Russian Peak

Re: Russians forecast to 2040

A normal energy prediction is 3 years

10 is considered long term

36 years is stretching usefullness, maybe interesting reading though

10 is considered long term

36 years is stretching usefullness, maybe interesting reading though

- Simon_R

- Lignite

- Posts: 234

- Joined: Thu 16 May 2013, 09:28:06

Re: Russians forecast to 2040

Simon_R wrote:A normal energy prediction is 3 years

Who uses a 3 year forecast and how to they use it?

- dashster

- Lignite

- Posts: 385

- Joined: Fri 28 Dec 2012, 08:39:24

- Location: California

Re: Russians forecast to 2040

It is used for forwards purchase of Gas/Coal in the Electric Generating business.

Commonly created by the Plexos modelling tool

Commonly created by the Plexos modelling tool

- Simon_R

- Lignite

- Posts: 234

- Joined: Thu 16 May 2013, 09:28:06

Re: Russian Peak

VANKOR OIL FIELD, Russia, March 30 (Reuters) - Oil output at Rosneft's Vankor deposit, a driver of Russia's recent oil production growth, may start declining next year, a top company official said, underlining the challenges of production in far-flung regions.

Russia, one of the world's top oil producers, is tapping oil at a pace of 10.65 million barrels per day, a post-Soviet record-high, thanks to a ramp-up at Vankor and other new fields.

"(Vankor's) oil production will stay at the plateau of 22 million tonnes this year, while next year it may decline slightly," said Alexander Cherepanov, the chief engineer of Vankorneft, a Rosneft subsidiary which is developing the field.

Vankor, launched by state-run Rosneft in August 2009, is Russia's northernmost onshore oil production project. It is part of Russia's push to tap new, challenging regions, such as Arctic offshore and East Siberia as oil deposits in West Siberia, the heartland of Russian oil production, are gradually depleted.

Oil from the field, located partly on the Taimyr peninsula beyond the Polar circle, is delivered to China by pipelines.

Rosneft's production, which account for 40 percent of Russia's total oil output, declined in 2014 to 205 million tonnes from 207 million in 2013.

http://www.reuters.com/article/2015/03/ ... NZ20150330

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Russian Peak

From Ron at POB

This from Reuters:

Comments from Tully @ OilPrice

.

This from Reuters:

Dec 22 Russia's oil production may start declining in 2017 if a tough taxation policy continues, Energy Minister Alexander Novak said in interview to Kommersant news daily published on Tuesday.

The government has decided to freeze its oil export duty instead of cutting it to 36 percent from 42 percent next year, as had been previously planned, due to state budget constraints. The oil industry has been worrying that the freeze will continue beyond 2016.

"There are risks of output decline starting from 2017," Novak said.

"If this decision ... actually lasts for a year and the companies believe it, they will continue taking loans and invest and this will allow them to keep output steady in 2017-18," Novak added.

"But if the companies now get a signal that this decision not to cut the oil export duty is for longer, they will not take loans and won't make investments."

Russia's oil output, buoyed by investments made in the past two to three years, is forecast to rise to 533 million tonnes this year from 526.7 million tonnes in 2014, Novak said.

Comments from Tully @ OilPrice

.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Russian Peak

pstarr wrote:It seems the Russians are stuck between an ice flow and their soggy bottom. If they reduce their export tariff to increase export market share and income, they run short of capital to develop the Arctic. After the $150 billion Kashagan washout its unlikely the Arctic will be developed for $500 billion.

Arctic oil is essentially DOA now that the only two potential players are out. Canada can't get near this stuff. Like Kashagan it is on the other side of an endless bog. How much does that remove from EIA's rosy projections for yet-to-be-developed for future world oil production? 20 mbpd more or less?

People who are writing off peak oil need to go and buy a clue. We are headed for a supply crunch regardless of the mythical glut that is supposedly indicated by the low oil prices. In fact, the low oil prices will make the constriction quicker since more oil is consumed than would have been with a higher price. This is in addition to the lack of new supply development as you point out.

- dissident

- Expert

- Posts: 6458

- Joined: Sat 08 Apr 2006, 03:00:00

Re: Russian Peak

It is interesting (to me) that the rise in Russian oil production 2002-2004 didn't cause the price of oil to collapse. Maybe it isn't shale oversupply that caused the current collapse at all, maybe it is a very sick global economy. Oh well, beating a dead horse, back to watching Russian production decline...

- GoghGoner

- Heavy Crude

- Posts: 1827

- Joined: Thu 10 Apr 2008, 03:00:00

- Location: Stilłwater subdivision

Re: Russian Peak

RU offset the decline of the N Sea and switch from export to import in China.

RUs collapse last century and the postponement of that production is the reason we didn't peak in the 00s

RUs collapse last century and the postponement of that production is the reason we didn't peak in the 00s

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Russian Peak

When is that Russian oil pipeline system to China going to be completed? I know it is in several phases before they get connected to their European network, going first from the fields in the Far East, then from mid Siberian fields as they build it from the Pacific westward.

II Chronicles 7:14 if my people, who are called by my name, will humble themselves and pray and seek my face and turn from their wicked ways, then I will hear from heaven, and I will forgive their sin and will heal their land.

- Subjectivist

- Volunteer

- Posts: 4701

- Joined: Sat 28 Aug 2010, 07:38:26

- Location: Northwest Ohio

Re: Russian Peak

Subjectivist wrote:When is that Russian oil pipeline system to China going to be completed? I know it is in several phases before they get connected to their European network, going first from the fields in the Far East, then from mid Siberian fields as they build it from the Pacific westward.

This is for natural gas and not oil. The plans are to have it up by 2019.

- dissident

- Expert

- Posts: 6458

- Joined: Sat 08 Apr 2006, 03:00:00

Re: Russian Peak

I was casually listening to NPR in the car yesterday and some guy was talking about Russian economic depression and collapse from declining energy. He wasn't Russian himself but he was talking about the social devastation to come and mentioned "assuming he and everyone are still alive afterwards" Nice little PO apocalyptic meme slipped in there.

Do not seek the truth, only cease to cherish opinions.

- jupiters_release

- Heavy Crude

- Posts: 1301

- Joined: Mon 10 Oct 2005, 03:00:00

Re: Russian Peak

Quite a frank assessment of Russia's Oil reserves in this Pravda article.

http://www.pravdareport.com/business/co ... olution-0/

"Bloomberg has recently said that Western sanctions against Russia act in a restrictive way - they give about 0.3% of GDP.

Oil price is a different story.

It is the price of oil that largely causes the deep economic crisis that Russia continues to fall into.

It is hard to say when we hit the bottom.

In this crisis, I see two main reasons.

The first one is the geological one.

Russia has missed two revolutions - the shale oil revolution and the heavy oil revolution.

We were ignoring these revolutions at the time when the rest of the world was taking advantage of them.

"Saudi Arabia was the world's number one oil power.

Now it takes the second position.

Venezuela has declared unimaginable reserves of heavy oil.

This country takes the first place with internationally recognised oil reserves of about 300 million tons.

Saudi Arabia comes second and Canada with its heavy oil comes third.

The States is on the way to become the world's number one oil producer with the help of shale oil.

"I saw a book in which Putin was called the energy emperor.

However, I do not know why Russia was not trying to take advantage of heavy oil even though we have lots of it in Western Siberia and on the Russian Valley.

All of a sudden, oil has become a resource that is fantastically inexhaustible.

Only one country, such as Venezuela, is capable of supplying oil to the rest of the world.

Venezuelan oil reserves are estimated at 600 million tons of oil.

These reserves are enough to ensure uninterrupted oil shipments for the whole world for six years.

Venezuelan heavy oil is very cheap: it sells at about 15 or $20 per barrel.

Canadian oil is a lot more expensive - about $40.

Russia is ranked eighth in the world.

What is worse, we haven't had any large new discoveries during the recent decade."

"What do we have for shale oil and heavy oil?"

"Russia has never worked in the field of heavy oil. We did not work in the field where we could make discoveries. We were hoping for the Arctic.

However, we came across such a serious obstacle as sanctions, as Russia is unable to develop Arctic oil independently.

We need Western technologies for that."

"Strangely enough, Russia is turning a blind eye on all this and is not trying to find new oil deposits.

We say that we are good with what we have, while other countries look for resources and they find them.

Russia is the only country it does not discover nontraditional oil.

To make matters worse,

Russia has lost the scientific base.

The technological disadvantage is immense.

To to crown it all, the West is waging a targeted war against Russia and it will continue this war until Putin is removed from power."

"What does the West do to conduct this oil war against Russia?"

"The West has failed to mastermind a real hot war against Russia - we could see it on the example of the Ukrainian crisis - so now they proceeded to a hybrid war or an oil war against our country.

"The United States has recently decided to lift sanctions from Iran.

Iran will add one or two million.

Afterwords, the United States allowed oil exports for the first time in 40 years.

Russia is being attacked from all directions."

"They will continue to decline.

I do not think that oil will rise higher than $60 dollars per barrel ever again, and the West will try to take advantage of it to destroy Russia with the help of Russia's main source of income - oil."

"Does Russia have a product that no other country in the world has?"

"No, we don't.

Russia's rich natural resources is a myth.

We have lost all the chrome, uranium in Kazakhstan and Ukraine.

Kazakhstan has become the world's leader in uranium production.

We have lost manganese in Ukraine and Georgia.

We've lost mercury in Ukraine.

We have also lost 40% of gold and 60% of lead and zinc.

We have lost our geological service.

What we do have is natural gas.

Russia is the world's number one producer of natural gas."

http://www.pravdareport.com/business/co ... olution-0/

Ready to turn Zombies into WWOOFers

-

Shaved Monkey - Intermediate Crude

- Posts: 2486

- Joined: Wed 30 Mar 2011, 01:43:28

Re: Russian Peak

People should know that Pravda has become like a supermarket tabloid a long time ago. It only had "weight" before the USSR collapsed. The article sounds hysterical. Non-conventional oil exploitation is about costs and not technology. Right now there is no economic incentive to develop the Bazhenov deposits or potential tar sands in eastern Siberia. The USA passed its peak back in 1973 and obviously non-conventional development resulted. Russia has not yet passed its peak conventional production. So we are looking at a 40 to 50 year difference in the trajectory of the US and Russian oil industries.

- dissident

- Expert

- Posts: 6458

- Joined: Sat 08 Apr 2006, 03:00:00

Re: Russian Peak

I would imagine part of the thinking behind the lack of exploration or exploitation of other oils would be to not bring on new supply and reduce the price by increasing supply.

Unfortunately supply and demand dont dictate price in the real world anymore.

Venezaula having 6 years global supply was an interesting tid bit

so Saudi has less

Thats not a lot of years

Unfortunately supply and demand dont dictate price in the real world anymore.

Venezaula having 6 years global supply was an interesting tid bit

so Saudi has less

Thats not a lot of years

Ready to turn Zombies into WWOOFers

-

Shaved Monkey - Intermediate Crude

- Posts: 2486

- Joined: Wed 30 Mar 2011, 01:43:28

Don’t bet on Russia capping oil output

https://www.ft.com/content/8741742a-864 ... 59a58ac7a5

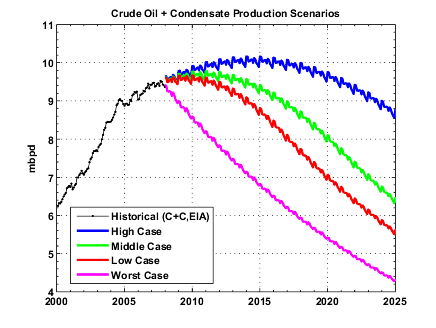

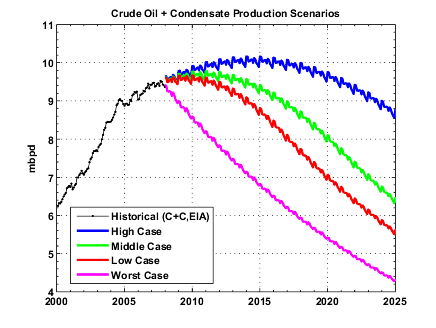

According to the consensus at the defunct Oil Drum Russia should have been well past peak by now.

http://www.theoildrum.com/node/3626

In spite of the sharp fall in the price of oil since 2014, the Russian oil industry is healthy and production, confounding many predictions to the contrary, is growing steadily.

Indeed, boosted by the launch of several greenfields this month, Russian oil output has gained around 200,000 barrel per day in September alone to a post-Soviet record of 11.18m barrels per day.

Although this booming rate of output gains cannot be sustained; slow, steady production increases from these levels will remain the norm at least until 2020. So how is this dichotomy of rising production and sharply lower oil prices possible?

First, Russian oil production is highly profitable on a pre-tax basis, much more so than is generally understood. Second, both the Russian oil tax regime and the rouble are highly geared to oil prices, cushioning wellhead margins and keeping overall well economics for producing companies surprisingly stable in almost any oil price environment.

The precipitous fall in oil prices since mid-2014, from over $100 per barrel to just below $50 a barrel today, has resulted in a rapid reduction in investment in the global oil industry, which has naturally resulted in a significant reduction in field-level activity.

Most visibly, the number of working US oil rigs has collapsed by about 75 per cent from the 2014 peak. Canada (-79 per cent), Latin America (-54 per cent), and the Asia-Pacific region (-32 per cent) also all saw significant drops in rig activity. Even in the Middle East, where Saudi Arabia is in the process of taking market share, the number of rigs in operation has fallen 12 per cent from 2014 peak levels.

Russia, however, is clearly bucking this trend. Although upstream capital expenditure in the country has fallen in dollar terms, that has been entirely due to the sharp fall in the rouble. Drilling activity itself has actually risen by 25 per cent since 2014, driving a steady rise in Russian oil output even as the rest of the non-OPEC world sees various degrees of declines.

This increase in oil production despite sharply lower oil prices has caught many observers by surprise. In December of 2014 Opec forecasted a small, 10,000 bpd production loss for Russia in 2015, while the International Energy Agency predicted a more significant 90,000 bpd fall. In reality Russian output went up by about 140,000 bpd.

In December of 2015 Opec again predicted a decline in Russian output for 2016, this time of around 70,000 bpd, while the IEA anticipated “largely flat” output. In the event, Russian production broke through the 11m bpd level in early September, and with the launch of several new greenfield projects hit 11.18m bpd by September 20, the highest level since 1989 when Russia was still part of the Soviet Union. Looking forward, we expect Russian oil production to continue to climb, if less dramatically, for the medium term until hitting about 11.5m bpd in 2020.

So how has Russian oil production been able to outperform the forecasts of knowledgeable observers, increasing production in spite of low oil prices?

We see two general reasons: First, contrary to common misconception, Russia’s oil production is not a high-cost venture. Instead, the typical Russian barrel of oil resides far down the cost curve, generating economic value even at oil prices below $20 per barrel, although the bulk of that economic value goes to the Russian government via taxes, rather than to producers in the form of profit.

Second, both Russia’s oil tax regime (explicitly) and the free-floating rouble (in effect) are tied to the price of oil. The combination of an automatically-adjusting tax burden and rouble work to act as a very effective cushioning mechanism for wellhead operating margins.

The union of only modestly lower, and generally stable, wellhead margins and sharply lower upfront well costs has served to keep new well economics for producers surprisingly stable in almost any oil price environment for Russia’s oil companies. Indeed, we estimate that the returns of a standard vertical well in West Siberia today are the same or even higher than what would have been earned on that same well in June of 2014 when oil was around $112 a barrel.

This somewhat counter-intuitive result — that field-level returns could be stable in spite of sharply lower oil prices — is probably what has caused otherwise knowledgeable observers to serially underestimate Russia’s production potential the last few years.

So what does this imply for Russian oil production going forward?

In short, with a stable return environment and substantial geological resources left to tap, we see Russian oil production continuing its slow climb for at least the next five years. While the increase in any given year is unlikely to be large enough to move the needle on global oil markets, neither can other global producers look to Russia for help in reining in output to boost the price of oil.

According to the consensus at the defunct Oil Drum Russia should have been well past peak by now.

http://www.theoildrum.com/node/3626

- dissident

- Expert

- Posts: 6458

- Joined: Sat 08 Apr 2006, 03:00:00

Re: Don’t bet on Russia capping oil output

dissident wrote:According to the consensus at the defunct Oil Drum Russia should have been well past peak by now.

http://www.theoildrum.com/node/3626

Actually, the "high case" prediction published in the "oil drum" puts the peak in Russia around 2015-16.

-

Plantagenet - Expert

- Posts: 26619

- Joined: Mon 09 Apr 2007, 03:00:00

- Location: Alaska (its much bigger than Texas).

Re: Don’t bet on Russia capping oil output

Plantagenet wrote:dissident wrote:According to the consensus at the defunct Oil Drum Russia should have been well past peak by now.

http://www.theoildrum.com/node/3626

Actually, the "high case" prediction published in the "oil drum" puts the peak in Russia around 2015-16.

I don't recall high cases being considered the most probable in any of the TOD discussions and articles. Also, it is 1.5 million barrels per day short this "high" case. That projection graph is a joke.

- dissident

- Expert

- Posts: 6458

- Joined: Sat 08 Apr 2006, 03:00:00

Re: Don’t bet on Russia capping oil output

BREAKING NEWS UPDATE: U.S. suspends diplomatic contacts with Russia

Outcast_Searcher is a fraud.

- StarvingLion

- Permanently Banned

- Posts: 2612

- Joined: Sat 03 Aug 2013, 18:59:17

Who is online

Users browsing this forum: No registered users and 197 guests