Has the danger of Peak Oil passed?

Re: Has the danger of Peak Oil passed?

I am not too worried about telling people any more about what's going on with peak oil. They don't hear me anyway. I was heartened to hear that nobody listens to the people who really are at the forefront of Peak Oil. Here's a quote by Ron Patterson, who is the main researcher at Peak Oil Barrel:

Ron Patterson says:

04/25/2016 AT 10:21 AM

" I have three sons, six grandchildren and four great-grandchildren. And I tell them exactly what I think. And none of them believe a goddamn word of it.

I can only quote Montaigne, ‘all I say is by way of discourse and nothing by way of advice. I should not speak so boldly, were it my duty to be believed."

I agree with him. All you can do is tell people once or twice.

Then it's up to them to either take it seriously or not. We tried...

Ron Patterson says:

04/25/2016 AT 10:21 AM

" I have three sons, six grandchildren and four great-grandchildren. And I tell them exactly what I think. And none of them believe a goddamn word of it.

I can only quote Montaigne, ‘all I say is by way of discourse and nothing by way of advice. I should not speak so boldly, were it my duty to be believed."

I agree with him. All you can do is tell people once or twice.

Then it's up to them to either take it seriously or not. We tried...

Deep in the mud and slime of things, even there, something sings.

-

Revi - Light Sweet Crude

- Posts: 7417

- Joined: Mon 25 Apr 2005, 03:00:00

- Location: Maine

Re: Has the danger of Peak Oil passed?

Revi - Or as the great Texas comedian Ron White puts it more simply: "You can't fix stupid".

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Has the danger of Peak Oil passed?

Here's a portion of another post I thought might put some of the "has the danger of PO passed" bullsh*t into perspective:

Consider when the Rockman started with Mobil Oil in 1975 the oil patch was very aware of the dangers of PO. His mentor explained PO and the struggle the oil patch faced THEN. Again this is 40+ years ago. We didn’t then nor now call it “peak oil” in the oil patch. It has always been the “reserve replacement problem”. The problem wasn’t a lack of new reserves to hunt for but the lack of new reserves as large as the ones we had already developed. Those were the reserves we’ve been trying to replace for more than 4 decades and it has always been a struggle. In the US not much success in that regards until we started expanding in the shallow water GOM in the 70’s and 80’s and then eventually the Deep Water GOM. Even when we had the price spike in the late 70’s and more than 4,500 drill rigs were put into the service the US did not see any meaningful increase in oil production.

Consider the reserve replacement goal: from 1949 to 2011 the US has produced 215 BILLION BBLS OF OIL. And many tens of billions of bbls produced before 1949. And since 1975 when the Rockman first learned of PO the US has produced 130 BILLION BBLS OF OIL. Now think about one of the biggest DW GOM that might produce 500 million bbls of oil. While it sounds big that field replaces only 0.4% of the reserves we’ve produced since 1975. Now drop back to the onshore. The Rockman is trying to increase production from just one relatively small trend in Texas. Small but still produced 4.5 BILLION BBLS OF OIL. And that trend is now DEAD as far as developing NEW RESERVES: there are no undeveloped reservoirs left to find. Which shouldn’t be a shock since the trend was heavily explored starting in the 1930’s. All the major fields had been discovered and developed 60 years ago. What’s left to recover from existing wells amount to only hundreds of thousands of bbls.

Of course high oil prices made developing the KNOWN oil reserves in the unconventional reservoirs economic since most of the drilling and frac’ng tech had already been refined.

But it’s easy to be impressed with some of the new numbers: the EIA now estimates 4.84 million bopd from all the unconventional trends. That’s 1.8 BILLION BBLS OF OIL PER YEAR. So if oil prices had not collapsed and there were an infinite number of unconventional wells left it would only take another 72 years of drilling with 1,600 rigs/day and $50+ TRILLION in new capex to replace the reserves the US has produced since the Rockman started in 1975. And 120 years to replace the US production since 1949. And another perspective: some estimate the KSA has produced about 150 BILION BBLS OF OIL since Ghawar Field came on in 1951. At a rate of 10.5 mm bopd it will require the KSA to hold its current rate for about 40 years to replace the reserves it has produced through 2015.

Helps to put some of those numbers into perspective, eh? LOL

Consider when the Rockman started with Mobil Oil in 1975 the oil patch was very aware of the dangers of PO. His mentor explained PO and the struggle the oil patch faced THEN. Again this is 40+ years ago. We didn’t then nor now call it “peak oil” in the oil patch. It has always been the “reserve replacement problem”. The problem wasn’t a lack of new reserves to hunt for but the lack of new reserves as large as the ones we had already developed. Those were the reserves we’ve been trying to replace for more than 4 decades and it has always been a struggle. In the US not much success in that regards until we started expanding in the shallow water GOM in the 70’s and 80’s and then eventually the Deep Water GOM. Even when we had the price spike in the late 70’s and more than 4,500 drill rigs were put into the service the US did not see any meaningful increase in oil production.

Consider the reserve replacement goal: from 1949 to 2011 the US has produced 215 BILLION BBLS OF OIL. And many tens of billions of bbls produced before 1949. And since 1975 when the Rockman first learned of PO the US has produced 130 BILLION BBLS OF OIL. Now think about one of the biggest DW GOM that might produce 500 million bbls of oil. While it sounds big that field replaces only 0.4% of the reserves we’ve produced since 1975. Now drop back to the onshore. The Rockman is trying to increase production from just one relatively small trend in Texas. Small but still produced 4.5 BILLION BBLS OF OIL. And that trend is now DEAD as far as developing NEW RESERVES: there are no undeveloped reservoirs left to find. Which shouldn’t be a shock since the trend was heavily explored starting in the 1930’s. All the major fields had been discovered and developed 60 years ago. What’s left to recover from existing wells amount to only hundreds of thousands of bbls.

Of course high oil prices made developing the KNOWN oil reserves in the unconventional reservoirs economic since most of the drilling and frac’ng tech had already been refined.

But it’s easy to be impressed with some of the new numbers: the EIA now estimates 4.84 million bopd from all the unconventional trends. That’s 1.8 BILLION BBLS OF OIL PER YEAR. So if oil prices had not collapsed and there were an infinite number of unconventional wells left it would only take another 72 years of drilling with 1,600 rigs/day and $50+ TRILLION in new capex to replace the reserves the US has produced since the Rockman started in 1975. And 120 years to replace the US production since 1949. And another perspective: some estimate the KSA has produced about 150 BILION BBLS OF OIL since Ghawar Field came on in 1951. At a rate of 10.5 mm bopd it will require the KSA to hold its current rate for about 40 years to replace the reserves it has produced through 2015.

Helps to put some of those numbers into perspective, eh? LOL

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Has the danger of Peak Oil passed?

Revi wrote:I am not too worried about telling people any more about what's going on with peak oil. They don't hear me anyway.

Don't hear you? Or aren't about to fall for the same old same old when instead they were given low prices for oil and natural gas because drill-baby-drill worked out pretty well?

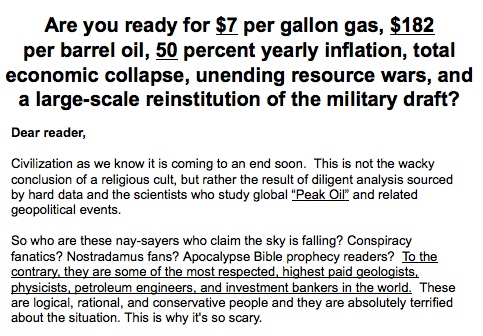

lest we forget, this is what peak oil was selling before we landed smack in the middle of glut instead...

Revi wrote: I was heartened to hear that nobody listens to the people who really are at the forefront of Peak Oil. Here's a quote by Ron Patterson, who is the main researcher at Peak Oil Barrel:

Ron Patterson says:

04/25/2016 AT 10:21 AM

" I have three sons, six grandchildren and four great-grandchildren. And I tell them exactly what I think. And none of them believe a goddamn word of it.

Sounds about right...maybe he sold them the original peak oil, and when they are out driving their 300HP aluminum bodied Ford trucks getting 20mpg, or EVing to work and not caring at all about fuel costs, they don't listen because he has been claiming the same thing ever since peak oil was supposed to have happened last time?

boy who cried wolf and all..

Revi wrote:I can only quote Montaigne, ‘all I say is by way of discourse and nothing by way of advice. I should not speak so boldly, were it my duty to be believed."

I agree with him. All you can do is tell people once or twice.

Then it's up to them to either take it seriously or not. We tried...

Yes...and can't be taken seriously yet because of how little we understood about resource economics. Guys like Lynch ate our lunch for a reason, and we should learn from it so as to not repeat the mistakes of the past. Be they the peak oil meme of 2005, or the running out of Jimmy Carter back in the 1970's. Let's face it, malthusians have been wrong since malthus died, and just..keep...hoping...just once....to be right.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Has the danger of Peak Oil passed?

ROCKMAN wrote:Revi - Or as the great Texas comedian Ron White puts it more simply: "You can't fix stupid".

True...but to whom are you referring...the peak oilers who keep getting it wrong, forgetting the POD idea as you've explained well, not understanding the power of the unconventionals to rewrite the production landscape as Mr reserve pointed out years ago, or those who told everyone it was a load of bull, and are now laughing it up in the middle of the current glut?

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Has the danger of Peak Oil passed?

Adam - I can paint that answer with a rather broad brush. But let me focus of the govt/politicians. There's no excuse for even our most scientifically challenged legislators: they have large staffs and lots of funds to do the research. Just consider the absurdity of how many in Congress and the administration continue the completely insane “Now the US can export oil since the POTUS cancelled the ban last January” bullsh*t. It doesn’t even require any research: all a staffer has to do is go online and pull down the govt’s own figures that show that the US has exported 1.7 BILLION BBLS OF OIL since the ‘ban’ was put in place in the 70’s. The process takes less than 60 seconds. Or just the fact that last years, before the POTUS set the “ban” aside the US exported over 160 million bbls of oil. IMHO every congressman /administration official/employee that truly feels there has been a ban on exporting US oil should be immediately removed from their position.

How can this govt come up with anything close to a reasonable response to the energy situation if so many are totally ignorant of such an easily confirmed FACT.

How can this govt come up with anything close to a reasonable response to the energy situation if so many are totally ignorant of such an easily confirmed FACT.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Has the danger of Peak Oil passed?

No doubt lots of predictions were wrong but not just on the pessimistic side, there is plenty of wrongness to go around so I'd think it is a little disingenuous to swing at the boy who cried wolf strawman without admitting to the boys who cried free lunch.

CERA said in 2008 that we'd be at 112mbd by 2017, lynch said as late as '09 that $30 oil was right around the corner — turns out we put up with 4 years of the highest average oil price since oil before it finally got there. KSA said they could pump 50mbd for 50 years, except they never have for even a day. I could go on but thats all I have time for now.

Expensive unconventional oil is no substitute for cheap conventional oil. The decline in US consumption at the price level that enabled LTO illustrates that perfectly. But 'Merican ingenuity is not the reason we didn't peak in the oughts. Credit that to the collapse of communism in the USSR that postponed a whole bunch of their consumption and their peak to about now; and, the "liberation" of Iraq, at the cost of many dead Americans ... although they do have the thanks of grateful oil company shareholders everywhere.

From CrudeOilPeak, notice especially the cyan blue and lime green slices which propped up production and the economy while the receipts from record high prices were plowed into fracking leases and pumper rigs.

The point is that even with 10 years of high price, 4 in a row of the highest average real prices ever, the bottom tier of that chart continued to decline, the offset being the countries that had been hindered by politics. And even now, 6-8-10 years post epiphany, fracking is only making any big mark in the US and only when supported by prohibitively high prices.

CERA said in 2008 that we'd be at 112mbd by 2017, lynch said as late as '09 that $30 oil was right around the corner — turns out we put up with 4 years of the highest average oil price since oil before it finally got there. KSA said they could pump 50mbd for 50 years, except they never have for even a day. I could go on but thats all I have time for now.

Expensive unconventional oil is no substitute for cheap conventional oil. The decline in US consumption at the price level that enabled LTO illustrates that perfectly. But 'Merican ingenuity is not the reason we didn't peak in the oughts. Credit that to the collapse of communism in the USSR that postponed a whole bunch of their consumption and their peak to about now; and, the "liberation" of Iraq, at the cost of many dead Americans ... although they do have the thanks of grateful oil company shareholders everywhere.

From CrudeOilPeak, notice especially the cyan blue and lime green slices which propped up production and the economy while the receipts from record high prices were plowed into fracking leases and pumper rigs.

The point is that even with 10 years of high price, 4 in a row of the highest average real prices ever, the bottom tier of that chart continued to decline, the offset being the countries that had been hindered by politics. And even now, 6-8-10 years post epiphany, fracking is only making any big mark in the US and only when supported by prohibitively high prices.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Has the danger of Peak Oil passed?

ROCKMAN wrote:Adam - I can paint that answer with a rather broad brush. But let me focus of the govt/politicians. There's no excuse for even our most scientifically challenged legislators: they have large staffs and lots of funds to do the research. Just consider the absurdity of how many in Congress and the administration continue the completely insane “Now the US can export oil since the POTUS cancelled the ban last January” bullsh*t.

But...we did export some oil. Are you referring to more of an angle whereby we become a net exporter, rather than just exporting itself?

Rockman wrote: It doesn’t even require any research: all a staffer has to do is go online and pull down the govt’s own figures that show that the US has exported 1.7 BILLION BBLS OF OIL since the ‘ban’ was put in place in the 70’s. The process takes less than 60 seconds. Or just the fact that last years, before the POTUS set the “ban” aside the US exported over 160 million bbls of oil. IMHO every congressman /administration official/employee that truly feels there has been a ban on exporting US oil should be immediately removed from their position.

How can this govt come up with anything close to a reasonable response to the energy situation if so many are totally ignorant of such an easily confirmed FACT.

I guess I'm not sure which fact you are defending or attacking? I mean, I'm with you on the exporting thing, you are correct, you can whip those facts up pretty quick from the energy stat and analysis experts at the EIA, but staffers don't work for Congresscritters to talk about facts, they are advocates for whatever point of view the Congresscritter wants.

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Has the danger of Peak Oil passed?

Pops wrote:No doubt lots of predictions were wrong but not just on the pessimistic side, there is plenty of wrongness to go around so I'd think it is a little disingenuous to swing at the boy who cried wolf strawman without admitting to the boys who cried free lunch.

CERA said in 2008 that we'd be at 112mbd by 2017, lynch said as late as '09 that $30 oil was right around the corner — turns out we put up with 4 years of the highest average oil price since oil before it finally got there. KSA said they could pump 50mbd for 50 years, except they never have for even a day. I could go on but thats all I have time for now.

I got it, sure. So the EIA was right with their global estimate from 2006, Lynch it turns out was more right than those who said the world was ending and is still talking about it as well, so was Pete McCabe with his article back in about 1998, saying that oil would return in real terms to the path it had been on for decades before, although I think it is actually lower than even that, but the problem lies mostly with how these rates drive response isn't it?

If peak oilers had been right, half of us would have starved off by now, everything I demonstrated in that graphic above. Let's face it, nobody gives a CRAP about oil production rates, we all care about the consequences of those rates. Matt Savinar, now a famous astrologist, looked into the future and came up with that graphic above...I know I know...don't ask me HOW a great astrologist can get it that wrong, but still...

Pops wrote:Expensive unconventional oil is no substitute for cheap conventional oil.

When you buy fuel for your car or truck, can you tell the difference? I can't...can't even ask for a pump tht gives me the good crude based stuff, versus the stuff manufactured from tar sands. I would like to spend my dollars on wise ecologically sound oil and gas development, but it turns out that chemical engineers can make gasoline and diesel out of all kinds of stuff, rendering your distinction to one without a difference to anyone except chemical engineers.

Pops wrote:The point is that even with 10 years of high price, 4 in a row of the highest average real prices ever, the bottom tier of that chart continued to decline, the offset being the countries that had been hindered by politics. And even now, 6-8-10 years post epiphany, fracking is only making any big mark in the US and only when supported by prohibitively high prices.

Oil production ALWAYS declines. Just ask Rock. But we're all still here because guys like him keep cranking it out. As far as fracking, we get half our oil from it, so yes it is a big mark, and it was there as recently as 2015. When prices weren't anywhere near "prohibitive". As Rock said, all you have to do to find this info is kee an eye on that wonderful tax payer funded den of experts.

http://www.eia.gov/todayinenergy/detail.cfm?id=25372

That wasa such a good piece of information, I wonder when they'll do one for gas as well?

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Has the danger of Peak Oil passed?

The point is that even with 10 years of high price, 4 in a row of the highest average real prices ever, the bottom tier of that chart continued to decline, the offset being the countries that had been hindered by politics. And even now, 6-8-10 years post epiphany, fracking is only making any big mark in the US and only when supported by prohibitively high prices.

Interesting chart Pops. Something that struck me:

Countries where declines were significant

1. UK

2. Norway

3. Mexico

4. Other ME

5. Libya

6. Iran

Countries where increases were noted in the period

1. Azerbaijan

2. Russia

3. Kazachstan

4. Colombia

5. Brazil

6. China

7. Angola

8. UAE

9. Qatar

10. Saudi Arabia

11. Iraq

12. Canada

13. USA

Arguably out of the decliners there are two which are certainly on their last legs, UK and Norway where they have pretty much drilled up everything prospective and costs are prohibitive. Of the group Mexico declines were at one field and were not offset not because of lack of resource but because of problems inherent with PEMEX and a nationalized industry, lots of potential left. Libya of course is the fallout of the post Gadhafi mess and Iran is a product of ongoing sanctions and basic incompetence in their NOC. Both Iran and Libya could come back on stream if they got their respective acts together. Likewise Mexico is trying to clean up its act but has been hampered by the low price.

Of the countries that saw increases I would say there are only a few that could potentially increase their production further. Russia still has some untapped potential in Eastern Siberia and the Barents, Kazachstan could produce more if they were able to figure out all the production issues surrounding the major fields fringing the Caspian, Saudi Arabia still has a couple of million barrels a day of spare capacity, Iraq still has untapped potential in the western desert and refurbishment of some of their older fields, Canada counts mainly on heavy oil which is hurt worse than most with low oil price and also requires some technological advances with regard to subsurface recovery, the USA still has a lot of shale potential although the best spots are now all pretty much drilled and it comes down to improvements in production practices, downspacing, efficiencies etc. The Gulf Coast Perdido deep and ultra-deep water offshore still has potential but is very costly and I don’t hold any hopes for US East Coast offshore. Brazil is a basket case at the moment and most of the potential there is ultra deep water with huge expense. Angola has fields that have been waiting for commissioning for over 10 years. That being said there is some hope for ultra deep sub-salt oil in a mirror image to what occurs offshore Brazil although that will take much higher prices.

Another interesting observation is that this analysis must include liquids given the inclusion of Qatar production which is almost all liquids extracted from the offshore supergiant North Field (the Iranian portion of this is called South Pars). So if we are talking about just oil peak and not oil and liquids peak it is a bit confusing.

Of all the countries which could increase production it is all a product of cost vs price and of course demand. If the oil was needed and price was high enough they could increase. This is partly why I have held to the view of a very long bumpy peak.

-

rockdoc123 - Expert

- Posts: 7685

- Joined: Mon 16 May 2005, 03:00:00

Re: Has the danger of Peak Oil passed?

Adam wrote:Lynch it turns out was more right than those who said the world was ending

The doomer strawman aside we're 20mbd below CERA's prediction

and have spent maybe 3 times what Lynch said we would to date,

and the US drilled 300,000 new wells(!) but only got a very temporary 4.3mb/d

Which is already falling as fast as it rose because price is way below breakeven...

the same price you are touting as proof the pessimists were wrong...

LOL

Of course I can tell the difference between conventional and non when I fill up, can't you? Conventional oil cost maybe $10/bbl to produce, LTO/tar/GOM/x-heavy 5 times as much. Pretty sure that the price we pay reflects the fact that conventional oil (what Lynch/Yergin said would increase indefinitely) has peaked. Really, look at that chart, no growth outside the US and CA since 2005 after a decade of record high oil prices.

The only growth is in LTO and the reason we won't be seeing a prolonged slump in price like we have in the past with conventional oversupply is the rapid declines that require high price to offset... unconventionals need high price --- and the worrying thing about peak oil is, after all, high price.... get the irony?

Really, doomers deserve all the ribbing they get. I'll even take my share (even though I'm not really an overnight armageddonist). But you are falling into the same trap, I think. You show up at PO.com in the middle of a glut and act like the previous record prices and market gyrations were an anomaly. They weren't, things have changed, cheap oil can't keep up with demand, necessitating more expensive substitutes. This will only continue.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Has the danger of Peak Oil passed?

Thanks for that roc.

Seems like there is always some political bottleneck somewhere, no? I was thinking of Iran, Lybia & Mexico particularly as politically restricted and significant producers. I did read that a well has actually started producing in the Tupi field off Brazil (though I think they now call it Lula... but maybe not for long, LOL)

What is your guess as to the effect of the current price on future production? Say 5 years hence?

.

Seems like there is always some political bottleneck somewhere, no? I was thinking of Iran, Lybia & Mexico particularly as politically restricted and significant producers. I did read that a well has actually started producing in the Tupi field off Brazil (though I think they now call it Lula... but maybe not for long, LOL)

What is your guess as to the effect of the current price on future production? Say 5 years hence?

.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Has the danger of Peak Oil passed?

Pops wrote:fracking is only making any big mark in the US and only when supported by prohibitively high prices.

It doesn't have to be "prohibitively" high.

Oil experts from the ME were being very frank in stating a few months back (like the swimming-pool article) that if prices get high enough ($50-60 maybe) then the drilling will simply pick right up again where it left off in the US and prevent the price from going back up to 2008 levels again. Their tone was one of CAPITULATION to there being a relatively low price-cap on oil for the near future. In other words, yes, some price volatility, but no outright oil price shocks.

"If the oil price crosses above the Etp maximum oil price curve within the next month, I will leave the forum." --SumYunGai (9/21/2016)

-

ennui2 - Permanently Banned

- Posts: 3920

- Joined: Tue 20 Sep 2011, 10:37:02

- Location: Not on Homeworld

Re: Has the danger of Peak Oil passed?

I agree, they will start right back when the price is right.

But, the right price depends entirely on location.

In the center of a sweet spot with 1kb/d initial flow, $30 or $50/bbl may make money. There are some wells being made even now.

But out a few miles where 250bbl initial flow rate is expected, $100/bbl may be a loser.

Just like conventional reservoirs aren't everywhere and all you need to do is sink a hole to get a gusher, LTO isn't everywhere either. There are sweet spots. 300,000 of which have already been fracked.

But, the right price depends entirely on location.

In the center of a sweet spot with 1kb/d initial flow, $30 or $50/bbl may make money. There are some wells being made even now.

But out a few miles where 250bbl initial flow rate is expected, $100/bbl may be a loser.

Just like conventional reservoirs aren't everywhere and all you need to do is sink a hole to get a gusher, LTO isn't everywhere either. There are sweet spots. 300,000 of which have already been fracked.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Has the danger of Peak Oil passed?

I agree, at which point all of us fall back on ROI speculation. Pessimists manufacture high break-even numbers and optimists manufacture low break-even numbers.

It's not that different when discussing the break-even for Saudi crude while they were flooding the market. Pessimists assumed the Saudis were taking a loss and optimists assumed they were pulling a small profit.

Note that the Saudi's notably came out recently with some strategic plan to run their economy on something other than oil, and references a truly massive oil-wealth nestegg. Ultimately you have to go by the information that's out there and the observable behavior and not just plug in self-serving numbers and suggestive but vague terms like "prohibitive".

My feeling is that yes, fracking will deplete quickly. It's not a viable long-term stalling tactic, but I think there's still a second wind to be had as the drills went idle due to the glut, not advanced depletion. When it will crank up again and how much mileage it gets before geologic depletion wipes it out, I don't know.

It's not that different when discussing the break-even for Saudi crude while they were flooding the market. Pessimists assumed the Saudis were taking a loss and optimists assumed they were pulling a small profit.

Note that the Saudi's notably came out recently with some strategic plan to run their economy on something other than oil, and references a truly massive oil-wealth nestegg. Ultimately you have to go by the information that's out there and the observable behavior and not just plug in self-serving numbers and suggestive but vague terms like "prohibitive".

My feeling is that yes, fracking will deplete quickly. It's not a viable long-term stalling tactic, but I think there's still a second wind to be had as the drills went idle due to the glut, not advanced depletion. When it will crank up again and how much mileage it gets before geologic depletion wipes it out, I don't know.

"If the oil price crosses above the Etp maximum oil price curve within the next month, I will leave the forum." --SumYunGai (9/21/2016)

-

ennui2 - Permanently Banned

- Posts: 3920

- Joined: Tue 20 Sep 2011, 10:37:02

- Location: Not on Homeworld

Re: Has the danger of Peak Oil passed?

What is your guess as to the effect of the current price on future production? Say 5 years hence?

Hah....how long is a piece of sting?

I am on board with some of my acquaintances at WoodMac who fully believe that if prices stay low for too long that we will reap the whirlwind as demand overtakes supply and the time gap to replace the necessary supply is too short. The shale oil/gas story is a bit different because the time gap is relatively short assuming companies can get money to make the "frack log" happen but the big project offshore in Africa, Brazil etc will take time. WoodMac's biggest point is throughout the past 4 decades the price drops have not stopped exploration entirely whereas this one has. It is the time gap between ramping up exploration, finding something, commissioning it etc. that is the problem given it can't keep up with a continual rising demand on oil.

I believe we will have another price jump in the next couple of years. Won't predict when but I think it is inevitable. But that's just the opinion of an old retired guy.

-

rockdoc123 - Expert

- Posts: 7685

- Joined: Mon 16 May 2005, 03:00:00

Re: Has the danger of Peak Oil passed?

Thanks roc.

I sorta think the Fracking Head Fake is actually a bigger danger than "peak oil." When prices were high, consumers got the message, they purchased more efficient cars, drove less, maybe moved closer.

But because of the Great Frack, folks are convinced Tech foiled Mother, America is gonna be great again and the party's gonna roll on forever. So not only are they not thinking about getting more local, they are going in the opposite direction, driving more and buying f-150s to go to the QuilSac.

All the while investment in the big projects that are 95% of production grinds down to zilch. As mentioned, politics liberated Russian and Iraqi oil which averted peak in the oughts and high price sustained conventional oil in the teens, but just barely.

5 or 10 million barrels a day of shale is great— but only if there is 90 million a day of everything else.

I sorta think the Fracking Head Fake is actually a bigger danger than "peak oil." When prices were high, consumers got the message, they purchased more efficient cars, drove less, maybe moved closer.

But because of the Great Frack, folks are convinced Tech foiled Mother, America is gonna be great again and the party's gonna roll on forever. So not only are they not thinking about getting more local, they are going in the opposite direction, driving more and buying f-150s to go to the QuilSac.

All the while investment in the big projects that are 95% of production grinds down to zilch. As mentioned, politics liberated Russian and Iraqi oil which averted peak in the oughts and high price sustained conventional oil in the teens, but just barely.

5 or 10 million barrels a day of shale is great— but only if there is 90 million a day of everything else.

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Re: Has the danger of Peak Oil passed?

Pops wrote:Really, doomers deserve all the ribbing they get. I'll even take my share (even though I'm not really an overnight armageddonist). But you are falling into the same trap, I think. You show up at PO.com in the middle of a glut and act like the previous record prices and market gyrations were an anomaly. They weren't, things have changed, cheap oil can't keep up with demand, necessitating more expensive substitutes. This will only continue.

I spent more than a little time going back through the old threads brought up by ennui2, and if there was anything that showed up as a trend, it was that no one except Rockman and Mr reserve was even willing to speculate on what could happen next, or why. So sure, ribbing doomers is fair, but those 2 at least have proven that among all the signals, market, production, screams from doomers for the end, not everyone was fooled.

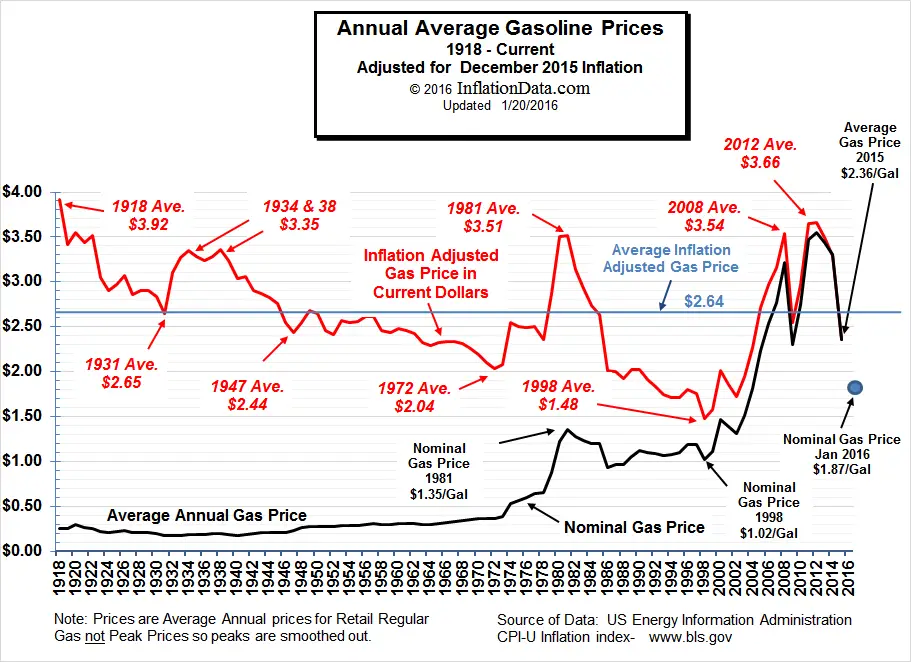

Things have changed. I paid $1.91/gal to put gas in the car this evening. That is about $0.33/gal in 1971 dollars.

http://data.bls.gov/cgi-bin/cpicalc.pl

The price of gasoline in 1971? About $0.36/gal.

https://www.google.com/webhp?sourceid=c ... 0in%201971

The market price for gasoline tells quite a story about the cost of all that old oil, versus the new stuff, don't you think?

As far as keeping up with demand, well, I've used this reference before and not a single person seems to have been able to refute a certified expert's opinion on why even the idea of "keeping up with demand" isn't what it used to be. Admittedly, she has certifiable experience as an economist, but if 2005 peak oil claims proved anything, it is that more economists are needed in this debate, not fewer.

http://www.wsj.com/articles/why-the-wor ... 1430881507

Plant Thu 27 Jul 2023 "Personally I think the IEA is exactly right when they predict peak oil in the 2020s, especially because it matches my own predictions."

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

Plant Wed 11 Apr 2007 "I think Deffeyes might have nailed it, and we are just past the overall peak in oil production. (Thanksgiving 2005)"

-

AdamB - Volunteer

- Posts: 9292

- Joined: Mon 28 Dec 2015, 17:10:26

Re: Has the danger of Peak Oil passed?

Adam - "...they are advocates for whatever point of view the Congresscritter wants." Which is exactly the point I keep pounding. At best some of those critters are being willfully ignorant of the facts. Facts, as you say, that are readily available. Which also means many of them know exactly what the facts are. Which means those are not "points of views" but flat out big lies being told for their electorial benefit. And in my world that earns them the title of traitors. LOL.

As far as needing more economists in the debate that will only make matters more confusing if they don't have a very strong grounding in the fossil fuel extraction business. Sorta like hoping for more OBGYN docs to help look for a cancer sure. You really need experts in any field in order to develop decent models. And then you still have to have a political system that pushes those facts into the public arena. A political system that the US clearly lacks. Lacking as indicated by the continued misrepresentation of US oil exports. If the DC critters can't or are unable to get such a simple FACT straight what hope is there for them to develop realistic responses to the much more complex dynamics?

IOW if a person really believes 2 + 2 = 3 what chance do they have to correctly integrate a differential equation? LOL.

As far as needing more economists in the debate that will only make matters more confusing if they don't have a very strong grounding in the fossil fuel extraction business. Sorta like hoping for more OBGYN docs to help look for a cancer sure. You really need experts in any field in order to develop decent models. And then you still have to have a political system that pushes those facts into the public arena. A political system that the US clearly lacks. Lacking as indicated by the continued misrepresentation of US oil exports. If the DC critters can't or are unable to get such a simple FACT straight what hope is there for them to develop realistic responses to the much more complex dynamics?

IOW if a person really believes 2 + 2 = 3 what chance do they have to correctly integrate a differential equation? LOL.

-

ROCKMAN - Expert

- Posts: 11397

- Joined: Tue 27 May 2008, 03:00:00

- Location: TEXAS

Re: Has the danger of Peak Oil passed?

AdamB wrote:no one except Rockman and Mr reserve was even willing to speculate on what could happen next, or why.

1.3 million posts and you can only find 2 people willing to speculate? Here?

You aren't looking very hard, lol

Here is some speculation, just sos you recognize it:

Gas was below $2 in today's money for nearly 2 decades post embargo, even lower than before OPEC, because high prices back then produced a glut of conventionally produced oil. I'll be surprised if gas stays below $2 for even 2 months this time. That is simply because fast depleting LTO wells cost more and deplete faster than conventional. It ain't rocket surgery. About 40% of the cost of gasoline is oil so $2 gas requires oil at $35 or less... and LTO pretty obviously is not profitable in sufficient amounts below $35 to make a decades long surplus.

http://www.gasbuddy.com/Charts

http://inflationdata.com/articles/wp-co ... n-2016.jpg

The legitimate object of government, is to do for a community of people, whatever they need to have done, but can not do, at all, or can not, so well do, for themselves -- in their separate, and individual capacities.

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-- Abraham Lincoln, Fragment on Government (July 1, 1854)

-

Pops - Elite

- Posts: 19746

- Joined: Sat 03 Apr 2004, 04:00:00

- Location: QuikSac for a 6-Pac

Who is online

Users browsing this forum: No registered users and 263 guests