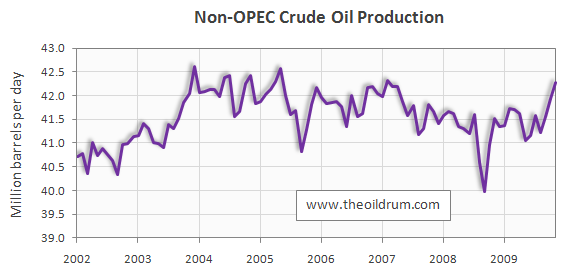

I deliberately showed non-OPEC production because they were the ones supposedly more affected by the credit crunch. It's not like the Saudis need much access to credit.

AirlinePilot wrote:My premise held true and once again for the reading impaired NOWHERE DID I SAY THE EFFECTS WOULD BE PERMANENT.

I said it would have large impact on production in the near term to be exact

Nope, sorry. Another . . falsehood. This thread is filled with quotes by you and articles posted by you about the

long-term effects of the credit crunch. For example:

Posted September 6, 2009:

AirlinePilot wrote:Yes OF they are raising money and finding oil and spending capital etc. I do not, nor have I denied that. What you are failing at in your argument is the dismissal of the magnitude of the spending going on now versus what was going on a year or two ago. There is no refuting 20-30% less capital spending as an industry. It does not result in greater production down the road, it WILL result in less. The industry cannot pivot quickly with increased prices and this will have an impact which you choose to ignore.

This is typical of your mantra with the economy as well. The O&G industry is in trouble, maybe not terminally, but trouble none the less. You choose to refuse to see it and that's just fine. I'll continue to balance your cornucopian game with a dose of reality now and then.

It is now 5+ months later. If you regard 5 months as "down the road," then your quote from September 6 was in error because the credit cruch HASN'T resulted in lower production - in fact, production started going up as you wrote that! On the other hand, if you regard 5 months as "short-term," then your post from today was a . . . falsehood . . . because in this post from September 6 you were talking about the longer term.

One way or another, you are pretending you didn't say something that you did. I can find many more quotes like this from you in this thread.

It's like in

It's like in