Peak oil theory debunked (merged) Pt. 3

Re: Peak oil theory debunked (merged) Pt. 3

"The remaining oil in North America is basically worthless. Drilling of that stuff is not preventing collapse." And yet today the US refineries are paying about $140 BILLION PER YEAR for that worthless oil. I suppose we each have our own definition of "worthless". LOL

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Peak oil theory debunked (merged) Pt. 3

ROCKMAN wrote:"The remaining oil in North America is basically worthless. Drilling of that stuff is not preventing collapse." And yet today the US refineries are paying about $140 BILLION PER YEAR for that worthless oil. I suppose we each have our own definition of "worthless". LOL

Dying laughing becomes a distinct possibility when folks are that deep down the rabbit hole.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Peak oil theory debunked (merged) Pt. 3

Adam - But IMHO it's good to have some comic relief around. Otherwise such a serious subject would be more difficult to absorb.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Peak oil theory debunked (merged) Pt. 3

The EIA graph is utter rubbish. It invokes a mythical, basically unlimited undiscovered category to produce such retarded projections. There is no hint of a basis for expecting such vast replacement of depleting conventional reservoirs. Discoveries of conventional oil have been crashing since the 1960s. An organization that invokes magical thinking on conventional has zero credibility on non-conventional oil. Again, there is no indication that non-conventional oil reserves are vast. The surge in production since 2008 does not constitute any evidence vast non-conventional reserves.

The EROEI debate is nonsense as well. At the present time non-conventional is still cheap to extract. In the near future it will be too expensive to extract 1 barrel of oil by burning 20 barrels and over. Those 20 barrels are not in situ like in the case of the failed attempt to convert kerogen into oil in shale deposits (and the notion of burning vast quantities of oil into CO2 just to extract a small fraction which will also be burned is suicidal given climate change). Energy will have to be diverted to extract the equivalent of 5% or less of it. That's like going to your bank, taking your money and then gambling away 100% of it to get 5% of what you had. People have been arguing that the oil price will never reach high levels because the global economy cannot handle it. That in itself kills off any chance of extraction of very low EROEI oil. The cost of energy to extract it will be higher than any return. This includes deploying nuclear power plants to extract deep tar sands deposits. It is nonsensical to expend cheap energy to extract expensive energy in much smaller quantities. Energy is energy. EROEI is a good indicator telling you if you start leaving the rationality reservation.

The EROEI debate is nonsense as well. At the present time non-conventional is still cheap to extract. In the near future it will be too expensive to extract 1 barrel of oil by burning 20 barrels and over. Those 20 barrels are not in situ like in the case of the failed attempt to convert kerogen into oil in shale deposits (and the notion of burning vast quantities of oil into CO2 just to extract a small fraction which will also be burned is suicidal given climate change). Energy will have to be diverted to extract the equivalent of 5% or less of it. That's like going to your bank, taking your money and then gambling away 100% of it to get 5% of what you had. People have been arguing that the oil price will never reach high levels because the global economy cannot handle it. That in itself kills off any chance of extraction of very low EROEI oil. The cost of energy to extract it will be higher than any return. This includes deploying nuclear power plants to extract deep tar sands deposits. It is nonsensical to expend cheap energy to extract expensive energy in much smaller quantities. Energy is energy. EROEI is a good indicator telling you if you start leaving the rationality reservation.

- dissident

- Expert

- Posts: 6458

- Joined: Sat 08 Apr 2006, 03:00:00

Re: Peak oil theory debunked (merged) Pt. 3

d - "That in itself kills off any chance of extraction of very low EROEI oil." The very point I've been trying to beat into some folks. I sign the invoices for the energy my company uses to drill and i know how much we produce. SomeweSomewehere below an EROEI of 5 or 6 wells become uneconomic to drill. But that was when oil was around $90/bbl. At today's prices only projected with significant!y higher EROEI are worth drilling YES: EROEI for the average oil prospect is currently higher today then it was 3 years ago.

That will be impossible for some to accept.

That will be impossible for some to accept.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Peak oil theory debunked (merged) Pt. 3

dissident wrote:The EIA graph is utter rubbish. It invokes a mythical, basically unlimited undiscovered category to produce such retarded projections.

No it doesn't. And the shales aren't "undiscovered". They have a supply based model, itself a rarity and proof that they understand the basics of these issues, and their model basically just runs around and drills up existing locations. And it isn't even unlimited, they have explained this quite well, these parts of their methodology. Do you object to the geology being used to help quantify the supply side, and or perhaps the objection is to the very idea of POD, which they use explicitly, and Rockman himself talks about quite often? Did you miss the working paper on use of geology?

https://www.eia.gov/workingpapers/pdf/g ... encies.pdf

Dissident wrote: There is no hint of a basis for expecting such vast replacement of depleting conventional reservoirs.

Fortunate indeed that the graph doesn't say the volumes come from conventional reservoirs then. Did you even LOOK at the components of the expected future production?

Dissident wrote:The EROEI debate is nonsense as well. At the present time non-conventional is still cheap to extract. In the near future it will be too expensive to extract 1 barrel of oil by burning 20 barrels and over.

Fortunate indeed then that EROEI isn't OROOI. Energy comes in many forms, and nobody, ANYWHERE (well, except this post of yours) thinks that folks are burning oil to get oil...folks are using ENERGY to get oil, and that ENERGY comes from all sorts of places.

But you are right, because of these differences in BTU value, EROEI is nonsense.

Dissident wrote: People have been arguing that the oil price will never reach high levels because the global economy cannot handle it. That in itself kills off any chance of extraction of very low EROEI oil.

That isn't what Simmons said. He even lost bets saying the opposite. It isn't what Heinberg has claimed. It isn't what Savinar and Ruppert and all of the now quiet peak oilers were claiming, it isn't what Whipple and ASPO and TOD were claiming at the time. Your claim is peak oil revisionism, in light of a common misunderstanding about resource economics.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Peak oil theory debunked (merged) Pt. 3

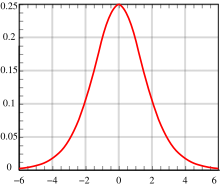

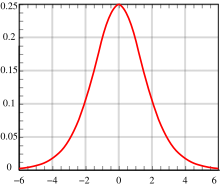

As we get farther and farther downfield, it's important to remember that the peak-oil movement originally worshiped under the altar of this simple and elegant symbol.

From inception, peak-oil has attempted to simplify a complex system, and using the conventional peak of the US as the validation test-run for this symbol, priming the gates for curve-fitting world production against the symbol, and wishcasting various dooms on the back-slide of the curve.

This oversimplification turned out to be inadequate at predicting the oil supply/demand dynamic that we've just experienced over the last 10 or so years since TOD claimed peak.

So now peak oilers have had to scramble and come up with a far more complex model in which to explain the movement of the markets. And predicting the economy is several orders of magnitude more complex than Hubbert's Curve. If it were that easy, there would be a lot more millionaire stock traders and short-sellers.

From inception, peak-oil has attempted to simplify a complex system, and using the conventional peak of the US as the validation test-run for this symbol, priming the gates for curve-fitting world production against the symbol, and wishcasting various dooms on the back-slide of the curve.

This oversimplification turned out to be inadequate at predicting the oil supply/demand dynamic that we've just experienced over the last 10 or so years since TOD claimed peak.

So now peak oilers have had to scramble and come up with a far more complex model in which to explain the movement of the markets. And predicting the economy is several orders of magnitude more complex than Hubbert's Curve. If it were that easy, there would be a lot more millionaire stock traders and short-sellers.

"If the oil price crosses above the Etp maximum oil price curve within the next month, I will leave the forum." --SumYunGai (9/21/2016)

-

ennui2 - Permanently Banned

- Posts: 3920

- Joined: Tue 20 Sep 2011, 10:37:02

- Location: Not on Homeworld

Re: Peak oil theory debunked (merged) Pt. 3

ennui2 wrote:So now peak oilers have had to scramble and come up with a far more complex model in which to explain the movement of the markets.

Done deal. And interestingly, not a single peaker is willing to match that equation to the US production profile and demonstrate how much better it fit what the US has done, compared to Hubbert's simplistic, single cycle model.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Peak oil theory debunked (merged) Pt. 3

"...and that ENERGY comes from all sorts of places."

It comes from ponzi fuel (which guts the real economy underlying it via everything must get cheaper and get rid of all the employees)...this character 'Petro' from Pattersons website said today:

"First of, you have the wrong idea as to how the financing of shale drillers happens.

The way you think it happens (i.e.: they go to bank, present their business model and oil price expectations and blah, blah , blah and bingo….Goldman gives them the money!) does not exist anymore.

It indeed happened that way (more or less, of course I am simplifying) PRIOR to 2000 – not today.

Goldman (or any bank…put the name you like here) uses the oil price and business model of the sale player ONLY to bullshit the shareholders into voting it…..it does not give a crap what the company does and how it does it and at what price.

Here where the “beauty” starts:

that loan then, which on bank’s balance sheet is considered an asset, is re-hypothecated dozens, upon dozens, upon dozens of times as a futures’ OTC derivatives’ bet with businesses that have nothing to do with shale players and are half a world away – china let’s say.

So, if one too many of them fail, driven out of business by responsible guys like you – even though their combined debt size is nothing compared to….oh, lets say JP Morgans’ assets, the avalanche it starts buries us all."

Third, as the result of the repeal of Glass_Stegal in 1999 – thank you very much R. Rubin, L. Summers and most importantly our dear B.Clinton who signed it into law

(don’t fuss democrats. For me there is NO difference between republicrats and democlicans. Reagan and Bush were as bad, or worse!) – commercial and investment banking became one and all and turned to what’s called TRANSACTIONAL banking.

Meaning: everything, without exception is repackaged and resold multiple times to grater fools"

"and then you have Nik Gs and the rest who think that oil and energy are just like any other commodity and we somehow can do without them and so on and so on…..

You get my point…."

----------------------------------------

All ponzi's collapse violently and quickly and unexpectedly. Petro's post just shows the entire Global Economy is more or less the same as the Albanian Pyramid Schemes.

But NOOOOO...Oilman Expert Rockman says this shitshow is legit ...and you just don't understand it. What is there to understand? The oil "business" is driven by money printing and central planning. The "market" is a rigged grand fraud.

bTW, 'Petro' is a 'Total Collapse' DOOMER like me.

Outcast_Searcher is a fraud.

- StarvingLion

- Permanently Banned

- Posts: 2612

- Joined: Sat 03 Aug 2013, 18:59:17

Re: Peak oil theory debunked (merged) Pt. 3

AdamB wrote:ennui2 wrote:So now peak oilers have had to scramble and come up with a far more complex model in which to explain the movement of the markets.

Done deal. And interestingly, not a single peaker is willing to match that equation to the US production profile and demonstrate how much better it fit what the US has done, compared to Hubbert's simplistic, single cycle model.

Hubbert's model works on economically recoverable oil reserves. A well never have sine wave production, when they decline they don't recover. And as far as I know, the global oil production doesn't have a sine wave profile. Since 1970, there are a lot of perturbations, with various effects on local production due to geopolitical, geologic and economic reasons, but the production always grew.

Maybe we will see a sine wave profile on top of a plateau for some years, but this won't change the global shape which is Hubbert's curve. And the plateau was expected to happen before a real decline.

-

tita - Coal

- Posts: 418

- Joined: Fri 10 Jun 2005, 03:00:00

Re: Peak oil theory debunked (merged) Pt. 3

tita - Close but still not completely correct. Hubbert wasn't concerned about the economics of the remaining US reserves...just the volume left to produce. And his "single sine curve" proved to be amazingly correct. How could that be? Easy: it was based upon the projection of future production from the KNOWN US OIL TRENDS. Folks really need to read his paper and stop depending on all the bullsh*t others are saying about his work. He SPECIFICALLY says his model doesn't include future new trends that could be developed. In fact he actually points to the shales and offshore plays as future potential. He also SPECIFICALLY says that his bell shaped curve will not be anywhere close to symmetrical: the tail will stretch out much longer then the build up.

Folks are constantly misrepresenting Hubbert in an effort to support various positions they've taken. And some of those positions are valid. But they hurt their credibility by building such strawmen arguments based on Hubbert's work. Projections that are still correct today FOR THOSE TRENDS HE BASED HIS MODEL UPON. And not to take anything away from him but those trends were rather mature when he developed his model. BTW a modern day Hubbert could do the same with our current shale plays: obviously they offer a new sine wave of US oil production. And as long as prices stay low they present a curve very similar to what Hubbert developed for the trends he used: a rapid build up followed by a much slower decline. IOW another asymmetric bell shaped curve. Granted we've just started on the backside of the curve but it isn't that difficult to see it developing, is it?

BTW his projection for global oil production suffers greatly from the simple fact that the great Middle East oil trends had not been identified yet and thus were not part of the population his statistics were based upon.

Folks are constantly misrepresenting Hubbert in an effort to support various positions they've taken. And some of those positions are valid. But they hurt their credibility by building such strawmen arguments based on Hubbert's work. Projections that are still correct today FOR THOSE TRENDS HE BASED HIS MODEL UPON. And not to take anything away from him but those trends were rather mature when he developed his model. BTW a modern day Hubbert could do the same with our current shale plays: obviously they offer a new sine wave of US oil production. And as long as prices stay low they present a curve very similar to what Hubbert developed for the trends he used: a rapid build up followed by a much slower decline. IOW another asymmetric bell shaped curve. Granted we've just started on the backside of the curve but it isn't that difficult to see it developing, is it?

BTW his projection for global oil production suffers greatly from the simple fact that the great Middle East oil trends had not been identified yet and thus were not part of the population his statistics were based upon.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Peak oil theory debunked (merged) Pt. 3

tita wrote:Maybe we will see a sine wave profile on top of a plateau for some years, but this won't change the global shape which is Hubbert's curve. And the plateau was expected to happen before a real decline.

Sorry, Hubbert's curve isn't supposed to have a plateau.

"If the oil price crosses above the Etp maximum oil price curve within the next month, I will leave the forum." --SumYunGai (9/21/2016)

-

ennui2 - Permanently Banned

- Posts: 3920

- Joined: Tue 20 Sep 2011, 10:37:02

- Location: Not on Homeworld

Re: Peak oil theory debunked (merged) Pt. 3

StarvingLion wrote:"...and that ENERGY comes from all sorts of places."

It comes from ponzi fuel (which guts the real economy underlying it via everything must get cheaper and get rid of all the employees)...this character 'Petro' from Pattersons website said today:

Mr Lion, do you understand how "bootstrapping" worked, when it was used to drill shale wells back before the amateurs, or you and I, were born? And just because the current boom was financed with less of the hard work of the industry, and more of the frenzy to borrow, that there will come a time in the future when boottrapping will be just as en-vogue then, as it was in the past?

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Peak oil theory debunked (merged) Pt. 3

ROCKMAN wrote:BTW a modern day Hubbert could do the same with our current shale plays: obviously they offer a new sine wave of US oil production. And as long as prices stay low they present a curve very similar to what Hubbert developed for the trends he used: a rapid build up followed by a much slower decline.

This is from Ted Patzek's blog:

http://patzek-lifeitself.blogspot.de/20 ... ng_16.html

Supposing that ultimate total production from the Eagle Ford will be 50% higher than the ultimates reported in the two charts below, 2.7*1.5 = 4 billion barrels of oil and 12 Tcf*1.5 = 18 Tcf will be produced. Therefore, in total, the Eagle Ford shale might eliminate 1.5 years of U.S. crude oil imports, and satisfy 8 months of consumption of natural gas.

Also supposing that ultimate total production from the Bakken will be 50% higher than the ultimates reported in the two charts below, 2.6*1.5 = 3.9 billion barrels of oil and 3.3 Tcf*1.5 = 5 Tcf will be produced. Therefore, in total, the Bakken shale might eliminate 1.5 years of U.S. crude oil imports, and satisfy 2 months of consumption of natural gas.

As far as I know, Patzek's an outspoken 'peaker', but he also has credentials as a scientist and reservoir engineer. And in this post he doesn't even mention oil and gas prices (except for ballooning industry spending).

And maybe it's only my still confused amateur understanding, but as someone here put it a while ago, there's prices and there's geology that shape the dynamic. Prices are basically unpredictable, but they affect the short-term dynamics, the wells drilled within the next one or two years. Over a longer time span you'll see the 'sine-wave', as markets move up and down. But finally, if you look at the total lifespan of a field or trend, over fifteen or twenty years, then the sine-wave of stop-and-go development becomes simply an average. And all that's left then is geology. That's where ole King Hubby comes in.

You do not have the required permissions to view the files attached to this post.

- Zarquon

- Lignite

- Posts: 321

- Joined: Fri 06 May 2016, 20:53:46

Re: Peak oil theory debunked (merged) Pt. 3

Zarquon wrote:[

And maybe it's only my still confused amateur understanding, but as someone here put it a while ago, there's prices and there's geology that shape the dynamic. Prices are basically unpredictable, but they affect the short-term dynamics, the wells drilled within the next one or two years. Over a longer time span you'll see the 'sine-wave', as markets move up and down. But finally, if you look at the total lifespan of a field or trend, over fifteen or twenty years, then the sine-wave of stop-and-go development becomes simply an average. And all that's left then is geology. That's where ole King Hubby comes in.

Yes we are very short sighted and over react to price fluctuations. When the Saudis finally run out of their easy to lift and sell crude which they have fed into the market slowly to "preserve it for future generations" we will get back onto the curve he predicted. Some forget that for-warned is for-armed and that plateaus are the result of people taking advantage of Hubert's warning.

-

vtsnowedin - Fusion

- Posts: 14897

- Joined: Fri 11 Jul 2008, 03:00:00

Re: Peak oil theory debunked (merged) Pt. 3

Yes. The short-term chart-watching and all the overblown nail-biting over them is what holds people back from gaining a full understanding. Expand the time-horizon out longer and average things more and you'll see things start to resemble some of the abstract models. I'm just tired of fast-crash near-term doomers creating a loyalty test where you have to interpret every chart dip as a sign of the "big one" otherwise you get tarred and feathered as a paid corny sock-puppet. There is no one single "official" doomer viewpoint despite attempts on the part of Gail and a few other stalwarts to create one.

"If the oil price crosses above the Etp maximum oil price curve within the next month, I will leave the forum." --SumYunGai (9/21/2016)

-

ennui2 - Permanently Banned

- Posts: 3920

- Joined: Tue 20 Sep 2011, 10:37:02

- Location: Not on Homeworld

Re: Peak oil theory debunked (merged) Pt. 3

Zarquon wrote:ROCKMAN wrote:BTW a modern day Hubbert could do the same with our current shale plays: obviously they offer a new sine wave of US oil production. And as long as prices stay low they present a curve very similar to what Hubbert developed for the trends he used: a rapid build up followed by a much slower decline.

This is from Ted Patzek's blog:

http://patzek-lifeitself.blogspot.de/20 ... ng_16.html

And where might the production response to price be?

As Mr Rockman predicted, WAY back when, that curve changes with respect to price, it is not near the geology thing that people have made it out to be.

The EIA builds their models just this way, and they obviously know WHY there are additional volumes available, and it has to do with the definition of technically recoverable resources and their conversion to reserves, as they explained recently.

https://www.eia.gov/workingpapers/pdf/trr.pdf

Hubbert's curve have been thoroughly discredited already, every single one he made, the US being the last to fall. Tad should know this, but engineers not being as clever as geologists, maybe he just hasn't caught up with the newest thoughts on the topic, even though the EIA obviously has.

Without a production response to price, WHOEVER is using a bell shaped curve is doing it wrong. Period.

Hence the since wave curve of oil production, to represent what happens down the road when the price rebounds.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Peak oil theory debunked (merged) Pt. 3

Adam, when all is said and done there IS still a geological limit. It's just that there are phase-changes in what people drill for and how aggressively, which are based on market forces and how much stuff is left (i.e. going for the low-hanging-fruit first). The problem with doomers is that they simply take a snapshot of things as it is now and assume that these phase-changes will never happen. Drilling tapers off always means the oil's running out with no alternative explanation is ever considered. High cost of drilling means the cost to drill must always be high. X amount of oil used to drill means X amount of oil must ALWAYS be used to drill. Various above-ground disruptions will keep disrupting things or get worse, never better. Just this monochromatic pessimistic analysis. The reality is that, as I keep saying, BAU finds a way to hang on longer than doomers think it will. It will not hang on forever, just longer than doomers want.

"If the oil price crosses above the Etp maximum oil price curve within the next month, I will leave the forum." --SumYunGai (9/21/2016)

-

ennui2 - Permanently Banned

- Posts: 3920

- Joined: Tue 20 Sep 2011, 10:37:02

- Location: Not on Homeworld

Re: Peak oil theory debunked (merged) Pt. 3

ennui2 wrote:Adam, when all is said and done there IS still a geological limit.

Of course there is. And the paper from the EIA I referenced in the prior post understands this relationship explicitly, and has a cool graphic showing how oil and gas extracted can grow with changes in technology, assumptions of changes in technology, or whatever, all while honoring the geologic limit. That concept is operating at a level beyond just fitting time series data, which is so popular on this topic. Hasn't worked, but that is because it ignores exactly the sort of understanding that folks like the EIA have.

ennui2 wrote:It's just that there are phase-changes in what people drill for and how aggressively, which are based on market forces and how much stuff is left (i.e. going for the low-hanging-fruit first).

That idea is exactly captured by the paper I referenced. There is a reason why the EIA doesn't fall for doomer stories of oil production, and that paper certainly shows that there are people inside that organization already past the peaker understanding of how oil production works.

ennui2 wrote: The problem with doomers is that they simply take a snapshot of things as it is now and assume that these phase-changes will never happen. Drilling tapers off always means the oil's running out with no alternative explanation is ever considered. High cost of drilling means the cost to drill must always be high. X amount of oil used to drill means X amount of oil must ALWAYS be used to drill. Various above-ground disruptions will keep disrupting things or get worse, never better. Just this monochromatic pessimistic analysis. The reality is that, as I keep saying, BAU finds a way to hang on longer than doomers think it will. It will not hang on forever, just longer than doomers want.

Hanging on into tomorrow isn't good enough doom. It must happen now!! And when one trigger for their favorite doom scenario doesn't pan out, there are always others. Climate change being one of the current majority favorites I believe.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Peak oil theory debunked (merged) Pt. 3

AdamB wrote:Hanging on into tomorrow isn't good enough doom. It must happen now!! And when one trigger for their favorite doom scenario doesn't pan out, there are always others. Climate change being one of the current majority favorites I believe.

Why now and not X plus years from now? The fact that we do not know the exact date does not diminish the enormity of the problem.

Does it make a difference if you are killed, or your children ,or your great great grandchildren?

-

vtsnowedin - Fusion

- Posts: 14897

- Joined: Fri 11 Jul 2008, 03:00:00

Who is online

Users browsing this forum: No registered users and 106 guests