shallow sand wrote: However, a model that requires continuous CAPEX just doesn't seem to me to be one that will work out.

Which is why they have chosen cash flow over reserve acquisition.

shallow sand wrote: However, a model that requires continuous CAPEX just doesn't seem to me to be one that will work out.

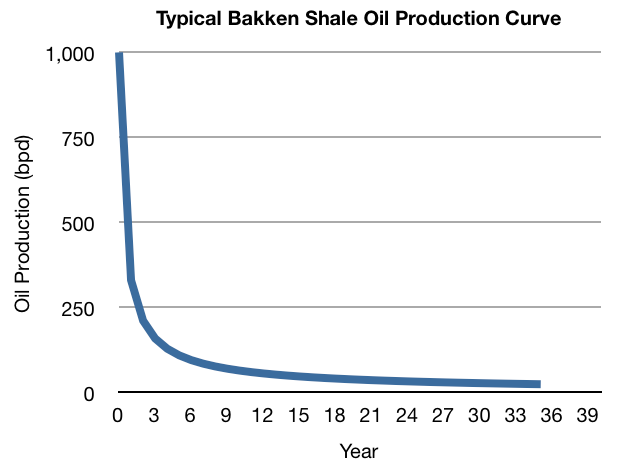

shallow sand wrote:By long tail I mean the steep decline flattens and the wells produce at a nearly constant level for many years.

shallow sand wrote: What I think is important is that level on average going to be 100 bbl day or stripper rates below 15?

Do you have a guess at how much that is, say as a % of original OIP or of ultimate recovery?ROCKMAN wrote:The bulk of the areas left to be exploited remain so for political reasons

shallow sand wrote:As for the depletion allowance, it doesn't make any wells profitable that otherwise wouldn't be. It reduces income tax on profitable wells. If a well is not profitable, the depletion deduction is disallowed. Strippers used to be exempt from this, but part of the new years day tax compromise that no one noticed was the repeal of unlimited depletion for stripper wells.

Once the price of oil becomes too expensive for people to afford, society will totally fall apart

Repent wrote:Of course the assumption here is that people will not be able to afford it at some point. Money is a social construction, if they change the rules, print more money, change the way money is distributed in society (Rationing), any of these things will affect peoples ability to afford oil.

Users browsing this forum: No registered users and 38 guests