AndyA wrote:Is this caused by a reduction in consumption or an increase in production?

US through July. The past 3 weeks it has reached 8.8 million barrels/day.

World through July.

I'm not exactly sure what is going on, but there seem to be a few commodities that have been sliding in price this year.

There have been

record corn and soybean crops this year, at least in the US. Beef and pork went way up earlier this year but have since come down.

I'm thinking it has more then a little to do with the deflationary pressures of high debt, low growth in new debt and a genuine lack of money good collateral.

No, it has nothing to do with that. It has everything to do with increased supply coming online, coupled with a rising dollar.

Companies have stopped investing via capex and are investing in share buybacks, which is one way of saving energy.

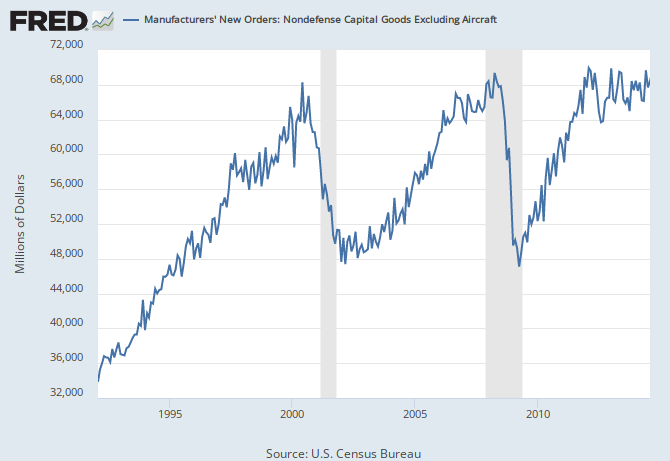

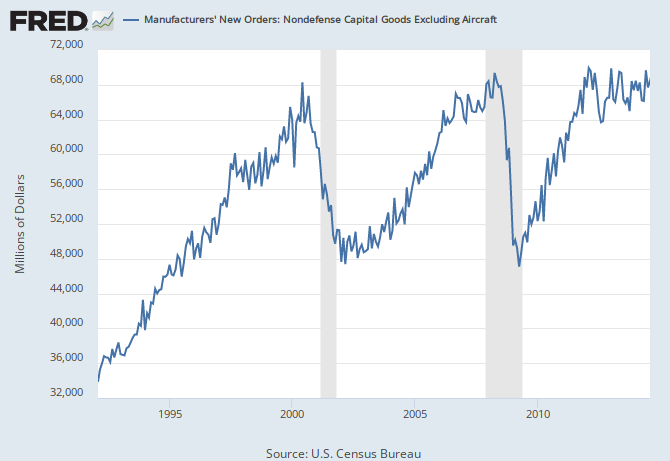

Capital spending in the US, at least, has recently reached record levels.

If Ebola continues to spread then the price of everything non medical can be expected to fall.

Only if fatalities from Ebola reach, like, 50 million or more. It's concentrated in *the* part of the world that pretty much consumes the least per capita.