Pops wrote:Yeah but...

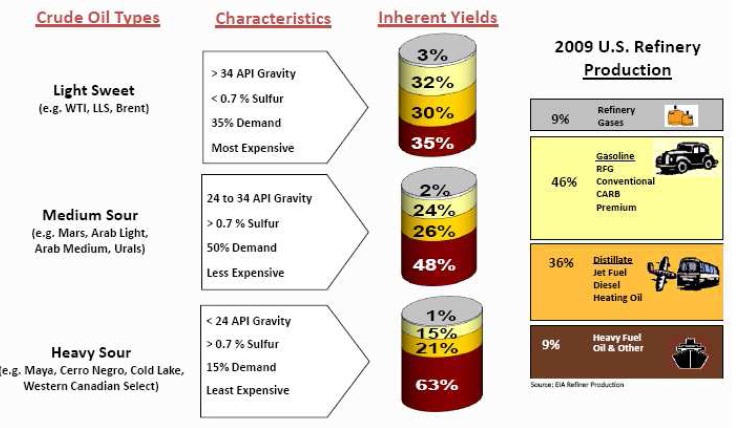

It isn't as simple as either of you paint. "Oil" extraction didn't peak in '05 and production of light sweet crude hasn't continued merrily upward. All new additions can be accounted for by tar sands and LTO from north America, ditto the falling price. Distillate increase is because of x-heavy & tar sand; and LTO makes the gasoline and lighter stuff.

I don't think it is as simple as you paint either. As I and pstarr mentioned, refineries can tune their ratios of gasoline:distillate production. US refineries have traditionally tuned their output to produce nearly twice as much gasoline as diesel. This ratio was flipped in Europe. European refineries produced twice as much distillate as gasoline. There is even season changes in the ratios. In the US, gasoline production is cranked up for the summer driving season. In the winter, distillate production is cranked up for heating oil. Refineries also respond to foreign demand. When global demand for distillates started picking up, US refineries started altering their ratios to produce more distillates. This paper has a good summary, although the second part of it gets rather technical. Still, they have a nice graph on page 5 showing the different distillate ratios used by the US, European, and rest of the word refineries. Small adjustments in the gasoline:distillate ratio can be done with simple operation changes or minor upgrades. Larger adjustments in the ratio require significant capital investments.

With growing demand pressure from the middle distillate market, refineries in the United States and Europe may see incentives to respond to the increased middle distillate demand trend with both short-term operational flexibility and some long-term processing additions or modifications. In addition, U.S. refiners should see growing economic opportunities for diesel exports, adding incentive to produce more middle distillate fuels and less gasoline, even with a slower economic outlook than previously expected.

Refiners are finding ways to shift yield to more middle distillate. refiners have chosen a variety of options to provide greater middle distillate yields. The paths include simple distillation cut-point changes; better separation efficiency around those cut points; changing conversion process operating variables; using catalysts with better distillate selectivity; and other options involving small capital investments. Also, several recent major U.S. refinery expansions (planned and recently operating) have incorporated hydrocracking units rather than FCC units. In discussions with industry experts, PI and EIA explored what refiners are doing, the extent of change possible with modest investment, and the constraints on making changes.

Distillation Unit Changes for Increased Distillate Production

A refinery’s middle distillate production can be increased by expanding the boiling point range of middle distillate material from primary distillation and from downstream conversion units to capture all the material that will meet middle distillate product specifications.

Outside the United States, favorable taxes for diesel have provided an incentive to maximize diesel production, and refiners have worked to capture all middle distillate boiling range material in middle distillate products by implementing more precise distillation processes.5 The non-U.S. refiners may have 10 to 14 trays between the flash zone and the distillate draw, whereas U.S. refiners may have only 2 to 5 trays. Furthermore, the vacuum distillation units used by non-U.S. refiners are also designed or revamped to produce diesel from the vacuum column’s top-side draw, enabling added middle distillate recovery from the vacuum unit.

FCC Unit Changes for Increased Distillate Production

The first thing that refiners point out when discussing increasing distillate yield on the FCC unit is that the yield of LCO (the distillate product stream from the FCC unit) can be increased by reducing FCC reactor temperature, which reduces conversion. More recently, however, new catalyst formulations with better cracking capabilities for heavy, high-boiling-point materials enable refiners to make modest distillate yield increases without increasing slurry oil production. A recent paper6 on strategies for maximizing FCC LCO described a diesel catalyst and the use of recycling a heavy oil fraction. Recycle of heavy catalytic cracking gas oil was common practice in FCC operation in the pre-zeolytic catalyst years of the 1960s, but it has disappeared since then. The paper indicated that, in cases using recycling and a diesel catalyst with good bottoms cracking characteristics, slurry-oil volumes remained constant, and the LCO-to-gasoline yield ratio increased.

Increasing Distillate Production at U.S. Refineries – Past Changes and Future PotentialHere's another report on refiners making new investments to increase distillate production:

US refiners aim to maximize distillate output to work attractive export arbitrage opportunities, but may leave high-priced hydrocracker investments to competitor Valero Energy, who wants to be the first North American refiner to produce as much distillate as gasoline. Valero plans to implement a one-to-one gasoline-to-distillates ratio by around 2015, after more than $3 billion worth of projects go live to increase the company's distillate production.

Hydrocracker projects are under way at the company's 180,000 b/d Meraux, Louisiana, 290,000 b/d Port Arthur, Texas, and 270,000 b/d St. Charles, Louisiana, refineries. Hydrocrackers allow for the reprocessing of various feedstocks into higher value products and give a relatively large yield of low sulfur distillates like jet fuel and diesel.

Historically, US refiners have had a two-to-one output ratio for gasoline and diesel, respectively. "We are changing our portfolio to make more diesel. [By 2015] our whole system will be about one-to-one of gasoline to diesel ratio."

Refiner Phillips 66 distillates production is also moving closer to 50% of its total refinery output. Marathon is investing to increase its distillate output at its 490,000 b/d Garyville, Louisiana and 206,000 b/d Robinson, Illinois, refinery, to increase distillate output.

US refiners maximize distillate production, exportsPops wrote:I suppose it is a simple matter (for someone) to figure out how much of the stuff coming out of a particular well at a particular time was " in liquid phase in natural underground reservoirs" but I'm not all that sure how much it matters (or if anyone actually sits down and figures it).

I don't think it really matters either.

The oil barrel is half-full.