THE EIA Thread pt 3 (merged)

API vs. EIA data

I've always wondered why these 2 reports can be so different. Heres an overview from Marketwatch of both of these reports.

LINK

Looks like reporting to EIA is the law, while API isn't. API has been around since 1929, EIA reporting since 1979.

Who do you believe?

LINK

Looks like reporting to EIA is the law, while API isn't. API has been around since 1929, EIA reporting since 1979.

Who do you believe?

-

frankthetank - Light Sweet Crude

- Posts: 6201

- Joined: Thu 16 Sep 2004, 03:00:00

- Location: Southwest WI

Re: API vs. EIA data

It should be noted that Valero, the soon to be largest US refiner, does not report to the API.

The road goes on forever and the party never ends - REK

-

pip - Coal

- Posts: 480

- Joined: Wed 21 Apr 2004, 03:00:00

- Location: Republic of Texas

THE EIA Thread pt 3 (merged)

bratticus wrote:7 billion people with no money can't cause oil demand to rise.peripato wrote:OilFinder2 wrote:At any rate, the IEA has now jumped on the bandwagon too, at least for 2008.

--> Bloomberg <--IEA Says Oil Use to Fall for First Year Since 1983

By Grant Smith

Dec. 11 (Bloomberg) -- The International Energy Agency, an adviser to 28 nations, said global oil demand will contract this year for the first time since 1983 and cut its outlook for 2009.

Consumption worldwide will shrink in 2008 by 200,000 barrels a day, or 0.2 percent, the IEA said in a monthly report today. The reduction in demand is concentrated in developed economies in the Organization for Economic Cooperation and Development, where oil use will tumble 3.3 percent. Next year’s growth may be wiped out if the economic slump deepens, the agency said.

[...]

They're forecasting a 400K bpd increase in demand next year. Time will tell whether that forecast holds up.

As long as the population is growing (human and vehicular), and there is economic activity in the world, demand will keep rising. With the oil price so low there will be many willing buyers.

Your viewpoint is overly simplistic. At this stage it is apparent that consumption has not dropped that dramatically this year, according to the EIA figures, and is forecast to rise in 2009.

-

peripato - Heavy Crude

- Posts: 1335

- Joined: Tue 03 May 2005, 03:00:00

- Location: Reality

Re: EIA: World oil demand to fall for first time in decades

peripato wrote:My focus is solely on the 2008 figures in the EIA report I've linked to which clearly shows that most of the demand destruction for that year has already been.

Uhh, yeah, that's because most of the year itself "has already been." It's already December and they've got data for November. So of course most of the demand destruction "has already been."

Stuff for doomers to contemplate:

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

-

copious.abundance - Fission

- Posts: 9589

- Joined: Wed 26 Mar 2008, 03:00:00

- Location: Cornucopia

Re: EIA: World oil demand to fall for first time in decades

200,000 barrels per day drop in consumption = 2.88 minutes less oil consumption per day or 17.52 hours for the year, or about 3/4 of a day DROP IN CONSUMPTION! Does that take into consideration there was 366 days this year vs. 365? If so, then we're in the plus and our consumption drop has been wiped out because of the leap year in 2008! OMG man!

Are you actually saying this is a MEANINGFUL DECLINE? Please wake me up when the decimal moves a little more to the right please, maybe by like 2 spots? A drop in under 3 less minutes of consumption globally PER DAY does not compare to our current economic contraction that is being measured in double digits.

Oilfinder2, you're trying to make up the hype just like the Doomers are.

Are you actually saying this is a MEANINGFUL DECLINE? Please wake me up when the decimal moves a little more to the right please, maybe by like 2 spots? A drop in under 3 less minutes of consumption globally PER DAY does not compare to our current economic contraction that is being measured in double digits.

Oilfinder2, you're trying to make up the hype just like the Doomers are.

-

ki11ercane - Coal

- Posts: 448

- Joined: Sun 02 Dec 2007, 04:00:00

- Location: Winnipeg, MB, Canada

Re: EIA: World oil demand to fall for first time in decades

The fact that it has dropped (or, is about to drop) for the first time since 1983 is significant. That's 25 straight years of increases come to an end.

Stuff for doomers to contemplate:

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

-

copious.abundance - Fission

- Posts: 9589

- Joined: Wed 26 Mar 2008, 03:00:00

- Location: Cornucopia

Re: EIA: World oil demand to fall for first time in decades

ki11ercane wrote:200,000 barrels per day drop in consumption = 2.88 minutes less oil consumption per day or 17.52 hours for the year, or about 3/4 of a day DROP IN CONSUMPTION! Does that take into consideration there was 366 days this year vs. 365? If so, then we're in the plus and our consumption drop has been wiped out because of the leap year in 2008! OMG man!

Are you actually saying this is a MEANINGFUL DECLINE? Please wake me up when the decimal moves a little more to the right please, maybe by like 2 spots? A drop in under 3 less minutes of consumption globally PER DAY does not compare to our current economic contraction that is being measured in double digits.

Oilfinder2, you're trying to make up the hype just like the Doomers are.

Amen. Let's wait for demand/production to drop by 4 or 5%, and then Oil Finder will have something to really crow about! Given the depth of global economic destruction assisted by a nearly 4 year production plateau, one can imagine the additional horrors waiting in the wings as we reach this level. Oil Finder go store the bubbly…

Last edited by peripato on Thu 11 Dec 2008, 23:07:42, edited 1 time in total.

-

peripato - Heavy Crude

- Posts: 1335

- Joined: Tue 03 May 2005, 03:00:00

- Location: Reality

Re: EIA: World oil demand to fall for first time in decades

OilFinder2 wrote:peripato wrote:My focus is solely on the 2008 figures in the EIA report I've linked to which clearly shows that most of the demand destruction for that year has already been.

Uhh, yeah, that's because most of the year itself "has already been." It's already December and they've got data for November. So of course most of the demand destruction "has already been."

The EIA says you're wrong. Demand is rising now, and according to them will not decline next year. However, I concede they might just be full of it – but then again so are you.

-

peripato - Heavy Crude

- Posts: 1335

- Joined: Tue 03 May 2005, 03:00:00

- Location: Reality

Re: EIA: World oil demand to fall for first time in decades

OilFinder2 wrote:The fact that it has dropped (or, is about to drop) for the first time since 1983 is significant. That's 25 straight years of increases come to an end.

Yep, growth has to stop sometime. How does contraction square with you, huh? What does this mean for all that oil and gas discovery you keep harping on about?

-

peripato - Heavy Crude

- Posts: 1335

- Joined: Tue 03 May 2005, 03:00:00

- Location: Reality

Re: EIA: World oil demand to fall for first time in decades

peripato wrote:OilFinder2 wrote:The fact that it has dropped (or, is about to drop) for the first time since 1983 is significant. That's 25 straight years of increases come to an end.

Yep, growth has to stop sometime. How does contraction square with you, huh?

Recessions - and even the occasional depression - are inevitable. There is nothing anyone can do to stop the business cycle. So whenever the latest expansionary cycle comes to a halt, usually as a victim of its own excesses, you simply have to wait for the excesses to wring themselves out, and another cycle can start anew. As I posted here, there is nothing new about what is going on. It has happened many times in the past, and it will happen again many times in the future.

peripato wrote:What does this mean for all that oil and gas discovery you keep harping on about?

Hard to say. Obviously it'll affect some companies more than others. But even in cases where a company might scale down exploration activities, whenever the price of energy rises again, exploration activity will pick up again.

Stuff for doomers to contemplate:

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

-

copious.abundance - Fission

- Posts: 9589

- Joined: Wed 26 Mar 2008, 03:00:00

- Location: Cornucopia

Re: EIA: World oil demand to fall for first time in decades

OilFinder2 wrote:peripato wrote:OilFinder2 wrote:The fact that it has dropped (or, is about to drop) for the first time since 1983 is significant. That's 25 straight years of increases come to an end.

Yep, growth has to stop sometime. How does contraction square with you, huh?

Recessions - and even the occasional depression - are inevitable. There is nothing anyone can do to stop the business cycle. So whenever the latest expansionary cycle comes to a halt, usually as a victim of its own excesses, you simply have to wait for the excesses to wring themselves out, and another cycle can start anew. As I posted here, there is nothing new about what is going on. It has happened many times in the past, and it will happen again many times in the future.

How so if oil is set to peak/has peaked? Where will the energy come from in a world of energy contraction? Also isn't it true that the last time this sort of shakeout occurred the oil industry was in decline for nearly 20 years, coinciding with sluggish economic growth. There were also far fewer people, less infrastructure and a smaller GDP to support back then, so I don't imagine it will be any fun, as one after another, these elements start to shrink too.

peripato wrote:What does this mean for all that oil and gas discovery you keep harping on about?

Hard to say. Obviously it'll affect some companies more than others. But even in cases where a company might scale down exploration activities, whenever the price of energy rises again, exploration activity will pick up again.

Where will the energy and money come from to explore and produce from more and more difficult locations, if these two essentials are shrinking in availability?

-

peripato - Heavy Crude

- Posts: 1335

- Joined: Tue 03 May 2005, 03:00:00

- Location: Reality

Re: EIA: World oil demand to fall for first time in decades

peripato wrote:How so if oil is set to peak/has peaked?

You don't know for a fact that oil is about to/has already peaked. You merely believe it has.

peripato wrote:Where will the energy come from in a world of energy contraction?

Whenever oil production does peak (whether that be 5 or 50 years from now), this does not mean energy production will peak. There are vast amounts of natural gas. The world supplies of uranium can last hundreds, if not thousands, of years. They can always build huge numbers of solar farms in the Mojave Desert. Etc., etc., etc.

peripato wrote:Also isn't it true that the last time this sort of shakeout occurred the oil industry was in decline for nearly 20 years, coinciding with sluggish economic growth.

The last time the price of oil crashed in 1985-86 was in the midst of a long economic boom which lasted from 1983-1990, which was interrupted by a brief recession in 1990-91, and which was then followed by an even longer economic boom from 1991-2000.

I can't believe I'm explaining recent history to someone.

peripato wrote:There were also far fewer people, less infrastructure and a smaller GDP to support back then, so I don't imagine it will be any fun as one after another these elements start to shrink too.

And there are now more people to look for oil and gas, and to develop and build alternative energies than there was back then. The larger economy now means there is more capital to develop these things.

peripato wrote:What does this mean for all that oil and gas discovery you keep harping on about?Hard to say. Obviously it'll affect some companies more than others. But even in cases where a company might scale down exploration activities, whenever the price of energy rises again, exploration activity will pick up again.

Where will the energy and money come from to explore and produce from more and more difficult locations, if these two essentials are shrinking in availability?

There will not be less energy (see first reply this post). If or when the price of energy goes up due to an economic upswing, energy companies will make more money, and thus have more money to spend on exploration.

Stuff for doomers to contemplate:

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

-

copious.abundance - Fission

- Posts: 9589

- Joined: Wed 26 Mar 2008, 03:00:00

- Location: Cornucopia

Re: EIA: World oil demand to fall for first time in decades

OilFinder2 wrote:peripato wrote:How so if oil is set to peak/has peaked?

You don't know for a fact that oil is about to/has already peaked. You merely believe it has.

No I don't hold an opinion one way or the other about whether oil has already peaked, but supply appears to have plateaued - sustained high prices have not done anything to bring on higher production, and only super-cornucopians think that oil won't peak for another 50 years.

peripato wrote:Where will the energy come from in a world of energy contraction?

Whenever oil production does peak (whether that be 5 or 50 years from now), this does not mean energy production will peak. There are vast amounts of natural gas. The world supplies of uranium can last hundreds, if not thousands, of years. They can always build huge numbers of solar farms in the Mojave Desert. Etc., etc., etc.

Super-cornucopian, oil is our biggest source of primary energy. When it declines, ergo there will be less energy available. You can't possibly compare natural gas, with all its constraints, to the supreme fungibility and versatility of oil.

As for uranium, please let's leave idle speculation about resource size where it belongs. It's still about how much electricity you can reasonably hope to produce at any given time (flows). There are limits. You know, limits?

peripato wrote:Also isn't it true that the last time this sort of shakeout occurred the oil industry was in decline for nearly 20 years, coinciding with sluggish economic growth.

The last time the price of oil crashed in 1985-86 was in the midst of a long economic boom which lasted from 1983-1990, which was interrupted by a brief recession in 1990-91, and which was then followed by an even longer economic boom from 1991-2000.

Umm you're talking about the stock market boom? The one built on debt and derivatives? Oh yeah the economy was really swell for the mega rich, but try telling that to the middle class whose wealth position actually stagnated during all this time, and is now set to fall off a cliff.

Sources: CensusBureau.gov

MeasuringWorth.com

I can't believe I'm explaining recent history to someone.I assume you're not very old.

I can't believe how deluded and in denial you are. You must be in a lot of pain puppy. All cherished assumptions of the future about to go up in smoke...

peripato wrote:There were also far fewer people, less infrastructure and a smaller GDP to support back then, so I don't imagine it will be any fun as one after another these elements start to shrink too.

And there are now more people to look for oil and gas, and to develop and build alternative energies than there was back then. The larger economy now means there is more capital to develop these things.

Most of this capital is speculative bullshit, it is being utterly destroyed in the biggest deflationary contraction in modern history. It will take years for this to work through the system and by then there will be a lot fewer companies, a lot fewer employees, and a lot less investment for everything - including renewables.

peripato wrote:What does this mean for all that oil and gas discovery you keep harping on about?Hard to say. Obviously it'll affect some companies more than others. But even in cases where a company might scale down exploration activities, whenever the price of energy rises again, exploration activity will pick up again.

Where will the energy and money come from to explore and produce from more and more difficult locations, if these two essentials are shrinking in availability?

There will not be less energy (see first reply this post). If or when the price of energy goes up due to an economic upswing, energy companies will make more money, and thus have more money to spend on exploration.

All this activity takes money and energy, both of which we will soon have much less of.

Last edited by peripato on Fri 12 Dec 2008, 01:09:17, edited 2 times in total.

-

peripato - Heavy Crude

- Posts: 1335

- Joined: Tue 03 May 2005, 03:00:00

- Location: Reality

Re: EIA: World oil demand to fall for first time in decades

mos6507 wrote:joewp wrote:cipi604 wrote:Don't worry it will go to 20$ a barrel, for years maybe. Meanwhile the oil industry will rust.

Yeah, talk about your rock and a hard place. If the price stays high, the economy tanks. If the price stays low, production tanks and the price shoots up and the economy tanks. Then the price goes down and so does production capacity. Wash, rinse, repeat.

Funny how the capitalist market-driven economy contains the seeds of its very demise.

There's more, of course. Oil runs out soon = Mad Max doom. Oil doesn't run out soon = climate doom. We get onto hippie dippie renewables and permaculture = population doom. Limits to growth. It's a bitch.

Therefore, perpetual growth is overrated.

- bodigami

- Permanently Banned

- Posts: 1921

- Joined: Wed 26 Jul 2006, 03:00:00

us comercial oil inventory

I recently found the link to the EIA site. and upon looking at the supply and cosumtion side see that we are still useing more than we are producing. but what i am unable to figure out is? on the invetory side it show Dec. to be at 994million barrels Of comercial inventory. But

on wednesdays supply figure they are showing. 320.8 million barrels.

so any body in the know as to the difference in the comercial inventory,as to the weekly reported inventory?

on wednesdays supply figure they are showing. 320.8 million barrels.

so any body in the know as to the difference in the comercial inventory,as to the weekly reported inventory?

-

horsedrawn - Wood

- Posts: 9

- Joined: Sat 10 Mar 2007, 04:00:00

- Location: Wisconsin

Re: EIA: World oil demand to fall for first time in decades

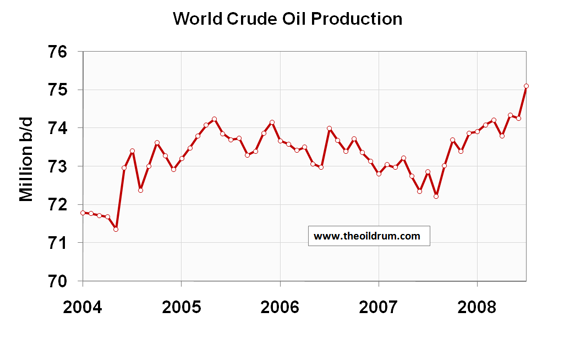

peripato wrote:No I don't hold an opinion one way or the other about whether oil has already peaked, but supply appears to have plateaued - sustained high prices have not done anything to bring on higher production, and only super-cornucopians think that oil won't peak for another 50 years.

High prices *did* bring on additional production - eventually. It does take some time for it to come online. Note the rise beginning the middle of last year:

peripato wrote:Super-cornucopian, oil is our biggest source of primary energy. When it declines, ergo there will be less energy available. You can't possibly compare natural gas, with all its constraints, to the supreme fungibility and versatility of oil.

Illogical. At one time our biggest source of energy was coal. Does the decline of coal as our primary energy source mean that total energy declined? No. Therefore, it does not follow that if oil declined that total energy would also decline.

Furthermore, your statement concerning natural gas was also randomly pulled out of thin air with no factual backing. It so happens that natural gas makes a perfectly good transportation fuel. You simply threw in the word "constraints" without having the slightest clue whether NG had such constraints or not. NG is as fungible and versatile as oil, and as discussed in this thread, it is abundant.

peripato wrote:As for uranium, please let's leave idle speculation about resource size where it belongs. It's still about how much electricity you can reasonably hope to produce at any given time (flows). There are limits. You know, limits?

Ah yes, standard doomer response - throw in the word "limits" without even reading the information provided in the article. But yes, you are correct: There could be "limits" to the amount of electricity provided by nuclear power - a "limit" which is likely hundreds or thousands of years away. Not much of a "limit" if you ask me.

I suppose there is also a "limit" on the amount of energy we can ultimately expect to be provided by the sun: Another billion years or so 'till we hit the "limit."

peripato wrote:peripato wrote:Also isn't it true that the last time this sort of shakeout occurred the oil industry was in decline for nearly 20 years, coinciding with sluggish economic growth.The last time the price of oil crashed in 1985-86 was in the midst of a long economic boom which lasted from 1983-1990, which was interrupted by a brief recession in 1990-91, and which was then followed by an even longer economic boom from 1991-2000.

Umm you're talking about the stock market boom? The one built on debt and derivatives? Oh yeah the economy was really swell for the mega rich, but try telling that to the middle class whose wealth position actually stagnated during all this time, and is now set to fall off a cliff.

Sources: CensusBureau.gov

MeasuringWorth.com

An utterly off-topic, strawman reply. The last time "this sort of shakeout occurred " in the early 80's (deep recession, oil price rise then crash) was followed by 17 years of economic expansion and only 1 year of contraction. So much for the "sluggish economic growth" you complained about. And last time I looked the oil companies are still around and doing fine, thank you, rather than being "in decline" as you claimed. Having shown you these facts, you are left to reply with some nonsense about class struggle, evil greedy rich people and other such leftist tripe.

Oh - but wait! Since you seem to guage the health of an economy on how well the middle class does, the economic collapse and decline in energy availability you advocate will make their plight even worse! Beware of what you ask for, you just might get it!

peripato wrote:I can't believe I'm explaining recent history to someone.I assume you're not very old.

I can't believe how deluded and in denial you are. You must be in a lot of pain puppy. All cherished assumptions of the future about to go up in smoke...

Such an effective debating tactic!

peripato wrote:Most of this capital is speculative bullshit, it is being utterly destroyed in the biggest deflationary contraction in modern history. It will take years for this to work through the system and by then there will be a lot fewer companies, a lot fewer employees, and a lot less investment for everything - including renewables.

The deflation you speak of will lower the costs for the needed energy projects, thus lowering the investment needs. You can read about it in JD's blog for starters. I can also show you declining prices for steel, polysilicon for solar panels, and a whole host of other cost inputs to energy projects. It all evens out.

peripato wrote:All this activity takes money and energy, both of which we will soon have much less of.

In your dreams!

Stuff for doomers to contemplate:

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

-

copious.abundance - Fission

- Posts: 9589

- Joined: Wed 26 Mar 2008, 03:00:00

- Location: Cornucopia

Re: EIA: World oil demand to fall for first time in decades

Oil at $46 pb.

I'll hold on that oil demand for 2009. Not wanting to be cynical but you can throw all the respected opinion and statistics around as much as you like, but we are living in a world economically different to that of the 80's even the 90's, and peoples economic activities are different. Sure people are having to tighten their belts, but when they see something going for next to nothing (or similar to the good ole days), you can bet the cash registers in the forecourts will be Kaching-chinging. Whether you accept it or not, we are a society that exists only to derive pleasure from spending, and as oil gives us a false sense of liberation and freedom, you can expect the general populous to want their fix. Signs of Cold Turkey started to happen this Summer with oil at $150, but at $46!!!!!

I'll hold on that oil demand for 2009. Not wanting to be cynical but you can throw all the respected opinion and statistics around as much as you like, but we are living in a world economically different to that of the 80's even the 90's, and peoples economic activities are different. Sure people are having to tighten their belts, but when they see something going for next to nothing (or similar to the good ole days), you can bet the cash registers in the forecourts will be Kaching-chinging. Whether you accept it or not, we are a society that exists only to derive pleasure from spending, and as oil gives us a false sense of liberation and freedom, you can expect the general populous to want their fix. Signs of Cold Turkey started to happen this Summer with oil at $150, but at $46!!!!!

THE FUTURE IS HISTORY!

-

Gazzatrone - Tar Sands

- Posts: 581

- Joined: Mon 07 Nov 2005, 04:00:00

- Location: London, UK

Re: EIA: World oil demand to fall for first time in decades

peripato wrote:No I don't hold an opinion one way or the other about whether oil has already peaked, but supply appears to have plateaued - sustained high prices have not done anything to bring on higher production, and only super-cornucopians think that oil won't peak for another 50 years.

High prices *did* bring on additional production - eventually. It does take some time for it to come online. Note the rise beginning the middle of last year:

Please, a few hundred thousand additional barrels over the course of 4 years is hardly a stellar result given the huge price incentive to bring on more production. More like squeezing blood from a stone. But I grant that it is not conclusive whether we've peaked yet. But I'm sure its close.

peripato wrote:Super-cornucopian, oil is our biggest source of primary energy. When it declines, ergo there will be less energy available. You can't possibly compare natural gas, with all its constraints, to the supreme fungibility and versatility of oil.

Illogical. At one time our biggest source of energy was coal. Does the decline of coal as our primary energy source mean that total energy declined? No. Therefore, it does not follow that if oil declined that total energy would also decline.

Coal was supplanted by oil because it was a superior fuel source. What is the primary source of energy which can substitute for oil for all its net power, versatility and cheapness?

Furthermore, your statement concerning natural gas was also randomly pulled out of thin air with no factual backing. It so happens that natural gas makes a perfectly good transportation fuel.

You simply threw in the word "constraints" without having the slightest clue whether NG had such constraints or not. NG is as fungible and versatile as oil, and as discussed in this thread, it is abundant.

You don't know what you're talking about. NG suffers from a much greater logistical burden to bring it to market. More so, those markets are for the most part regional, unlike oil which is much cheaper to produce, deliver and store - this makes it a fuel ideal for the purposes of international trade.

peripato wrote:As for uranium, please let's leave idle speculation about resource size where it belongs. It's still about how much electricity you can reasonably hope to produce at any given time (flows). There are limits. You know, limits?

Ah yes, standard doomer response - throw in the word "limits" without even reading the information provided in the article. But yes, you are correct: There could be "limits" to the amount of electricity provided by nuclear power - a "limit" which is likely hundreds or thousands of years away. Not much of a "limit" if you ask me.

No even non-doomers recognise that some things are either not worth the effort, or physically impossible to exploit. Shit, even economists know this.

I suppose there is also a "limit" on the amount of energy we can ultimately expect to be provided by the sun: Another billion years or so 'till we hit the "limit."

The sun will last another 5 billion years, and there are always other limits besides energy, but that's the doozy.

peripato wrote:Also isn't it true that the last time this sort of shakeout occurred the oil industry was in decline for nearly 20 years, coinciding with sluggish economic growth.

The last time the price of oil crashed in 1985-86 was in the midst of a long economic boom which lasted from 1983-1990, which was interrupted by a brief recession in 1990-91, and which was then followed by an even longer economic boom from 1991-2000.

Umm you're talking about the stock market boom? The one built on debt and derivatives? Oh yeah the economy was really swell for the mega rich, but try telling that to the middle class whose wealth position actually stagnated during all this time, and is now set to fall off a cliff.

Sources: CensusBureau.gov

MeasuringWorth.com

An utterly off-topic, strawman reply. The last time "this sort of shakeout occurred " in the early 80's (deep recession, oil price rise then crash) was followed by 17 years of economic expansion and only 1 year of contraction. So much for the "sluggish economic growth" you complained about. And last time I looked the oil companies are still around and doing fine, thank you, rather than being "in decline" as you claimed. Having shown you these facts, you are left to reply with some nonsense about class struggle, evil greedy rich people and other such leftist tripe.

You are utterly clueless. Most of this wealth was accumulated using debt, which is yet to be be paid back. Many people have been forced to borrow, or required their partners also bring home an income, to maintain their lifestyles. This chart shows the decline in household equity over the decades as Americans' have been transferring the ownership of their homes to the banks, in an effort to keep up appearances..

Yep the economy was real swell for the average American...

During the decades of the 80's and 90's western oil companies made little new investment in refineries, personnel (with many lay-offs) or exploration. Low oil prices saw to that.

Oh - but wait! Since you seem to guage the health of an economy on how well the middle class does, the economic collapse and decline in energy availability you advocate will make their plight even worse! Beware of what you ask for, you just might get it!

What I want or say is immaterial, same goes for you - our power to influence reality is limited. The trajectory of human events makes it virtually certain that substantial doom awaits us, and probably not before too long. The cracks are already appearing, with the bust

up of the economy, the appearance of resource constraints, massive ecological destruction and accelerating climate change.

peripato wrote:I can't believe I'm explaining recent history to someone.I assume you're not very old.

I can't believe how deluded and in denial you are. You must be in a lot of pain puppy. All cherished assumptions of the future about to go up in smoke...

Such an effective debating tactic!

If the shoe fits.

peripato wrote:Most of this capital is speculative bullshit, it is being utterly destroyed in the biggest deflationary contraction in modern history. It will take years for this to work through the system and by then there will be a lot fewer companies, a lot fewer employees, and a lot less investment for everything - including renewables.

The deflation you speak of will lower the costs for the needed energy projects, thus lowering the investment needs. You can read about it in JD's blog for starters. I can also show you declining prices for steel, polysilicon for solar panels, and a whole host of other cost inputs to energy projects. It all evens out.

Yep, you hit it home there Curly, trillions of dollars lost in home equity is just no match for the few millions saved by making more efficient solar panels. What could I have been thinking?

peripato wrote:All this activity takes money and energy, both of which we will soon have much less of.

In your dreams!

Wait and see super-cornucopian. Wat and see. The earth is no magic pudding, and we are not exempt from the laws of nature. Burning stuff to produce energy is not that clever. Producing your own energy from scratch, well that's something different. Oh, but then again - in your dreams.

-

peripato - Heavy Crude

- Posts: 1335

- Joined: Tue 03 May 2005, 03:00:00

- Location: Reality

U.S. Oil Consumption Flat Through 2030, EIA Predicts

--> Bloomberg <--

U.S. Oil Consumption Flat Through 2030, EIA Predicts

By Tina Seeley

Dec. 17 (Bloomberg) -- U.S. oil consumption will be flat through 2030, as the use of biofuels, rising oil prices and new car efficiency standards temper demand for petroleum, the Energy Information Administration said.

The last 20 years “has been a history of rising oil use,” Howard Gruenspecht, acting head of the agency, part of the U.S. Energy Department, said in a speech today in Washington. The new outlook “projects a break in this trend, with no appreciable growth in oil consumption between now and 2030 and biofuels being all of the growth in liquids.”

Use of liquid fuels, including biofuels, will grow by 1 million barrels a day between 2007 and 2030, the agency said in its Annual Energy Outlook. Ethanol consumption will increase to 12.2 billion gallons, and cellulosic ethanol feedstocks will reach 12.6 billion gallons by 2030, EIA says.

[...]

Stuff for doomers to contemplate:

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

-

copious.abundance - Fission

- Posts: 9589

- Joined: Wed 26 Mar 2008, 03:00:00

- Location: Cornucopia

Re: U.S. Oil Consumption Flat Through 2030, EIA Predicts

Of course.

More biofuels is in line with what the New Boss will expect, of course.

With overall liquid fuel demand in the AEO2009 reference case growing by only 1 million barrels per day between 2007 and 2030, increased use of domestically-produced biofuels, and rising domestic oil production spurred by higher prices, the net import share of total liquids supplied, including biofuels, declines from 58 percent in 2007 to less than 40 percent in 2025 before increasing to 41 percent in 2030 (Figure 1).

Looks like they're projecting $75/bbl pretty soon on this already obsolete graph:

Drill Now ain't happenin' at the moment, GOM is still ca.14% shut in as well. Flat US production won't be a problem in their projected world demand of 112.5 mb/d in 2030, natch. Course there'll be about 70 million more citizens, too.

Cogito, ergo non satis bibivi

And let me tell you something: I dig your work.

And let me tell you something: I dig your work.

-

TheDude - Expert

- Posts: 4896

- Joined: Thu 06 Apr 2006, 03:00:00

- Location: 3 miles NW of Champoeg, Republic of Cascadia

Return to Peak oil studies, reports & models

Who is online

Users browsing this forum: No registered users and 32 guests