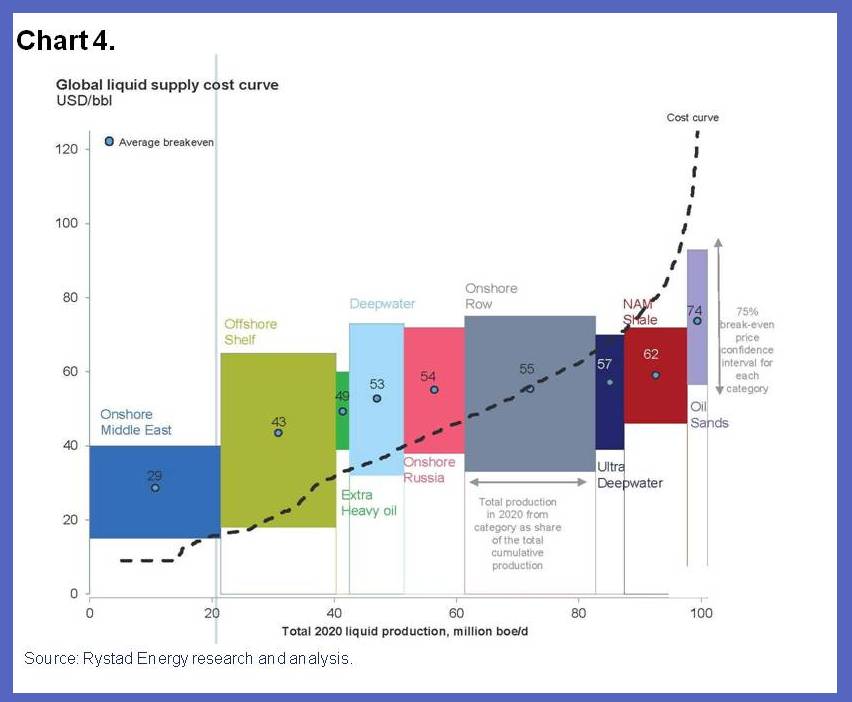

Pops wrote:According to the model in my brain, the economy is not able to pay above $100 for new, 'non-conventional' oil fields. This isn't written down anywhere, the number might be $120 or $80 but it seems pretty certain it's in the ballpark that correlates to 5%-10% of US GDP. On the first chart the red band around $100 is where the economy chokes, the orange, eyeballed trendline of "base" oil price seems to be entering that range now...

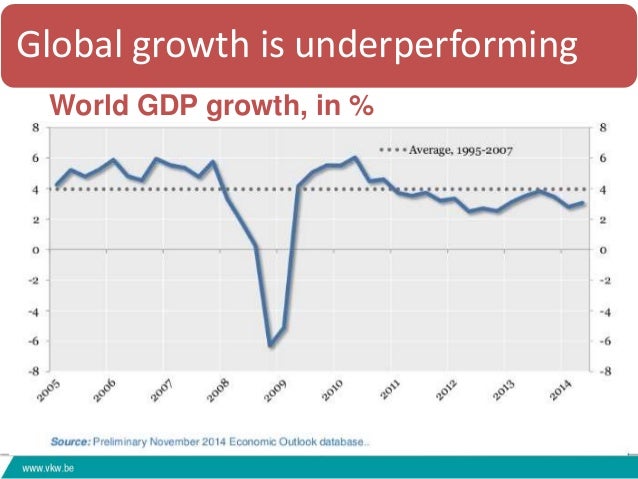

Basically you were saying that the $100 or so price could not be sustained because such a price would collapse the economy after some time. Only after such an economic crash would the price fall back down.

Unfortunately for your little model from 4 years ago, we have now gotten an oil price crash without it being caused by an economic crash. I don't see anything, anywhere in your first post here indicating you thought a repeat of 1985-86 would ever be possible again. But that's what we got.