Place Yer Bets - Next Recession

Re: Place Yer Bets - Next Recession

Lots of Irish builders in Western Australia when there was no local tradies left after they went up north to the mines to get rich.

Problem is most of the tradies are now heading back home because they got the sack from the mines when iron ore prices plummeted.

This guy did ok...for now

http://www.smh.com.au/small-business/gr ... 0pou3.html

Problem is most of the tradies are now heading back home because they got the sack from the mines when iron ore prices plummeted.

This guy did ok...for now

http://www.smh.com.au/small-business/gr ... 0pou3.html

Ready to turn Zombies into WWOOFers

-

Shaved Monkey - Intermediate Crude

- Posts: 2486

- Joined: Wed 30 Mar 2011, 01:43:28

Re: Place Yer Bets - Next Recession

Shaved Monkey wrote:Lots of Irish builders in Western Australia when there was no local tradies left after they went up north to the mines to get rich.

Problem is most of the tradies are now heading back home because they got the sack from the mines when iron ore prices plummeted.

This guy did ok...for now

http://www.smh.com.au/small-business/gr ... 0pou3.html

That's a major worry, as we expect that many of the diaspora have only short term work visas in places like Australia & Canada. When those visas are not renewed, a lot will come home and most likely go straight on to the dole. The only real growth here is in software development and call centre tech support for multinational companies exploiting the tax regime here.

Religion is regarded by the common people as true, by the wise as false, and by rulers as useful.:Anonymous

Our whole economy is based on planned obsolescence.

Hungrymoggy "I am now predicting that Europe will NUKE ITSELF sometime in the first week of January"

Our whole economy is based on planned obsolescence.

Hungrymoggy "I am now predicting that Europe will NUKE ITSELF sometime in the first week of January"

-

dolanbaker - Intermediate Crude

- Posts: 3855

- Joined: Wed 14 Apr 2010, 10:38:47

- Location: Éire

Re: Place Yer Bets - Next Recession

pstarr wrote:You lack historical perspective Loki. You must be young. The housing bubble was a last-ditch attempt to get out of the doldrums that had already set in at the beginning of the new millennium, after the boom years of President Clinton. The price of gasoline was screaming upward, from $1.00 gallon at the pump 2002. The Fed, the banks encourage the housing bubble to re-invigorate the economy as gasoline climbed in a few short years to $2.50 then $3.00 in 2006. That was $trillions of dollars stolen from the US economy.

Yes. Debt, the velocity of money, growth all shrunk as folks became poorer. Unfortunately neither the housing bubble and various stimulations have managed to get us out of the GREATEST RECESSION EVER.

Okey dokey

A garden will make your rations go further.

-

Loki - Expert

- Posts: 3509

- Joined: Sat 08 Apr 2006, 03:00:00

- Location: Oregon

Re: Place Yer Bets - Next Recession

dolanbaker wrote:Looking at the poll results, I am the only one to expect a minor correction.

The thread is definitely US-centric, without saying so, unfortunately. This site used to be more international, or at least so I remember.

The poll is pretty much irrelevant in the parts of Europe that are already in an outright depression. Also irrelevant for the other parts of Europe and Japan that are experiencing very low inflation or actual deflation. Not necessarily recession in the arbitrary "two quarters of GDP decline" definition, but certainly stagnation.

Canada and Australia, on the other hand, never really felt the full effects of the Great Recession. Nor did China, which is a special case, a rather large, interesting special case that I think has the potential to blow up sooner than any of the "advanced" economies most PO.com posters live in.

So if China's bloated real estate bubble pops next week and they go into a debt deflation spiral, how does that affect the US economy? Or the Australian economy? Or the UK's?

A garden will make your rations go further.

-

Loki - Expert

- Posts: 3509

- Joined: Sat 08 Apr 2006, 03:00:00

- Location: Oregon

Re: Place Yer Bets - Next Recession

What if the next bubble is the shale drilling boom ?

States with seemingly strong economies like North Dakota, Texas, Oklahoma, New Mexico, Pennsylvania and Louisiana (to some extent) that weathered the housing bubble would be harshly affected. I'm thinking you could see oil related companies with high debt get wiped out, high unemployment, severe fiscal crisis in areas where state and local governments believed that the drilling would last for 30 years. It could be a blood bath. Now in saying that the reduction in drilling in those areas will drastically lower production from these areas in as little as one year due to high decline rates, so the roller coaster could ramp up again once people came out of of the bomb shelters.

States with seemingly strong economies like North Dakota, Texas, Oklahoma, New Mexico, Pennsylvania and Louisiana (to some extent) that weathered the housing bubble would be harshly affected. I'm thinking you could see oil related companies with high debt get wiped out, high unemployment, severe fiscal crisis in areas where state and local governments believed that the drilling would last for 30 years. It could be a blood bath. Now in saying that the reduction in drilling in those areas will drastically lower production from these areas in as little as one year due to high decline rates, so the roller coaster could ramp up again once people came out of of the bomb shelters.

- wildbourgman

- Coal

- Posts: 483

- Joined: Sun 07 Jul 2013, 10:05:52

Re: Place Yer Bets - Next Recession

Loki wrote:dolanbaker wrote:Looking at the poll results, I am the only one to expect a minor correction.

The thread is definitely US-centric, without saying so, unfortunately. This site used to be more international, or at least so I remember.

The poll is pretty much irrelevant in the parts of Europe that are already in an outright depression. Also irrelevant for the other parts of Europe and Japan that are experiencing very low inflation or actual deflation. Not necessarily recession in the arbitrary "two quarters of GDP decline" definition, but certainly stagnation.

Canada and Australia, on the other hand, never really felt the full effects of the Great Recession. Nor did China, which is a special case, a rather large, interesting special case that I think has the potential to blow up sooner than any of the "advanced" economies most PO.com posters live in.

So if China's bloated real estate bubble pops next week and they go into a debt deflation spiral, how does that affect the US economy? Or the Australian economy? Or the UK's?

Partly true on the membership, I think the real effect is more akin to number of active posters than to their region or origin. We used to get many more posts per day than we get now in the late Aughties, and that meant we got a lot more international perspective as a side effect.

If China or India fall apart from an economic bubble it will completely rock the world economy. Their production and consumption of resources have a huge influence, and if that consumption goes down 25% or even 10% for a few months to a few years it will tip the balance of costs all over the globe. Remember the Asian Tiger phenomenon 20 odd years ago? Vietnam/Thailand/Myanmar/Indonesia were building skyscrapers and whole new cities where rice had been growing before. When there bubble burst half those buildings languished unfinished until they had to be torn back down for public safety reasons. That crash caused the price of oil on the world market to hit modern lows in the 1990's and fueled economic growth in North America and Europe as a side effect.

If China crashes it won't have the same overall result because so much of our wealth in North America and Europe is now tied into the economy of China. Last time globalization was much more of a theory than a practice. Today globalization, love it or hate it, is a very strong factor.

Alfred Tennyson wrote:We are not now that strength which in old days

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

-

Tanada - Site Admin

- Posts: 17055

- Joined: Thu 28 Apr 2005, 03:00:00

- Location: South West shore Lake Erie, OH, USA

Re: Place Yer Bets - Next Recession

I'm not sure how "unfortunate" it is for an english language site to be frequented predominately by english speakers from english speaking countries.

The thing I see globally is the continuation of the investment in "emerging markets" (by a lot of US Corps BTW) all hoping to recreate the triumphs of the past, are now hitting a wall. Those initial leaps can't be recreated; dollar a day wages, cheap containerized shipping, and cheap long distance digital management are gone. It's like switching from a 7mpg vehicle to a 14mpg vehicle doubles your efficiency but the same 7mpg increase in a 14mpg vehicle only increases efficiency by half and the next 7 increases it only a third. Dimishing returns.

I had this argument with someone here who said all that mattered was if the labor force continued to expand the economy would automatically follow. But we live in a world created and operated on cheap energy - where have you herd that before, LOL

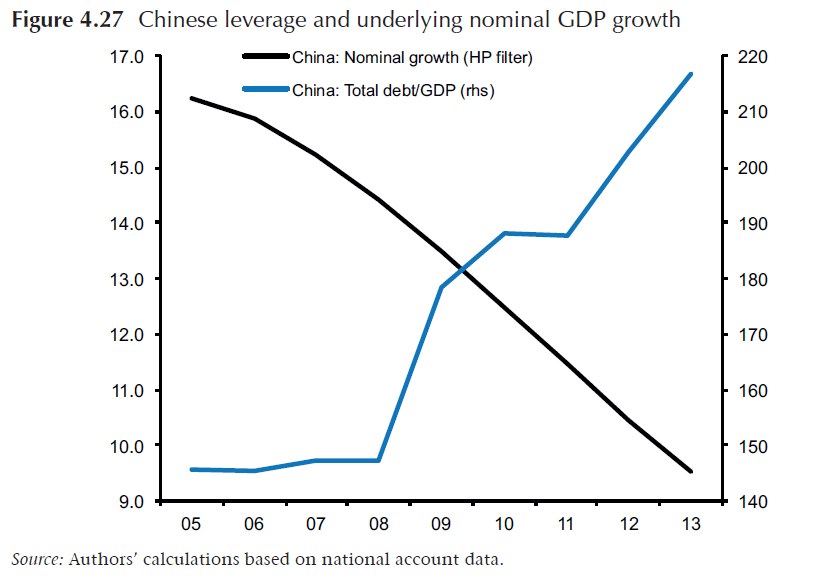

The US deleverd - in reality that is too nice a word, we defaulted on lots of mortgage debt and turned around and added college debt; but others hung on, take a look at the Chinese:

http://fortune.com/2014/10/28/global-re ... storm+Tech)

Take a look at this eye-popper:

http://systemicriskandsystematicvalue.b ... oblem.html

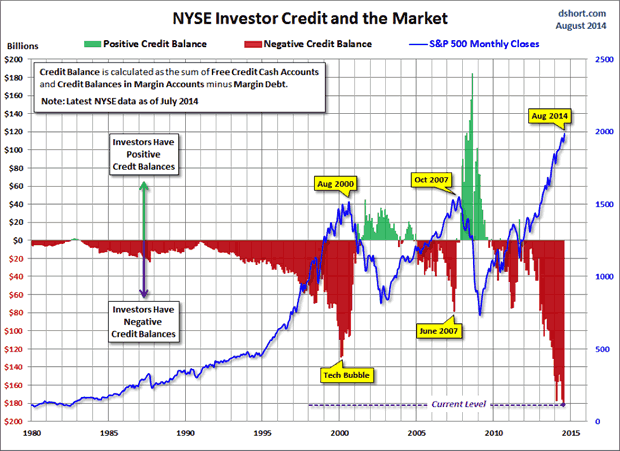

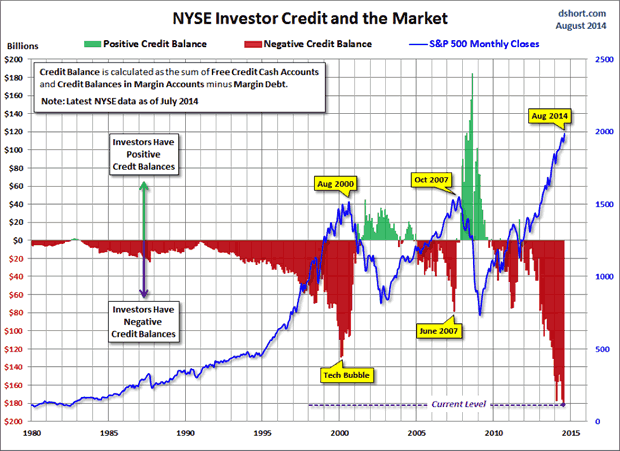

Of course you notice that is "non-financial" debt. Here is a picture of stock market debt:

I don't know how many regular humans are still in the market, perhaps its all computers trying to get as close as the physically can to the exchange servers so they get a few nanoseconds advantage. But the equities look to me to be exactly like the sub-prime housing market a decade ago, pretty well any company with a heartbeat can sell a bond or float a loan - and a near negative interest.

like it or not the markets do have an effect on J6p, since he mailed in the keys he is less able to go with the flow, with less cushion than he had before the crash. Old farts like me who are staring at fewer and fewer years to put anything by will have a hard time weathering another 401k bust like the last one.

The thing I see globally is the continuation of the investment in "emerging markets" (by a lot of US Corps BTW) all hoping to recreate the triumphs of the past, are now hitting a wall. Those initial leaps can't be recreated; dollar a day wages, cheap containerized shipping, and cheap long distance digital management are gone. It's like switching from a 7mpg vehicle to a 14mpg vehicle doubles your efficiency but the same 7mpg increase in a 14mpg vehicle only increases efficiency by half and the next 7 increases it only a third. Dimishing returns.

I had this argument with someone here who said all that mattered was if the labor force continued to expand the economy would automatically follow. But we live in a world created and operated on cheap energy - where have you herd that before, LOL

The US deleverd - in reality that is too nice a word, we defaulted on lots of mortgage debt and turned around and added college debt; but others hung on, take a look at the Chinese:

http://fortune.com/2014/10/28/global-re ... storm+Tech)

Take a look at this eye-popper:

http://systemicriskandsystematicvalue.b ... oblem.html

Of course you notice that is "non-financial" debt. Here is a picture of stock market debt:

I don't know how many regular humans are still in the market, perhaps its all computers trying to get as close as the physically can to the exchange servers so they get a few nanoseconds advantage. But the equities look to me to be exactly like the sub-prime housing market a decade ago, pretty well any company with a heartbeat can sell a bond or float a loan - and a near negative interest.

like it or not the markets do have an effect on J6p, since he mailed in the keys he is less able to go with the flow, with less cushion than he had before the crash. Old farts like me who are staring at fewer and fewer years to put anything by will have a hard time weathering another 401k bust like the last one.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Place Yer Bets - Next Recession

Timo wrote:I'll go one further and predict this will all happen on Wednesday, not Tuesday.

Honestly, i had no way of knowing that the Fed would cease QE as a means of stimulating the US economy. But, that's just what they did. My prediction was spot on!

Coincidental, yes, but still..........the next recession starts NOW! And it is WEDNESDAY!

- Timo

Re: Place Yer Bets - Next Recession

Pops wrote:I'm not sure how "unfortunate" it is for an english language site to be frequented predominately by english speakers from english speaking countries.

The thing I see globally is the continuation of the investment in "emerging markets" (by a lot of US Corps BTW) all hoping to recreate the triumphs of the past, are now hitting a wall. Those initial leaps can't be recreated; dollar a day wages, cheap containerized shipping, and cheap long distance digital management are gone. It's like switching from a 7mpg vehicle to a 14mpg vehicle doubles your efficiency but the same 7mpg increase in a 14mpg vehicle only increases efficiency by half and the next 7 increases it only a third. Dimishing returns.

US Corps are venturing overseas because #1, they can escape paying US taxes, and #2, American resources are all used up. Our financial well has run dry. The landed gentry in this country have no choice but to exploit those lesser developed nations because we are the Joneses, and it's every human being's dream to live like us. We can produce, finance, and provide what they want. We've already got it, can't afford more of it, Boomers are retiring, and millenials are just too tired of it to care. The game here in the US is over. If we want to keep making money, we have to go overseas.

- Timo

Re: Place Yer Bets - Next Recession

#1

Stuff for doomers to contemplate:

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

http://peakoil.com/forums/post1190117.html#p1190117

http://peakoil.com/forums/post1193930.html#p1193930

http://peakoil.com/forums/post1206767.html#p1206767

-

copious.abundance - Fission

- Posts: 9589

- Joined: Wed 26 Mar 2008, 03:00:00

- Location: Cornucopia

Re: Place Yer Bets - Next Recession

Pops wrote:I'm not sure how "unfortunate" it is for an english language site to be frequented predominately by english speakers from english speaking countries.

Unfortunate in the sense that the site has become so America-centric that the OP doesn't have to even specify it's a question about recession in the US. Or were you also asking about Australia, Canada, the UK, etc.?

The US deleverd - in reality that is too nice a word, we defaulted on lots of mortgage debt and turned around and added college debt; but others hung on, take a look at the Chinese:

Good debt charts. But according to Pstarr, there is no such thing as a debt problem, and even if there was, it could easily be solved by more debt

US households and businesses deleveraged a bit, but surprisingly little given the extreme debt levels and the severity of the Great Recession. Still lots of bad debt to be digested, yet all signs point to a period of renewed credit expansion. Credit bubbles are hard to predict, the next pop could just be a little one next week where some robot traders lose a bit of cash, or it could be The Big One in five years that leads to a decades-long global debt-deflation spiral compounded by increasingly severe resource limits.

Your chart on China shows why I think they're more likely to experience a serious economic spasm sooner than the US. Credit expansion there has been rapid and massive. The wildcard is that their government holds much of this debt, but I think analysts generally overestimate the power of the CCP. Will they enter in outright recession? Probably not, but could put the brakes on their rapid doubling rate.

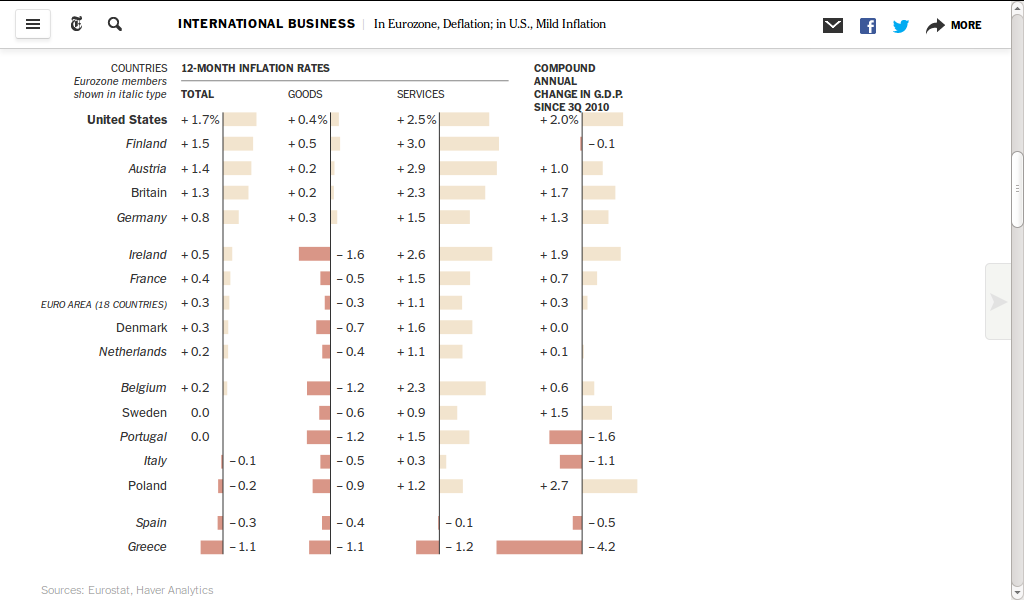

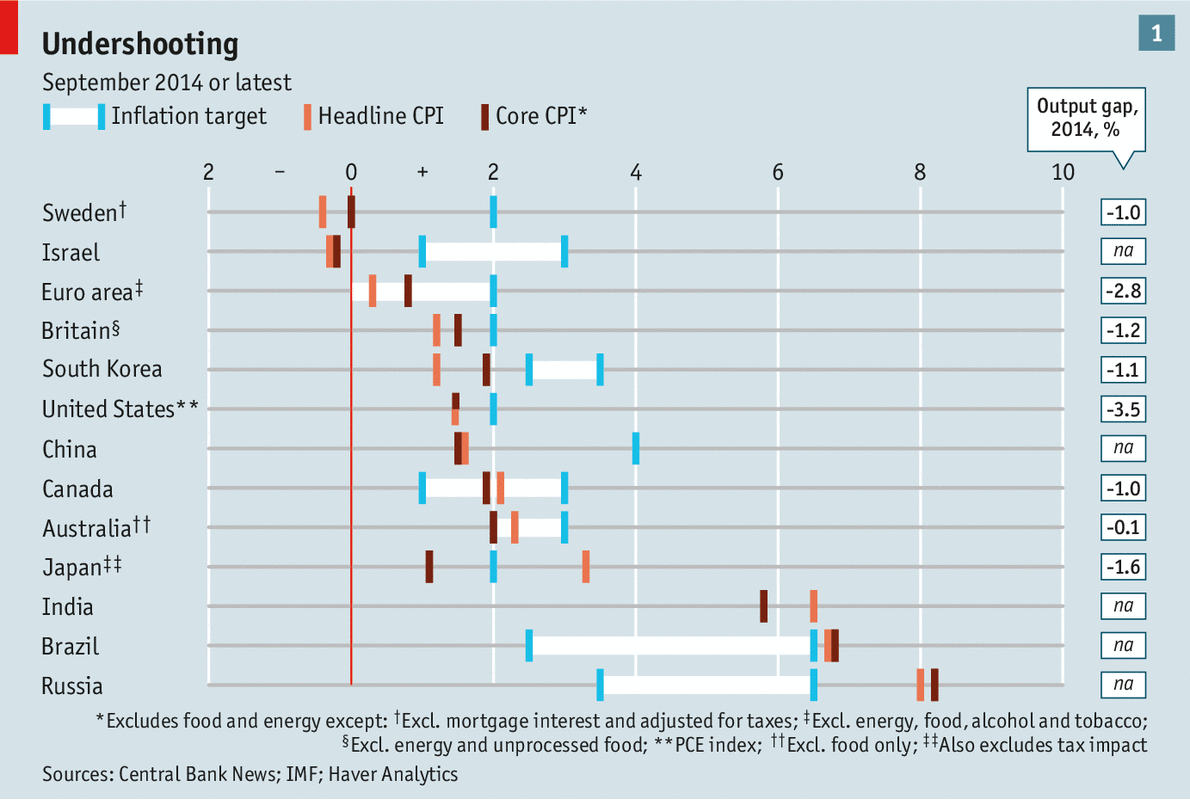

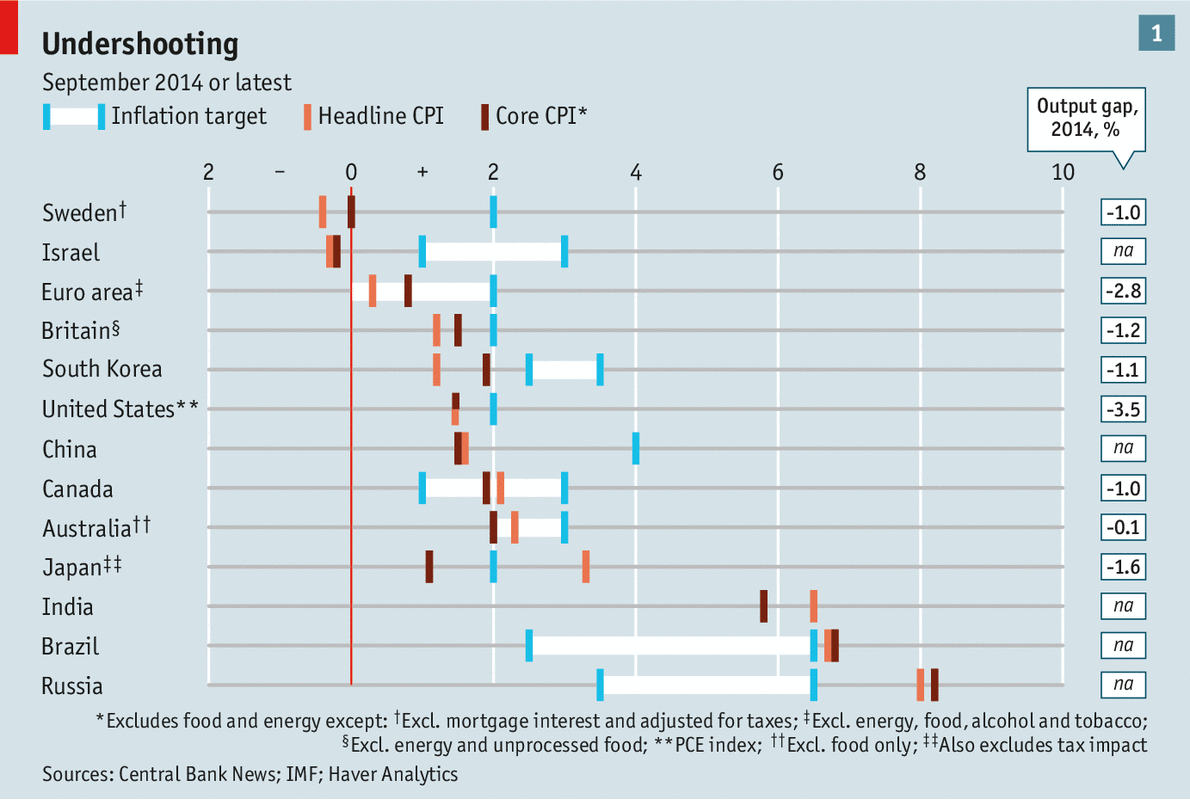

Much of Europe is already in recession and either lingering with deflation or in outright deflation:

The spread between goods and services is interesting.

A garden will make your rations go further.

-

Loki - Expert

- Posts: 3509

- Joined: Sat 08 Apr 2006, 03:00:00

- Location: Oregon

Re: Place Yer Bets - Next Recession

Loki wrote:Still lots of bad debt to be digested, yet all signs point to a period of renewed credit expansion.

You're right about that I think, Loki. Look at the little 2008 divot in this march of debt - that was "The Great Recession"

If my debt-to-income had ever been 4:1 no bank in their right mind would have ever loaned me money.

This page shows most countries with positive growth as measured by GDP or PPP - France, Italy, Spain and a few others down around stagnant. Most are growing, at least nominally. But I don't know how many of those are just little self-flagilated bubbles of central bank soap like the one we in the US have worked up.

Like you say, as in anything else, it will go on as long as it goes and they can keep making the payments.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Place Yer Bets - Next Recession

Hey its a casino right

Don't play if you cant afford it

gamblers anonymous . com

Its just for fun .its a game people.

Don't bet the farm.

Or you already did.

You've got problems.

find GOD or something

Don't come begging over here to pay your gambling debt.

Don't play if you cant afford it

gamblers anonymous . com

Its just for fun .its a game people.

Don't bet the farm.

Or you already did.

You've got problems.

find GOD or something

Don't come begging over here to pay your gambling debt.

- fjciv

- Wood

- Posts: 7

- Joined: Thu 30 Oct 2014, 14:51:16

Re: Place Yer Bets - Next Recession

I finally signed up for The Econimist and turns out I did it for a good article - good in the sense that it is saying a lot of the same things I have been LOL - just luck luck on my part.

It is basically about deflation and features this chart:

It is basically about deflation and features this chart:

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Place Yer Bets - Next Recession

If you need anymore proof real estate has gone mad.

Cat ladys house that should have been condemned goes for over a mill the empty block next door door goes for a little more

http://theage.domain.com.au/real-estate ... 1fe70.html

I used to live a few streets away from here ..sold too soon

Cat ladys house that should have been condemned goes for over a mill the empty block next door door goes for a little more

http://theage.domain.com.au/real-estate ... 1fe70.html

I used to live a few streets away from here ..sold too soon

Ready to turn Zombies into WWOOFers

-

Shaved Monkey - Intermediate Crude

- Posts: 2486

- Joined: Wed 30 Mar 2011, 01:43:28

Re: Place Yer Bets - Next Recession

A few days ago the central bank of Sweden lowered the prime interest rate to 0%. This zero point will stay until "inflation has clearly picked up pace", at least until the middle of 2016. The interest rate has never been this low, though some other European countries have negative ones, meaning they pay people to borrow money.

Even if the latest step wasn't so large, it is but one step in a line leading to a symbolic border. It is an extreme measure. The zero is a desperate call: Borrow money! Get into debt! Jack up the prices!

So, is Sweden in a crisis? Oh, no, no, no! They're all saying that the crisis is behind us. Everything is going fine! The business cycle is pointing upwards. Unemployment is going down. Just one tiny problem: there's no inflation to speak, in fact there's a slight deflation. Thus this little detail: free money for the banks.

Just a technicality. Nothing weird.

Even if the latest step wasn't so large, it is but one step in a line leading to a symbolic border. It is an extreme measure. The zero is a desperate call: Borrow money! Get into debt! Jack up the prices!

So, is Sweden in a crisis? Oh, no, no, no! They're all saying that the crisis is behind us. Everything is going fine! The business cycle is pointing upwards. Unemployment is going down. Just one tiny problem: there's no inflation to speak, in fact there's a slight deflation. Thus this little detail: free money for the banks.

Just a technicality. Nothing weird.

- Henriksson

- Peat

- Posts: 80

- Joined: Wed 30 Jul 2014, 08:23:55

Re: Place Yer Bets - Next Recession

Shaved Monkey wrote:If you need anymore proof real estate has gone mad.

Cat ladys house that should have been condemned goes for over a mill the empty block next door door goes for a little more

http://theage.domain.com.au/real-estate ... 1fe70.html

I used to live a few streets away from here ..sold too soon

Steve Keen has been famously wrong about the impending crash in the Australian housing market. In 2008 he predicted a 40% drop over 10-15 years. The staying power of the bubble seems to have confounded him.

Nevertheless, looks pretty bubbly to me. What goes up must come down

A garden will make your rations go further.

-

Loki - Expert

- Posts: 3509

- Joined: Sat 08 Apr 2006, 03:00:00

- Location: Oregon

Re: Place Yer Bets - Next Recession

Henriksson wrote:A few days ago the central bank of Sweden lowered the prime interest rate to 0%. This zero point will stay until "inflation has clearly picked up pace", at least until the middle of 2016. The interest rate has never been this low, though some other European countries have negative ones, meaning they pay people to borrow money.

Even if the latest step wasn't so large, it is but one step in a line leading to a symbolic border. It is an extreme measure. The zero is a desperate call: Borrow money! Get into debt! Jack up the prices!

So, is Sweden in a crisis? Oh, no, no, no! They're all saying that the crisis is behind us. Everything is going fine! The business cycle is pointing upwards. Unemployment is going down. Just one tiny problem: there's no inflation to speak, in fact there's a slight deflation. Thus this little detail: free money for the banks.

Just a technicality. Nothing weird.

Sweden's economic situation interests me, unfortunately I know very little about. The coverage of Sweden in the US press is generally about either rotten fish or bikini teams.

What do you think is behind the recent drop in Swedish unemployment?

Still surprisingly high, though. I wonder how comparable your "unemployment rate" is to our U-3 rate, which is what the US media generally cites.

Any insights you have on the Swedish economy, particularly the housing bubble and the labor market, would be appreciated.

A garden will make your rations go further.

-

Loki - Expert

- Posts: 3509

- Joined: Sat 08 Apr 2006, 03:00:00

- Location: Oregon

Re: Place Yer Bets - Next Recession

FWIW classical economists (such as John Maynard Keynes) look at the world through a lens of simple equilibrium models

http://www.econmodel.com/classic/

and do not take into account the complex effects of central banks and their ability to create money (in the form of debt) which in turn has an effect on real estate/stock/commodity/etc prices (which in turn has an affect on public pensions/etc.)

http://keenomics.s3.amazonaws.com/debtd ... _OCRed.pdf

To try and keep my finger on the pulse of the local economy one thing I pick up every once in a while is a copy of "Dream Home Magazine"

http://blog.dreamhomesmagazine.com/digi ... pub~SD.htm

specifically I look at the section titled "Dream Stats" which has a table of historical 30 year mortgage rates (going back a few decades), the corresponding average Fed funds rate and the delta

what is also interesting to note in the publication is the Chinese characters (in an english language real estate marketing publication).

As I see things, the reason real estate prices have grown for prime residential real estate (along with rental properties) is because global forces are influencing local real values.

In other words local prime real estate (in my neck of the woods) is viewed as being inexpensive and just another investment vehicle in a global market...

What is going to be interesting IMHO is what happens when the vast majority of people wake and realize the system as it exists today is corrupt/unsustainable given that central bank of the USA has printed 4+ trillion and the central bank of China has printed 16+ trillion (since 2008 in order to keep the economy going)

Coincidentally one other thing that is going to affect the economy in my neck of the woods is water (or rather the lack thereof)

http://www.cbsnews.com/news/depleting-the-water/

http://www.econmodel.com/classic/

and do not take into account the complex effects of central banks and their ability to create money (in the form of debt) which in turn has an effect on real estate/stock/commodity/etc prices (which in turn has an affect on public pensions/etc.)

http://keenomics.s3.amazonaws.com/debtd ... _OCRed.pdf

To try and keep my finger on the pulse of the local economy one thing I pick up every once in a while is a copy of "Dream Home Magazine"

http://blog.dreamhomesmagazine.com/digi ... pub~SD.htm

specifically I look at the section titled "Dream Stats" which has a table of historical 30 year mortgage rates (going back a few decades), the corresponding average Fed funds rate and the delta

what is also interesting to note in the publication is the Chinese characters (in an english language real estate marketing publication).

As I see things, the reason real estate prices have grown for prime residential real estate (along with rental properties) is because global forces are influencing local real values.

In other words local prime real estate (in my neck of the woods) is viewed as being inexpensive and just another investment vehicle in a global market...

What is going to be interesting IMHO is what happens when the vast majority of people wake and realize the system as it exists today is corrupt/unsustainable given that central bank of the USA has printed 4+ trillion and the central bank of China has printed 16+ trillion (since 2008 in order to keep the economy going)

Coincidentally one other thing that is going to affect the economy in my neck of the woods is water (or rather the lack thereof)

http://www.cbsnews.com/news/depleting-the-water/

truth is,...

www.ThereIsNoPlanet-B.org

www.ThereIsNoPlanet-B.org

-

phaster - Tar Sands

- Posts: 511

- Joined: Sun 15 Jul 2007, 03:00:00

Re: Place Yer Bets - Next Recession

Pops, IMO you're missing a choice on your poll, so I can't answer.

The suggested choice is something like: I don't know. (Predicting recessions is like trying to predict the stock market -- there is little meaningful evidence this can reliably be done).

Now, if the intent is to say "those who don't wish to play prognosticator need not apply", I'm good with that.

The suggested choice is something like: I don't know. (Predicting recessions is like trying to predict the stock market -- there is little meaningful evidence this can reliably be done).

Now, if the intent is to say "those who don't wish to play prognosticator need not apply", I'm good with that.

Given the track record of the perma-doomer blogs, I wouldn't bet a fast crash doomer's money on their predictions.

-

Outcast_Searcher - COB

- Posts: 10142

- Joined: Sat 27 Jun 2009, 21:26:42

- Location: Central KY

62 posts

• Page 3 of 4 • 1, 2, 3, 4

Return to Geopolitics & Global Economics

Who is online

Users browsing this forum: No registered users and 38 guests