will be rather short lived.

https://shaleprofile.com/index.php/2016 ... roduction/

ROCKMAN wrote:This look like a pretty good review of the relatively new and EXISTING WELLS that are the basis of the recent production surge. How many new wells are drilled and what they'll add is a different question and will take time to answer. But this report does a good job of documenting how the existing surge will be rather short lived.

https://shaleprofile.com/index.php/2016 ... roduction/

Pacific Drilling will already be the fifth US-exchange listed offshore drilling company to undergo a comprehensive debt restructuring following the footsteps of Hercules Offshore (OTCPK:HEROQ), Vantage Drilling (OTCPK:VTGDF), Paragon Offshore (OTCQX:PGNPQ) and Seadrill (NYSE:SDRL).

While Hercules Offshore - after having to file for bankruptcy a second time within 10 months - is now facing dissolution, Vantage Drilling has successfully restructured its debt by basically wiping out its former shareholders.

Paragon Offshore is still in the process of getting its recently revised reorganization plan approved in bankruptcy court but if successful, current shareholders will keep a respectable 53% of the equity.

Seadrill so far hasn't disclosed any details regarding the ongoing negotiations with its creditors but currently expects to present a solution until the end of the year. I already provided an outlook on potential outcomes in an article published earlier this year.

Rockman makes the same assumptions about future oil/NG prices almost all other companies make: they'll stay at current levels

Complete nonsense.

The colossal German Energiewende disaster obviously was timed on the basis of a much higher oil prediction that was absolutely fundamentally correct. So was all the oil companies planning. They can't all be wrong.

rockdoc123 wrote:Complete nonsense.

The colossal German Energiewende disaster obviously was timed on the basis of a much higher oil prediction that was absolutely fundamentally correct. So was all the oil companies planning. They can't all be wrong.

the only thing that is complete nonsense here is pretty much all of the rather incoherent ramblings you post.

Rockman is exactly correct. I have worked for numerous Oil and Gas companies over the years and spent a lot of time reviewing economic projections by other companies that are filed within their 51-101 or SEC reserves filings. In each and every case the forward projection is based on current price plus an adjustment made for inflation at the rate when the report was created. Indeed all of the third party reserve auditors are instructed to use this methodology for their economic projection for various reserve categories. The only time you will see anything different is when there is a known change that will happen in the future (eg. a legislated change in royalty rate or tax etc). Oil and Gas companies my be hoping for higher prices but their business models are based on a case that is "business as usual" and neither pessimistic nor optimistic for the time of creation.

rockdoc123 wrote:Complete nonsense.

The colossal German Energiewende disaster obviously was timed on the basis of a much higher oil prediction that was absolutely fundamentally correct. So was all the oil companies planning. They can't all be wrong.

the only thing that is complete nonsense here is pretty much all of the rather incoherent ramblings you post.

Rockman is exactly correct. I have worked for numerous Oil and Gas companies over the years and spent a lot of time reviewing economic projections by other companies that are filed within their 51-101 or SEC reserves filings. In each and every case the forward projection is based on current price plus an adjustment made for inflation at the rate when the report was created. Indeed all of the third party reserve auditors are instructed to use this methodology for their economic projection for various reserve categories. The only time you will see anything different is when there is a known change that will happen in the future (eg. a legislated change in royalty rate or tax etc). Oil and Gas companies my be hoping for higher prices but their business models are based on a case that is "business as usual" and neither pessimistic nor optimistic for the time of creation.

A more than 60 percent plunge in oil prices since mid-2014 has forced oil producers worldwide to write down the value of their assets.

In a note earlier this month, Jefferies estimated that a group of integrated oil companies had impaired assets worth $103 billion since the start of 2014. This is equivalent to 8 percent of their 2014 net assets.

The brokerage expects more asset impairments in the industry, noting that Exxon is the only major producer to not have written down any assets.