Based upon this graph,

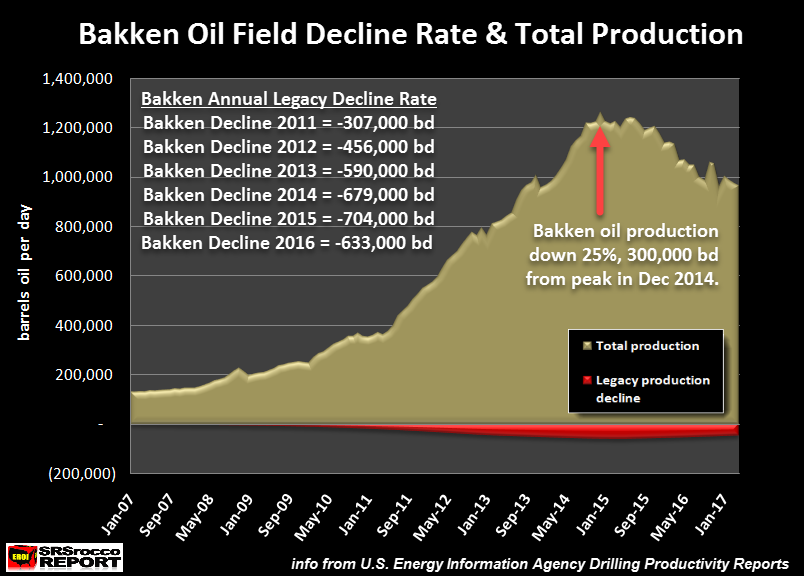

Bakken on December 31, 2012 was producing about 700,000 bbl/d

All those Bakken wells that were producing that 700,000/bbl/d nearly three years ago have gone through their steep decline phase and at the end of 2015 will still be producing about 250,000/bbl/d of oil, day in and day out. When I think of Bakken Legacy production this is the oil I am referring to.

So what does this mean for the future with the much slower drilling rate that has been undertaken in 2015? Here is how I see it and I welcome corrections from Toolpush/ROCKMAN/other industry experts.

A little over 12 months from now we will reach December 31, 2016 and the legacy output will include the wells IMO drilled between January 1, 2013 and December 31, 2013 that will have gone through their steep decline period by that date. Based on past performance I believe that will mean legacy output will rise from the current 250,000/bbl/d to a level of around 350,000/bbl/d.

But what about the wells from 2014 and 2015 that are still in their steepest decline rates as we enter 2016? As of October 2015 per the graph above those wells were producing about 625,000/bbl/d of the 1,050,000/bbl/d currently coming from the Bakken. If they follow the typical decline rates for the next year then at the end of next year they will be putting out about 300,000/bbl/d. Added to the legacy production by then of 350,000/bbl/d the Bakken will produce at minimum 650,000/bbl/d plus whatever new production comes into production during 2016. For the years 2012, 2013 and 2014 that new production amounted to between 200,000/bbl/d and 300,000/bbl/d. However those kind of increases were only taking place when drilling was going on as quickly as possible and prices were very high. During 2015 drilling rates have fallen steeply from a year ago and now more closely resemble rates from 2010 when the Bakken boom was just in its first flush of success. If things continue as seems likely for the next six months I believe we will settle in around 200,000/bbl/d of additional 'new' 2016 production by the end of next year.

Adding the new, still steeply declining, and pre 2014 legacy numbers together gives me a guess of 850,000/bbl/d coming from the Bakken December 31, 2016. That puts us at the same output from Bakken that we had December 31, 2013 when OPEC started looking at market share as a serious concern. It also means the fall from 1,150,000bbl/d is not nearly as severe as the initial decline rates of wells lead many of us, myself included, to expect it to be. A loss of 300,000/bbl/d is no laughing matter, but in terms of the world market it is easily absorbed until such time as peak oil declines actually set in and cut total supplies. Also during the 2016 period the bankruptcies will accumulate and the cash flush investors or companies like the one ROCKMAN works for will be able to buy up many legacy wells for far less than the cost of new well drilling, allowing them to keep them in production for many years even as they decline slowly going forward.