Stimulus spreading

Re: Stimulus spreading

You can see those better here

http://www.advisorperspectives.com/dsho ... he-SPX.php

http://www.advisorperspectives.com/dsho ... he-SPX.php

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Stimulus spreading

That what my gut reading was, good to see it graphed. I guess Average Joe was able to finance stuff easily, too. Since wages haven't increased, the low interest rates haven't done us too much good.

I've seen a lot of headlines that say Six Years. What does sub-prime auto loan defaults and commodity prices circa 2009 have in common? I guess we will have to wait and see. Is the US in for a day of reckoning for all that stimulus? It felt so good.

I've seen a lot of headlines that say Six Years. What does sub-prime auto loan defaults and commodity prices circa 2009 have in common? I guess we will have to wait and see. Is the US in for a day of reckoning for all that stimulus? It felt so good.

Fitch: Losses on U.S. Subprime Auto ABS Climb to Six-Year High

Read more: http://www.digitaljournal.com/pr/2478655#ixzz3SmAPpo4t

- GoghGoner

- Heavy Crude

- Posts: 1827

- Joined: Thu 10 Apr 2008, 03:00:00

- Location: Stilłwater subdivision

Re: Stimulus spreading

Global equities hit new record as cheap money reigns

Global equities set a new record high and bond yields sank to fresh lows on Thursday as investors positioned for an extended era of cheap money ahead of the European Central Bank's looming bond-buying scheme.

There were also signs the euro zone economy may be turning a corner as consumer morale picked up in the bloc's largest economies and bank lending fell at a slower place.

- GoghGoner

- Heavy Crude

- Posts: 1827

- Joined: Thu 10 Apr 2008, 03:00:00

- Location: Stilłwater subdivision

Re: Stimulus spreading

The ECB plans to buy €60 billion ($67 billion) worth of government and corporate bonds every month until September 2016.

The decision to start purchasing public sector bonds was made in mid-January. The program is aimed to stimulate the economic recovery of the Eurozone and to decrease the risk of deflation.

At a press-conference following Thursday's ECB Governing Council meeting in Nicosia, Draghi said that he expects economic recovery in the Eurozone to "gradually broaden and strengthen."

Read more: http://sputniknews.com/business/2015030 ... z3TWboUZYQ

Quantitative easing: what does it mean for consumers?

Since 2009, the Bank of England has used QE to try and revive the British economy. But evidence from the Office of National Statistics showed that the bank’s purchase of a third, or £375 billion-worth, of government bonds (or gilts) actually made the richest 10 per cent richer by hundreds of thousands of pounds. According to the Bank of England, QE in the UK delivered a massive boost to the wealth of the most prosperous 10 per cent of households in Britain while delivering relatively scant returns for the poorest.

- GoghGoner

- Heavy Crude

- Posts: 1827

- Joined: Thu 10 Apr 2008, 03:00:00

- Location: Stilłwater subdivision

Re: Stimulus spreading

The deflation bogeyman

Why, then, are so many central bankers so worried about low inflation rates?

One possible explanation is that they are concerned about the loss of credibility implied by setting an inflation target of 2% and then failing to come close to it year after year. Another possibility is that the world’s major central banks are actually more concerned about real growth and employment, and are using low inflation rates as an excuse to maintain exceptionally generous monetary conditions. And yet a third explanation is that central bankers want to keep interest rates low in order to reduce the budget cost of large government debts.

None of this might matter were it not for the fact that extremely low interest rates have fueled increased risk-taking by borrowers and yield-hungry lenders. The result has been a massive mispricing of financial assets. And that has created a growing risk of serious adverse effects on the real economy when monetary policy normalizes and asset prices correct.

- GoghGoner

- Heavy Crude

- Posts: 1827

- Joined: Thu 10 Apr 2008, 03:00:00

- Location: Stilłwater subdivision

Re: Stimulus spreading

LOL, yeah, just ask the folks who invested in LTO.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Stimulus spreading

An interest rate cut from South Korea Thursday takes the number of central banks that have stepped up their monetary easing this year to 24 and that number is likely to rise, analysts say.

http://www.cnbc.com/id/102499561?__sour ... picks=true

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Stimulus spreading

Japan’s Central Bank Warns of Temporary Return to Deflation

The bank predicted the lull in inflation would be temporary, however. It said in its assessment that prices would eventually start rising, spurred by low unemployment and rising incomes, though it did not say when that might happen. It chose not to modify the expansive bond-buying program it has been using to encourage inflation, keeping its target for purchases of government debt at 80 trillion yen, or about $660 billion, a year.

Mr. Kuroda was appointed Bank of Japan governor by Prime Minister Shinzo Abe in 2013, with a mandate to pull Japan out of deflation by whatever means necessary. He immediately ordered a sharp increase in the bank’s bond buying, then expanded it again late last year.

- GoghGoner

- Heavy Crude

- Posts: 1827

- Joined: Thu 10 Apr 2008, 03:00:00

- Location: Stilłwater subdivision

Re: Stimulus spreading

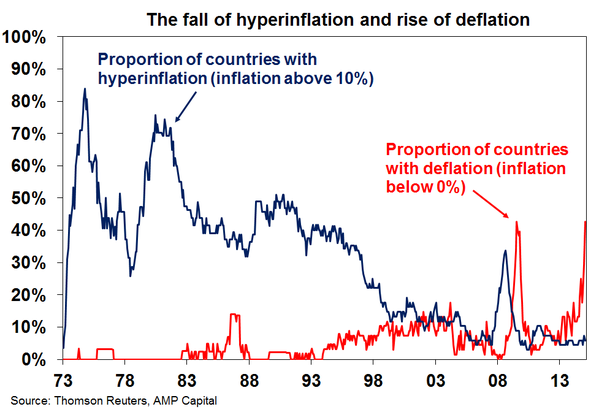

With stimulus and deflation rising at the same time, you have to wonder what the endgame might look like...

Economic Surrealism

Economic Surrealism

In part, this doubtless reflects growing investor fears about unusual risks in a world where little conventional policy ammunition is left to deal with, for example, another global recession. Yet, the longer that negative interest rates persist – and the lower they go – the bigger the risk of a fundamental shift in the operation of the financial system.

We may already be on the verge of witnessing restrictions on the provision of bank credit. Further out, it is just possible to imagine a world in which cash is king, with money stored in vast warehouses, and where we return to a world not so dissimilar to that which prevailed under the Gold Standard. Central bankers should be careful what they wish for.

- GoghGoner

- Heavy Crude

- Posts: 1827

- Joined: Thu 10 Apr 2008, 03:00:00

- Location: Stilłwater subdivision

Re: Stimulus spreading

GoghGoner wrote:With stimulus and deflation rising at the same time, you have to wonder what the endgame might look like...

"Don’t panic, Wall St. is safe!"

-

peripato - Heavy Crude

- Posts: 1335

- Joined: Tue 03 May 2005, 03:00:00

- Location: Reality

Re: Stimulus spreading

Romania cuts interest rates to record low, more easing seen

Polish, Hungarian and Serbian policymakers also cut their rates earlier this month due to low inflation and the European Central Bank's bond purchases, which attract investors to the region's higher yields and support currencies.

But the prospect of pending interest rate hikes in the United States may put an end to easing in the region.

- GoghGoner

- Heavy Crude

- Posts: 1827

- Joined: Thu 10 Apr 2008, 03:00:00

- Location: Stilłwater subdivision

Re: Stimulus spreading

Now that everybody is getting into the stimulus game, it isn't so fun for American bankers anymore?

Dangers Lurk in Fed's Zero Rate Policy

Dangers Lurk in Fed's Zero Rate Policy

To be clear, the Fed was right to aggressively lower interest rates after the 2008 crisis. But continuing with zero interest rates and quantitative easing for seven years after the crisis is in conflict with the goal of increased employment and growth. By robbing individual savers and financial institutions of income, and artificially boosting asset prices, the Fed and ECB are unwittingly creating the circumstances for the next financial crisis.

The Fed and ECB should therefore abandon zero rates and quantitative easing and move to gradually increase interest rates to restore cash flow to the financial system. Mr. Bernanke and his former colleagues on the Federal Open Market Committee ought to recall Adam Smith's famous dictum that the “great wheel of circulation" is the means by which the flow of goods and services moves through the economy. If the Fed really wants to fight deflation and eventually hit a 2% inflation target, then we must embrace policies that make the proverbial wheel turn faster, not slower. We can do this by gradually ending financial repression and restoring balance to global monetary policy.

- GoghGoner

- Heavy Crude

- Posts: 1827

- Joined: Thu 10 Apr 2008, 03:00:00

- Location: Stilłwater subdivision

Re: Stimulus spreading

China's stimulus is not having any effect and their slowdown is still getting worse. Their stocks bounced higher today in hopes of more stimulus.

Are cheaper diamonds a sign of something bigger?

Are cheaper diamonds a sign of something bigger?

Diamond prices have tumbled almost 15 percent over the past 12 months and that has Nicholas Colas, chief market strategist at Convergex, eyeing a larger trend. (Tweet this)

"The reason all this intrigues me is not as a prospective shopper, but rather because the price of 'Commodity' diamonds is a very good case study in macroeconomic deflationary pressures," Colas said in a report for clients.

- GoghGoner

- Heavy Crude

- Posts: 1827

- Joined: Thu 10 Apr 2008, 03:00:00

- Location: Stilłwater subdivision

Re: Stimulus spreading

If this rise in commodity prices is speculation then I think I might have to adjust my view on how much speculation can drive prices -- for oil, it was a $10 range. I wonder if the credit flood hasn't changed the game.

Such a crazy world right now, bad news increases speculative bets on commodities because speculators like more stimulus.

Copper’s Win Streak Hits Seven Days

Such a crazy world right now, bad news increases speculative bets on commodities because speculators like more stimulus.

Copper’s Win Streak Hits Seven Days

“This is a Chinese story,” said John Payne, senior market analyst with futures brokerage Daniels Trading in Chicago. “The more negative the data is out of China, the more it’s a bullish indicator [for copper], because of expectations” for additional efforts to pump up the economy, he said.

- GoghGoner

- Heavy Crude

- Posts: 1827

- Joined: Thu 10 Apr 2008, 03:00:00

- Location: Stilłwater subdivision

Re: Stimulus spreading

I was going to write a post on the great blood-sucking vampier squid that is Gold/Sacks, and bubbles and speculation, and cetera but I should work a little instead. Suffice to quote Matt Taibbi:

Here are some links

http://www.resourceinvestor.com/2015/03 ... nue?page=1

http://www.rollingstone.com/politics/ne ... e-20100405

http://www.cftc.gov/ucm/groups/public/@ ... 10-ata.pdf

If America is circling the drain, Goldman Sachs has found a way to be that drain — an extremely unfortunate loophole in the system of Western democratic capitalism, which never foresaw that in a society governed passively by free markets and free elections, organized greed always defeats disorganized democracy.

Here are some links

http://www.resourceinvestor.com/2015/03 ... nue?page=1

http://www.rollingstone.com/politics/ne ... e-20100405

http://www.cftc.gov/ucm/groups/public/@ ... 10-ata.pdf

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Stimulus spreading

Yes, and one of those bubbles was---oil speculation in 2008!

But that's something people (like pstarr) wouldn't want to concede happened.

BTW, as to your sig, Pops, Liz Warren is my senator. I met her at a local appearance during her campaign, and I would like her to run but I doubt she will. But she's more electable than Bernie Sanders.

But that's something people (like pstarr) wouldn't want to concede happened.

BTW, as to your sig, Pops, Liz Warren is my senator. I met her at a local appearance during her campaign, and I would like her to run but I doubt she will. But she's more electable than Bernie Sanders.

"If the oil price crosses above the Etp maximum oil price curve within the next month, I will leave the forum." --SumYunGai (9/21/2016)

-

ennui2 - Permanently Banned

- Posts: 3920

- Joined: Tue 20 Sep 2011, 10:37:02

- Location: Not on Homeworld

Re: Stimulus spreading

There was a reason for speculative position limits imposed on markets back in the 1930.

Supply was tight, spare capacity was low or the run up couldn't have happened, even GoldSacks can't physically hoard that much oil, but they were right there pushing the market long.

And since the stimulus, the bubble has been LTO.

ibid.Between 2003 and 2008, the amount of speculative money in commodities grew from $13 billion to $317 billion

Supply was tight, spare capacity was low or the run up couldn't have happened, even GoldSacks can't physically hoard that much oil, but they were right there pushing the market long.

And since the stimulus, the bubble has been LTO.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Stimulus spreading

The Fed's Low Interest Rates Are Increasing Inequality

Party on, dudes - China's stock market surges on Beijing's latest stimulus efforts

It is a commonly held belief that the Fed’s low interest rates have been responsible for inflating stock market values. Because people with more wealth tend to own more stock, to the extent that the Fed has been the cause of higher stock prices, it has worsened wealth inequality. Similarly, low interest rates have meant low borrowing costs for large corporations with direct access to capital markets (through corporate bonds). This cheap money helps to boost corporate profits which, again, flow mostly to the wealthy.

Party on, dudes - China's stock market surges on Beijing's latest stimulus efforts

- GoghGoner

- Heavy Crude

- Posts: 1827

- Joined: Thu 10 Apr 2008, 03:00:00

- Location: Stilłwater subdivision

60 posts

• Page 2 of 3 • 1, 2, 3

Return to Geopolitics & Global Economics

Who is online

Users browsing this forum: No registered users and 77 guests