Page added on September 4, 2015

Why the U.S. Gets the Most Out of Cheap Oil

Cheap oil should be good economic medicine for almost anybody who isn’t trying to sell the stuff. Yet only one country has been able to take full advantage of the 14-month collapse in the price of crude: the U.S.

A big part of the reason was the success of the Federal Reserve at repairing the country’s credit after the financial crisis. That let corporations reduce their debt to the lowest levels in decades while the unemployment rate fell to 5.1 percent from 10 percent. Consequently, American producers and consumers were in a strong position to enjoy the fruits of their labors with oil in retreat.

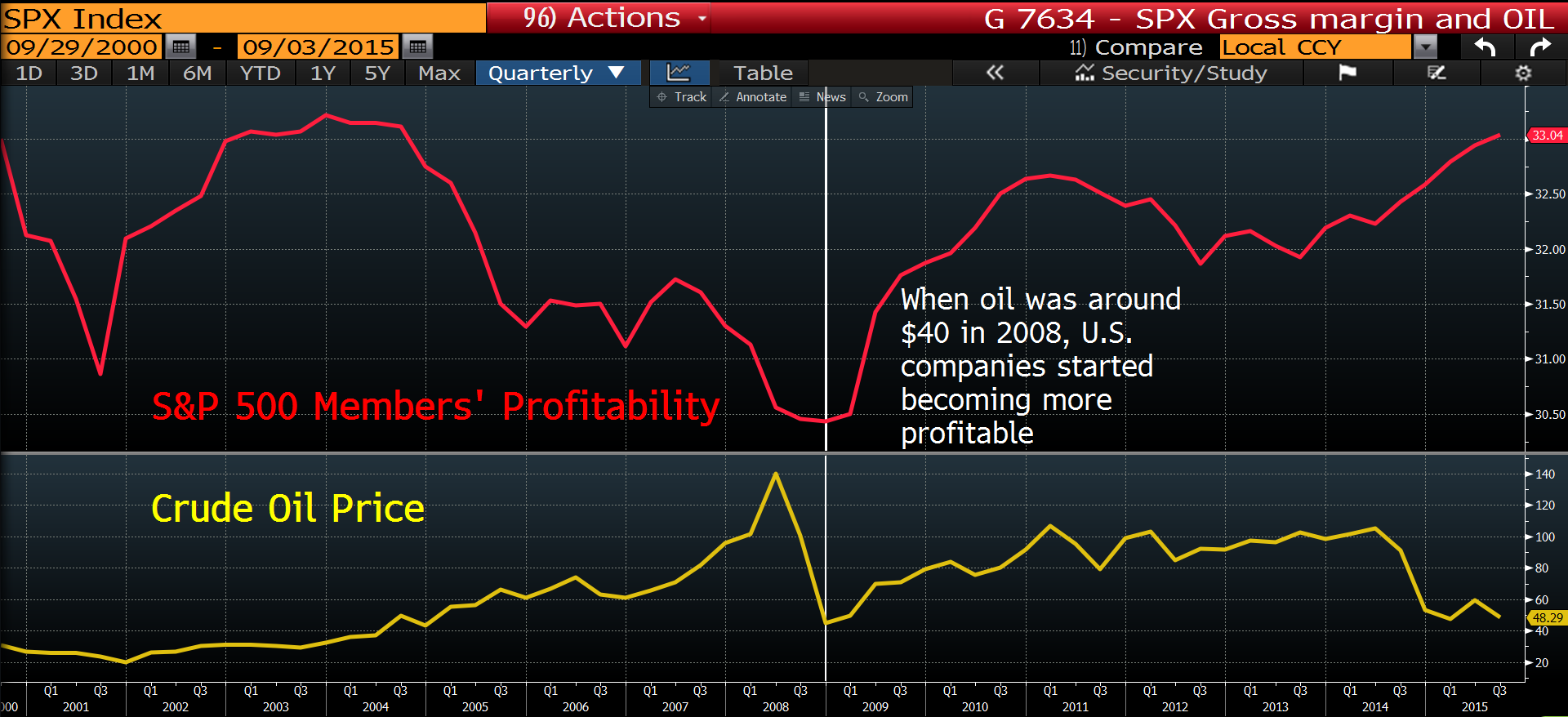

Oil and Profitability

The rest of the world keeps struggling to make the most of cheap oil. Industrial production in Japan, the third-largest economy, is down about 15 percent from its 2008 peak. Germany, the fourth-biggest, is growing at only 1.7 percent a year, while the countries that make up the euro zone share an unemployment rate of 11 percent.

China’s composite Purchasing Managers Index, which measures the health of manufacturers, has declined to a new low, buffeted by slowing growth and waning investor confidence. Brazil is contracting from depressed commodity prices, diminished trade with China and a widening government corruption scandal.

In the U.S., by contrast, producers and consumers are in harmony. Companies in the Standard & Poor’s 500 Index have the lowest net debt-to-earnings ratio in at least 25 years, along with $3.52 trillion in cash and marketable securities and record earnings per share, according to data compiled by Bloomberg. For these companies, the ratio of net debt to Ebitda, or earnings before interest, taxes, depreciation and amortization, is 1.7, down from a high of 4.9 in 2003 and near a 25-year low.

The American economy is seeing the fastest average monthly job creation since 1999. As more Americans join the job market, they have more money to spend as manufacturing efficiency improves. That probably explains why Detroit’s three automakers reported surprisingly robust sales in August. General Motors says that total industry sales this year will climb to 17.3 million, the most since 2006.

U.S. companies became more profitable and consumer demand surged as oil was collapsing to a low of $37.32 a barrel on Aug. 24 from $104.67 in June of 2014. That’s reflected in the healthy gross margins of the 500 companies in the S&P, which edged up to 33 percent this year from 32 percent in the second quarter of 2014.

Lower costs of raw materials and energy needed to run a factory are giving U.S. companies the ability to produce more of what they make at lower cost. Meanwhile, their customers had extra cash to spend. This lets Americans drive up sales of consumer companies like Whirlpool, CarMax and Chipotle Mexican Grill. Sales per share of the 85 companies in the S&P’s Consumer Discretionary Index are at their highest valuation since Bloomberg began compiling the data in 1990.

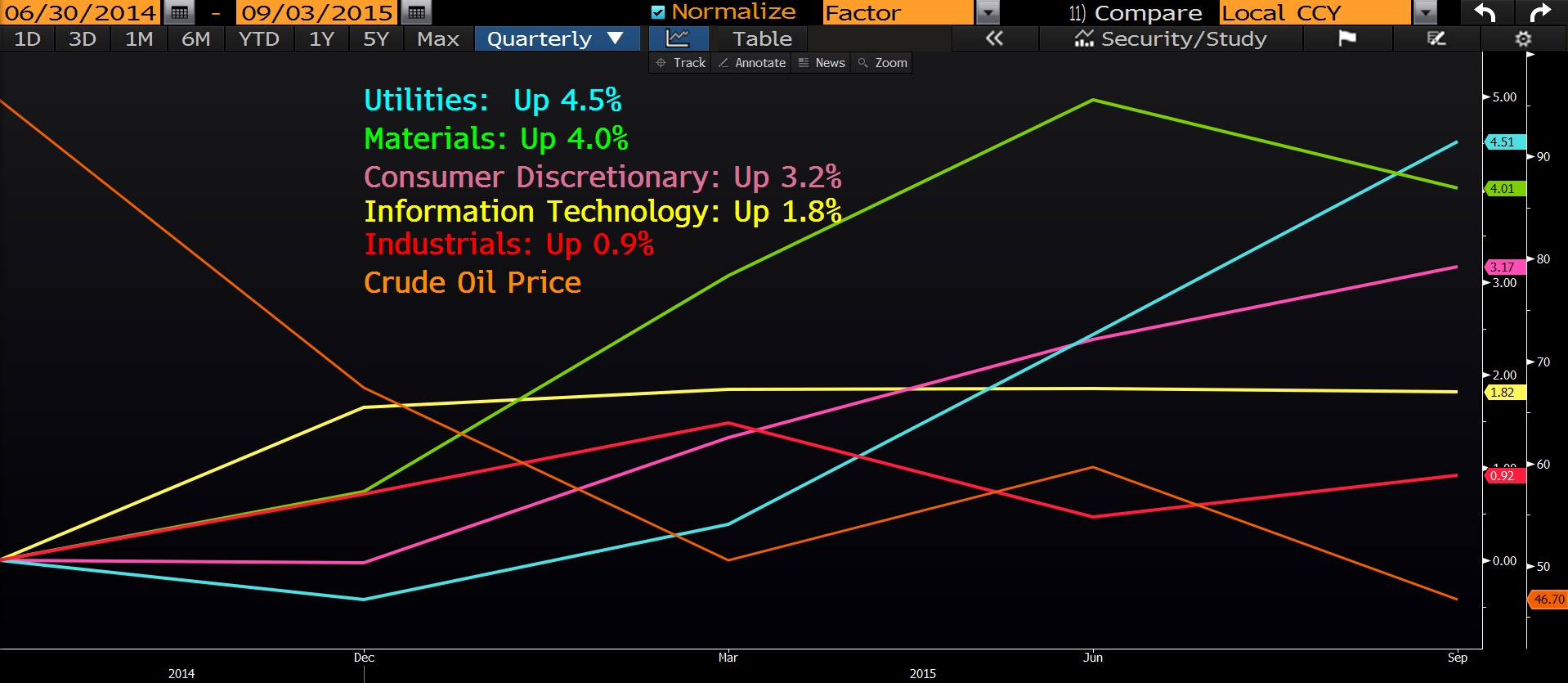

Among the nine relevant industry groups in the S&P 500 (excluding the financial industry, which doesn’t show the gross margin measure), five experienced rising profitability as oil declined.

Industries With Rising Profitability

There are dozens of examples of companies with much improved profit since oil started losing so much of its value. The gross margin for General Motors increased to 14.6 percent from 9.6 percent during the past 12 months. For Goodyear Tire & Rubber, the No. 3 global tire maker, it climbed to 27.4 percent from 24.1 percent. Alcoa, the largest U.S. producer of aluminum, saw its gross margin expand to 15.5 percent from 12.4 percent.

The last time companies showed such a marked improvement in profitability was in the immediate aftermath of the financial crisis at the end of 2008, when oil fetched $40 a barrel, comparable to its price today.

Futures traders anticipate oil rising to $62 a barrel by June 2023. That’s still less than the $64 price they speculated it would be a month ago and well below the $94 for 2019 they were predicting five years ago, Bloomberg data shows.

If these expectations hold up, the period that correlates most with the present is the 1990s, when oil hovered at $20 a barrel. Then as now, cheap oil boosted the price of the dollar, which rose 46 percent between 1995 and 2001 as American companies became increasingly profitable. Even today’s strong dollar remains 17 percent below its 2001 peak, and rising gross margins help lighten the impact of the stronger currency. Once again, the U.S. economy gets better in an era of cheap oil.

12 Comments on "Why the U.S. Gets the Most Out of Cheap Oil"

Makati1 on Fri, 4th Sep 2015 10:02 am

Bloomberg, Schoomberg…BS!

If you are a numbers cruncher, you will like this:

“The debts of the government in the USA are $46.1 trillion and the USA’s actual GDP is $14.77 trillion, which makes the US government debt to GDP ratio 312%…A financial and economic collapse in the USA is imminent if steps are not taken immediately to pay down the gigantic governmental debt in the USA. Steps to accomplish this were outlined: healthcare reforms, one Social Security pension for all with enhanced benefits and higher taxes on the rich. Then there’s the weakest link. The hundreds of trillions of dollars worth of derivatives, written by the wall street people, will be terminal to the USA when even a small fraction of those derivatives go bad, intentionally or unintentionally”

http://davidstockmanscontracorner.com/wall-street-and-the-military-are-draining-americans-high-and-dry/

And the blood runs on the Market floor…

penury on Fri, 4th Sep 2015 10:45 am

The major portion of the article does not reflect reality.

Plantagenet on Fri, 4th Sep 2015 11:27 am

Good to see the U.S. Economy improving (except the oil sector, of course)

BobInget on Fri, 4th Sep 2015 12:00 pm

Oil today under $50 is unsustainable.

Simple like borsht.

BC on Fri, 4th Sep 2015 12:03 pm

Plant, based on payroll tax receipts and reported wages and salaries, US employment is overstated by as much as 1%. Were employment actually growing nearly ~2% and wage and salary disbursements (faster growth for the top 10-20%, of course) growing 4%, real GDP would be growing at 3.25-3.75% instead of 2% (and slowing recently to below “stall speed” for the 4-qtr. average).

More than 9 million people have dropped out of the labor force since 2007. Had the labor force continued growing at the trend rates before 2000 and 2007, the U rate would be 12%. Had the labor forced tracked the population growth, the U rate would be 9-10%.

Also, the 12-month average of payroll receipts has decelerated from a cyclical high in Q1-Q2 2014 to the levels of Mar-Apr 2008 and May-Aug 2001, i.e., recession like.

https://www.businesscycle.com/ecri-news-events/news-details/economic-cycle-research-ecri-cheap-labor

Moreover, the quality of the composition of the growth of employment since 2009 is very poor, with growth of low-paying employment dominating.

No surprise, then, that Redbook’s chain store sales since Feb-Mar have been growing at the slowest 3- and 6-month average YoY rates since the onset of the recessions in early 2008 and early 2001.

Auto sales are booming in one respect because of subprime auto loans but also because of the replacement cycle, which, when done, turns down for 5-7 or more years thereafter. But auto sales per capita and household are at historical recession-like levels going back to the 1970s.

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=1HYB

https://research.stlouisfed.org/fred2/graph/fredgraph.png?g=1KiO

Then take a look above at orders and wholesale sales and inventories, which are contracting YoY and tracking recessionary.

So, absent subprime loan-induced auto sales (and increasingly leases), the US economy is not nearly as strong as is suggested by headline figures.

This is why “the market” does not expect the Fed to raise rates in Sept or Oct, and no more than 25 bps in Dec, but that’s on the probabilistic edge.

Anyway, I suspect that this will fall on deaf ears (or eyes wide shut), but it is what it is.

John Orr on Fri, 4th Sep 2015 12:04 pm

Listen…we should all club together and play this game of cards….with the general knowledge on this web site we could all be rich….I’m in for $1000

BC on Fri, 4th Sep 2015 12:40 pm

John Orr: 😀 :-O :-#

Makati1 on Fri, 4th Sep 2015 6:28 pm

John, this is an interesting collection of humanity, isn’t it? ^_^

We represent a complete cross section of Western inhabitants. From extreme denialists to Armageddon types. Most are well educated, thinking and open minded people with a wide range of experiences. That is why this is the only site I comment on, and read most of the comments posted, daily. You can learn more about the condition of the real world from them than from most articles written for money.

I’ll cover and raise you $500. LOL

Harquebus on Fri, 4th Sep 2015 7:01 pm

I don’t often comment however, I also always read other peoples.

The global economy is running on cheap credit and when that stops, everything stops.

“The problem is that the Fed must prevent the real economy from growing, otherwise, workers wages will improve, prices will rebound, inflation will rise, and the Fed will be forced to raise rates. And, of course, higher rates are what Wall Street fears most, in fact, the six year bull market was built entirely on cheap, plentiful liquidity that has inflated historic bubbles in financial assets across-the-board.”

“A thriving economy with low unemployment, rising incomes and wages, and positive inflation is the death knell for zero rate shenanigans, like stock buybacks”

http://www.unz.com/mwhitney/return-to-crisis-things-keep-getting-worse/

“What we have found is that the underlying financing mechanisms of the suburban era — our post-World War II pattern of development — operates like a classic Ponzi scheme, with ever-increasing rates of growth necessary to sustain long-term liabilities.”

“as with any Ponzi scheme, new growth provides the illusion of prosperity. In the near term, revenue grows, while the corresponding maintenance obligations — which are not counted on the public balance sheet — are a generation away.”

http://www.strongtowns.org/the-growth-ponzi-scheme/

Boat on Fri, 4th Sep 2015 9:34 pm

Harquebus,

No immigration, no unemployment is where the world needs to go. There will still be innovation and products made that will take market share from a smaller pie. A smaller pie is the only chance for sustainability.

GregT on Fri, 4th Sep 2015 11:33 pm

“A smaller pie is the only chance for sustainability.”

A smaller pie also mean a reduced standard of living for everyone. Or a vastly reduced standard of living for the middle and lower classes.

GregT on Fri, 4th Sep 2015 11:44 pm

It also means more unemployment, and more emigration. Exactly what is happening, and exactly what will continue to get larger as the pie shrinks.