Peak Oil Barrel: Peak Oil 2015

Re: Peak Oil Barrel: Peak Oil 2015

tita - And while you're at let's not forget how much the Rockman and the rest of the US oil patch hates the Canadians and was for President Obama doing anything to impede their imports. Unfortunately he really did nothing. We are not one happy band of brothers: we are competitors for the consumer $'s. And as long as the vast majority of those customers are content to continue to consume fossil fuels and directly generate the vast majority of the GHG that is driving climate change we'll keep making our bit of the profit...along with the various govts.

I'll assume you understand that the oil patch is more then glad to have the climate change finger pointed at it then the real culprits...the consumers. If the govt went after them the way it pretends to go after the oil patch and forced less consumption the oil patch would be in a world of hurt. LOL. Really.

I'll assume you understand that the oil patch is more then glad to have the climate change finger pointed at it then the real culprits...the consumers. If the govt went after them the way it pretends to go after the oil patch and forced less consumption the oil patch would be in a world of hurt. LOL. Really.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Peak Oil Barrel: Peak Oil 2015

ROCKMAN wrote:tita - And while you're at let's not forget how much the Rockman and the rest of the US oil patch hates the Canadians and was for President Obama doing anything to impede their imports. Unfortunately he really did nothing. We are not one happy band of brothers: we are competitors for the consumer $'s. And as long as the vast majority of those customers are content to continue to consume fossil fuels and directly generate the vast majority of the GHG that is driving climate change we'll keep making our bit of the profit...along with the various govts.

I'll assume you understand that the oil patch is more then glad to have the climate change finger pointed at it then the real culprits...the consumers. If the govt went after them the way it pretends to go after the oil patch and forced less consumption the oil patch would be in a world of hurt. LOL. Really.

Speaking of the oil patch and sell sell sell, is Mexico a net energy importer now that the big natural gas export project is in place? They were losing ground on oil exports for about a decade now and with the big imports they are now getting from Natural Gas presumably to supply all that NAFTA relocated industry, they have to be close to being a net importer.

For whatever reason we used to talk about Mexico oil prospects a lot but lately there hasn't been a whole lot of news that I have seen. Any news I missed ROCKMAN? Or Toolpush, Rockdoc123, and all the other oil industry insiders around here?

Alfred Tennyson wrote:We are not now that strength which in old days

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

-

Tanada - Site Admin

- Posts: 17056

- Joined: Thu 28 Apr 2005, 03:00:00

- Location: South West shore Lake Erie, OH, USA

Re: Peak Oil Barrel: Peak Oil 2015

For whatever reason we used to talk about Mexico oil prospects a lot but lately there hasn't been a whole lot of news that I have seen. Any news I missed ROCKMAN? Or Toolpush, Rockdoc123, and all the other oil industry insiders around here?

Mexico has been hurt by the low oil price much worse than many countries. This is largely due to the fact that Pemex had never achieved any sort of efficiency of operation as seen in North America. Their costs are high a large part of which are costs associated with paying employees reasonably high wages but moreso because of the requirement for large payouts if they lay anyone off. Pemex was struggling to reach greater efficiency when the price dropped. Because oil and gas provide a very large part of the gov'ts annual income they have had to drag more and more money out of Pemex, to the point where Pemex had to release all of the service companies working for them and cut all of their planned programs. Frustration on both Pemex side and gov't side resulted in the head of Pemex getting the heave ho recently.

The bid rounds which were seen to be what would kick off a new era in Mexico oil and gas have not been exactly what was anticipated. The first round had economics that were impossible to work with and it was only a few national oil and gas companies who wanted "feet on the ground" who bid. The second round which was onshore had lots of interest and a fair number of qualified bidders. Unfortunately the way they had orchestrated the bidding process set it up for a big failure. Companies accepted fixed work programs and profit sharing but were required to bid away an extra percentage of "carried" participation to the government. And as has happened previously companies get stupid (eg. Libya bid rounds). Economics I have seen suggested that bidding away much more than 25% interest would render the projects uneconomic when oil was $50/bbl. The companies who won all bid much higher than that with one "brain trust" from Canada bidding 80%! And of course now that prices aren't even near $50 they are expecting to renegotiate these contracts which the Comision Nacional Hydrocarburos (CNH) regulatory body has said will not happen. So in short, a real mess.

Mexico ministry of Energy (SENER) has said they are pushing forward with additional bid rounds but in this environment, unless prices rise I can't see them being too successful. I have heard that SENER and CNH realize the issue with the last bid round and plan to adjust in the upcoming rounds.

The opportunities are there, it's just at $30 - $40 oil it isn't easy to see how anyone can make money.

-

rockdoc123 - Expert

- Posts: 7685

- Joined: Mon 16 May 2005, 03:00:00

Re: Peak Oil Barrel: Peak Oil 2015

Looks like May production yoy is going to show a huge decline. You have a 1.8 MBD decline just in US and Canada. Another 0.5 MBD from Latin America. Outages in Nigeria, Libya, and Iraq probably around 0.2 MBD. So 2.5 MBD decline offset by 0.5 MBD increase in Iran?

Right now, looks like 2016 there will be less oil produced than 2015.

Right now, looks like 2016 there will be less oil produced than 2015.

Outages around the world start to accumulate. In addition to the huge, if temporary, losses from Canada, supplies seem to be falling in multiple places around the globe. U.S. oil production is down 800,000 barrels per day from its April 2015 peak. Venezuela lost 188,000 barrels per day in the first quarter due to aging oilfields and an economic crisis. Latin America on the whole lost 441,000 barrels per day in the first quarter.

- GoghGoner

- Heavy Crude

- Posts: 1827

- Joined: Thu 10 Apr 2008, 03:00:00

- Location: Stilłwater subdivision

Re: Peak Oil Barrel: Peak Oil 2015

It's a glut. There's no incentive yet to produce more.

"If the oil price crosses above the Etp maximum oil price curve within the next month, I will leave the forum." --SumYunGai (9/21/2016)

-

ennui2 - Permanently Banned

- Posts: 3920

- Joined: Tue 20 Sep 2011, 10:37:02

- Location: Not on Homeworld

Re: Peak Oil Barrel: Peak Oil 2015

GoghGoner wrote:Looks like May production yoy is going to show a huge decline. You have a 1.8 MBD decline just in US and Canada. Another 0.5 MBD from Latin America. Outages in Nigeria, Libya, and Iraq probably around 0.2 MBD. So 2.5 MBD decline offset by 0.5 MBD increase in Iran?

Right now, looks like 2016 there will be less oil produced than 2015.

Pretty irrelevant depending on demand. We learned in 2008 that demand destruction is far more powerful a force than natural field declines, and then we learned immediately afterwards that industry had some tricks up its sleeve in terms of oil production, like growing the US faster than at any time in its history, and did it so much that the world flipped on its head and the Saudi's couldn't withstand the onslaught, and changed their sales strategy because of it. Talk about market power. As usual, and as the US industry has in the past, it overdid a good thing, caused a glut globally by producing more oil than the world wanted and presto....glut city.

So now we sit and wait and see what happens. The energy forecasting experts are saying it will take awhile to work ourselves out of the glut, and these guys consider not only supply like a peak oiler might, but inventory and demand as well.

Maybe a better balance by the end of next year?

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

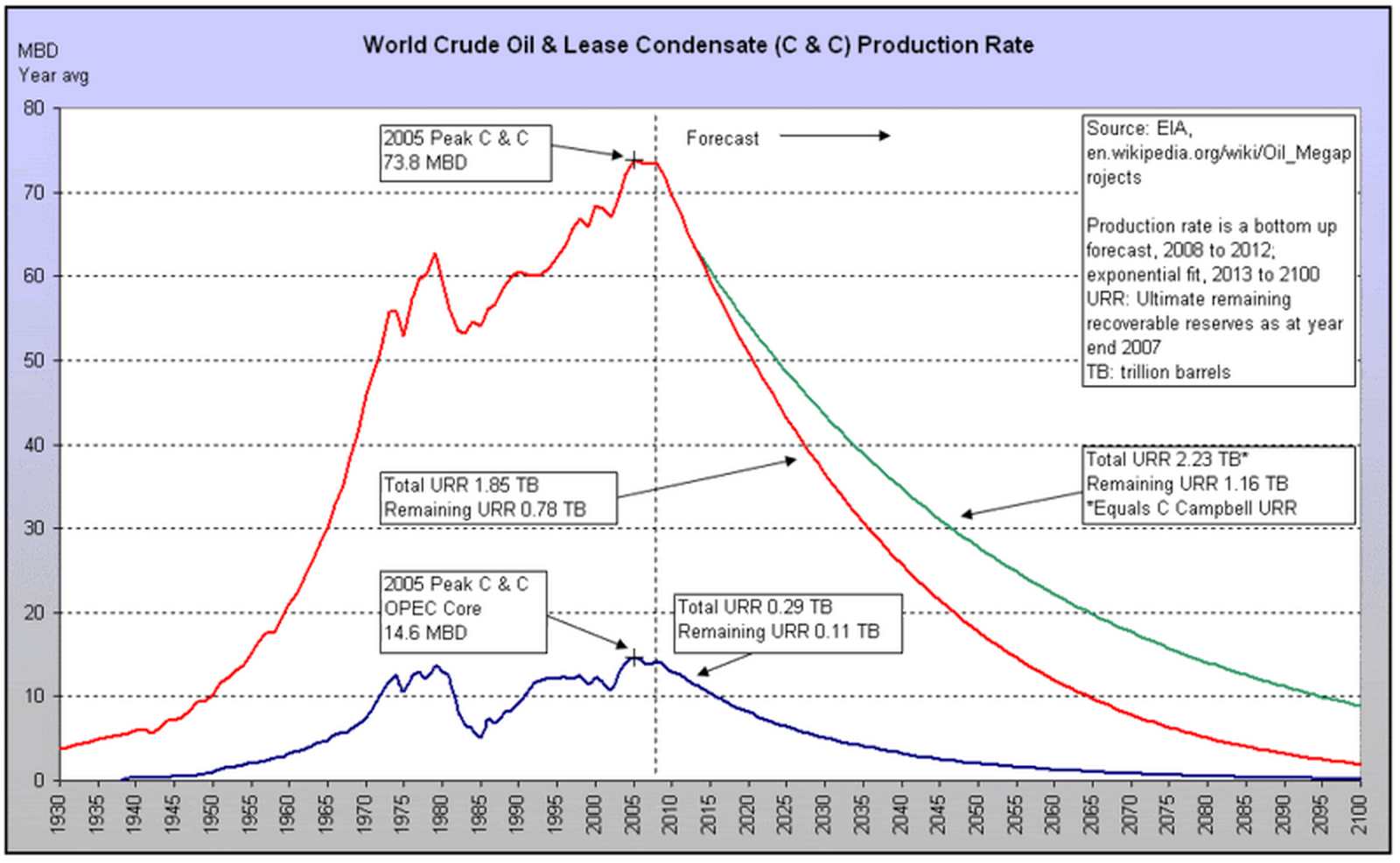

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Peak Oil Barrel: Peak Oil 2015

pstarr wrote:We are at or over the peak.

Again.

The difference between peak oil and now? This time we know the power of Rock's POD, and the sheer scalabiity and volume possible from shale production.

Peak oil can no longer be claimed without doing more work than just attaching a decline to whatever today's production is. That method has failed. When nothing but a high price can smash past oil records, including record increases in production, then we must do something else. We need to account for the hundreds of billions of shale barrels that the EIA enumerated in their study, the conventional crude and lease condensate volumes counted by the USGS and updated in 2012, their ongoing assessments of international shale volumes, their estimates of existing field growth, and the price that makes yet more oil production possible, just as it was in the US when everyone said it was in decline.

Without considering the effects of price, all is for naught.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Peak Oil Barrel: Peak Oil 2015

Sure, more money creates more oil, but the money's gone, so we are at peak oil again.

It's going to get interesting now.

Rig counts are falling all over the world.

http://peakoilbarrel.com

It's going to get interesting now.

Rig counts are falling all over the world.

http://peakoilbarrel.com

Deep in the mud and slime of things, even there, something sings.

-

Revi - Light Sweet Crude

- Posts: 7417

- Joined: Mon 25 Apr 2005, 03:00:00

- Location: Maine

Re: Peak Oil Barrel: Peak Oil 2015

Revi wrote:Sure, more money creates more oil, but the money's gone, so we are at peak oil again.

Money might be gone where you live, but as has been mentioned elsewhere, you really need to visit the places where economic growth is chugging right along, not caring a whit for what rural folks think or need because the world of the future isn't being built for rural folks.

Revi wrote:It's going to get interesting now.

It did last time as well. And the time before that. And before that.

it only takes picking up a newspaper to see that interesting is going on every day.

This is what happens in a glut. It isn't even a surprise. The real fall of in drilling rig count happened in the late 70's. Nothing before or since has approached it. The world didn't end then either, even with a far larger fall in rig count.

8th graph down on the right. Sorry it won't let me link to it, but it shows how lilliputian the current issue is, compared to the great collapse of the late 70's.

http://www.wtrg.com/prices.html

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Peak Oil Barrel: Peak Oil 2015

Adam - In the late 70's, there was an oil shock, followed with a not-really-a-glut because KSA tried to counter it decreasing its prod. The full glut happened in 1986, when KSA flooded the market. So, technically, the glut took 3'500 rigs away (77%) in the US, but it was between 82 and 86.

The actual fall from 2000 to 500 (75%) is almost in the same proportion of the fall in early 80's. We had less rigs because of 3D and Hz, and an already good knowledge of the underground because they drilled like crazy everywhere before.

Don't forget that it lasted almost 20 years. The glut was maintained with increasing production outside US despite low prices. The international rig count remained steadier. But now, we are back to the 1999 levels, the lowest global rig count recorded in 40 years.

The actual fall from 2000 to 500 (75%) is almost in the same proportion of the fall in early 80's. We had less rigs because of 3D and Hz, and an already good knowledge of the underground because they drilled like crazy everywhere before.

Don't forget that it lasted almost 20 years. The glut was maintained with increasing production outside US despite low prices. The international rig count remained steadier. But now, we are back to the 1999 levels, the lowest global rig count recorded in 40 years.

-

tita - Coal

- Posts: 418

- Joined: Fri 10 Jun 2005, 03:00:00

Re: Peak Oil Barrel: Peak Oil 2015

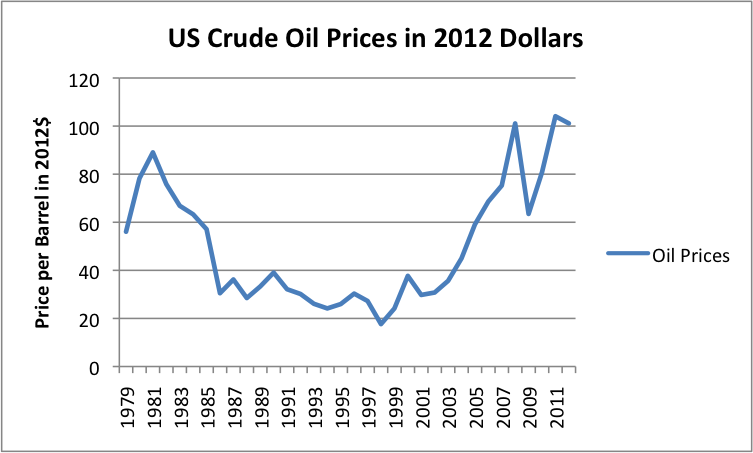

pstarr wrote:Utter BS. Every US recession (save one in 1998?) was preceded by rapidly rising oil prices.

Really? The early 1980's one where prices skyrocketed 50%....or the one a year or so later where prices fell even more first?

The early 90's where the price fell 25% first? Maybe you don't want to count that one either. The early 2000's where they jumped 25%? That works! But who defines "skyrocket" as some run of the mill 25% increase?

Did you mean...ALL of them except half of them where it fell first, except for the US recession that wasn't?

https://en.wikipedia.org/wiki/List_of_r ... ted_States

Or have you seriously messed up and were referring to Hamilton's work on international recessions instead? Which INCLUDED the late 1990's one..and define "skyrocketing" as small movements, most of the time less $5/bbl even?

pstarr wrote: It is commonly accepted by every economist that the 1973 and 1979 recessions were a specific consequence of high oil prices a result of war and/or trade restriction. The last Great Recession was no different. Evidence around the world is not much different. The Egyptian collapse was a direct consequence of high oil. As were the collapses in the PIIG countries.

And historians know that some US recessions didn't even have oil around to cause them. But you said "every US recessions save one" (which wasn't a US recession), so apparently you forgot checking the history books first.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Peak Oil Barrel: Peak Oil 2015

tita wrote:Adam - In the late 70's, there was an oil shock, followed with a not-really-a-glut because KSA tried to counter it decreasing its prod.

That was the second oil shock of the 70's.

https://en.wikipedia.org/wiki/1973_oil_crisis

tita wrote: The full glut happened in 1986, when KSA flooded the market. So, technically, the glut took 3'500 rigs away (77%) in the US, but it was between 82 and 86.

Sure. And that happened because of a demand response to high prices of the time as the inefficiencies of oil use were wrung out of the economy (remember the introduction of the Japanese cars? I do).

The point being that it is quite interesting that those wailing about the drop today, forget that it was quite worse before. I wonder why? The information is easy to find.

tita wrote:The actual fall from 2000 to 500 (75%) is almost in the same proportion of the fall in early 80's. We had less rigs because of 3D and Hz, and an already good knowledge of the underground because they drilled like crazy everywhere before.

But the economic effect of drilling is based on absolute rig count, each rig paying wages to folks, and needing fed, as it were. You are speaking to the efficiency of modern drilling. This one we are all familiar with, because the statistic and analytic arm of the DOE provides us with far more good info now than it did way back when.

http://www.eia.gov/todayinenergy/detail.cfm?id=13651

https://www.eia.gov/workingpapers/pdf/d ... ciency.pdf

https://www.eia.gov/petroleum/drilling/

tita wrote:Don't forget that it lasted almost 20 years. The glut was maintained with increasing production outside US despite low prices. The international rig count remained steadier. But now, we are back to the 1999 levels, the lowest global rig count recorded in 40 years.

Now the glut can be maintained by resource play development. Maybe. Or maybe not. But what we do know is that Saudi Arabia is willing to shove everyone to the edge of disaster to stop this development, and they haven't had to change their business model since the 1970's. So whatever is happening now is certainly something different to them, and they are the 800# gorilla in this game. Well...until this happened anyway...and now we'll just have to wait and see.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Peak Oil Barrel: Peak Oil 2015

OPEC is in disarray. It's a shame, because this is their moment, but they don't have the discipline to work together.

Oh well, it will cause the oil that is left to be burned up that much faster.

Oh well, it will cause the oil that is left to be burned up that much faster.

Deep in the mud and slime of things, even there, something sings.

-

Revi - Light Sweet Crude

- Posts: 7417

- Joined: Mon 25 Apr 2005, 03:00:00

- Location: Maine

Re: Peak Oil Barrel: Peak Oil 2015

Revi wrote:OPEC is in disarray. It's a shame, because this is their moment, but they don't have the discipline to work together.

Oh well, it will cause the oil that is left to be burned up that much faster.

I know the popular meme is OPEC does this or that, however from the beginnings of their actions in the 1970's how has it worked? They have set quota's and made agreements scores of times in the last 40 years, but members have cheated on their quota's more often than not. The only real discipline has been KSA controlling their own production by reducing their own production to make up for other members cheating.

The two times historically that KSA has refused to cut their own production, in 1985-86 and in 2014-16 there has been a nominal glut on the world market and prices have been low.

II Chronicles 7:14 if my people, who are called by my name, will humble themselves and pray and seek my face and turn from their wicked ways, then I will hear from heaven, and I will forgive their sin and will heal their land.

- Subjectivist

- Volunteer

- Posts: 4701

- Joined: Sat 28 Aug 2010, 07:38:26

- Location: Northwest Ohio

Re: Peak Oil Barrel: Peak Oil 2015

Revi wrote:OPEC is in disarray. It's a shame, because this is their moment, but they don't have the discipline to work together.

Oh well, it will cause the oil that is left to be burned up that much faster.

Well, that will certainly take quite some period of time. We've only burned some fraction of it to date, and have quite some room to go.

The Carnegie Mellon study lists some 24 trillion barrels of oil total, and we've consumed maybe 1.3 trillion?

So we can burn faster, for longer, than most suspect.

http://carnegieendowment.org/2015/03/11 ... mate-index

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Peak Oil Barrel: Peak Oil 2015

pstarr wrote:Did you read the study Adam?As of 2013, there are an estimated 24 trillion barrels of oil in place, of which 6 trillion barrels are deemed technologically recoverable.

Of those 6 trillion in resources only 1 trillion are reserves, p5's specially. (It's a oil-geology thingy. Don't stress yourself)

Anyway 1 trillion has already been pumped out of the ground and burned up. So we are at a halfway point in both oil reserves and production. Do you know what the halfway mark is called? It has a fun name.Rhymes with bleak.

Yeas, you beat me too it Pstarr, I was about to point out that the worlds oceans have something like a billion tons of pure gold dissolved in them, but nobody counts them as recoverable because it would cost you about a million dollars an ounce to collect any of it. You can buy mined or recycled gold for about 0.5 percent of the price of ocean gold. Same thing with that 24 Trillion bbl/oil, like you said we can reasonably get about 1 Trillion of it out of the ground, but for the other 23 Trillion it would be far easier and even cheaper to substitute with other energy forms or even synthetic fuel made from electricity.

Alfred Tennyson wrote:We are not now that strength which in old days

Moved earth and heaven, that which we are, we are;

One equal temper of heroic hearts,

Made weak by time and fate, but strong in will

To strive, to seek, to find, and not to yield.

-

Tanada - Site Admin

- Posts: 17056

- Joined: Thu 28 Apr 2005, 03:00:00

- Location: South West shore Lake Erie, OH, USA

Re: Peak Oil Barrel: Peak Oil 2015

Common sense injection:

-Rig counts went down because it's a glut.

-The credit crisis was caused by ARM resets (I can keep posting the ARM reset chart that people keep ignoring).

-The dot com crash occured simultaneously with record low oil prices (that was around the time of the infamous drowning in oil cover). NOT all recessions are due to "peak oil"(TM).

Simply restating untruths again and again won't make them true. Stubbornness is not a rhetorical tactic. It only speaks to ignorance and bias.

-Rig counts went down because it's a glut.

-The credit crisis was caused by ARM resets (I can keep posting the ARM reset chart that people keep ignoring).

-The dot com crash occured simultaneously with record low oil prices (that was around the time of the infamous drowning in oil cover). NOT all recessions are due to "peak oil"(TM).

Simply restating untruths again and again won't make them true. Stubbornness is not a rhetorical tactic. It only speaks to ignorance and bias.

"If the oil price crosses above the Etp maximum oil price curve within the next month, I will leave the forum." --SumYunGai (9/21/2016)

-

ennui2 - Permanently Banned

- Posts: 3920

- Joined: Tue 20 Sep 2011, 10:37:02

- Location: Not on Homeworld

Who is online

Users browsing this forum: No registered users and 260 guests