Page added on December 18, 2014

Where Are Oil Prices Headed In The Long Run?

Global benchmark crude oil prices have declined sharply this year on slower demand growth and rising supplies. The growth in demand for crude oil has slowed down significantly this year due to moderating economic growth in emerging markets, such as China and India, and a slower than anticipated economic recovery in the Euro-zone. In China, the rate of growth in demand for petroleum products has fallen to almost half of what it was a year ago. As a result, the International Energy Agency expects the growth in global oil demand this year to hit a 5-year low. It expects demand, which stood at around 91.7 million barrels per day last year, to increase by just around 0.7 million barrels per day this year. For next year, the agency expects demand growth to be a bit higher, around 0.9 million barrels per day, but still less than the growth in supply from non-OPEC countries, which is expected to be around 1.3 million barrels per day. The price of front-month Brent crude oil futures contract on the ICE has declined by more than 48% since hitting a short-term peak of $115/barrel in June this year and is currently trading around $59/barrel. In this analysis, we discuss the key factors driving global crude oil prices and our view of how they could trend in the long run.

Slower Demand Growth

Before we discuss the current slowdown in demand growth for crude oil, it is important to understand what makes up crude oil demand. Crude oil is used by the refining and chemical industries to manufacture petroleum products for transportation and industrial uses. These petroleum fuels primarily include gasoline, diesel, jet fuel, kerosene, and fuel oil. They make up almost one-third of the global energy demand. More than 55% of the global demand for petroleum fuels comes from transportation. The remaining 45% of demand comes from industrial and power generation sectors with the latter contributing just around 5%. Most of the growth in demand for these fuels is expected to come from the transportation sector. This is because the global demand from industrial and power sectors is expected to remain largely stable in the long run, as the growth in demand from developing nations is expected to be mostly offset by the decline in developed nations. However, growing economic activity and vehicle ownership in the developing nations is expected to drive significant growth in petroleum fuel demand for transportation, which would be partially offset by improvements in vehicle fuel efficiency and the growing use of alternatives such as natural gas and biofuels in the transportation sector.

Transportation accounts for more than a quarter of the global energy demand. Liquid petroleum fuels including gasoline, diesel, and jet fuel currently meet almost all of this demand. Growth in economic activity and population along with vehicle fuel efficiency are the some of the key drivers for global transportation energy demand. While the demand for petroleum products has been consistently declining in developed economies, primarily due to vehicle fuel efficiency improvements, it has remained buoyant because of increasing economic activity in emerging markets. According to our estimates, the BRIC nations (Brazil, Russia, India and China) contributed almost 85% to the net growth in global crude oil consumption between 2008 and 2013. However, over the last 2-3 years, the growth in economic activity in these countries has slowed down significantly. For example, China’s GDP, which grew at 10.4% in 2010, expanded by just 7.7% last year and the IMF expects the slowdown to persist in the medium term. Similarly, India’s economic growth has also slowed down from 10.3% in 2010 to just 5% last year and it is expected to improve only marginally this year. This moderation in emerging markets’ growth and persistent weakness in the Euro-zone has led the growth in global crude oil demand to hit a 5-year low of around 700 thousand barrels per day this year.

Rising Non-OPEC Supplies and Diminishing Pricing Power of the Cartel

The production of crude oil from non-OPEC (Organization of Petroleum Exporting Countries) countries has increased sharply over the past few years, primarily because of the spectacular growth from U.S. tight oil production. According to our estimates, more than 85% of the net increase in global crude oil production between 2008 and 2013 has come form non-OPEC countries. Almost all of this increase could be attributed to the growth in tight oil production in the U.S., which has been phenomenal to say the least. From almost nothing in 2005, the country’s crude oil production from horizontal drilling of relatively impervious rocks has grown to around 4 million barrels per day currently and the outlook remains positive, as the EIA expects the U.S. to produce more than 25 billion barrels of tight oil over the next 30 years. Apart from the U.S., Canada’s crude oil production growth outlook is also quite robust. Thanks to abundant oil sands reserves, the country’s total proved reserves currently make up more than 10% of the global proved reserves. This makes it the third largest source of future crude oil supply after Venezuela and Saudi Arabia. The EIA expects crude oil production from Canada to grow at 1.8% CAGR in the long run.

On the other hand, the OPEC’s price controlling power has been severely restricted over the past few years because of internal conflicts and rising government spending by the member states. For example, Saudi Arabia’s crude oil export revenue, which traditionally exceeded the amount required to fund its government expenditures, enabling it to vary production levels in response to global supply or demand developments in the past, could now fall significantly short of its government expenditures if crude oil prices persist at current levels for very long. This is primarily because the Saudi government has substantially expanded its social and economic programs recently in order to diversify its economy and improve living standards. It plans to spend around $228 billion this year, up by 4.3% over last year. The IMF estimates indicate that the Kingdom would need to sell its crude oil at an average price of around $106/barrel in order to balance its fiscal budget. Therefore, despite the fact that Saudi Arabia maintains large financial reserves, revenue needs have become a more important consideration for the government before it responds to a situation of a steep decline in crude oil prices – like the one seen most recently – due to faster supply growth or a sustained downturn in demand. This was reflected in the OPEC’s decision last month to maintain its production target for the first half of next year despite the recent decline in crude oil prices.

Rising Finding, Development and Production Costs

On the cost side of things, the fact that finding and developing crude oil reserves is getting increasingly difficult has manifested itself quite profoundly on the financial statements of the world’s largest oil and gas companies over the last few years. According to the latest oil and gas reserves study published by EY, finding and development costs that include costs associated with unproved property acquisition, exploration, and development of proved reserves, increased at more than 14% CAGR between 2009 and 2013 to $22 per barrel of oil equivalent. Similarly, production costs, which include production taxes, transportation costs, and production-related general and administrative expenses, also increased at more than 14% CAGR between 2009 and 2013 to $19.60 per BOE. We expect the trend to continue in the long run, primarily because most of the growth in future crude oil production is expected to come from higher marginal cost areas like tight oil in the U.S., oil sands in Canada, and pre-salt reserves in Brazil.

Our Estimate

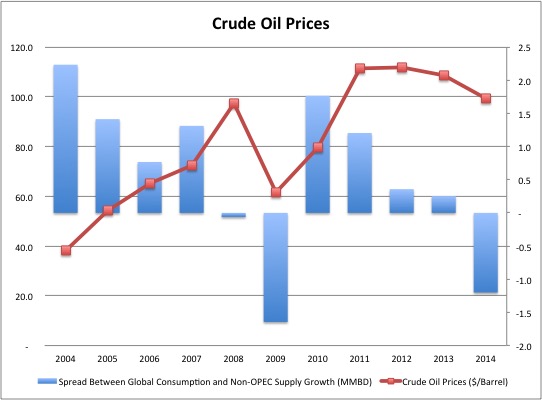

We believe that at the heart of the recent volatility in crude oil prices is the sharp increase in non-OPEC supplies relative to the overall demand growth. In order to substantiate this argument, we looked at the correlation coefficient between the annual change in global crude oil demand adjusted for the increase in non-OPEC supply and the change in Brent crude oil prices since 2004. We found the two variables to be highly correlated with a correlation coefficient of 0.8. Statistically, this implies that the spread between global demand and non-OPEC supply growth explains around 64% of the overall volatility in crude oil prices. While we agree that correlation does not imply causation, the behavior in oil prices relative to the estimated demand-supply spread does make intuitive sense. For example, as the chart below highlights, when non-OPEC supply growth exceeded the growth in crude oil demand by 1.6 million barrels per day in 2009, crude oil prices fell by almost 37%. Similarly, oil prices increased sharply by almost 29% in 2010 as the growth in demand exceeded non-OPEC supply growth by 1.8 million barrels per day.

We currently base our long-term crude oil price forecast on a linear regression model, which assumes that the strong correlation between the two variables described above will continue to hold in the long run. Based on this approach, we expect annual average crude oil prices to continue to decline in the short to medium term and bottom out by 2017 to reach $100 per barrel by 2020.

8 Comments on "Where Are Oil Prices Headed In The Long Run?"

J-Gav on Thu, 18th Dec 2014 2:19 pm

Too high for the average Joe to pay for it. The answer is pretty simple isn’t it?

nemteck on Thu, 18th Dec 2014 3:48 pm

“…. we expect annual average crude oil prices to continue to decline in the short to medium term and bottom out by 2017 to reach $100 per barrel by 2020.”

That is wrong since our shortonoil fellow of The Hill Group states that the oil price will be $0.00 in 2030-2035. In a more recent computation, however, he refined that to $26.90 in 2019 reaching, by extrapolation, $0.00 in May 2021.

shortonoil on Sun, 26th Oct 2014 8:10 am

shortonoil on Fri, 7th Nov 2014 8:16 am

MSN Fanboy on Thu, 18th Dec 2014 5:24 pm

Hopefully shortonoil is a liar. However in the event he isn’t well……. ahh shit…

Oh wait I prepped.

ahh yeah…

In the valley of the blind, the one eyed man is king.

Apneaman on Thu, 18th Dec 2014 9:25 pm

Oil Shock

“Since 2008, the world has become poorer; what remains of purchasing power has been diverted away from ordinary customers toward elites.”

“From a wider viewpoint, elite success at pauperizing the bulk of the human race is a crude form of resource conservation.”

http://www.economic-undertow.com/2014/12/10/oil-shock/

Davy on Thu, 18th Dec 2014 9:48 pm

AP, it is an example of ecosystem canibalization. Ecosystems are meant to be resilient, sustainable, and symbiotic not consumptive. The elite are consuming the producer class. We know how that ends.

lucidmind on Fri, 19th Dec 2014 3:24 am

It’s funny how the media is confident about their price prediction. When oil prices were going up steadily everyone predicted oil prices will go north to $200 someday. when oil prices started to fell everybody predicts now that oil prices will go to zero. it’s really nice how everybody try to manipulate the market. You think that $50 can last for long? the more it stays that low the more severe the future oil shock is gonna be IMO.

Low oil prices do two main things: Cut production in the mid long term (and even short term in some cases like shale oil) and two is increase consumer demand (mainly in developing countries like china).

Kenz300 on Fri, 19th Dec 2014 9:23 am

Oil prices fluctuate wildly……….

Monthly costs for energy produced by wind and solar stay relatively constant……….

Seems like there is a reduced investment risk in alternative energy sources compared to fossil fuels.

Bloomer on Fri, 19th Dec 2014 8:51 pm

Oil prices will continue their trend upwards and be a brake on economic growth when prices stay high for too long. When oil prices drop like recently, the economy recovers and demand and prices start their climb. The Oil Bears are in for a world of hurt.