ROCKMAN wrote:Adam - Good poop...thanks. But now we have low oil prices/much less US drilling in the once booming trends where production is declining.

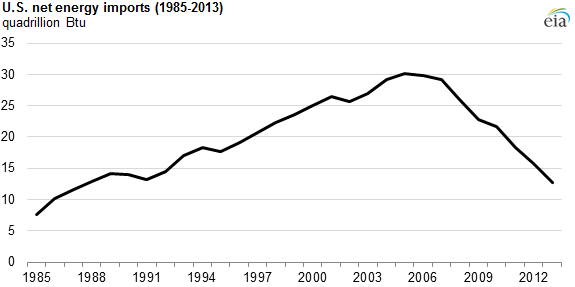

Yup. But that wasn't the point I addressed. I addressed the point of inability to achieve energy independence, on any basis as you said, and it turns out that we are at about a 91% production versus consumption level, which is far better than it once was, as the evidence demonstrates. And just as obviously, reporter types noticed and drew the obvious conclusion...for reporter types anyway.

And production is only one variable in two variable equation...as demand profiles change, as they have in the past decade, via the mechanisms that you call POD and I call something far more common (shifting supply and demand curves), then real live energy experts begin putting together scenarios that suddenly make those demand changes important, and by extension all of this effects independence potential. Here is said expert.

https://www.weforum.org/agenda/2016/04/ ... oil-peaks/Obviously she is suspect if only because the likes of Matt Savinar graduated from the school she teaches at, but I'm sure her's isn't the only idea on these lines.

Rockman wrote:And happening while consumption appear to be heading up even if slowly. That would seem to imply that when we see the net energy import chart in 5 years that tend may have reversed itself

It certainly might. or it might not. Your industry has increased volumes so much, and so fast, that the next obvious question that anyone must answer...prior to pretending we know enough to discuss the future...at what price will the same process activate again, and once activated, how long will it continue? The only people with the resources and manpower and expertise to tackle that issue are about ready to release their AEO 2016 report, but so far we just have the early release. haven't been able to go through it yet and see what the experts think, it just came out today.

http://www.eia.gov/forecasts/aeo/er/index.cfmPlant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"