by AirlinePilot » Tue 02 Mar 2010, 14:15:50

by AirlinePilot » Tue 02 Mar 2010, 14:15:50

ELM is evolving...westexas over at TOD has this post today....

"ELM 2.0 takes into account Chindia's rapidly increasing net oil imports, which went from 4.6 mbpd in 2005 to 6.0 mbpd in 2008 (EIA), a rate of change of +9.0%/year. Extrapolated out to 2010, they would be net importing about 7.2 mbpd. Expressed as a percentage of net exports from the (2005) top five net exporters, Chindia's net imports increased from 19% of the top five in 2005 to 27% in 2008, to a projected 33% in 2010. One can see where the trend is headed, as combined net exports from the (2005) top five showed a -2%/year rate of change, from 2005 to 2008.

But let's look at the Net/Net Exports from the top five, after subtracting out Chindia's net imports. In 2005, the Net/Net (2005 top five) number was about 19.4 mbpd. Assuming 22 mbpd Net Exports from the top five in 2010, and assuming 7.2 mbpd net imports into Chindia, the Net/Net number would fall to 14.8 mbpd in 2010.

Now, Sam's best case for the (2005) top five is that their net exports would be down to about 15 mbpd in 2018, and if we extrapolate Chindia's net imports, they would be approaching 15 mbpd in 2018, resulting in a projected Net/Net number of zero. If we do some "Cowboy Integration" (19.6 mbpd X 365 Days X 13 years X 0.5), it suggests that estimated post-2005 Net/Net Top Five Cumulative Exports are about 46 Gb. At the end of this year, the projected remaining Net/Net (2005) Top Five Cumulative Exports would be down to about 22 Gb, a five year Net/Net depletion rate of 15%/year. This is ELM 2.0."

Or more simply put......

Several Points: (1) Saudi Arabia is increasingly favoring China & India as their prime customers, with the US fading fast; (2) The (2005) top five account for about half of global net oil exports; (3) Closer to home, in the bottom half of 2005 net exporters, combined net exports from Canada, Mexico & Venezuela dropped by 20% in just four years, from 2004 to 2008; (4) The crux of the ELM 2.0 argument is that developing countries will continue to outbid developed countries for declining oil exports.

IMO, if my original post above isn’t just about the scariest thing that you have ever read, you don’t fully understand the problem.

Let’s try it this way. If we extrapolate recent trends, Chindia’s net imports in 2018 (eight years from now), expressed as a percentage of combined projected net exports from the (2005) top five net exporters, will be approaching 100%, leaving nothing for non-Chindia oil importers.

Now I understand that recent trends may not hold, but we all know how growing third world demand is going to be a problem. This is alarming stuff and why ELM is so important an issue to grasp.

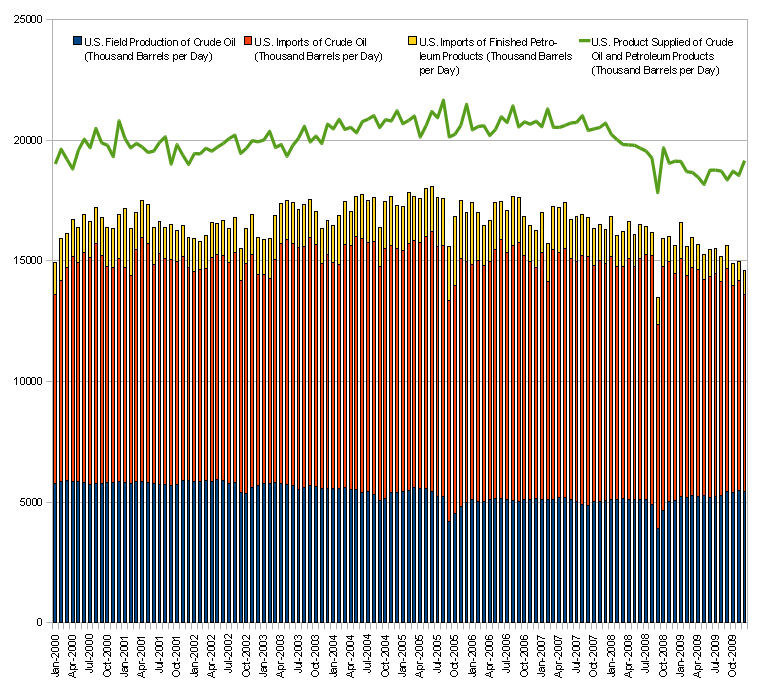

, next to that chart

, next to that chart  , is very scary.

, is very scary.