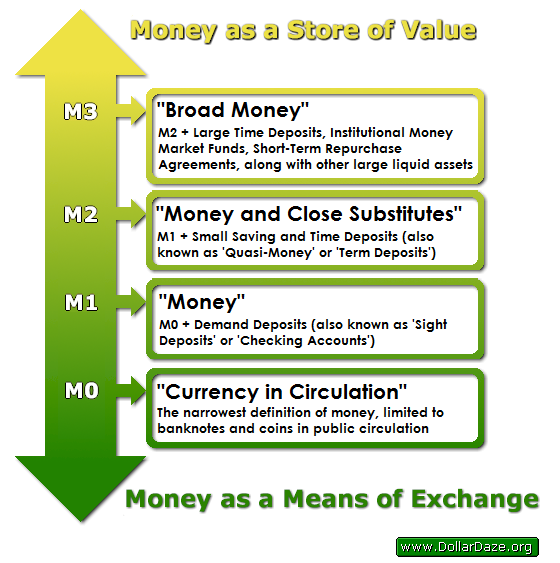

evilgenius wrote:You're right. I don't understand how you can think that money can be kept on a leash like you seem to propose. Nor do I see how, simply because it is out of your control, that it has to be engendered by a conspiracy of bankers. The simple truth is that the value of money is based upon the faith of the people. Whether that faith is registered in the complexities of markets, in the voodoo of market dynamics representing what everyone believes about the value of something over time and somehow pulled out in a quote at any one time, or in the actions of people borrowing and, therefore, causing expansion of the money supply based upon their faith represented in that action the value of money is always based upon what people believe it to be.

Being based upon the faith of 'the people' and not one man, money can never go onto a leash for any one man. If you seek to understand it that way, if you fall in love with it like that, you will always see a conspiracy or cabal or whatever behind its machinations. It's simply a tool that we use to communicate our faith to and with each other, and that not necessarily in the value of the instrument itself. Often it represents our faith in each other, in the direction our society is taking or in the possibilities we see in our collective futures.

There's more to it than that. Money is currently created as debt. The money creation process depends on credit. This is a bad scenario as it requires payment of more than the initial amount to pay off the debt. So therefore it requires continual growth to function correctly (in order to pay back the interest element). It's not about having money on a leash, it's about who creates it. If Governments are good for bonds they're good to mint coin, it's as simple as that. The IMF Chicago plan is one of potentially many ways of getting out of the current short-termist system. Remember the rationale for the Chicago plan:

At the height of the Great Depression a number of leading U.S. economists advanced a

proposal for monetary reform that became known as the Chicago Plan. It envisaged the

separation of the monetary and credit functions of the banking system, by requiring 100%

reserve backing for deposits. Irving Fisher (1936) claimed the following advantages for this

plan: (1) Much better control of a major source of business cycle fluctuations, sudden

increases and contractions of bank credit and of the supply of bank-created money.

(2) Complete elimination of bank runs. (3) Dramatic reduction of the (net) public debt.

(4) Dramatic reduction of private debt, as money creation no longer requires simultaneous

debt creation. We study these claims by embedding a comprehensive and carefully calibrated

model of the banking system in a DSGE model of the U.S. economy. We find support for all

four of Fisher's claims. Furthermore, output gains approach 10 percent, and steady state

inflation can drop to zero without posing problems for the conduct of monetary policy.

There are huge problems with the current monetary system and it needs to be changed in a world where energy is becoming scarcer and growth is no longer sustainable (nor desirable, given the ecological effects). Therefore a monetary system that isn't predicated on debt and growth is required. I've looked at a couple. I'd be interested if anyone had other ideas.